"Optional Strategies" Learn Iron Butterfly Combination Strategies and Timing of Use

Combination Strategy Iron Butterfly

Iron Butterfly strategy, Chinese is iron butterfly, is a combination of two unilateral spread orders, in order to change the loss flat point, maximum profit, maximum loss, is a neutral strategy.

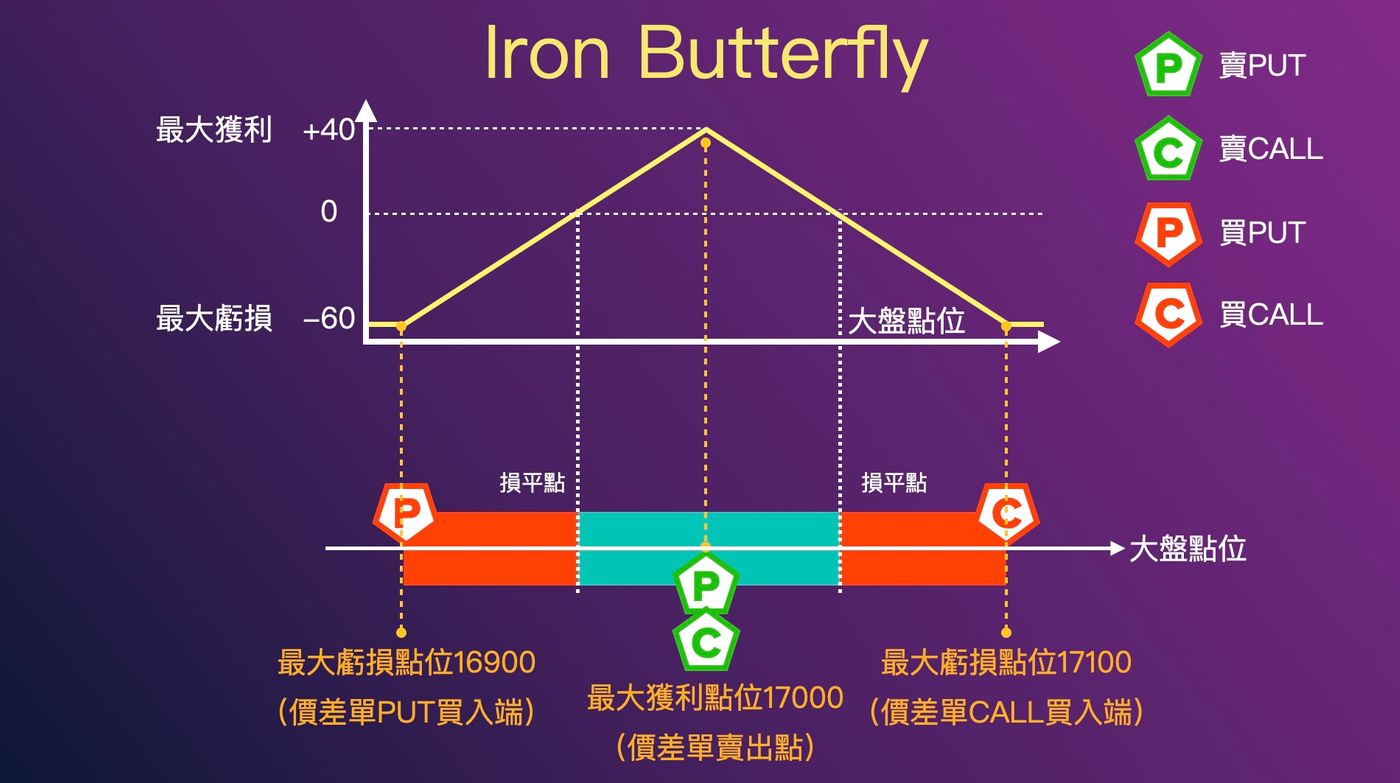

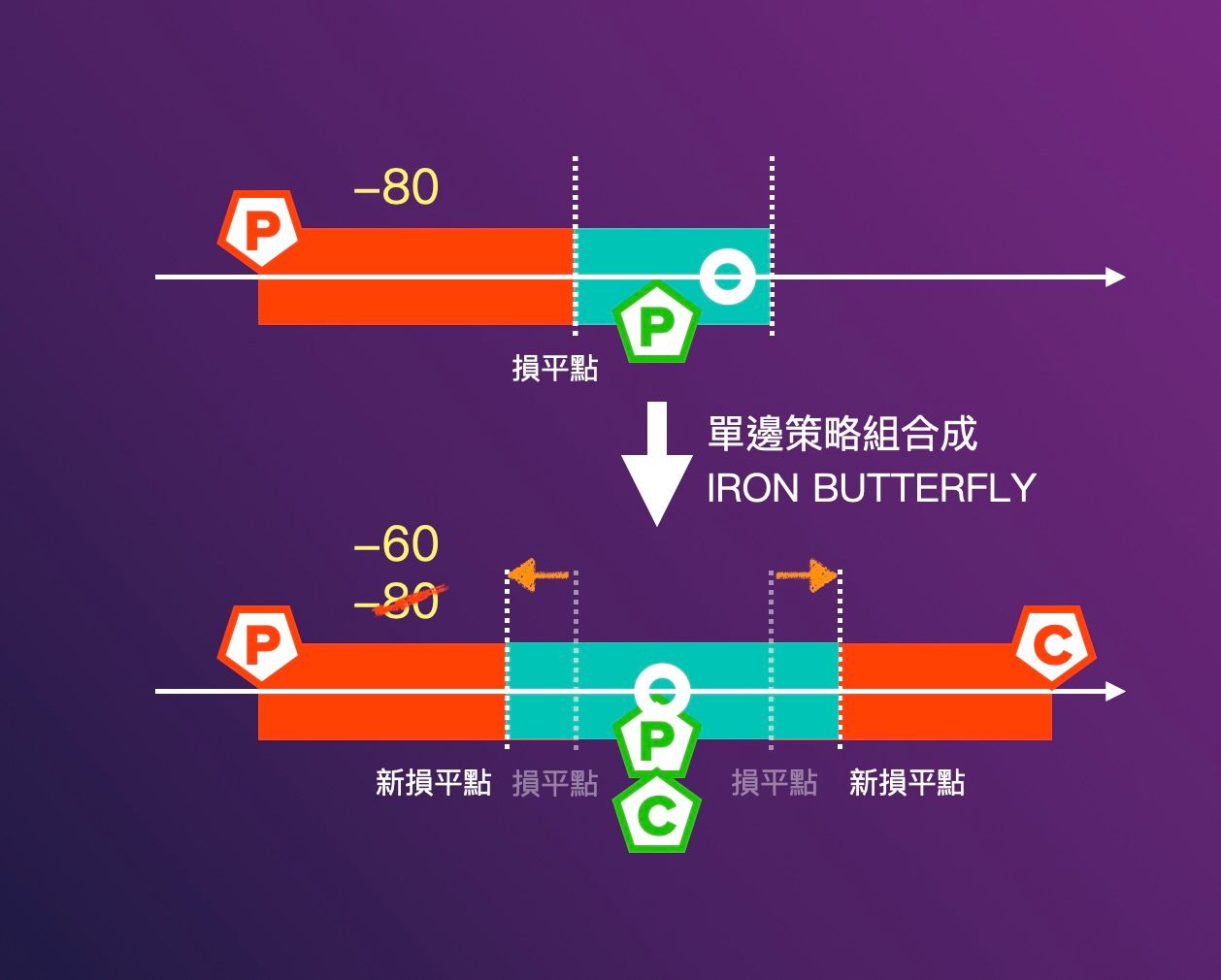

The combination method is to combine the CALL unilateral spread order and the PUT unilateral spread order at the selling end (sell at the same point), as shown in the figure below

Take 17000 Iron Butterfly as a case illustration, the composition of parts:

- Sell 17000 CALL for a 100-point spread order and receive a 20-point premium

- Sell 17000 PUT for a 100-point spread order and receive a 20-point premium

- Maximum profit of 40 points, maximum loss of 60 points

*If you are not familiar with spread orders, you can refer to What is an option spread order? Understand the concept and purpose of the spread order, and break the risk myth! Learn why spread orders are used, how to combine them, and how pips are calculated.

Strategy Profit and Loss Chart and Profit and Loss Calculation

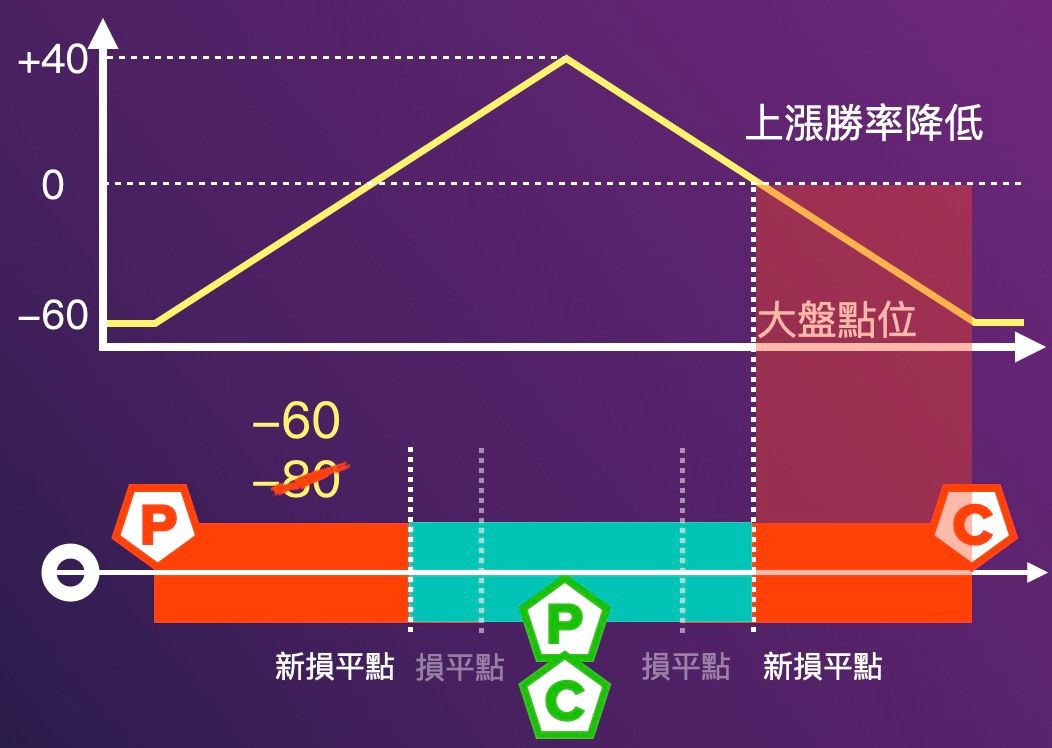

The horizontal axis of the profit and loss chart is the general inventory level, and the vertical axis is the profit.

In the figure, the selling end of the CALL and PUT spread order overlaps at 17000, the left (lower) is the buying end of PUT, the right (upper) is the buying end of CALL, and the maximum loss is limited within this range.

Iron Butterfly combination strategy, settlement in the middle of 17000 will have the highest profit, and the profit will decrease to both sides.

- Maximum profit calculation method: Points received for 2 sets of spread orders = 20 points + 20 points = 40 points

- The biggest profit point occurs when the sell side overlaps at 17000.

- Maximum loss calculation method: 100 pips spread order minus received premium = 100 - (20+20) = 60 pips.

- There are two maximum loss points, which appear at the buying end of the two sets of spread orders, which are 16900 and 17100 respectively.

Iron Butterfly has 2 break-even points, calculated as 17000 +/- 40 points, 16960 and 17040 respectively.

You can watch the 50-second Iron Butterfly instructional video to deepen the impression and improve the learning effect

Iron Butterfly Iron Butterfly Strategy Use Timing

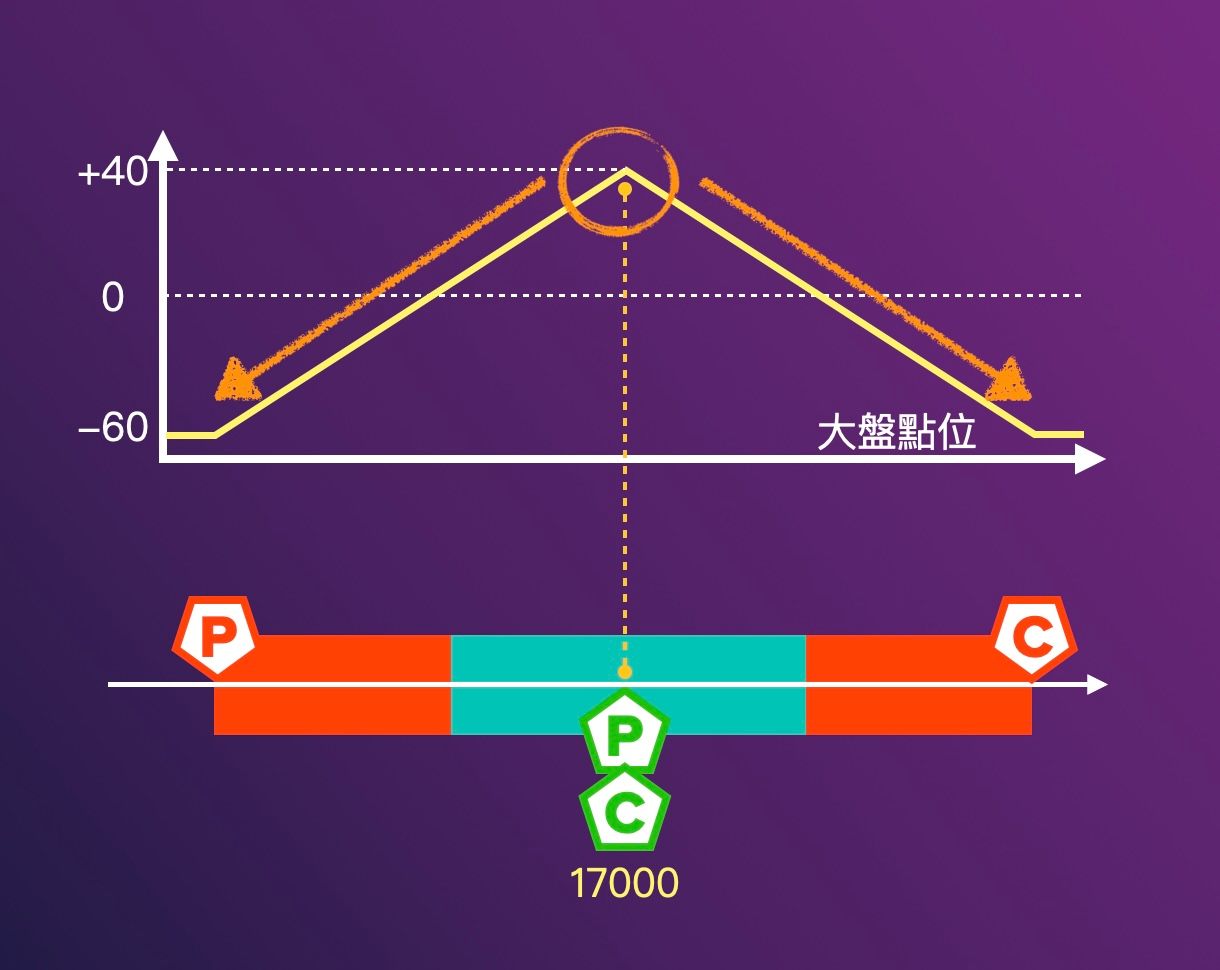

Iron Butterfly's feature "profits are concentrated and distributed to both sides", which is very suitable for adjusting positions. It is most often used to lock the overall position of maximum loss control and avoid major risks.

Assuming that PUT was originally sold as a one-sided strategy, a 100-point spread would receive a 20-point premium, and the maximum loss would be 80 points.

If the market falls below 16980, it will start to lose money; so when the market is falling, you can sell a set of CALL spread orders in advance, and the selling points overlap at the same point to do Iron Butterfly.

As shown in the figure below, even if the maximum loss still occurs in the same position, the loss leveling point will move, and the unilateral PUT spread order has been reduced from a loss of 80 points to a loss of 60 points, reducing the loss by 25%.

Because selling CALL and receiving premium can reduce the loss that is penetrated when falling, and the market will only go in one direction. Assuming that the market has fallen to 16900, the original maximum loss of 80 points can be covered by selling the CALL premium to make the maximum loss become 60 points. However, it should be noted that selling this group of CALL spreads will limit the profit and winning rate of future increases .

Therefore, Iron Butterfly is used for me to control the losses of the overall position without too much risk, and it is less used to increase profits.

You can watch the 50-second Iron Butterfly timing introduction video

Option teaching: understand combination strategies, hedge positions to reduce risks

After running the Youtube channel " Unpredictable Ups and Downs" for a few months, I have responded to thousands of messages, and I am well aware of the problems and solutions that most people encounter when option sellers conduct transactions. I rearranged the YouTube video to explain it with a more rigorous structure, and launched the " Speaking Choice Course ". With clear pictures and video descriptions, I can help you easily get started trading choice rights and become a chance for long-term and stable income. Profitable option traders.

This course especially focuses on the explanation of the process of opening a position. Hedging and hedging can greatly increase the winning rate of profit by using a combination strategy of option spread orders, such as Iron Condor, Iron Butterfly position opening and precise point calculation Guess the ups and downs, see the chips, master the calculation method of profit and loss smartly, and create a long-term profit method!

Please refer to my Selling Call Selling Put operation analysis video or watch the course overview video in 1 minute to quickly understand the teaching style and course content. 2 people traveling together will get another $438 off each, and control the operation together. correct! Join the course now and also get 22 consecutive weeks of profitable entry strategy teaching - large range strategy .

Learn about the course now: The choice course for speaking people

The original text was published on the official website "Optional Strategy" on Unpredictable Ups and Downs Learn Iron Butterfly Combination Strategies and Timing of Use

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More