Forget about Bitcoin? A Fintech Investment Opportunity You Shouldn't Miss!

Forget Bitcoin, Fintech is the protagonist of the epidemic era! - JP Morgan @ CNBC 2021.02.22

When it comes to finance, I think of banks. I wonder how long it has been since you/you have been to a bank? In the past, many things that could only be done at the bank have gradually been replaced by apps on mobile phones... These are the applications of financial technology in our lives!

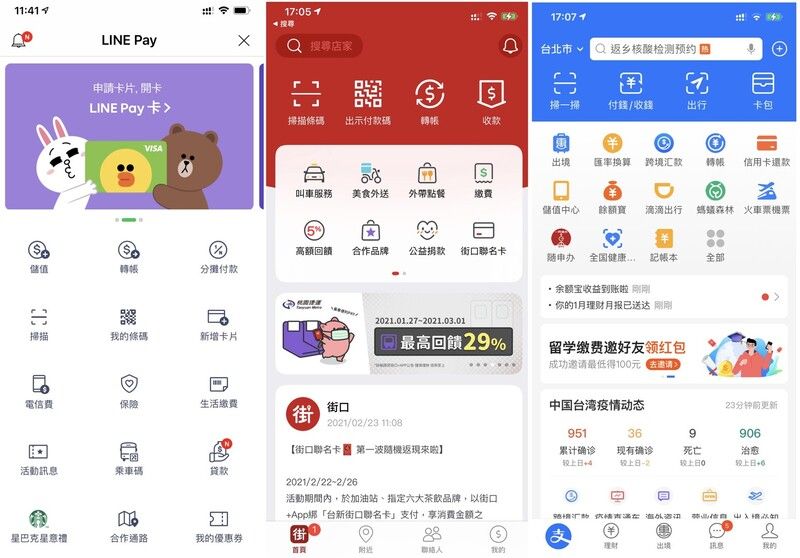

Friends who know the mainland must know that cash is rarely used. Without digital payment tools such as Alipay or WeChat, it is almost impossible to live in the mainland. In Taiwan, electronic payment apps such as Jiekou and Line Pay began to be launched in 2015. By the end of 2020, there were more than 11 million electronic payment users in Taiwan . In the past, they used to go to convenience stores to handle various living payment and roadside parking fees. Now they use digital payment tools to lie down. It can be handled on the sofa , and convenience store shopping, transfer, payment, etc. can also be done on the App!

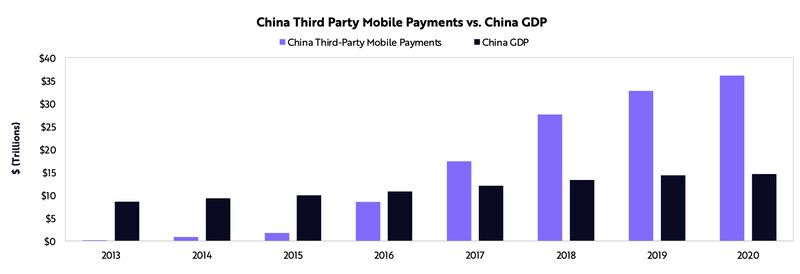

The mainland is currently the most developed country in mobile payment. The transaction amount of its third-party mobile financial payment (mobile Alipay, WeChat) has grown by 15 times in just 5 years, reaching 30 trillion US dollars in 2020, which is 3 times its GDP. , while the impact of the Covid-19 outbreak has accelerated the rapid growth of fintech in other regions.

Even in Taiwan, where financial regulations are relatively conservative and backward, Fintech has quickly facilitated our lives , and the Covid-19 epidemic has accelerated the growth of electronic payment applications without physical contact. But unfortunately, there are no ordinary investors in Taiwan who can seize this wave of rapid growth opportunities, so let's put our investment vision in the United States!

What is Fintech?

As the name suggests, Fintech = Financial Technology, which is to use technological innovation to provide more convenient and efficient financial services.

The scope of Fintech?

A picture from Venture Scanner introduces the actual and specific Fintech category. Among the top five fields that most technology companies invest in, four projects, including lending, payment, personal finance, and personal investment, are closely related to our lives . Taiwan's Line Pay, Jiekou App already covers related services in addition to personal investment .

The top five areas where Finetech companies invest the most:

- Lending

- Payment

- Personal Finance

- Equity Finance

- Personal investment (Retail investment)

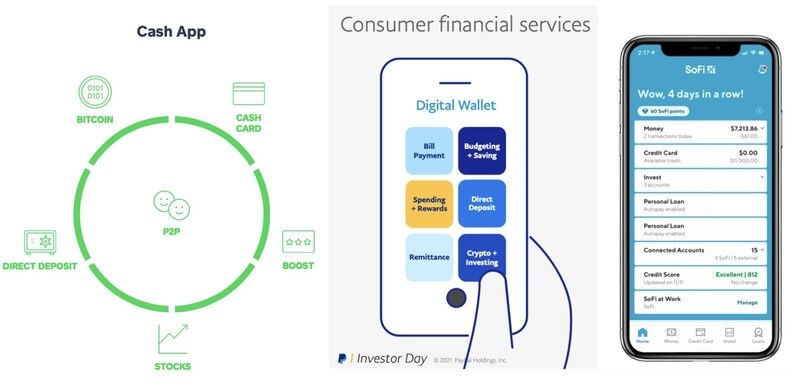

The development of mobile digital wallet (Digital Wallet) covers the top four areas that are closely related to general consumers , and combines them into a single App, such as Square's Cash App, Paypal's Venmo, and SoFi's SoFi App. Therefore:

Digital wallet is the most direct, visible, and relevant Fintech investment opportunity for consumers/investors

Market potential of digital wallets?

The application of Fintech has accelerated under the catalysis of the COVID-19 epidemic. Mobile phones are mobile digital wallets, providing services such as payment, lending, personal finance, investment, and even buying and selling Bitcoin. According to the estimates of Ark Fund, the US market alone There is a chance to reach $4.6 trillion by 2025.

The growth rate of mobile digital wallets

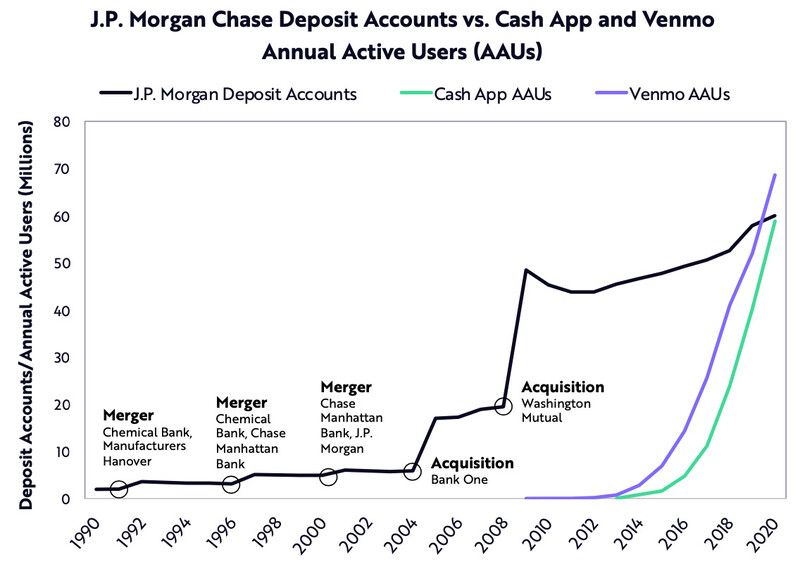

The two major digital wallets in the United States, Cash App and Venmo, took only 7 years and 10 years respectively , surpassing the 60 million users it took JP Morgan Chase, the traditional bank leader, to accumulate in 30 years. They have already entered a rapid growth before, and their development has been accelerated after the outbreak of the epidemic.

Which digital wallet companies can invest in?

- Paypal ($PYPL): Venmo, based on Paypal's vast user base

- Square ($SQ): Cash App, currently the most highly rated digital wallet

- SoFi ($IPOE): SoFi, started with Gen Z student loans, provides a complete one-stop digital wallet

But for JP Morgan's "Forget Bitcoin", Paypal's Venmo and Square's Cash App now both provide the function of buying Bitcoin . It seems that digital wallet companies don't think so. After all, consumers have direct need.

If you can't invest in Jiekou and Line, investing in a US digital wallet financial technology company with a larger market is a choice worthy of careful evaluation at present!

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More