Google Search Trends Analyze Bitcoin Market Outlook

Bitcoin has recently risen to nearly $42,000, more than double the top of the last bull market. Altcoin has also exploded in turn. The total market capitalization of cryptocurrencies has risen to more than $1.1 trillion, more than 35% higher than the top of the last bull market. The current market situation has risen sharply from when I searched for trend analysis on Google nine days ago .

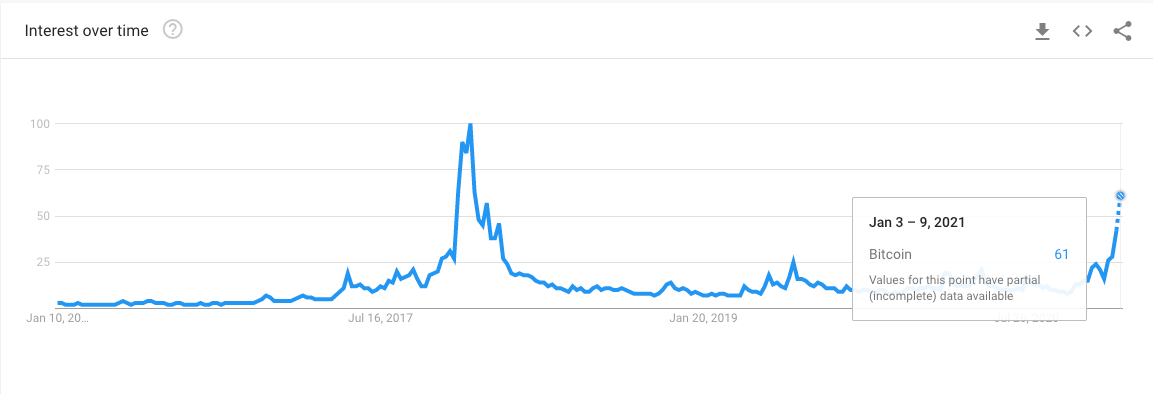

In Google's global search trends this week, the popularity of "Bitcoin" continued to climb, rising to 61% of its peak at the end of 2017.

If this trend continues, after two or three weeks, the search popularity will challenge the peak of 2017. I believe this will be a major resistance period for this rally.

Today, in the analysis of the MeWe group, the re-listing is as follows:

Due to my career, I am closely related to Cosmos atom, because our start-up was born in the Cosmos ecosystem, and atom is also our largest position. I have several roles at the same time, I am both a blockchain start-up founder and a cryptocurrency portfolio manager. The former often biases me and affects my performance in the latter. To manage a portfolio well, you must let go of your subjective will.

In the past three months, the rising market driven by Bitcoin has developed into three stages. The first stage is that Bitcoin has risen by itself, making consecutive new highs; the second stage is that Ethereum has risen sharply and is ready to challenge new highs; Take turns to explode.

This third stage is driven by big dealers. Polkadot, which is invested by many big VCs, took the lead in breaking through the historical high set in August last year. The current price is more than 50% higher than this high, challenging the market value of tens of billions of dollars. close. Then, the coins of large, medium and small size are each brilliant. In the past two days, BAND and SOL in my portfolio have also exploded. Both of them also have large households. Among them, SOL had a very large amount of coins unlocked the day before and then rose sharply, which is very obvious. The land is what the big households do in the world.

This altcoin surge is different from the one that started in the middle of last year. Last year, altcoin was the protagonist and bitcoin was the supporting role. This time, Bitcoin is the protagonist, and the theme is the change of basic factors: Bitcoin has been recognized as one of the reserve currencies by institutions. The real trigger point is not Square or MicroStrategy, but PayPal. Altcoin this time in the third stage only because of the chasing behind and the rapid rise in a short period of time. This is not because the market believes that the fundamental factors have changed, but because the funds are chasing behind.

Funds start chasing behind, which means that the rising market has reached the final stage. In the recent rising wave, atom, a powerful currency with no obvious dealer, has been lagging behind. If it cannot challenge the high level in the entire rising wave, I will not Wouldn't be surprised. However, if the atom starts to exert its strength later, I will not feel that "the market has finally awakened" because of this. On the contrary, I will only regard the strengthening of the atom as a signal that the entire market has peaked, because it means that the market has found that there is no speculation. Select some backward to speculate, this kind of capital-driven market situation is the last most brilliant moment of fireworks.

Simple conclusion: it's time to be more vigilant.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More