The business cycle of the stock market _ Now is the turning point of the business! ?

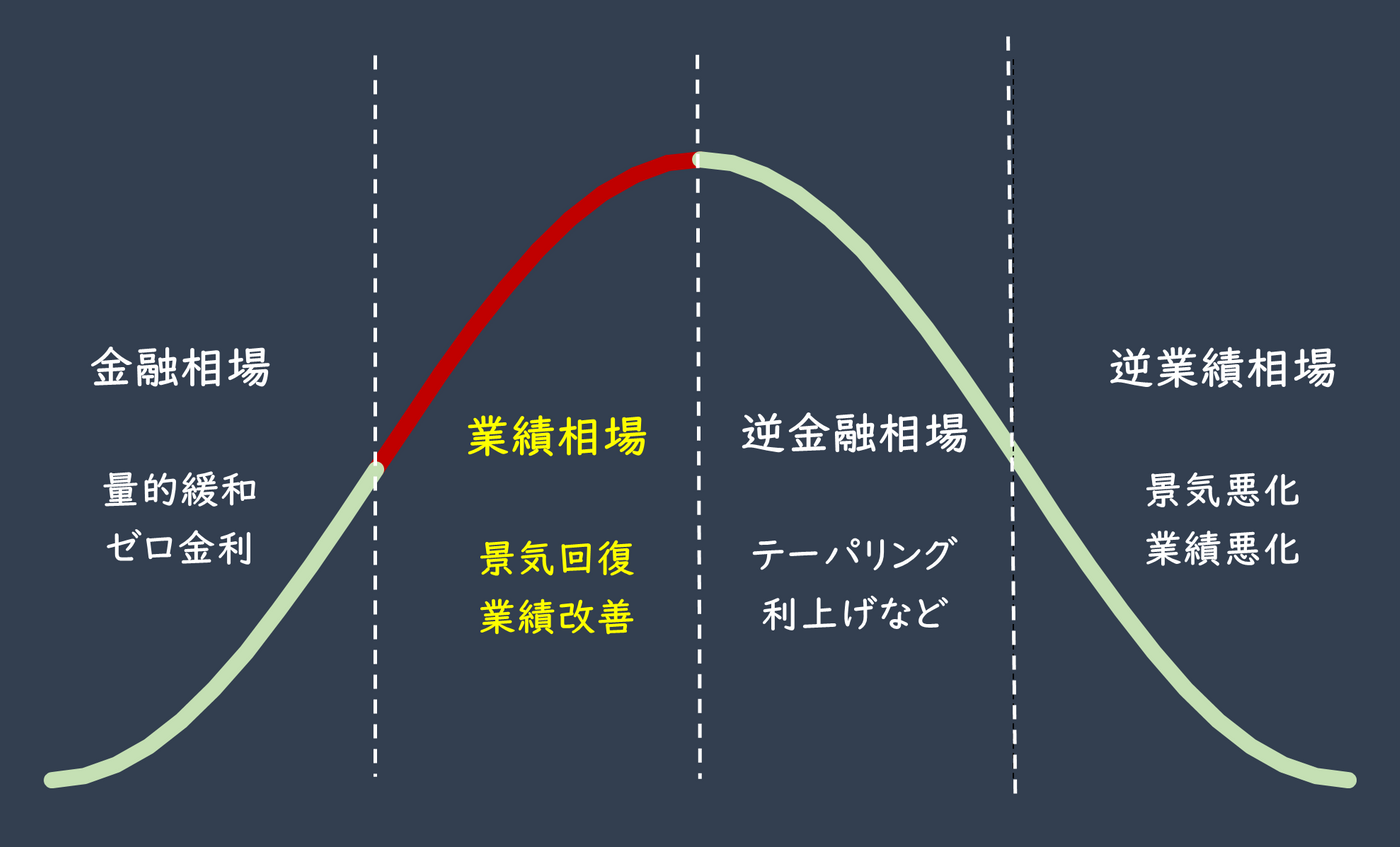

Everyone knows that the boom will continue to circulate, but do you really know how the boom in the stock market circulates? Today I want to share how the constant cycle works in the stock market; there are four stages in total:

First of all, I must apologize that most of the materials I usually read are in Japanese and English. The charts used here are presented in Japanese. I don’t know what the Chinese are called (because I can’t read Chinese literature), I will use the text. Let everyone read the content.

Stage 1: Financial Phase Fields

Stage 2: Performance Phase Field

Stage 3: Inverse Financial Phase Field

Stage 4: Inverse Performance Phase Field

Stage 1: Financial Phase Fields

If the financial phase field corresponds to this wave of epidemics, it will correspond to about March and April of 2020. Federal Reserve Chairman Powell announced the quantitative easing policy, and the government will throw a lot of money into bonds and the market. Unlimited capital flows into the market and almost zero interest rates make the market so much capital that even companies with extremely poor financial conditions, no benefits, poor health and poor prospects have also seen their stock prices rise. The reason is precisely because the capital is too abundant. . At this stage, the government can do whatever it takes to stimulate the economy, and the market was still in this stage until a while ago .

Stage 2: Performance Phase Field

The performance phase field refers to the process of rapid growth in performance after the financial phase field, or the process of economic growth. At this stage, the company's performance is the highest, so the stock price also rises with the performance . This is a phase of the law of the jungle, with polarization due to the emergence of many well-performing companies. The stock price of the company with good performance is high, the stock price of the company with bad performance is very low, and the company with bad performance will be easily abandoned.

Now I think it's time to get to that stage. Many companies are slowly getting rid of the impact of the epidemic, and their performance has gradually improved, such as traditional industries. Compared with companies that have grown rapidly since the epidemic, their performance has begun to slow down.

Stage 3: Inverse Financial Phase Field

The inverse financial phase signifies the end of quantitative easing and an imminent rise in interest rates. At this stage, the stock price has come to the top of the business cycle or has been slowly going downhill.

Here I have to mention that just looking at the inverse financial phase field will actually be different from the current situation during the epidemic. Under the epidemic, we must cut the end of quantitative easing and the rise of interest rates. Although they are written together at this stage, there have been some changes in recent years. The end of quantitative easing does not mean that interest rates will start to rise immediately. I personally think that the rise in interest is the beginning of the mud financial phase field.

Stage 4: Inverse Performance Phase Field

The economy begins to deteriorate and performance begins to decline . Just like in the early stage of the epidemic (around February and March 2020), the epidemic greatly affected the economy, and many countries locked down cities, locked the country, etc., which led to the disconnection of the global supply chain. At this stage, investors only have patience, there is almost no room for manipulation, and the cycle is usually not too short. There are several years of experience in history. This epidemic can be said to be a very short reverse performance field in history.

2021/10/1 Time point I think the US stock market is about to enter the performance phase. Companies with good performance in the market will be promoted to the sky, and companies with poor performance will fall to the bottom. There is also a saying that because the performance of technology companies has begun to be revised down and quantitative easing is about to end, it is about to enter the reverse financial phase.

The above diagram is just a formula for most cases, and may not be suitable for all cases. The current position in the market I think everyone will have different ideas, the only constant is that the market will continue to repeat this cycle.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More