📖 #218|Chinese government issues digital RMB

Hi, I'm Xu Mingen, the author of Block Potential. This is a regular bi-weekly published article, click here to view the full list of articles . For 249 yuan per month, you can unlock all the content.

China is one of the most developed countries in mobile payment in the world. People have long been accustomed to picking up mobile phones to pay with WeChat and Alipay. Recently, they have to further open the gap with other countries - issuing Digital Currency / Electronic Payment (DC/EP), surpassing Sweden to become the world's first government to issue digital currency.

Digital RMB is ready

You must have noticed that the English meaning of digital renminbi is actually "a combination of digital currency and electronic payment tools". Therefore, everyone is asking: "China's mobile payment is already so developed, why does the government jump out to issue digital currency or even launch a brand new electronic payment tool?"

Recently, Mu Changchun, head of the Digital Currency Research Institute of the People’s Bank of China (PBOC), explained the latest developments in the digital renminbi at a financial forum:

In the summer of 2014, President Zhou Xiaochuan mentioned that the central bank would study the possibility of issuing digital currency. There were a lot of questions that needed to be answered at that time, for example, why should the central bank’s digital currency be issued when electronic payments are already very developed? What technical route should the central bank's digital currency take, whether to adopt the blockchain or the account system?

This topic also involves many other issues, such as whether to pay interest or not, how to arrange the organizational structure and so on. Gradually, the central bank conducts research on these issues and draws some conclusions. From 2014 to the present, the research on the central bank's digital currency has been carried out for five years... Since last year, the relevant personnel have been developing related systems in the working state of "996". Now the central bank's digital currency can be said to be ready to come out.

Not only R&D personnel have to go to work at 9 am and get off work at 9 pm, 6 days a week. Even the director himself went to the online learning platform to open a course - Frontiers of Technological Finance: Libra and the Prospect of Digital Currency - to promote the new policy of digital renminbi. He explained in detail the three characteristics of digital renminbi in the course.

Three characteristics of digital renminbi

Why did the officials of China's central bank give a special class to explain the Libra launched by Facebook in the United States ? It turned out that Libra aroused the Chinese government's sense of crisis, so the digital RMB also has many places to pay tribute to Libra. The biggest difference between the two is that the currency issuer and the transaction bookkeeper have changed from the Libra Association to the Chinese government.

1. "Digital cash" that replaces banknotes

Mu Changchun said that the digital renminbi is used to replace paper money :

Its functions and properties are exactly the same as banknotes, except that its form is digital. We define it as a "digital payment instrument with valuable characteristics".

What does it mean to have a "value feature"? Simply put, it is "value transfer without the need for an account". You can understand it by thinking about paper money. When you pay with banknotes, you don't need an account, and the same is true for digital renminbi.

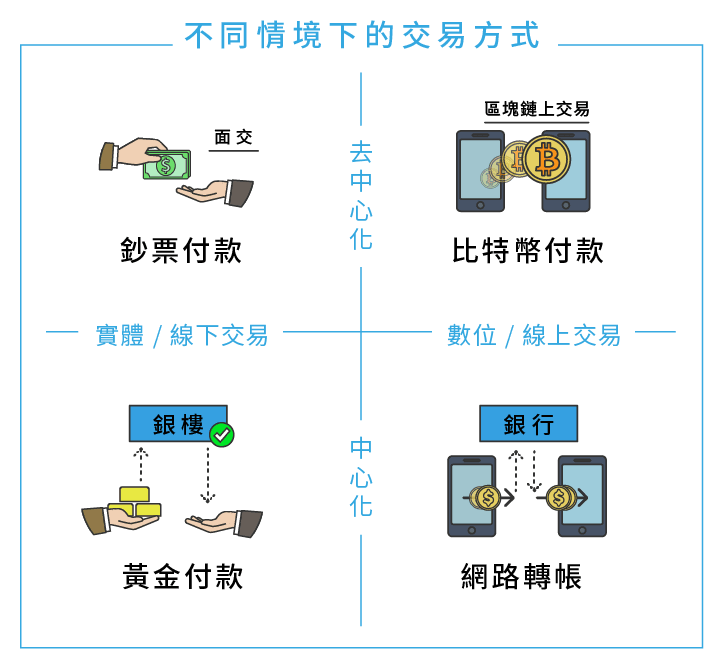

I would say digital RMB is "digital cash". Although it is a digital currency, it has three characteristics of cash:

- trade is liquidated

- everyone can hold

- Decentralized Exchange

"Transaction is settlement" is the first feature of cash, which can be paid in one hand and delivered in one hand, unlike cross-border remittance or card swiping, which has to wait a few days for the account to arrive.

"Everyone can hold" is the second characteristic of cash. We can put paper money in our pockets, but digital payments still require a digital wallet. People can receive and make payments as long as they have a wallet app in digital renminbi.

"Decentralized exchange" is the third characteristic of cash. The two parties do not need to register and log in to the intermediary before they can trade, but they can buy and sell as long as they take out cash. This is different from the current WeChat payment, Alipay or bank remittance, where intermediaries can fully grasp the transaction objects and transaction details.

With the picture below, you can see it more clearly.

Digital RMB is the same as Bitcoin, it is a digital decentralized transaction, but it adopts a centralized accounting and management model. As a result, the Chinese government claims that a digital renminbi can preserve the privacy of users' daily consumption without giving criminals or terrorists an opportunity.

It sounds contradictory, but it can be done. Once the transaction is decentralized, no intermediary agency can fully grasp the user's consumption privacy, but this does not mean that the transaction can be completely anonymous. Two data analysis companies, such as Chainalysis and CipherTrace , are mainly engaged in analyzing public data on the blockchain, assisting governments to find out the correlations among the chaotic data, and even piece together a complete set of stories.

The Chinese government also intends to do the same:

Transactions involving money laundering are all behavioral. For example, a large number of gambling behaviors occur after 12 o'clock in the evening, and all gambling transactions are not fractional, but are integer multiples of ten. Generally speaking, starting with a small amount, getting bigger and bigger, and suddenly there is no transaction, that is, you have lost all, which is in line with the characteristics of general gambling.

The same is true for telecommunication fraud. If a large amount of scattered money is concentrated in one account, then spreads out suddenly and quickly, and disappears into many accounts, which is in line with the obvious characteristics of electronic fraud. After we analyze these transaction characteristics, and then use big data and data mining technology to compare the identity, we can find the person behind.

Transactions are recorded in the database, and it is indeed easy to analyze behavioral characteristics. But how do you know who the actual owner of the account is? This has to rely on real-name authentication.

2. Wallet mining hierarchical management system

The digital renminbi is composed of digital currency and electronic payment. The relationship between the two is similar to the Calibra wallet developed by Libra and Facebook.

Libra's wallet service providers (such as Calibra) are responsible for checking whether each user is eligible for use by governments in various countries. The Chinese government also plans to follow the same model and launch its own wallet app :

For anti-money laundering considerations, we also have tiered and limited arrangements for wallets. For example, if you register a wallet with a mobile phone number, of course your wallet can be used, but the level must be the lowest, and it can only meet the daily small payment needs; but if you want to be able to upload your ID card, or upload another bank If you have a card, you can get a higher-level wallet. If you can go to the counter to sign in person, there may be no limit.

This is catching the big and letting go of the small. Users can bind their wallets and one-time mobile phone numbers to each other, but the amount of this pseudonymous transaction is probably only enough to buy breakfast. Just like no one will carry a pile of ten yuan change to buy and sell arms, if you want to use thousand yuan bills, you have to go through real-name authentication.

Large-value transactions have real-name authentication. In the future, if the Chinese government wants to check transaction records, the only question is whether to check it, but not whether it can be checked or not. And as long as most people have passed the real-name authentication, with monitors, GPS positioning and conversation records in the city, even those without real-name authentication will be invisible.

3. Issued through financial institutions

This is also similar to Libra. People do not buy Libra coins directly from the Libra Association, but after members of Libra Associations such as Spotify, Uber, and VISA pay a deposit to the association to obtain Libra coins, users directly obtain Libra coins from these companies in their lives.

Mu Changchun pointed out :

The process of placing digital RMB is the same as that of banknotes. Commercial banks open accounts in the central bank and pay 100% of the reserves. Individuals and enterprises open digital wallets through commercial banks or commercial institutions.

I feel that Mu Changchun's words are a secret.

Chinese people have long been accustomed to mobile payment. If digital renminbi can only be issued through commercial banks, the speed of popularization must be very slow. If you refer to Libra's practice, I guess that, in addition to commercial banks, even WeChat, Taobao, Douyin and even companies that have obtained these platforms can pay a deposit to the People's Bank of China and obtain digital RMB in the future, and then forward it to the public.

When is the best time to issue it? The Double 11 Shopping Festival, with its record-high transaction volume every year, is of course the first choice. If it is later, it will be a good time to take advantage of the Lunar New Year when people send red envelopes to each other through WeChat Pay. Distributing digital renminbi through existing platforms has the best effect and the lowest cost.

Seeing this, I believe you already have a certain understanding of the digital RMB. It is a decentralized digital currency, and although there is no centralized institution to grasp all the movements, the government can still push back everyone's transaction behavior from big data. In addition, digital renminbi will not compete with existing payment tools. These payment tools will become digital renminbi wallets. In the future, people may be able to use WeChat Pay to transfer digital renminbi to Alipay.

This is the payment barrier problem that Mu Changchun pointed out in the course.

Tools for keeping things safe

Why does China want to issue a digital renminbi? I will summarize the answer into two reasons: internal security and foreign resistance. Let’s look at the former first. According to Mu Changchun:

We see that now private payment institutions or platforms will set up various payment barriers. Alipay cannot be used where WeChat is used, and WeChat cannot be used where Alipay is used. But for the central bank's digital currency, as long as you can use electronic payment, It must accept the digital currency of the central bank.

From the central bank's point of view, commercial or technological payment barriers will reduce the liquidity of money, which is not conducive to the development of the renminbi.

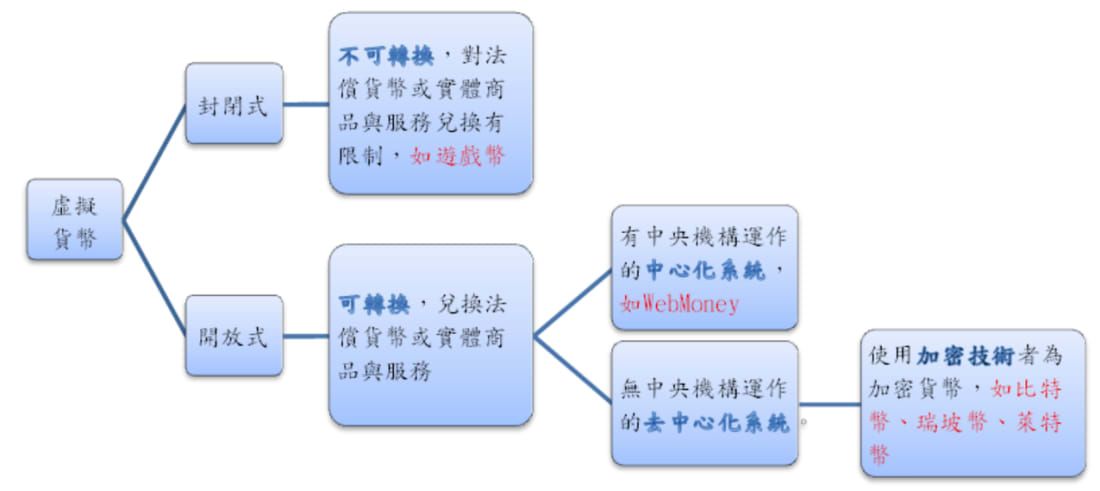

From a technical point of view, before the advent of Bitcoin in 2009, anyone who wanted to digitize paper money had to build a centralized system to keep accounts for users. Which services users can use depends on which services are provided by the centralized system. Moreover, the systems of the two companies are usually not interoperable, resulting in coins being locked in their respective systems, reducing the liquidity of money.

However, after the emergence of thousands of cryptocurrencies led by Bitcoin, people discovered that new technologies (such as blockchain) can split traditional payment tools into cryptocurrencies and wallets. Cryptocurrencies can flow in supported wallets, and wallets can be embedded in different applications. This breaks the payment barriers caused by the original technology. Therefore, the digital renminbi can not only improve the geographical restrictions of banknotes and the problems of high manufacturing costs, but also further overcome the current mobile payment barriers and improve the liquidity of the renminbi.

In addition, Mu Changchun pointed out that the issuance of digital renminbi at this time is a precautionary measure.

The digital RMB has a lot of reference to the design of Libra. Sun Tianqi, the chief accountant of China's State Administration of Foreign Exchange, said more clearly: "Libra may lead to the Libraization of transactions in China, allow domestic capital to flow out through Libra, and further weaken the international status of the renminbi." Compare the testimony of the head of Calibra to the US Congress , and you will find that this is actually a currency war.

Speaking of this, some people will inevitably want to ask: "Should Taiwan also issue digital NT dollars?" I don't think there is any rush. At present, countries that want to issue digital currency with blockchain-related technologies are mainly divided into two categories:

- International economic powers, such as China, the United States (Facebook's Libra) .

- Countries subject to economic sanctions, such as North Korea, Iran, Venezuela.

The former is to strive for international economic dominance through digital currency. The latter is to avoid the sanctions of economic powers through digital currency. The vast majority of countries, including Taiwan, are in between the two. Although issuing digital currency has the bonus effect of peace, it does not have the urgency of external driving.

Not only is the Taiwan government not accustomed to being the number one, but I don’t think it makes much sense to “follow the trend” and issue digital NT dollars at this time.

If you liked this article, it would be a shame to miss out on the members -only article.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More