Are virtual currency exchanges a good business? Observations from Coinbase's performance

In 2021, with the popularity of NFT and GameFi, the price of virtual currency, transaction volume and market value have exploded. Coinbase's financial report has delivered outstanding results, and YoY's revenue has grown by as much as 6 times. The future development is relatively unoptimistic. From the fall of Coinbase's stock price, it can be seen that there is a bit of a bad atmosphere. Can the exchange continue to achieve early stable income and growth?

This article "Coinbase Global: The Business Model Isn't Sustainable" points out the observation of Coinbase's market outlook, and points out several factors that will cause Coinbase's unsatisfactory performance in 2022. MeowHo organizes and further analyzes:

1. Market factors:

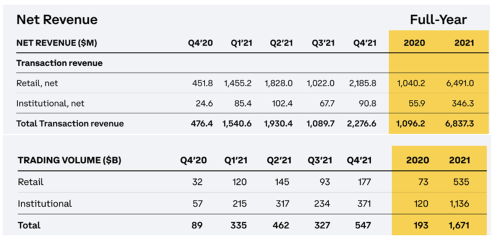

The virtual currency market is heading for a bear market, and the unstable market affects the transaction volume. According to Coinbase’s financial report, 93% of its revenue comes from transactions, and the decline in transaction volume obviously affects Coinbase’s earnings. This is also reflected in Q3 2021. Coinbase revenue is lower than other quarters

2. Competitor factors:

There are many large-scale competitors in the market, and more and more newcomers are joining the ranks of exchanges. In the past, Coinbase charged 1%~1.4% of the handling fee, but now facing the competition of competitors with low fees, is it still worth it? live? Investors are not stupid. When there is no significant difference in experience, what advantages does Coinbase have to make investors willing to pay high costs to affect their investment performance?

3. Regulations:

Internationally or in the United States, there is a tendency to list virtual currency transactions, which affects users and competitors.

(1) Will the increasingly strict supervision reduce investors' willingness to invest?

Personally, I don’t think regulation will affect it. Although regulation violates the spirit of decentralization, the use and investment of virtual currency will not change. In the long run, whether it is regulated or not, it is still very optimistic about the development; on the other hand, if countries issue digital currency applications, whether The impact of virtual currency is worth observing research

(2) In the past, traditional financial industries such as banks and investment institutions, with clearer supervision, can enter the market with peace of mind and become competitors of the current crypto exchange

The operation of exchanges is destined to face many risks and challenges in the coming days. However, the overall company layout of Coinbase is not only about exchanges, but also Coinbase ventures and other B2B service projects continue to increase, which is worthy of follow-up observation.

The challenge Coinbase faces is actually a problem that all exchanges need to face. I think this is also the reason why an exchange keeps launching various services and combinations, hoping to create differences to attract investment and stimulate trading volume.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More