[Buffett's 2022 shareholder letter: Berkshire's optimistic investment fields this year, Buffett's advice to young people. 】

Berkshire recently released its annual letter to shareholders. Berkshire’s performance this year finally beat the U.S. stock market again, and Buffett and Munger can take a breather.

Sort out the things that I think are quite important in the entire shareholder letter, and write them below:

1. Stick to value investing:

Buffett also emphasized that investing is long-term, and that value is found and bought when the market is misvalued. As Munger said, such obvious opportunities don't come every day.

Therefore, when looking for a good company, you must choose a CEO who has long-term economic advantages and a first-class CEO. (Choose a business and choose a manager, such as Coca-Cola and Apple.)

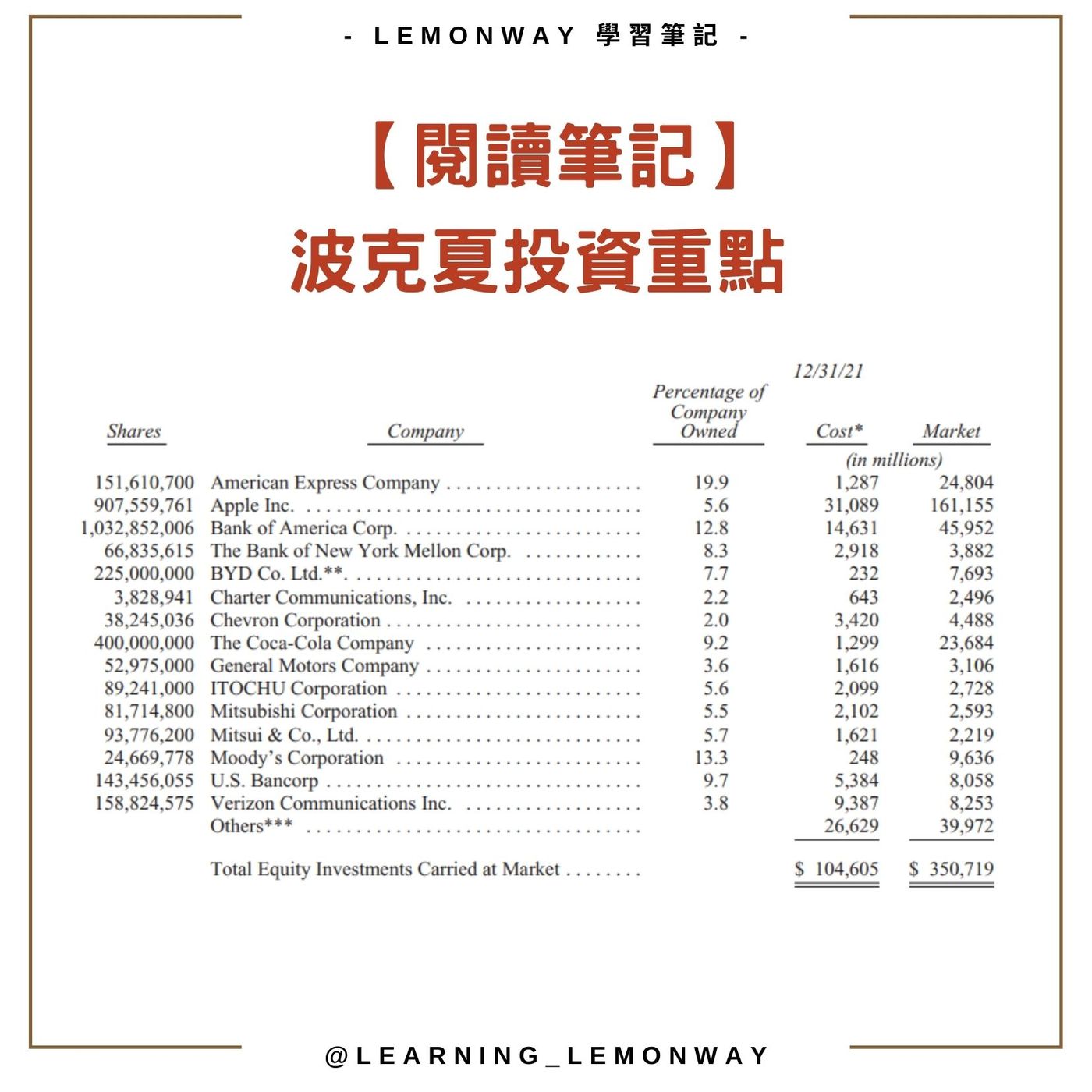

2. Four investment areas that Berkshire is optimistic about in 2022:

1. Financial insurance

The enterprise value of financial insurance, after the US central bank begins to turn hawk in 2022, should have better performance with inflation. And the financial industry is still growing in demand, one of Berkshire’s favorite areas. Taiwan's financial stocks have also experienced fairly stable price growth in the past six months.

2. Technology industry:

Not all tech companies are good. Companies that make money and have a moat business model are worth investing in, like Apple.

3. Logistics:

Berkshire's other big profit source this year has been BNSF Amtrak. In an era where global warming emphasizes carbon neutrality, logistics companies that can provide reduced carbon emissions are very important.

4. Energy:

American BHE companies are also Berkshire's investment focus. The business is responsible for wind, solar and transmission in most of the United States.

Berkshire's investment is actually quite obvious from the perspective of people's rigid needs. All corporate businesses must meet the necessities of human life, and they will perform well in conjunction with economic growth.

3. Some advice for young people:

If you don't need money for a while, it's more important to find people who want to work with you. While economic realities may interfere with such explorations, Buffett encourages students to never give up looking for such opportunities.

Because when you find that kind of job, you will no longer "work".

【Summarize】

After reading Buffett's shareholder letter this year, Berkshire has consistently adhered to Munger's patient long-term strategy.

Long-term investments are still the best for the general public. Berkshire's annual return of 20% over the past 20 years is far greater than the 10% or so of the broader market.

It is also important to look at industry trends. Buffett and Munger, on the other hand, are less optimistic about the technology industry that has emerged in recent years, and bear against Tesla and cryptocurrencies. But they just don't do what they're not good at.

I think the younger generation should be more exposed to the front-end trends of the industry, find the technological revolution that changes human life, and have a vision to match Berkshire's long-term investment strategy, and the value will be discovered sooner or later.

- If you want to know more content, welcome to keep track and update!

- Be my appreciative citizen and help me go further by sponsoring a cup of coffee every month. https://liker.land/william53241/civic?utm_source=dashboard&utm_medium=app&utm_campaign=sponsor_link_cta

- Lemonway daily study notes FB fan: https://www.facebook.com/profile.php?id=100055469826072

- Lemonway daily study notes IG fan: https://www.instagram.com/learning_lemonway/

- If you want to cooperate, you can come to me here: william5324144@gmail.com

- Join me to share the blockchain article on Telegram: https://t.me/lemonwaylearning

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More