What are the ways to invest in gold? The best investment in 2021!

Gold investment has now become the choice of many investors, but among the many gold investment products, which investment method is the best? What should I do after choosing a suitable gold investment product? Today, we will talk about the comparison of the more popular products among gold investment methods and channels. What are the best gold investment products in 2021? Which one is worth your investment!

1. What are the gold products? What's the difference?

1. Physical gold

Physical gold investment refers to gold bullion, gold coins, and gold jewelry, which are held in physical gold as investment. As an international hard currency, gold has a strong function of value preservation and appreciation, and the value of gold is inherent and inherent in itself.

2. Gold passbook

Gold passbook is a passbook issued by the bank to the customer after the customer opens an account with the bank. The customer can decide whether to conduct a single transaction by going to the bank counter or automated equipment according to the price of the gold passbook announced by the bank at that time.

3. Gold futures

Gold futures are also known as "gold futures contracts". A futures contract that trades on gold. Like general futures contracts, gold futures contracts also contain transaction units, quality levels, duration, last expiry date, quotation method, delivery method, minimum range of price changes, limits of daily price changes, etc.

4. Spot Gold

Spot gold is an international investment product. Gold dealers establish trading platforms and conduct online trading transactions in the form of leverage ratios. Spot gold is often referred to as the world's largest stock. Because of the huge daily trading volume of spot gold, the daily trading volume is about 20 trillion US dollars. There is no market maker in the spot gold market, the market is regulated, the self-discipline is strong, and the laws and regulations are sound.

5. Gold ETFs

Gold ETF investment is an open-end fund in which most of the fund assets are invested in gold-based assets, closely track gold prices, and are listed on stock exchanges. Gold producers consign physical gold to fund companies, and then fund companies rely on physical gold to publicly issue fund shares on the exchange and sell them to various investors. Commercial banks act as fund custodians and physical custodians respectively. During the duration of the fund, the fund can be freely redeemed.

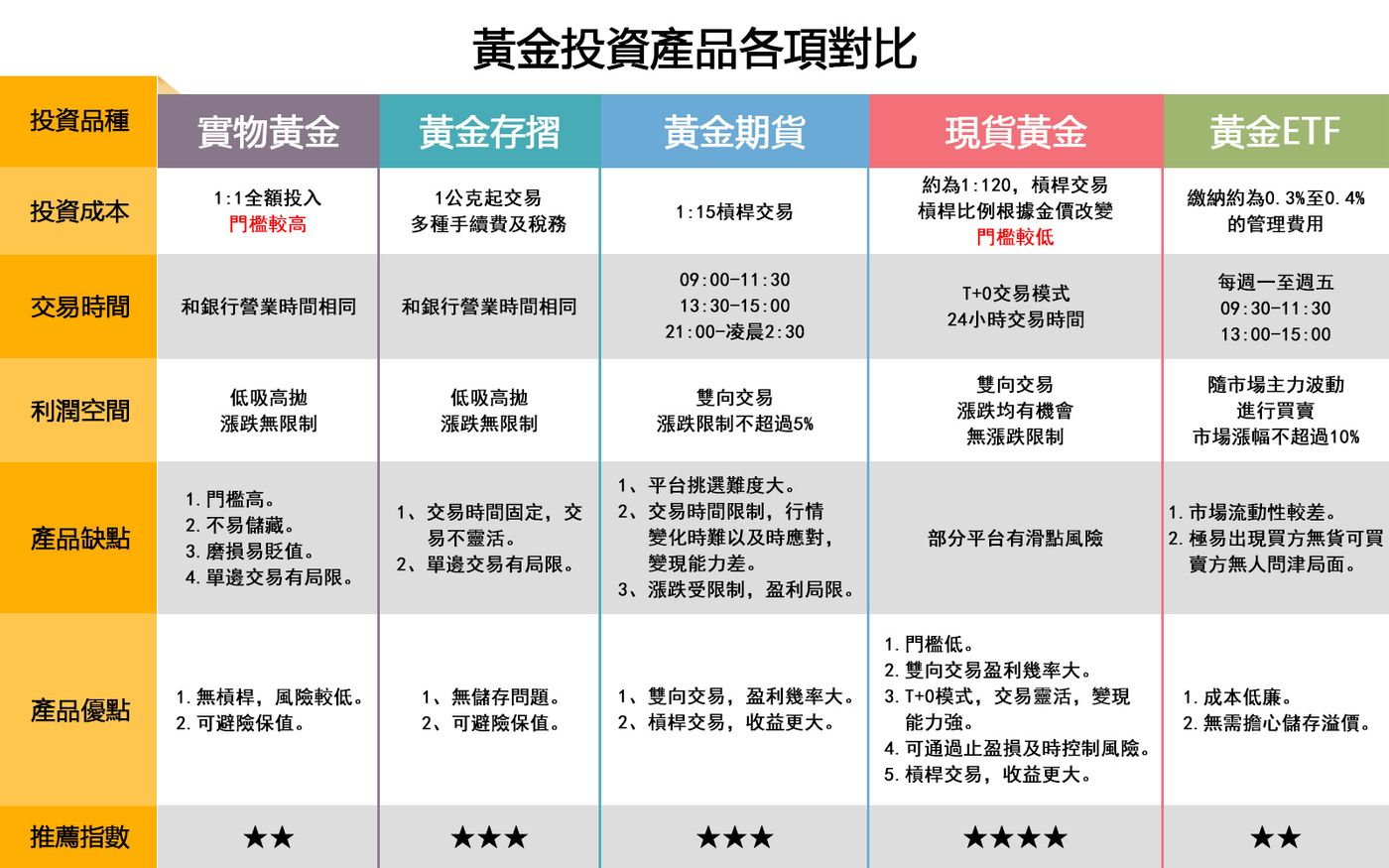

2. Detailed comparison of pros and cons to find the most suitable gold investment for you

After having a certain understanding of gold investment products, how can investors know which gold investment product is suitable for them? The editor has collected the pros and cons of each investment product to make a simple comparison and find the most suitable gold investment product for you.

Summary: Through the above simple comparison, we can know that spot gold is more suitable for gold investment beginners. In terms of cost, the threshold is lowered through the leverage ratio. In terms of income, there is a two-way transaction and profit space without limit of ups and downs. The risk is also a price-limited platform to improve risk control. In the face of risk, other products have no obvious way to reduce it. Therefore, spot gold investment is more suitable for investors.

Why precious metals recommend spot gold! Because the advantage is too great!

3. Understand the elements of a high-quality platform in order to choose the best platform

In terms of product returns and product risks, spot gold has more benefits and is also suitable for investors. If you choose spot gold as your investment product, you must first choose a suitable investment platform.

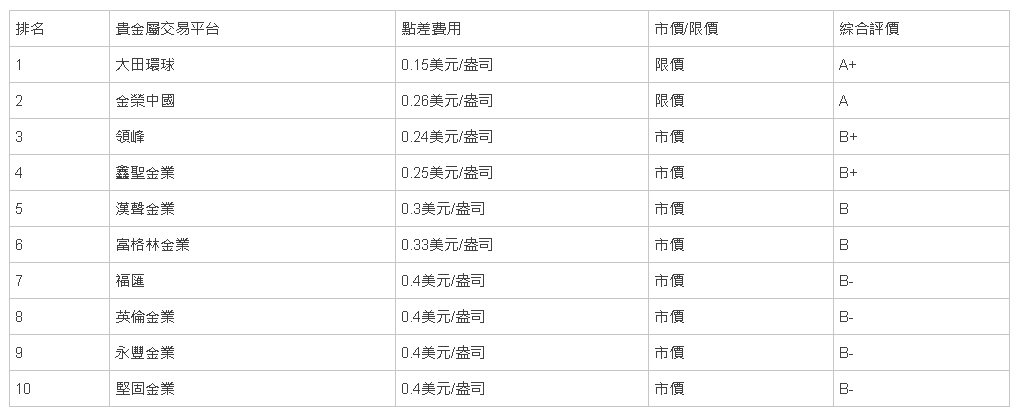

Take the following picture as an example, the editor has collected some information about the latest ranking of spot gold platforms in 2021

Source: 2021 Gold Spot Trading Platform Ranking

We take Datian Global, which has the highest rating, as an example to describe what should be paid attention to when choosing a high-quality spot gold investment platform, so as to find a more suitable investment platform for investors.

1. The formality of the platform is the first step in entering the market.

The spot gold investment market is huge and its quality varies. Therefore, before choosing a spot gold investment platform, you must ensure the formality of the investment platform; check the legality of the platform in the government regulatory agency. The platform supervision system in mainland China is not perfect, and due to regional problems, foreign platforms are more difficult to trace if they encounter legal problems in terms of terms. It is recommended to choose the Hong Kong gold platform.

In addition, you can check the office address of the spot gold investment platform to further confirm the formality of the platform. At the same time, you can also see the strength of the platform. Generally speaking, the larger the office scale of the platform, the stronger the strength.

2. Choose the platform of direct operation mode to protect the safety of funds.

Taking Datian Global Precious Metals Platform as an example, investors can directly access the spot gold investment market through the platform. They do not need to increase extra costs and directly control their own transaction orders, which not only reduces costs, but also reduces investment risks. , the transaction is more stable.

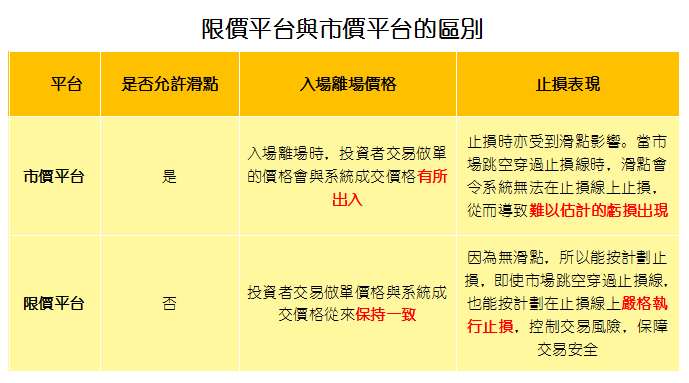

3. Choose a price limit platform to greatly reduce the risk of slippage.

90% of spot investments tend to ignore the importance of price-limiting platforms. The spot gold investment market fluctuates violently. Investors may experience slippage risk due to the jump in the market price when trading. The slippage risk is uncontrollable, and in severe cases, there is even a risk of loss. Therefore, when investors choose a spot gold trading platform, they should choose a price limit platform.

The price limit platform trades strictly according to the set price. No matter the market is fierce or gentle, the operation of take profit, stop loss or pending order can be carried out smoothly. Using the price limit platform to trade can not only stabilize the transaction situation but also avoid the risk of slippage. At present, there are not many price-limiting platforms on the market, such as Emperor Gold and Datian Global. For details, please click to view .

4. Select a low spread account to reduce the transaction

Easy cost.

The spread is the main investment cost of spot gold. Choosing a preferential account can save more money for investors.

The spot gold standard spread is generally 0.5. That's $50 a hand. At present, there are two types of profit-making methods on the market platform.

1. Commission rebate account: When trading, first deduct the spread fee of 50 USD for one lot, and then return the funds per lot after the transaction is closed. The current highest rebate on the market is $28, which means the actual cost of the first hand is: $22.

2. Micro-spread account: It is currently the exclusive account type of Datian Global. An account that selects a combination of prices with the minimum bid-ask spread in the market. Therefore, it is a floating spread, the minimum is as low as 0.1, and one lot is 10 US dollars. Generally not more than 0.25, a lot of 25 US dollars. Novices can use this account type to invest and reduce risk, click to get.

4. How to maximize the return of spot gold investment?

According to the conditions mentioned above, is it enough to find a suitable platform? No, choosing a suitable spot gold investment platform is to lay a foundation for profitability, and to expand investment profitability, you need to improve yourself.

1. Choose a low-threshold account to try to enter the market, experience trading, and exercise mentality

To expand profits, it is recommended to choose a low-threshold account below US$100 on the investment platform. Low-threshold accounts can allow investors to experience market changes more deeply, experience more when making orders, and help investors adjust their investment mentality. , and can further test whether the various services of the platform are suitable for you.

At present, most of the platforms have such low-threshold accounts, and the current lowest platform is the mini account of Datian Global, starting from 30 US dollars. Investors can choose according to their own circumstances to further test the quality of the platform. Or through a demo account , control it for free and extract experience!

2. Choose teaching services to improve profitability skills

According to the current market demand, investors prefer diversified services to improve profitability. Through the one-to-one service of the platform's novice tutors, the industry foundation can be laid from the simple to the deep. At present, the platforms that include one-to-one teaching services include: Jindao, Lingfeng, Datian Global and other platforms. The current service threshold is still Datian Global.

Summarize

Gold investment in 2021 is the most worthwhile year to invest in. The current situation is turbulent, the risk aversion sentiment is increasing, and the risk-averse properties of gold are constantly being amplified. Among the many investment products, spot gold is the most worthwhile investment. When choosing a platform, it is best to have a fixed standard to choose, so that it will be easier. I hope to be helpful.

Recommended reading:

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More