Left or right? Learn to choose sides before investing in stocks! |Am I a "stock" physical therapist? ! (five)

Finding the best, or in other words, the " entry and exit point " with the highest winning percentage is what every investor wants to do.

But when the stock price fell all the way,

Someone said: Do not pick up the fallen knife;

Some people say: Pulling back is an opportunity, the lower the price, the more you have to buy...

high stock price,

Some people say: breaking the support can determine the end of the trend;

Some people say: it is only safe to stop profit in batches...

It makes sense at first glance,

Especially because of this, I can't be sure before the transaction; I regret it after the transaction ...

Not because of the right and wrong of the above,

Rather, in terms of transactions, either approach is fine.

It also has its pros and cons,

Just find the right "that side"!

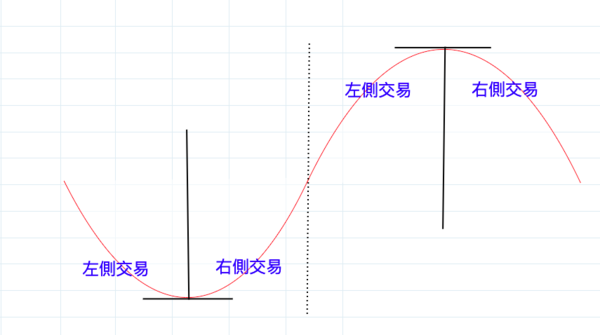

left side transaction

Bounded by "bottom and top",

Make a trade when the "left side" is close to the line,

This trading method is designed to trade "before the price has moved as expected ".

It is a " contrarian operation ".

Advantages - large profit margins:

This practice is usually more common in " medium and long-term " investors, such as Warren Buffett

"Enter the market in batches" when the stock price falls below the value,

Therefore, in the case of sufficient funds, such an approach can be bought at a relatively low point as much as possible;

Conversely, "sell in batches" when the price rises above the value.

The sell price will also be fairly close to the relative high .

Such an approach is more likely to drive up profits than left-hand traders.

Disadvantages - high risk:

Because it is a "contrarian operation": the lower the lower the more buying, the higher the higher the selling ,

It's a test of human nature.

It also tests investors' "confidence" in holding stocks.

And that confidence comes from knowing the holdings.

In addition, the " time cost " is also a risk of this approach,

Because no one knows where the real bottom and top are ,

The time for "waiting for profit" in the holding process is usually not short.

So whether you can create an excellent "annualized rate of return" still has to go back to:

The ability to control the risk of this company, this type of industry, and even the overall market.

right side transaction

Bounded by "bottom and top",

Trade on the "right" side after crossing the line,

This trading method is designed to trade when there is a " change in trend ",

For " homeopathic operation ".

Advantages - less risk:

This type of transaction is usually biased towards " short-term operations ".

Enter the market at the beginning of the "trend formation",

For example: breakout of consolidation range, breakout of downtrend line, breakout of neckline...

When these conditions occur, a change in trend is often followed by,

So the time cost is relatively low.

Again, selling is also when the market situation has changed significantly,

It is easier to avoid systemic risk than right-hand traders,

As long as you strictly abide by the "stop loss and stop profit",

It can achieve " big profit and small loss ".

Disadvantages - low profit margins:

Because the transaction is made during a period of "up and down" between gains,

must have lost some profits,

In addition, "the technical line is drawn by the main force ",

The chance of being " deceived " by the main force is also quite high.

That is to say, it has clearly broken through but pulled back the next day; it has clearly fallen below but has risen again...

Situations like these happen quite often.

It also often causes investors to be "washed out" and "shipped" ......

In addition, short-term " frequent transactions " will also lead to "increased transaction fees".

However, due to the small profit margin, to achieve the same annualized rate of return,

This will be the inevitable result.

in conclusion,

if for your own

Interested and confident in studying long- term factors such as stock fundamentals, value, industry, value valuation, etc.;

Patient, confident in holding stocks, willing to hold for a long time and wait for profit ,

Then you may be more suitable for "standing on the left",

But pay attention to the factors of " risk control, time cost "!

but if you

Likes to study data, graphs, visualizations...;

Have confidence in the " decisive " operation, cut when it is time to cut, and increase when it is time to increase;

You can take the " win rate " as the priority, and don't care about the loss for a while,

Then you can try to "stand on the right",

But be careful " don't condone orders, be disciplined "!

So in fact, it goes back to the original concept:

There is no best practice, only the most suitable,

Each trading method has its pros and cons,

Take advantage of its advantages and try to minimize the disadvantages indefinitely, and each trading method can be stable and profitable.

Think a little more...

In fact, transactions in the market are not so standardized, they must be left or right,

After reading the above sharing, you can also know that this is the truth of "the higher the risk, the higher the reward ",

Therefore, there are also ways to reconcile the way of left and right transactions to reduce risks.

To achieve a more balanced approach between risk and profit,

But that's where it gets even more difficult...

-------------------------------------------------- -------------------------------------------------

I'm Baker, I'm a physical therapist, welcome to my country

.

Under the current health care system in Taiwan, no matter what the zodiac sign, the therapist will definitely write the word "world-weary" in the personality column.

.

Over time, the burning dream fire in my heart gradually went out, and "doing the 'teacher' and walking the meat" became a buff at the meeting before going to work every day . . .

.

But in my country, I hope my residents can see the real face of physical therapy and then understand, understand, and even love this profession that is "no less than any other medical technology" and "not just brainless operations" . . .

.

Finally if you like my article

.

Please help me click "5 likes" below, or support me, give me full motivation to continue to bring good articles to all residents

.

You are also welcome to leave a message below to tell me what you think or what you want to see!

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More