The first bank in the Metaverse: What JPMorgan's VIP room in Decentraland means

NFT is another carrier of brand value. Its practicality is not the only consideration for buyers. It is also important to facilitate collection and display. But NFTs are not completely useless, and the Metaverse is one of the usage scenarios of NFTs. Last week JP Morgan announced the opening of a VIP room in Decentraland, becoming the first bank to enter the metaverse.

This article discusses JPMorgan's blockchain development and why they chose to open a VIP room in the Metaverse instead of setting up a "Metaverse Branch" directly?

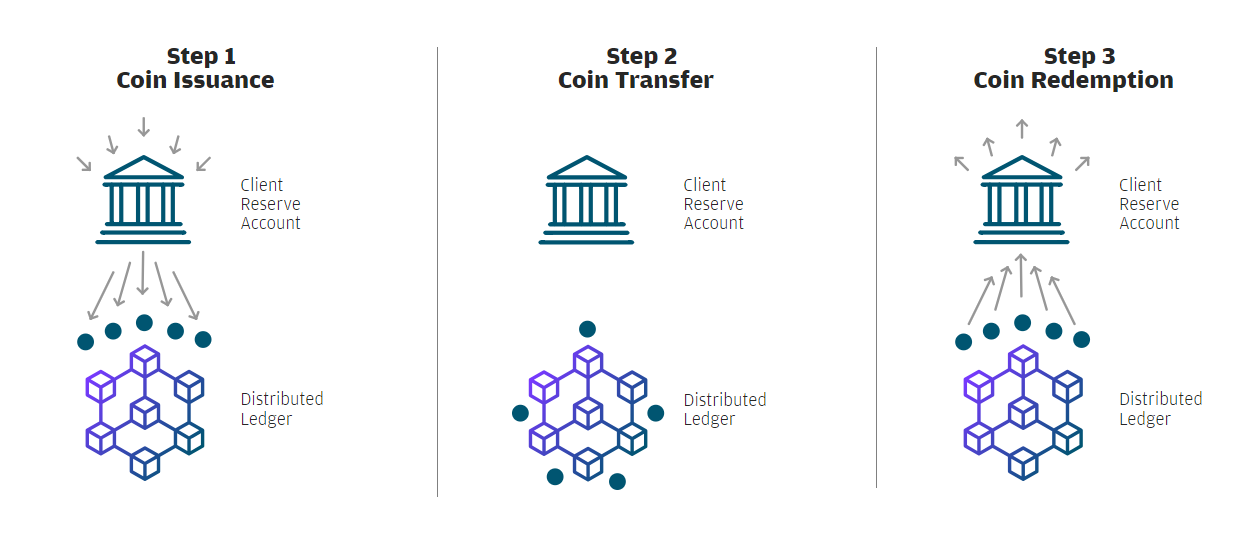

JPM Coin

JPMorgan Chase is arguably the bank most familiar with blockchain, with its blockchain division Onyx. They started researching blockchain as early as 2016 and launched JPM Coin, a USD stablecoin based on their own blockchain, in 2019. According to JPMorgan :

JPM Coin is a permissioned, shared accounting system that allows JPMorgan Chase customers to transfer U.S. dollars deposited with JPMorgan Chase through JPM Coin. This enables instant flow of value and solves the barriers of traditional cross-border payments.

Unlike the USDT and USDC dollar stablecoins, JPM Coin is not built on a public chain like Ethereum that everyone can use, but on a consortium chain (or private chain) created by JPMorgan Chase. JPM Coin is only available to JPMorgan Chase corporate clients and will not appear on the exchange.

The purpose of their issuance of JPM Coin is very simple, which is to improve the transfer efficiency of cross-border payment through the blockchain. JPMorgan will convert the $100 on the ledger into 100 JPM Coins at a 1:1 ratio, and process each transaction instantly through its own blockchain.

This bypasses the slow and expensive SWIFT transfer system, making cross-border payments as cheap as blockchain transfers, 24/7, and instant. At present, more than 400 financial institutions have used JPM Coin, which is one of the most successful alliance chain applications in the world.

It's just not feasible to move the same approach - building your own blockchain - to the metaverse. JPMorgan knows this too, which is why it chose to open the Metaverse's first banking lounge, Onyx Lounge, in Decentraland. The clues can also be seen from the Metaverse Business Opportunities Report published by JPMorgan Chase.

Metaverse VIP Room

JP Morgan Chase in the financial field "screaming water will freeze", and even building its own blockchain can find enough corporate customers to participate in the grand event.

But the metaverse aims to build a digital world that ordinary people can also walk into in person. Without enough users, the Metaverse will become JPMorgan's own "stand-alone game." Therefore, the report emphasizes how to do business in the existing metaverse, not like Meta wants to be the "creation god" of the metaverse.

The picture below is my selfie at the entrance of the JPMorgan Chase lounge. By clicking this link, you can also open Decentraland via a computer web browser and visit the lounge in person.

The Onyx Lounge has a total of two floors. There is no tea and no service staff in it, and it is fully self-service.

The lobby on the first floor has a walking tiger, a portrait of the CEO, and JPMorgan's blockchain development roadmap. On the second floor, there are several interview videos related to blockchain, as well as two research reports published by JPMorgan Chase.

Clicking on the video on the wall will play it directly, as if someone had embedded a YouTube video on the wall. Clicking on the research report will link to the JPMorgan Chase website and cannot be read directly in the Metaverse. The Onyx Lounge is more of a JPMorgan branding space in the metaverse than a bank counter that offers financial services.

According to JPMorgan's Metaverse report :

The Metaverse is the seamless integration of physical and digital life in which people can work, play, and trade. In the metaverse right now, almost every industry is full of opportunities. For example, people can buy limited edition digital branded clothing, or they can open digital galleries and private clubs on them.

The digital real estate market may also become very similar to the physical world in the future, with lines of credit, mortgages, and lease agreements all rolled out. Banks in the Metaverse will be able to accept people borrowing against digital land, and the lender may not be a company at all, but a DAO composed of netizens who have never met.

Although this piece of content is aptly written, it does not answer the most curious question of everyone - what are the opportunities for banks in the metaverse?

In the Metaverse, people's cash is the cryptocurrency in their wallets, and a transfer is a transaction record on the blockchain. Future deposits and loans will be completed through DeFi applications such as Aave and Compound. When most financial services can be completed directly through blockchain and smart contracts, the role of banks as transaction intermediaries becomes redundant in the metaverse.

Take the Metaverse Casino Atari Casino as an example, they listed the casino chips $DG on the Uniswap decentralized exchange, replacing the currency exchange counter of the casino. It also stipulates that gamblers must first go to OpenSea to buy designated clothing before entering the casino. If there is no designated clothing in the wallet, it is like walking into a fine dining restaurant wearing sandals, and you will be blocked by an invisible wall.

This is the classic application scenario of cryptocurrencies, DeFi and NFTs in the metaverse.

But in the current state of JPMorgan, JPM Coin is limited to its own blockchain. If it wants to build financial services for the Metaverse, JPMorgan will also have to adapt to the actual usage needs of it. Otherwise, even if it is full of opportunities, the launched services may be incompatible with DeFi on Ethereum, or even impact existing businesses. In the case of hitting a wall, JP Morgan had no choice but to first establish a symbolic VIP room in the Metaverse, rather than directly opening a "Metaverse Branch".

Compared with JP Morgan opening a VIP room and hurriedly publishing a metaverse business book that is currently difficult to practice, NIKE’s approach to the metaverse seems to be more pragmatic and in line with the appetite of currency players.

Nike acquires RTFKT

In December 2021, NIKE announced the acquisition of NFT studio RTFKT (pronounced artifact), extending the brand's influence to the metaverse. According to a NIKE press release:

NIKE today announced the acquisition of RTFKT, a leading brand of new collectibles combining culture, gaming and cutting-edge technology. This is a milestone in NIKE's digital transformation, expanding NIKE's presence in the digital world through RTFKT and enabling us to serve athletes and creators at the intersection of sports, creativity, gaming and culture.

Founded in 2020, RTFKT initially made its name with a pair of sneakers.

RTFKT used Tesla Cybertruck as a prototype to create a pair of NFT sneakers of the same style, and forced Musk to " put it on" through retouching. This pair of sneakers NFT was sold in 2020 with ETH equivalent to 90,000 US dollars. RTFKT also cooperated with CryptoPunks on NFT sneakers , and also cooperated with fashion artist Takashi Murakami on NFT avatars .

Although NIKE has not yet opened a store to sell sneakers in the Metaverse, RTFKT recently launched a blind box with NIKE co-branded and unopened, and the market price is close to 5 ETH. The market heat is evident.

There is no standard way of how companies enter the metaverse. But both JPMorgan Chase and NIKE may have to learn to return to zero and launch new products based on the Metaverse. If you just copy the successful model of the past, I am afraid that you can only open a "VIP room" in the metaverse.

If you liked this article, maybe you will also be interested in the past content of the block potential. In addition, please recommend the block potential to your relatives and friends 🙏

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More