4 major US stock indexes

Introduction and constituent stocks of the four major U.S. stock indexes

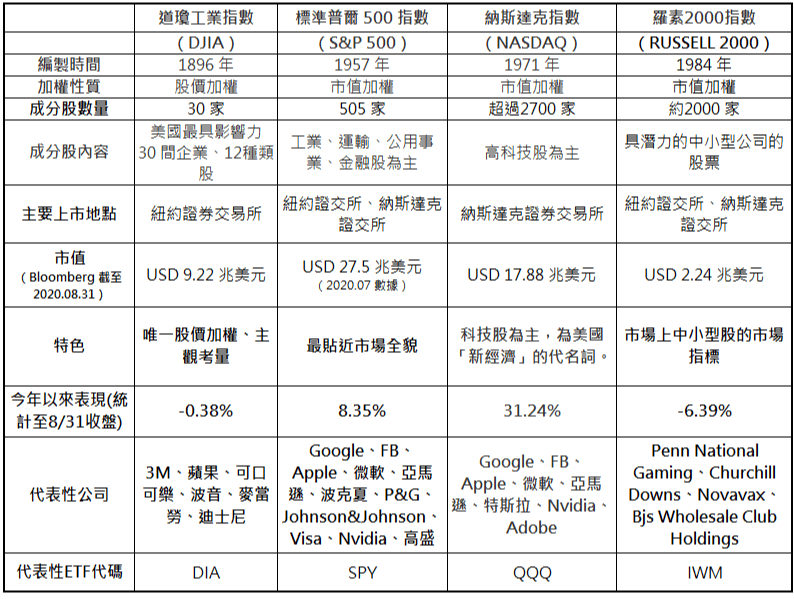

Unlike the Taiwan weighted index, which is compiled by the government and includes all stocks listed in Taiwan, there is no index in the United States that can include all listed companies. The major indexes are compiled by different private stock exchanges according to their own logic. The methods are compiled, each with its own characteristics and emphasis, the most representative of which are the Dow Jones Industrial Average, Nasdaq, S&P 500, and Philadelphia Semiconductor.

Dow Jones Industrial Average

Dow Jones Industrial Average (DJI)

The Dow Jones Industrial Average is the oldest of the four major indexes. It was jointly compiled by The Wall Street Journal and the founder of the Dow Jones Company, Charles Dow Jones. It was published in 1896 and has been more than 100 years old. It is of great significance to establish a stock market model. The Dow Jones Industrial Average has only 30 constituent stocks, and unlike other indexes that are weighted by market capitalization, the Dow Jones Industrial Index is the only index that is weighted by "stock price", and the higher the stock price, the greater the proportion. The Dow Jones Industrial Average has selected the most representative blue-chip companies in the United States, and it will also be adjusted according to the situation. However, due to too few constituent stocks and the subjective conditions of stock selection, it is slightly insufficient to represent the US stock market. From the perspective of the constituent stocks, we know that although the well-known Apple, Microsoft, Visa, McDonald's, Disney, etc. are listed as Dow Jones constituent stocks, the five FAANG stocks that are on the rise are in addition to Apple. , Amazon, Google, Facebook, Netflix and other four gears are excluded.

Standard & Poor's 500 (SPX) Standard & Poor's 500 (SPX) The Standard & Poor's 500 Index, usually referred to as "S&P 500" (S&P 500), was launched in 1957 and includes 500 listed companies in the United States, covering technology, finance, information and other fields. Companies to be included must be located in the United States, have a market capitalization of at least $8.2 billion, and have four consecutive quarters of positive earnings in accordance with generally accepted accounting principles, while also taking into account trading volume and liquidity. The S&P 500 constituents are weighted by market capitalization, selected by the committee after a comprehensive consideration of a number of principles to ensure representativeness, and are regularly adjusted quarterly. Because the S&P 500 is diverse and the industry is complete, the S&P 500 is considered to be the most representative of the overall U.S. stock market compared to the Dow Jones Index, which has only 30 constituent stocks, and the Nasdaq Index, which is concentrated in the high-tech industry. The trend index is even enough to show the rise and fall of the US economy.

Nasdaq 100 Index NASDAQ 100 Composite Index (NDX) The Nasdaq 100 Index was founded in 1971. The initial index was 100 points, and now it is more than 10,000 points. It has risen a hundred times in 50 years. The main reason for the amazing growth is that the Nasdaq Index is mostly composed of high-tech companies. These high-profile emerging companies have not only changed the operation of the world, but also become the driving force that leads the index to continue to soar. Undoubtedly, in addition to the five fang-fang stocks (FAANG), all its constituent stocks are on the list, and the recently popular electric car Tesla and video software Zoom are also guests, and because the constituent stocks are concentrated in the high-tech industry, then Starq is also regarded as the wind direction of the US stock market. The Nasdaq 100 Index is compiled using "market capitalization" as a weighted weight to include 100 individual stocks. What is more special is that the constituent stocks do not include financial stocks.

Philadelphia Semiconductor Index PHLX Semiconductor Sector Index (SOX) The Philadelphia Semiconductor Index, referred to as Feihan, was founded in 1993 and covers semiconductor design, equipment, manufacturing, sales and distribution, etc. It is an indicator of the global semiconductor industry prosperity. Listed in the Feihan Index, TSMC has also attracted the attention of investors due to its high proportion of Taiwan stocks and the close relationship between many electronic supply chains and the semiconductor industry. The constituent stocks are not specifically listed.

-------------------------------------------------- ----------------

DKSH commission fee discount online account opening~~

Salesperson of Shulin Branch of Dachang Securities Co., Ltd.: Liu Xinyu

Contact number: (02) 2675-2238 or 0983363862

Securities Dealer License No.: 109 Jinguanzheng Zongfenzi No. 0002

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!