[What is the joint margin model] 1 second makes Binance Futures trading simpler and more efficient

What is the Binance Joint Margin Model?

"Multi-asset model allows users to trade U-margined contracts between multiple margin assets" – Courtesy of Binance

Based on my uncle's experience, I found that most of my friends use USDT when trading contracts. Obviously, the handling fee for BUST transactions is lower and more favorable, but most people still choose to use USDT.

The reason is actually-

- More currencies that USDT can trade

- USDT trading volume is also relatively large

So even when trading BTC or ETH, I can use BUSD, but in order to trade smaller cryptocurrencies, I have to convert USDT to trade, which is really annoying.

However, since the emergence of the "joint margin model", this problem has been solved. As long as you enable joint margin, you can use "USDT" and "BUSD" as the same position and share their margin, so that you don't have to exchange it. , and a fee will be charged.

And it is very simple to open, just find "Assets" on the "U Standard Trading" page and click "Joint Margin Mode".

Home→ U Standard Trading→ Assets→ Joint Margin Model

The benefits of using the joint margin model

- Reduce fees for fiat currency transactions

- Improve margin usage efficiency

There have been many major events in the currency circle recently. Bitcoin has fallen below 30,000, and the UST algorithm stable currency problem has made many people start to face the problem of "fiat currency". Fiat currency seems to be very safe and stable, but in fact it still exists Not a small risk. On May 12, the decoupling of USDT also occurred. Although these are immature cases, for petty bourgeois like Uncle, the easiest way to diversify the systemic risk is to diversify investment.

Disperse assets on "BUSD" and "USDT" to reduce the risk of a certain currency. And since the discovery of "joint margin", for a person who trades in contracts every day, they can avoid paying the "handling fee" for converting coins, making transactions faster and more convenient.

In the first month of contract trading, the uncle liquidated his position twice. Now that I think about it, there was actually some BUSD in my wallet at that time. Maybe if I had opened the joint margin, the position would not have been liquidated. Did it happen? Or exploded together? However, the joint margin did make it easier for me to do "fund management" and "quick order" in the transaction.

I don't care how much USDT and BUSD are in the wallet. There is a Chinese saying that the soldiers are expensive. If you see an opportunity, but there is a little less money in your wallet, so that you can't place an order according to your strategy and habits, the uncle will meet you. After a few times, after the joint margin mode is turned on, there is no such problem.

Contract Trading Strategy

What can we do if we apply joint margin to your contract transactions?

1️⃣ Spread Convergence Strategy

Through the one-buy-one-sell strategy to earn the price difference, Binance offers trading on the same cryptocurrency in two different directions. For example, when Bitcoin has a significant price difference between different fiat currencies, then You can buy "long" with BTC/USDT and then "short" with BTC/BUSD, because they will eventually converge the price difference, so we can make arbitrage.

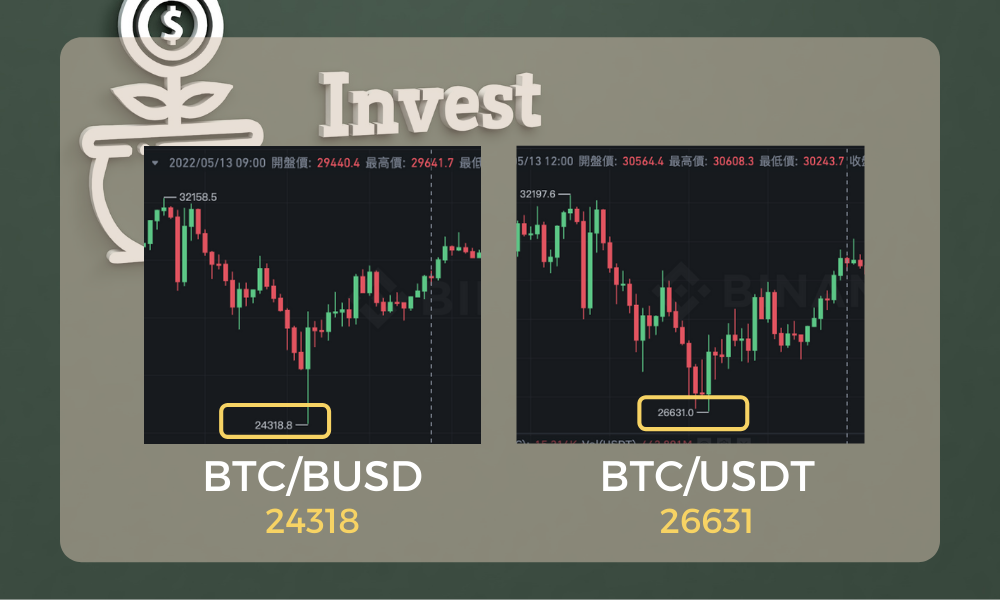

For example - on the 5th/12th, there was a significant price difference between BTC and BUSD and USDT. If we assume that the price decoupling is temporary, because both USDT and BUSD are exchanged 1:1 against the US dollar, their prices will always "converge".

At 9 o'clock in the evening on the 12th, there was a clear convergence. The price of USDT closed at 28458 and the price of BUSD closed at 28262, which means that USDT has risen (28458 – 26631 = 1827), and BUSD has risen (28262 – 24318). = 3944)

Let's trade on paper, if you go long around 'BUSD – 24318' and short 'USDT – 26631', theoretically, you will buy one long and one short, no matter how the price moves, because while making money, you will lose money. Therefore, the profit and loss should be almost zero, and we will not calculate the handling fee here.

However, if you do this when the price difference is very large, you just mentioned that they will eventually converge, and then there will be room for arbitrage after the price converges.

So when doing the spread convergence strategy, it is too troublesome to exchange between USDT and BUSD. At this time, please turn on the "joint margin mode", which can save a lot of time and handling fees.

Profit and Loss Calculation – Spread Convergence

BUSD ( 28262 – 24318 )/ 24318 = 0.162

USDT (28458 – 26631 )/26631 = 0.069

Assuming you buy 1000 U each -

Buy long BUSD, 1000x 0.162 = 162 BUSD (earn)

USDT short, 1000x 0.069 =69 USDT (loss)

Closing surplus = 162 – 69

2️⃣ Double World Single

I believe that those who have played grid contracts should have heard of Tiandi orders. They can arbitrage by setting grid contracts with large price ranges, and then buying low and selling high.

In my article [Binance Grid Trading Teaching] 3 Subtraction Experiences That Don’t Lose Money, I mentioned that there are two types of grid profits, one is “spread profit” and “grid profit”. If the price profit is greater than the spread profit, even a falling bear market will not necessarily lose money.

Tiandi order is to make the profit of the grid > the profit of the spread through long-term grid trading. Is it possible to do a double Tiandi order of one buy and one sale, so that both rising and falling can gain profits and reduce the risk of spread.

Therefore, if you turn on the "joint margin", you can execute the transaction more conveniently, and you don't have to think about switching to the other side of the market, making the trading strategy more convenient.

Experience of using the joint margin model

I don't know if you have noticed that when we get older, the number of bank accounts will grow with us, and it will become difficult to manage money, and the joint deposit is like stringing our bank accounts together. How much is there? Money can also be used directly to buy things, making the use of money more efficient.

common problem

How is the fee for using the joint margin model calculated?

The handling fee is the same as the general U-based transaction. You can refer to [How to calculate the handling fee of Binance]. The handling fee is reduced by 20%. Rebate code

How to calculate the profit of using the joint margin model?

If you use USDT to trade cryptocurrencies, the profit is USDT, and if you use BUSD, it is BUSD.

How to Register on Binance Exchange ( Intimate Link )

"Binance owns the world's leading blockchain asset trading platform and operates the entire Binance ecosystem." - Binance

Binance Exchange is the exchange with the largest trading volume in the world, and it is also a highly rated exchange with a score of 9.9 in the ranking of the Coinmarketcap website.

The way to buy cryptocurrencies is also very diverse and simple, it provides –

- bank wire

- credit card

- Binance C2C

- 3rd Party Payments – Simplex, Paxos

It also provides Chinese interface and instructional videos. It is a very friendly cryptocurrency platform for beginners. It also provides many services, such as –

- Cryptocurrency spot trading

- Cryptocurrency Contract Trading

- Financial Services

- NFT

Binance Advantages

- Multiple deposits

- Chinese interface

- Spot and contract transactions

- 400+ cryptocurrencies available

- No. 1 in the world in terms of transaction volume

- lower fees

- Have a hedge fund

Binance Cons

- Does not support Taiwan dollar withdrawal

- Online customer service only

- The contract is easy to play 😈

Make transactions more diverse and investment choices; if you are interested in Binance, registration is free, but please use Uncle's referral code - "T3TWUI2E", you can receive 20% commission for each transaction, Let you win at the starting point. (General friends up to 10%)

More related content is living in subtraction , and more cryptocurrencies are in the cryptocurrency Buddhist investment law

Link to the original text [Subtraction Life Proposal] Uncle Subtraction - Laxi

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More