I see the bear market of cryptocurrencies

**** The price of cryptocurrency is affected by various factors such as news events, policies of various countries, market demand, etc., and fluctuates greatly. Before participating, please carefully evaluate the risk range you can bear*****

It's been a long time since I posted. The warning at the beginning is really familiar. Whenever a customer asks me, I answer this. It has been nearly half a year since I stepped into the cryptocurrency industry at the beginning of the year. From the perspective of the US dollar, my personal assets have not increased but decreased. The more I work, the poorer I become, because almost all my salary has been replaced by Bitcoin. . However, from the perspective of Bitcoin, assets are still increasing steadily. Especially in recent weeks, it can be said that wages have been increased almost every day, because the functions of various exchanges are becoming more and more convenient. Anyway, the fixed investment robot is turned on. , the daily salary is settled instantly in Bitcoin.

<<Can Bitcoin still be bought?>>

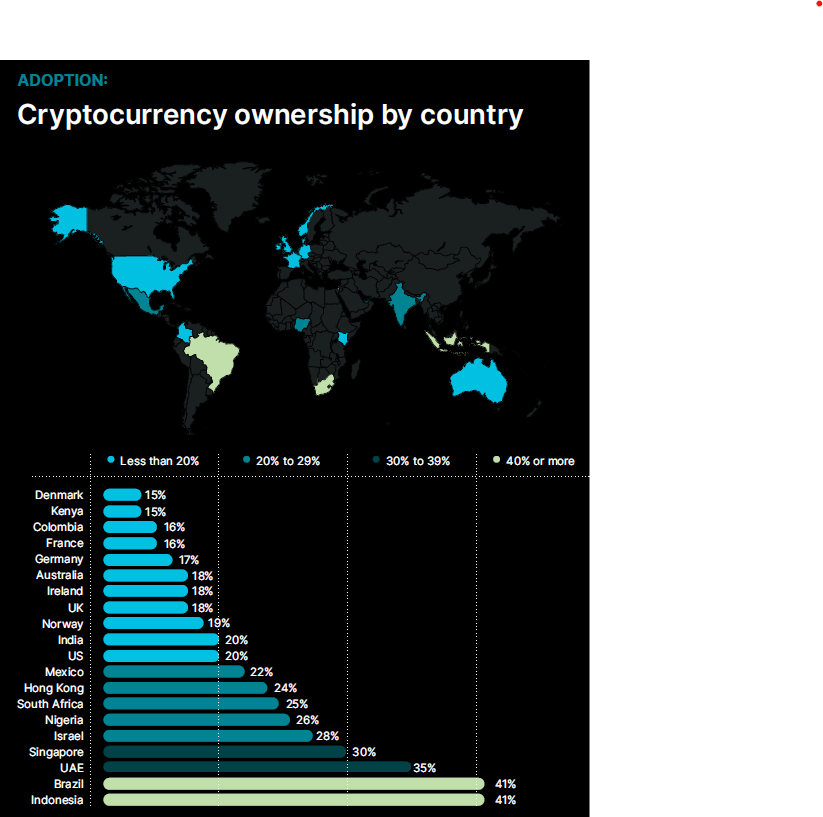

Because of the nature of the job, I will be exposed to a lot of information and reports. The price is nothing to talk about. Everyone knows that Bitcoin is falling, but what most people don’t understand is that the popularity of cryptocurrency has not declined because of the bad market, but it has continued to grow steadily, especially in Central and South America. and developing countries in Asia. To put it in a phrase, a term often used by speculators and watch teachers is called "volume-price divergence" . The price is falling, but the number of users is rising. For something that is completely hyped, when the price goes down, people rush to leave. Although the cryptocurrency market represented by Bitcoin is very speculative, there is no doubt that there is a continuous growing community and network effect. endorsement of its value.

<<Don't speculate, don't trade>>

Don't speculate on coins and don't trade. It's been more than a year since I stepped into this market, and I have been working in the exchange for nearly half a year. Although he is only a small shrimp participant who hardly touches the contract, the realized profits and losses so far are almost all caused by individuals irrationally chasing various funds. Of course there is a profit part, but the loss is still more than the profit. The world of trading is a zero-sum market. Some people win and others lose. The 80/20 rule is applicable in this world, and it may even be the 95/05 rule. A very small number of participants have obtained most of the wealth. In addition to skilled traders, this group of people also has professional quantitative trading teams, market makers, and exchange fees. The strength of opponents is basically not at the level that ordinary retail investors can challenge. If you recognize this one day earlier, you will be able to avoid some mistakes.

<<The elusive fiat currency is the root of the problem>>

As an exchange employee, I know very well that the bear market is fake, Bitcoin is the same Bitcoin, the population penetration rate is still growing, all the data shows that cryptocurrencies are the trend, and the incompetence of fiat currencies and governments is real. The fact that the recent rate hike by the Federal Reserve has caused the financial market to plummet has once again proved a fact:

"Financial markets are manipulated markets, and the few decision makers who have the power to issue money determine the fate of the majority."

Although the dollar itself has no physical reserves since it left the gold standard, it can still be regarded as a manifestation of the overall national strength of the United States. In the past few decades, the US government has borrowed a lot to issue its own air coins in exchange for various resources, and now it is once again threatening people in the world to print money. It has never been the obvious consortia and hedge funds that really smashed the market and cut the leeks. The mastermind behind the monopoly of currency issuance rights, and the chaotic monetary policy are the main causes of economic turmoil.

<<In addition to surviving, you must choose a side>>

Undoubtedly, today in 2022, most people still use fiat currency to communicate with each other, and it is still very far from the step of truly applying cryptocurrencies to daily payments. People who are still cryptocurrencies, it is estimated that they are not the prisoners of Stud Ouyin, or the seniors who have no worries about food and clothing and have long been free of wealth. Holding a certain amount of cash is not only an iron law of the investment market, but also a necessity for ordinary people's lives.

However, it would be naive to think of fiat currencies as a trusted safe haven. You must know that fiat currency is a thing that has no upper limit of issuance, the quantity can grow unlimitedly, and the value can be diluted unlimitedly. Choosing fiat currency is equivalent to declaring , " I believe that issuers will not abuse their power to plunder the fruits of my economic activities. " However, human economic history is full of betrayals of this trust, and there are always people who can step on others' backs for nothing. have resources. At present, if you want to break this dilemma, Bitcoin, which is backed by proof of work and mathematics, is still a relatively fair solution.

<<Welcome to the Early Bird Club>>

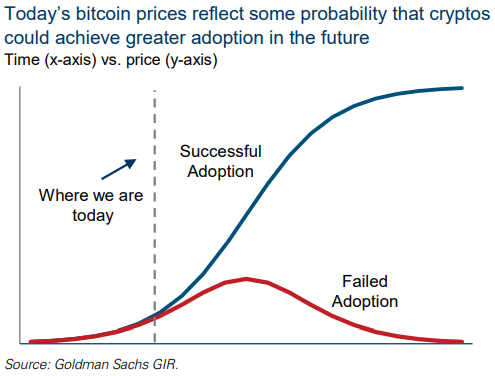

According to a report by investment bank Goldman Sachs, Bitcoin’s price curve hints at the possibility of a future toward mass adoption, and we are currently at a critical inflection point in the growth of the S-curve. Whether in terms of market value or the number of participants, the proportion of cryptocurrencies is still quite low, only about 3% of that of traditional finance. In the end, will it be possible to see explosive growth like technological innovations such as the Internet and smartphones? Only time will give us the answer. According to Metcalfe's Law , the value of a technology and invention is proportional to the square of the number of users. You don’t necessarily need real money to protect the market. Bitcoin takes over Ethereum. Continuing to use related services and participate in the community is also a kind of support. The rise and fall of cryptocurrencies is everyone’s responsibility. Let us continue to work hard in the bear market and continue to move forward, and do our best for this emerging industry.

**** The price of cryptocurrency is affected by various factors such as news events, policies of various countries, market demand, etc., and fluctuates greatly. Before participating, please carefully evaluate the risk range you can bear*****

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!