VIRES, the largest lending platform on WAVES, is shocked by governance dictatorship!?

Recap:

WAVES was kicked out in early April. A mysterious big user used a large amount of funds deposited by users on VIRES to lend USDC/USDT to pump WAVES on the Binance platform, and then minted WAVES as its own stable currency USDN and deposited it into the platform. Lending USDC/USDT cycles back and forth. (Part of it can be found at https://www.abmedia.io/20220406-waves-price-shed-over-50-percent-and-usdn-depegged)

As soon as the news came out, the funds that had not been lent out on the platform were withdrawn by users, a run crisis broke out, and the stablecoin lending rate also soared to 105APY. As soon as the news came out, the USDN pool on CURVE, a well-known stable currency exchange protocol on Ethereum, was also dumped in large quantities, and the price of WAVES also fell.

In the face of high interest rates and a liquidity crisis, the mysterious big family proposed to reduce the maximum lending rate to 40APY to solve their immediate needs. However, many users who were locked in the toilet firmly disagreed, and the vote was rejected.

This incident happened after a poll

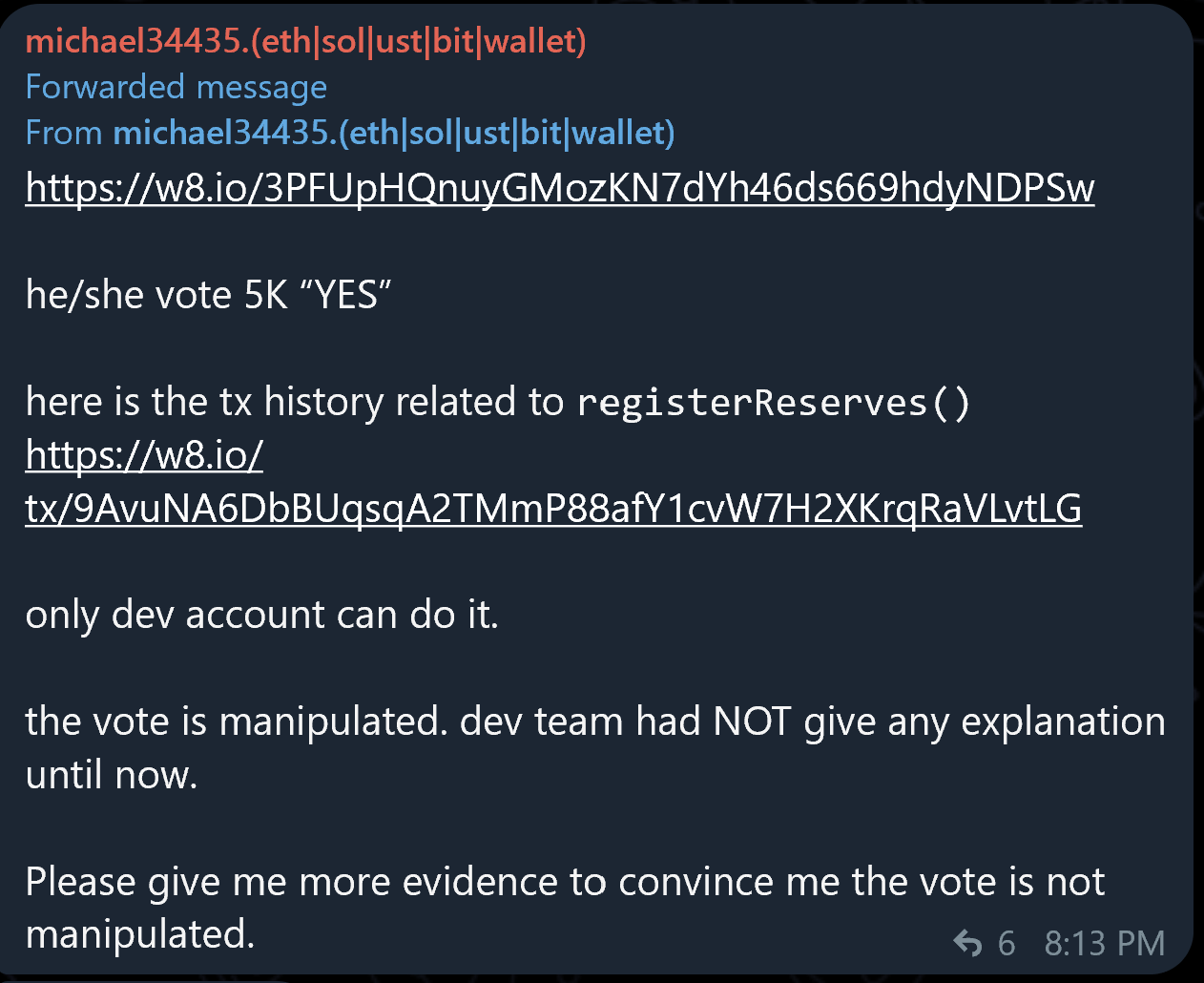

If you fail to vote, you can make another proposal. After the second vote, some users found that DEV, who should have maintained a neutral position, secretly stood on the side of the mysterious big family in this vote, and the proposal to reduce the interest rate by frantically pouring votes was passed. span

https://w8.io/3PFUpHQnuyGMozKN7dYh46ds669hdyNDPSw

https://w8.io/tx/9AvuNA6DbBUqsqA2TMmP88afY1cvW7H2XKrqRaVLvtLG

This move made many users angry, so that the DAO's purpose is completely useless, and the project party can just be dictatorial.

At present, the project party has not made a statement on this matter. But the incident has caused a lot of discussion in the community

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More