Zhang San's Road to Wealth and Freedom

One morning in 2020, Zhang San woke up from a dream, always feeling that something sneaked in and out of his mind. Looking around, today is still the same as usual, an ordinary day in the magical year of the new crown epidemic. At this moment, Zhang San found out where the strange feeling in his head came from, it should be the dream he had last night. In the dream, Zhang San became a rich man with a huge fortune like Bill Gates lingering. However, after waking up, he gradually realized that although the average worth of him and Bill Gates is more than 50 billion US dollars, Bill Gates' personal assets have exceeded 100 billion US dollars, which means that his wealth is between two people's. The total wealth should be regarded as "trivial" small. However, the huge gap did not knock Zhang San down. He shook his head vigorously, trying to confirm whether he was still in a dream, whether he was the great "Bill Gates" or the one who was about to go to work and sell his time. people. After confirming that he had left the dream and returned to reality, Zhang San finally realized that when he was closest to wealth and freedom, it was in his dream.

Wealth freedom is a very tempting word, but also a very deceptive word. Different people have different standards for "freedom". Some people think that having 10 million is financial freedom, some people think that 1 billion is needed, and some people think that as long as it is enough to survive, it is a kind of freedom. Although Zhang San is not a person with free wealth, it does not prevent Zhang San from being curious about his assets. How much assets do he have? He suddenly thought of the company's "financial statement", so can he have a financial statement of his own?

what are financial statements

Financial statements, which are very important to an enterprise, aim to provide information about the financial status, performance and changes of financial status of the enterprise, which is helpful for a wide range of users to make economic decisions [1]. That is to say, it can reflect the financial and operating conditions of an enterprise. People who speculate in stocks must be familiar with this concept. So how do financial statements help us personally? If you are a person who is used to bookkeeping, you should be able to appreciate the importance of this way of financial management. Our own financial statements can directly or indirectly reflect our assets, liabilities, income and other information, and can also help us better think and manage our wealth.

Even if your income is not high or your savings are not much, keeping accounts is a good habit to manage your wealth. If you feel that keeping accounts is trivial, you can sort out your monthly credit card bills. Because, for some things, we tend to think more actively after participating in it. When we develop the sensitivity to the concept of "finance", we will gradually become accustomed to thinking about how to "open source", how to "reduce expenditure", and how to increase our wealth by means of investment. The financial acumen that I have cultivated is what I think is the purpose of thinking about these series of questions, and it is also an effort to move closer to "wealth freedom".

Financial statements, which usually contain four basic statements[2]:

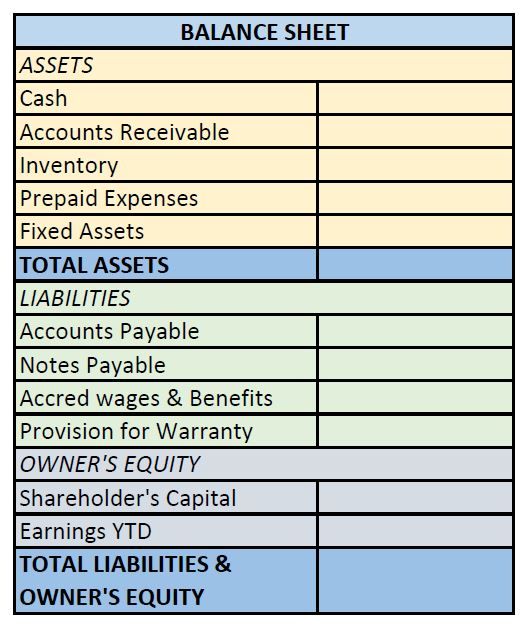

- Balance sheet - Reports a company's assets, liabilities, and owner's equity at a given point in time.

- Income statement Income Statement – Reports a company’s income, expenses and profits for a specified period. The income statement provides information about the operations of the business. These include sales and various expenses incurred during the stated period.

- Statement of changes Statement of changes in financial position – used to report changes in a company's equity during a specified period.

- Cash flow statement – reports the cash flow activities of a company over a period of time, especially its operating, investing and financing activities.

The three main items are the balance sheet, profit and loss statement, and cash flow statement. From the balance sheet, we can see whether a company has potential, what risks it faces, and what opportunities it has. From the income statement we can see whether a company is making money right now. From the cash flow statement, we can see the cash flow of a company, which is similar to the logistics capability of marching and fighting.

Balance Sheet

- Show financial status at a specific time

- Similar to a photo to visually display the financial status

- Know what assets and what liabilities

Assets: current assets (such as cash, stocks) + non-current assets (such as fixed assets, houses, etc.)

Liabilities: short-term and long-term loans, debt, stakeholders' equity

Income Statement

- Shows a business's gains or losses over time

- Ability to make money

- Similar to a video recording various behaviors in this process

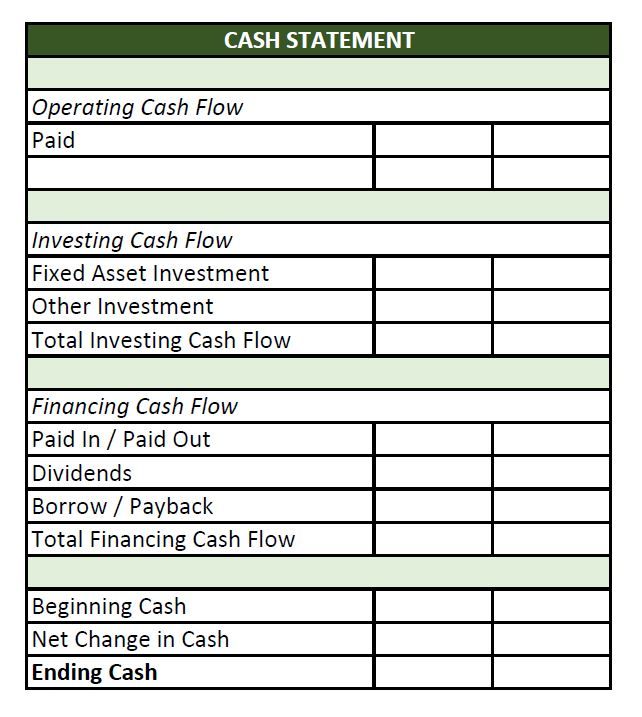

Cash Flow Statement

- Counting cash flows over time

- Similar to a video recording various behaviors in this process

- cash flow = cash inflow – cash outflow

- Including: cash flow from operating activities, cash flow from investing activities, cash flow from financial activities

Organized into a table:

Zhang San's Financial Statements

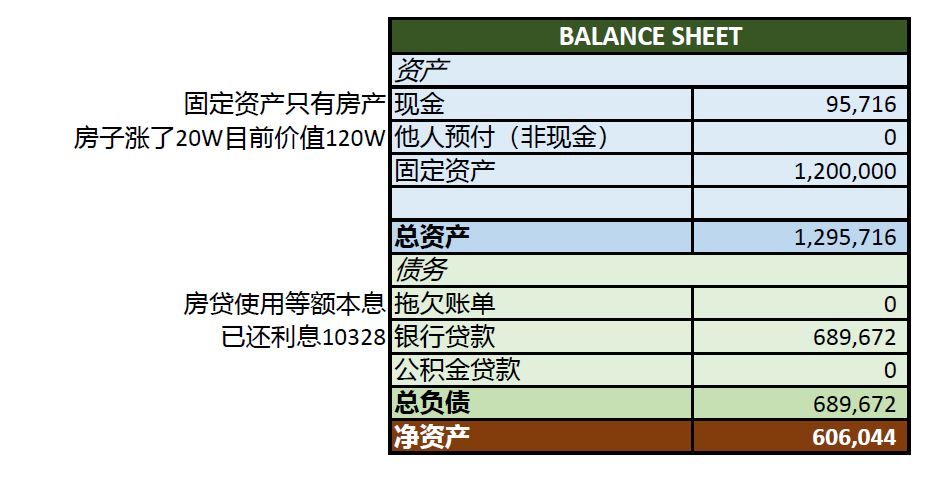

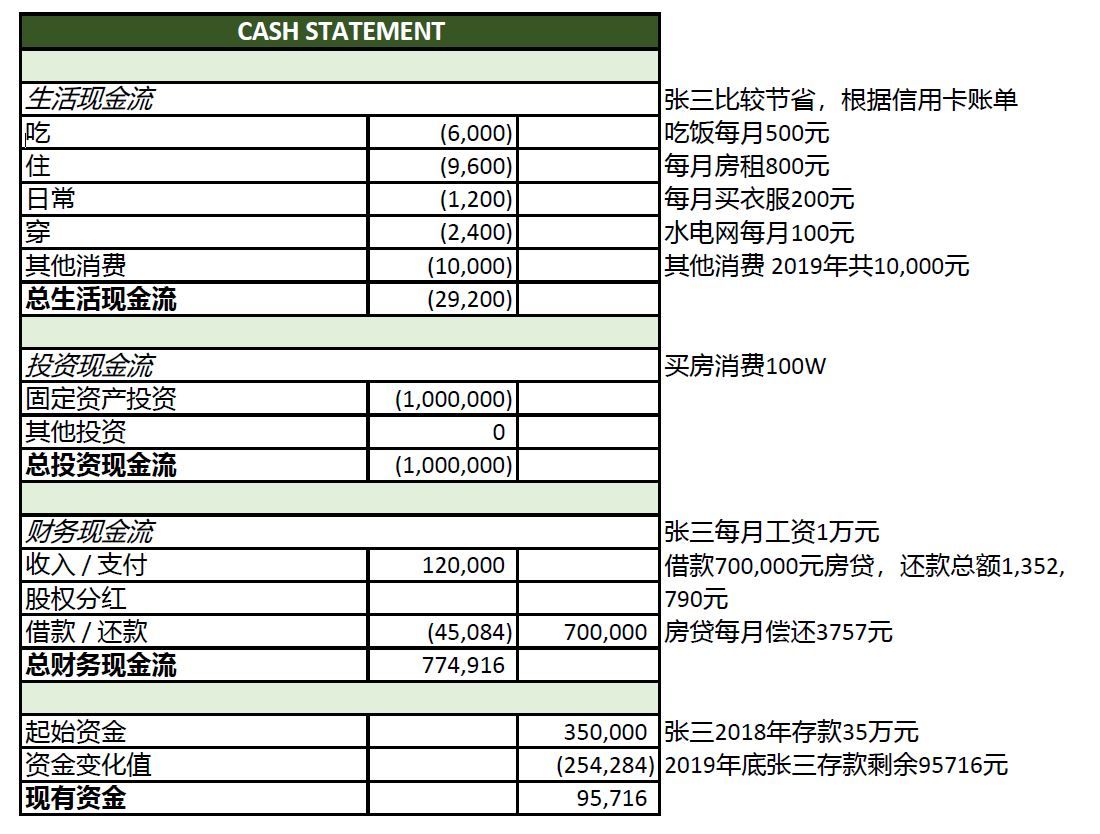

Holding the company's financial statement, Zhang San began to think about what his own statement would look like.

Zhang San is an aspiring young man with a monthly salary of 10,000 yuan. He has saved 35W through his own efforts for a few years. In 2019, he reluctantly bought a house worth 100W for investment, with a down payment of 30W. , Loan 70W, interest rate 5%, repayment in 30 years, 3757 need to be repaid every month. But fortunately, Zhang San is currently single, so there is no great family pressure. Zhang San hopes to know some of his financial situation, how to increase his wealth, and hopes to be promoted and raised as soon as possible to marry the goddess in his heart.

According to Zhang San's actual situation, the approximate financial statements of Zhang San in 2019 are roughly as follows:

Therefore, Zhang San had a deposit of 35W in 2018. Although the deposit in 2019 was only more than 9W, his net assets reached 60W. A small part of the main wealth growth comes from salary income, and most of it comes from investment income, that is, the appreciation of real estate. If Zhang San is lucky enough to achieve 10% net asset appreciation every year, then Zhang San's net worth will exceed 155W in 10 years (assuming Zhang San's salary does not increase and there is no inflation).

So if Zhang San can maintain a considerable income and find an investment channel that suits him, or buy Tesla shares at the beginning of this year, then Zhang San may reach 155W of wealth sooner, which is far from his goddess and wealth. Freedom is one step closer.

At the door of the company, Zhang San, full of confidence, held his fresh "financial statement", as if seeing his beautiful life decades later, he couldn't help clenching his fists to cheer himself up, and at the same time met the gaze of the goddess not far away . Standing next to the goddess, Li Si, who had just taken the Maserati from his father, noticed Zhang San's gaze, raised his head, and smiled at Zhang San. The atmosphere in the three-person room suddenly became a little subtle.

refer to

[1] https://en.wikipedia.org/wiki/Financial_statement

[2] “Presentation of Financial Statements” Standard IAS 1, International Accounting Standards Board. Accessed 24 June 2007.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!