Osmosis Decentralized Exchange Liquidity Mining Teaching [Updated Edition]

I originally wanted to write about some new exchanges first, but because I just saw that the interface of Osmosis has been updated, the previous article did not have the part of superfluid pledge, so let’s renovate the old article first, and put the part of superfluid pledge Add and update the pictures.

Old article: Osmosis decentralized exchange increases liquidity teaching, taking ATOM / OSMO trading pair as an example

What is increased liquidity

First of all, let’s briefly talk about what it means to increase liquidity [Liquidity Mining]. In short, when two coins are exchanged, there needs to be a pool of funds to deal with the immediate exchange, so there is no need to do it like in the exchange. There is also a need for a combination of buyers and sellers. On the blockchain, everyone can put idle funds into this pool . Of course, when someone makes an exchange, they will also pay some fees to increase liquidity as this pool. According to different coins, some annualized rewards can exceed 100% or even more, but the rewards of liquidity mining are floating , and the pool revenue you see now is not the same for a lifetime. In addition, investing in The principal of liquidity mining may still decrease or even approach zero, so it is necessary to check back regularly, adjust the configuration, and spread the risk.

is there any risk?

1. Contract risk: It means that there is a bug in the code.

2. Risk of running away: Some exchanges are not open source or truly decentralized, so the coins you put in are at risk of being swept away, and you must choose your investment projects carefully.

3. Impermanent loss [temporary loss]: From the coins deposited, when one of the coins increases or decreases more than the other, the result is that the investor will earn less or lose more than simply holding two coins. , on this point, some people think that because the reward is high, the loss can usually be offset, so it can be ignored. Some people propose that the risk of finding two coins with the same trend is lower, but the trend of the coins is always difficult to say... So Impermanent losses are an unavoidable risk for liquid miners.

In short, there is a risk of loss in investment. Please don’t use the money you have to eat tomorrow to increase liquidity. Check your risk tolerance first, do a good job of psychological construction beforehand, and have a basic understanding of the investment projects. It is enough to understand!

Pre-work

First, you need a Keplr wallet, because Osmosis currently only supports Keplr wallets, and then you need to have coins. You can transfer the coins in the Cosmos ecosystem to the Osmosis chain and then to the Osmosis decentralized transaction through IBC Transfer, so you can exchange them for other coins. Buy coins through centralized exchanges. Currently, most centralized exchanges support ATOM and CRO. After you prepare your wallet and cryptocurrencies, you can start to operate.

1. Enter the Osmosis decentralized exchange and connect to the Keplr wallet

URL: https://app.osmosis.zone/

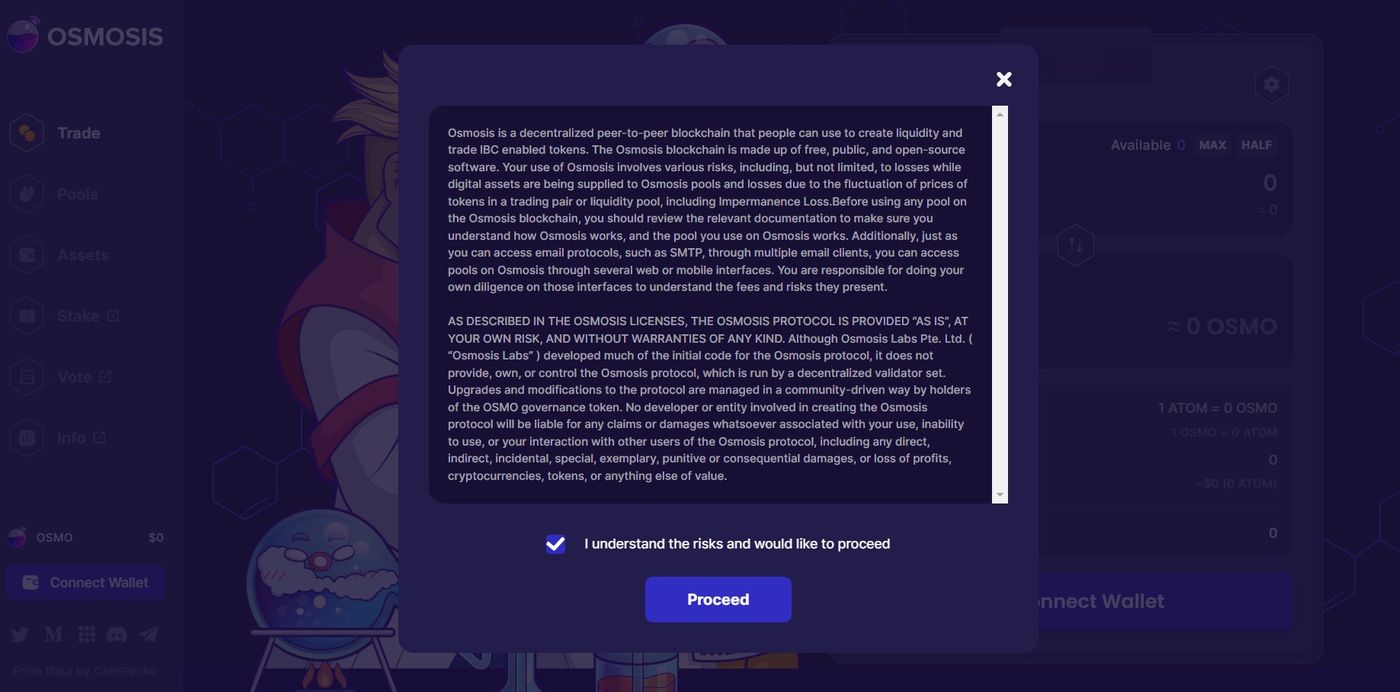

If you click for the first time Osmosis or you just cleared your browsing history, you will see some risk warnings first, just tick Proceed .

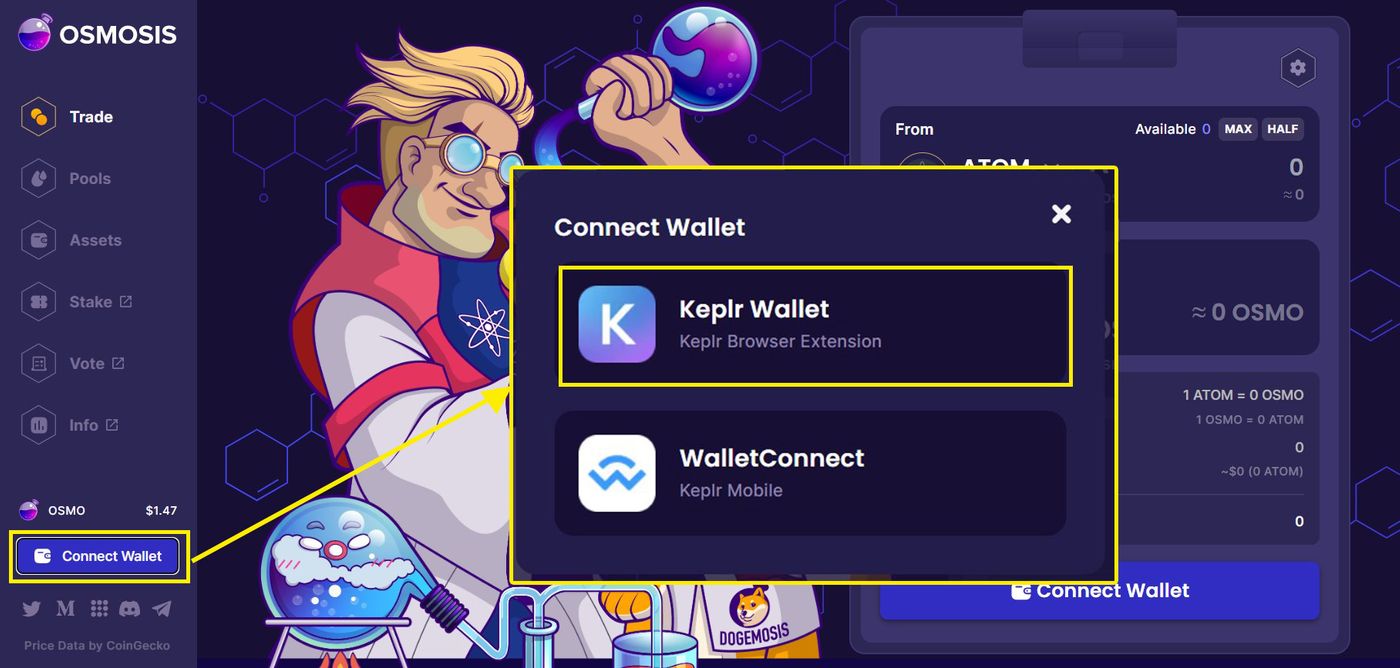

After entering the Osmosis exchange, you must first connect the wallet.

Click Connect Wallet and two options will pop up. The first one is the plug-in wallet connected to the browser, and the second one is the QRCode. You can use the mobile version of Keplr to scan the code to log in. I use the computer to operate, so I choose the first one.

The Keplr wallet should pop up a confirmation message when connecting for the first time, just click Approve.

After connecting the wallet, you can see the wallet name and the balance of OSMO.

2. Use IBC Transfer to transfer cryptocurrencies to the Osmosis chain

Therefore, I already have LikeCoin on the LikeCoin chain in my wallet, so now I need to perform an IBC Transfer to transfer LikeCoin to the Osmosis chain. This action can be executed directly on the Osmosis exchange.

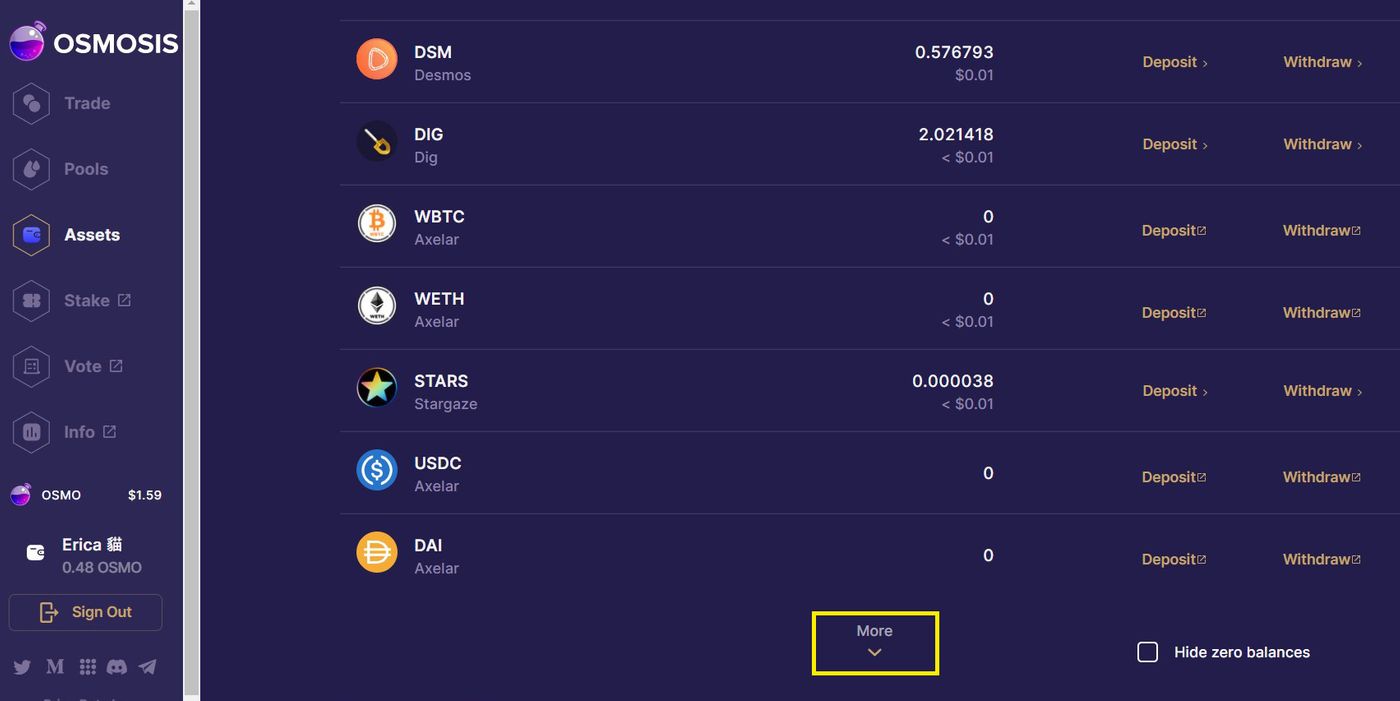

Click Assets on the panel.

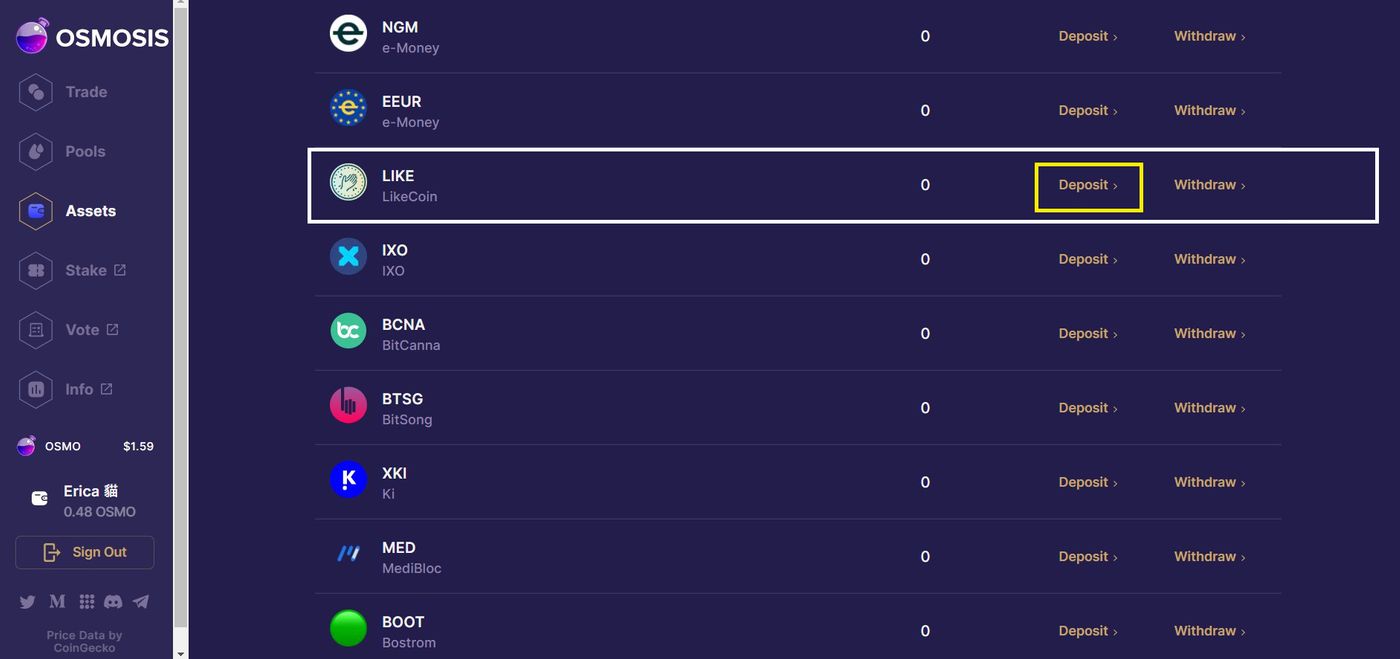

Find the currency you want to transfer, press Deposit, if you can't find the currency you are looking for, press More.

Find the LikeCoin I want to deposit, click Deposit.

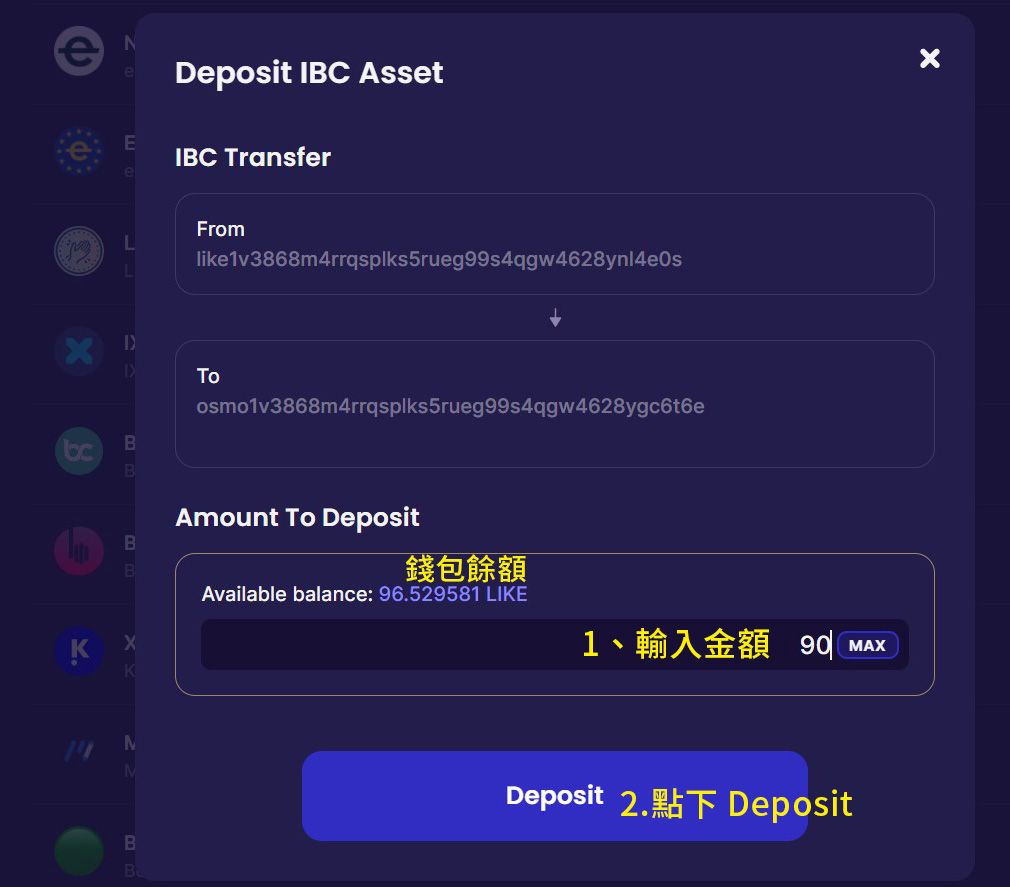

Next, you will be asked to enter the amount to be transferred, and click Deposit when the input is complete.

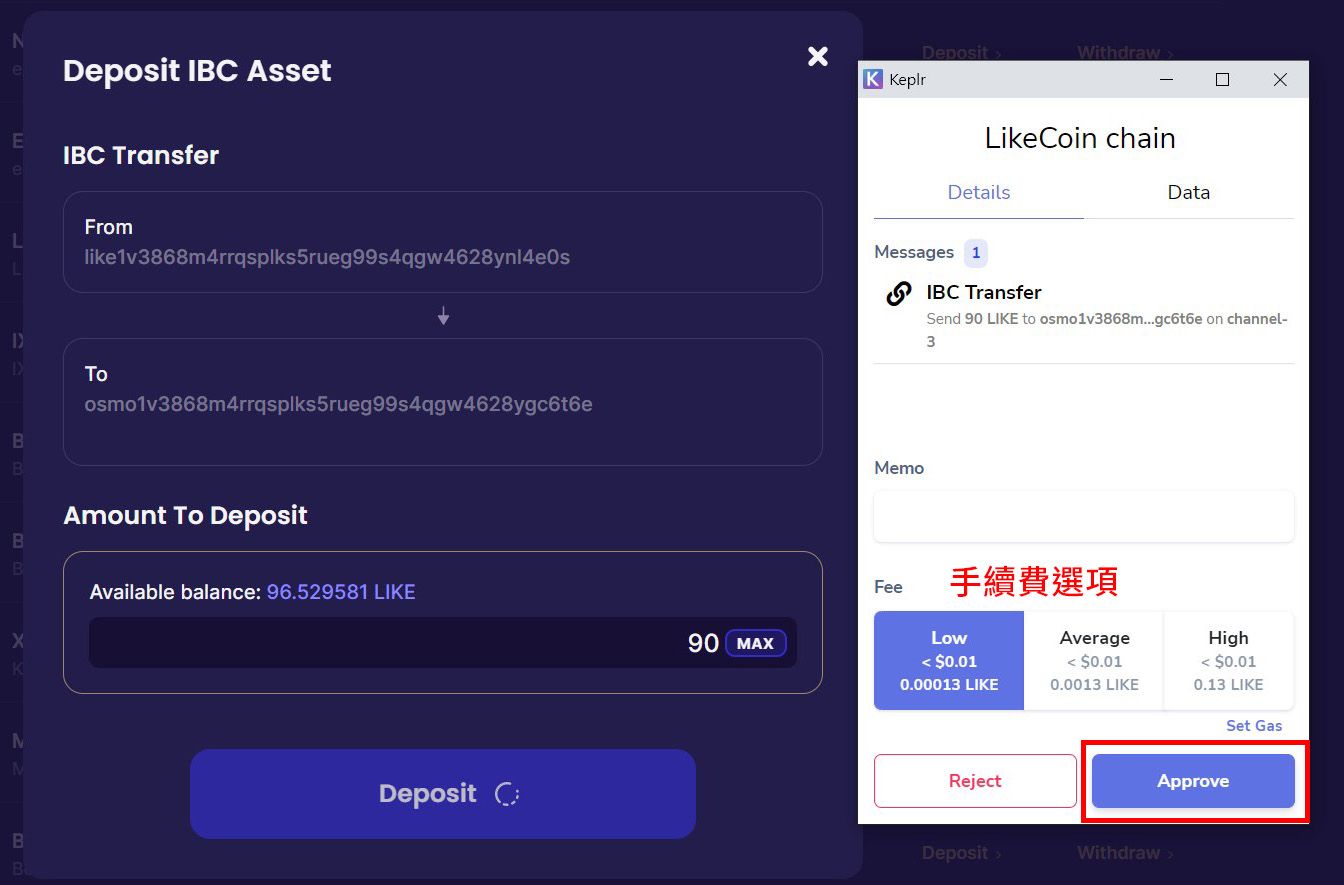

After clicking Deposit, the confirmation window of Keplr will pop up, telling you the handling fee of this IBC Transfer. If there is no problem, click Approve. At present, if the handling fee is low, it should be able to pass. If the handling fee is insufficient, change the selection.

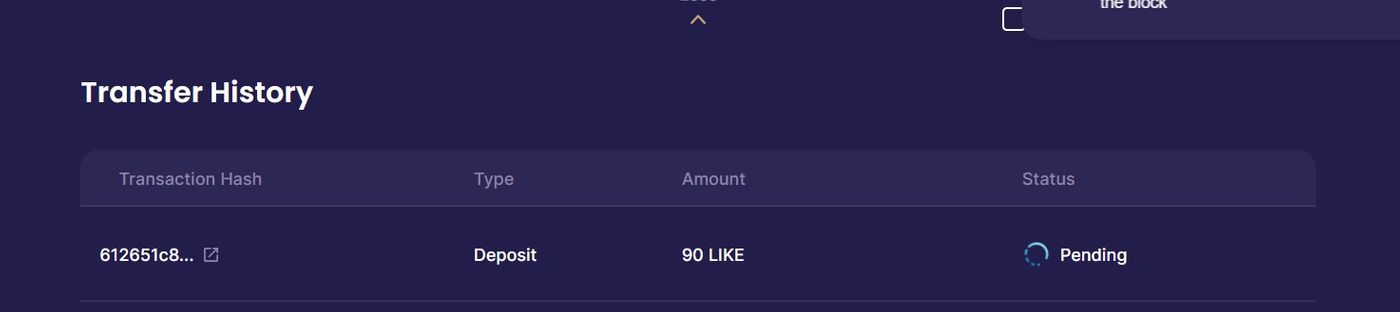

After the completion, pull the screen to the place of the transaction record below, you should see that the status is Pending

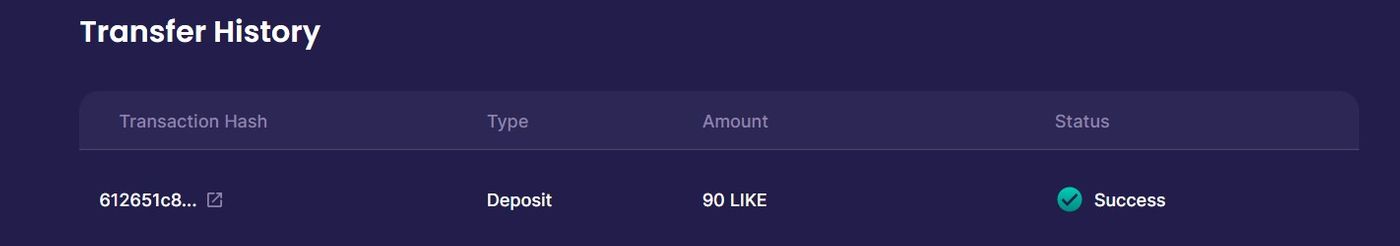

If there is no traffic jam, it will be credited soon.

At this time, you should be able to see that LikeCoin has been transferred in by pulling the asset list above!

If the transaction is unsuccessful, it will be returned to the LikeCoin chain. If it is not returned immediately, it may take a while. It has not happened recently, but it has been returned to the LikeCoin chain after a few hours.

3. Convert cryptocurrencies on the Osmosis exchange

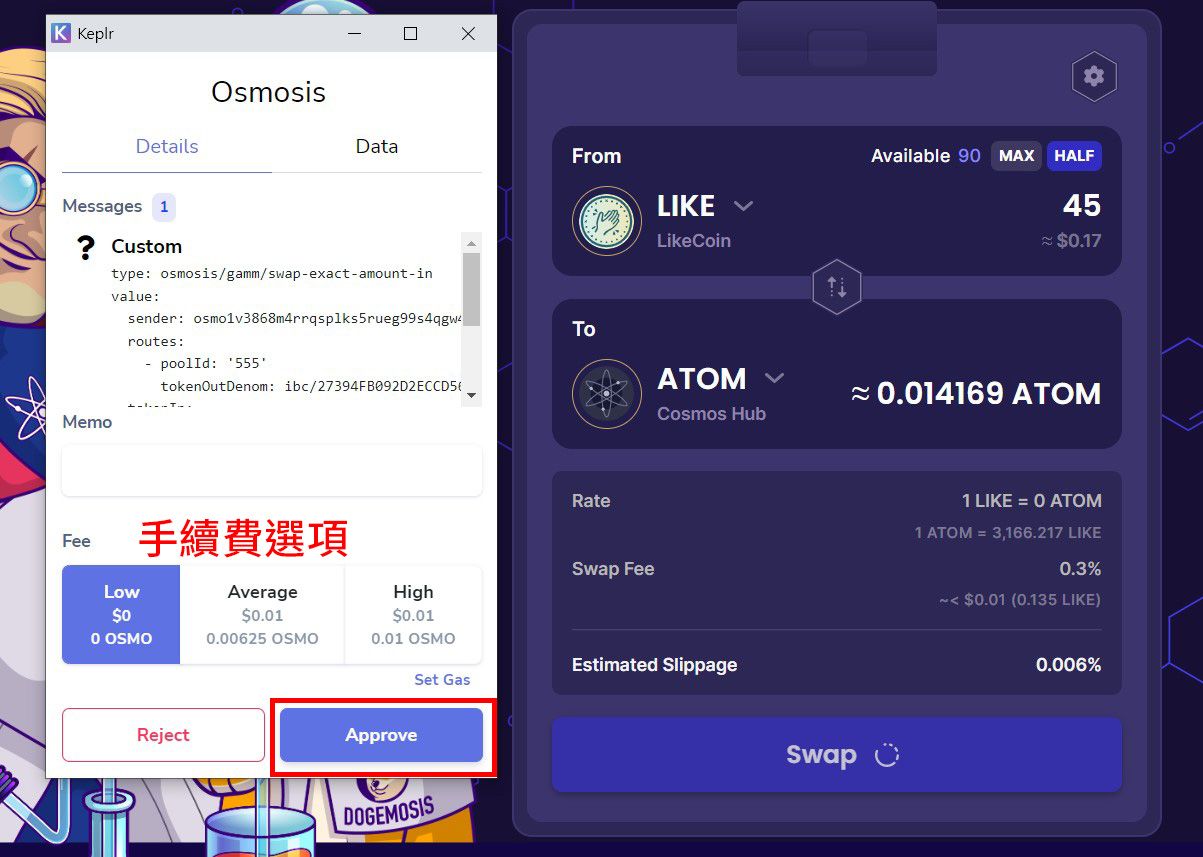

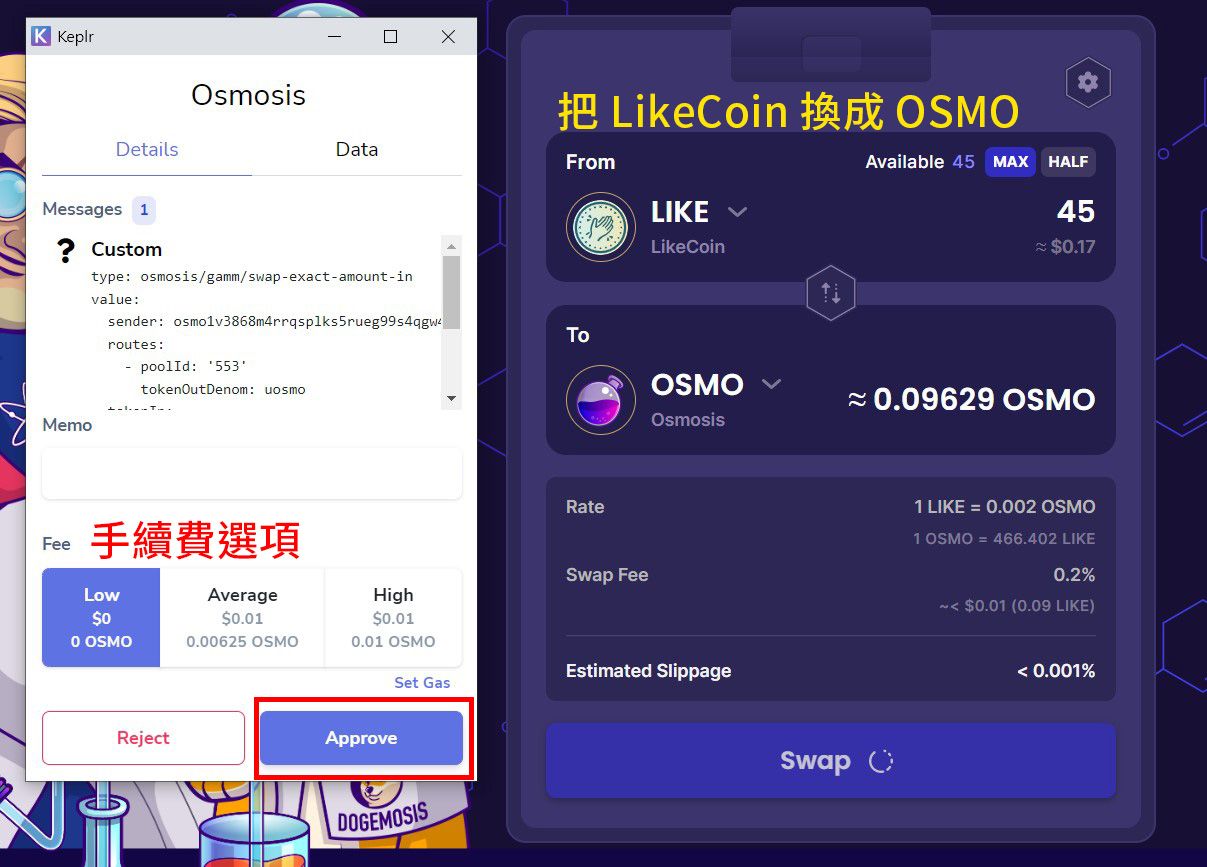

Because to increase the liquidity of the trading pair ATOM / OSMO, it is necessary to use ATOM and OSMO, so I have to exchange LikeCoin for ATOM and OSMO. The Pool I choose is 50% ATOM, 50% OSMO, so I will put it now. Half of the LikeCoins are exchanged for ATOM, and half of the LikeCoins are exchanged for OSMO.

- Click Trade on the panel.

- I want to change LikeCoin to ATOM so choose LikeCoin for From.

- To choose ATOM.

- Fill in the amount to be exchanged, and the amount that can be exchanged will automatically pop up, and there will be exchange information below! You can also use the MAX [replace all] and HALF [replace half] buttons to automatically fill in.

- Click Swap.

After that, the confirmation window of Keplr will pop up, telling you the information and handling fee of the transaction. After pressing Approve , the wallet and the exchange will pop up some messages to complete the exchange.

Then repeat the above steps to exchange LikeCoin for OSMO.

After the completion, go to Assets and you can see the latest amount of various coins after your exchange is completed.

Fourth, increase liquidity operations

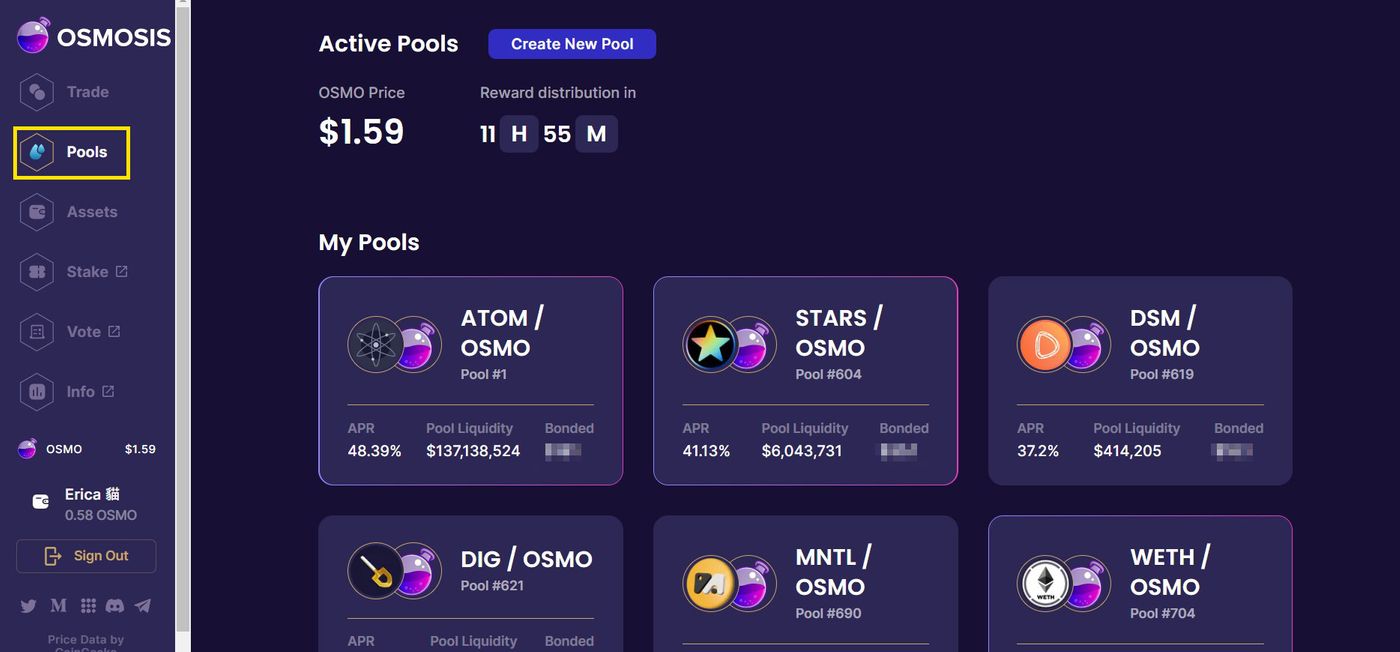

First click Pools on the panel to enter the page.

If you have done liquidity mining before, the pools you have invested in will be listed in My Pools at first. The liquidity of the pool... etc. At the top is the OSMO price and the countdown timer for the incentives.

Next, we can finally operate to increase liquidity. First, find the ATOM / OSMO pool, because it is the No. 1 pool and can be pledged with superfluidity, so it is easy to find, and it will be the first in the list of Superfluid Pools.

After entering the Pool page, you must first replace ATOM and OSMO with LP tokens. Press Swap Tokens to convert cryptocurrencies. The exchange of two coins in the pool can be done here!

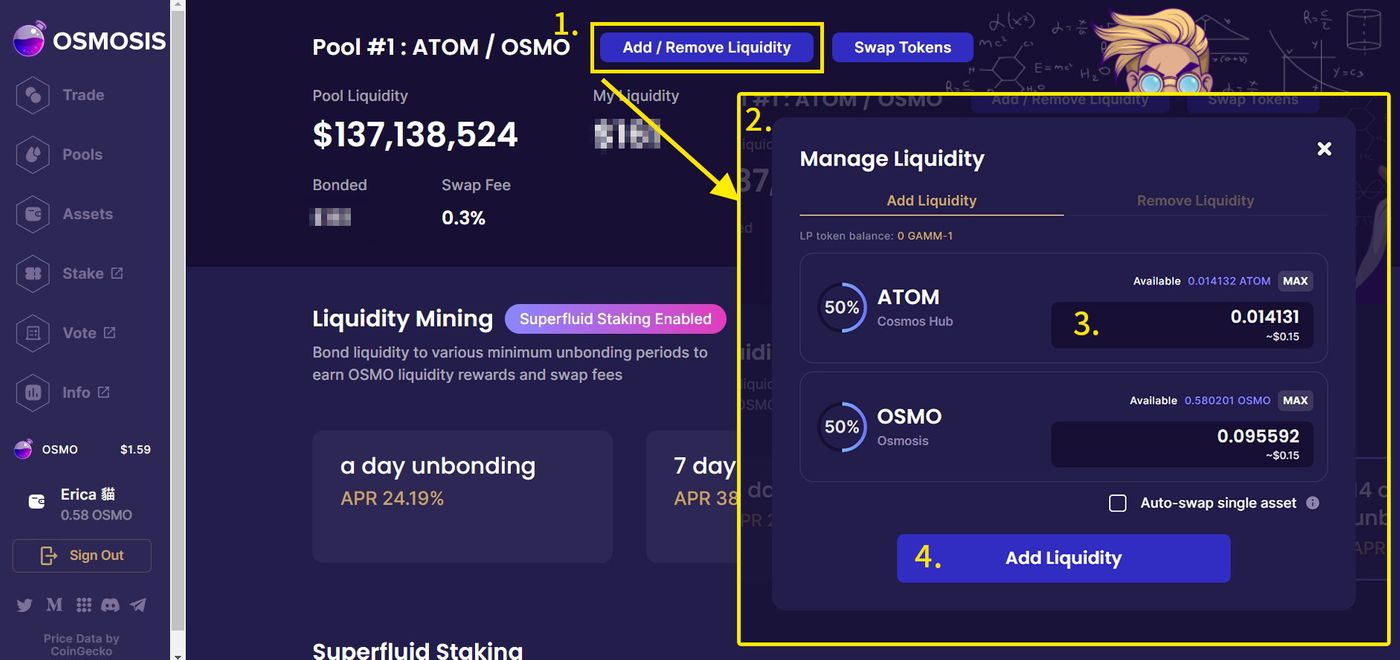

- Click Add/Remove Liquidity.

- The Manage Liquidity window will pop up, and the ratio to be placed will be displayed here. Most of them are 50% : 50%, that is, the same amount of ATOM and OSMO should be placed.

- Entering one of the amounts will automatically jump to the other required amount.

- Click Add Liquidity

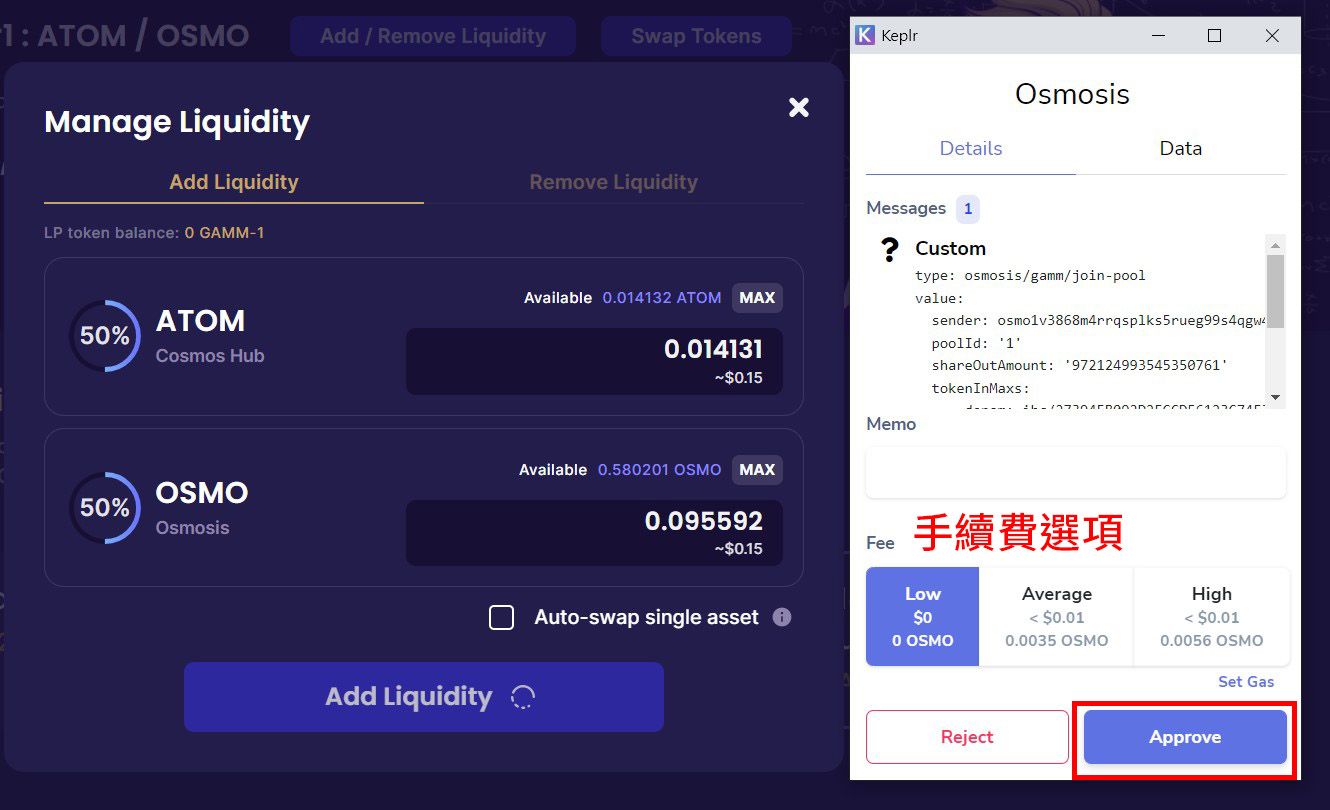

Next, the wallet will jump out to confirm.

After the completion, jump back to the screen and you will see the number of LP tokens held.

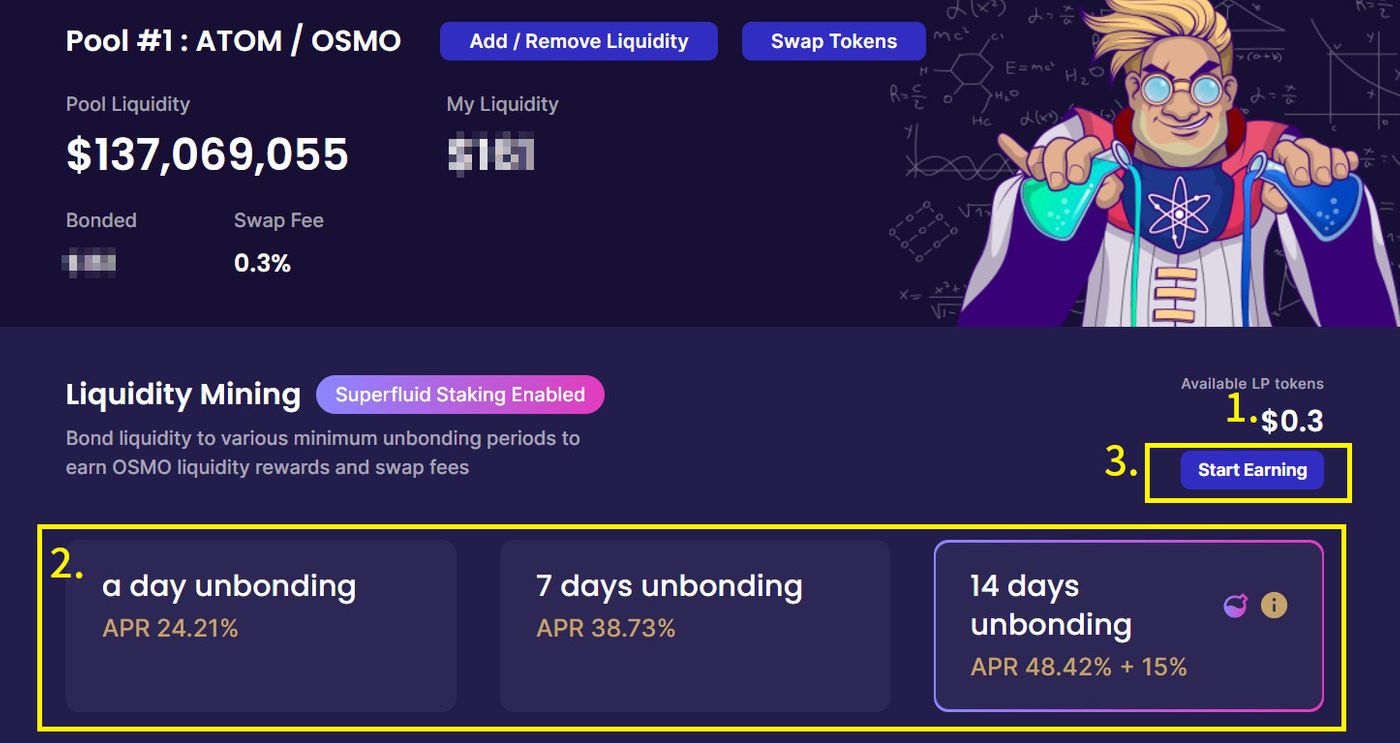

- The number of LP tokens held.

- You can choose the period of unbonding [Unbonding Duratio], there are 1 day, 7 days, and 14 days to choose from [referring to the time to wait for unbonding], and the annualized rate of return for each is different [You read that right , this trading pair is really a return rate of more than 100 parties], you can allocate the LP tokens you hold to different days, so that your coins can be used flexibly later, and you can use the coins in a hurry from the unbinding period of 1 day. that unbind.

- Click Start Earning to get started.

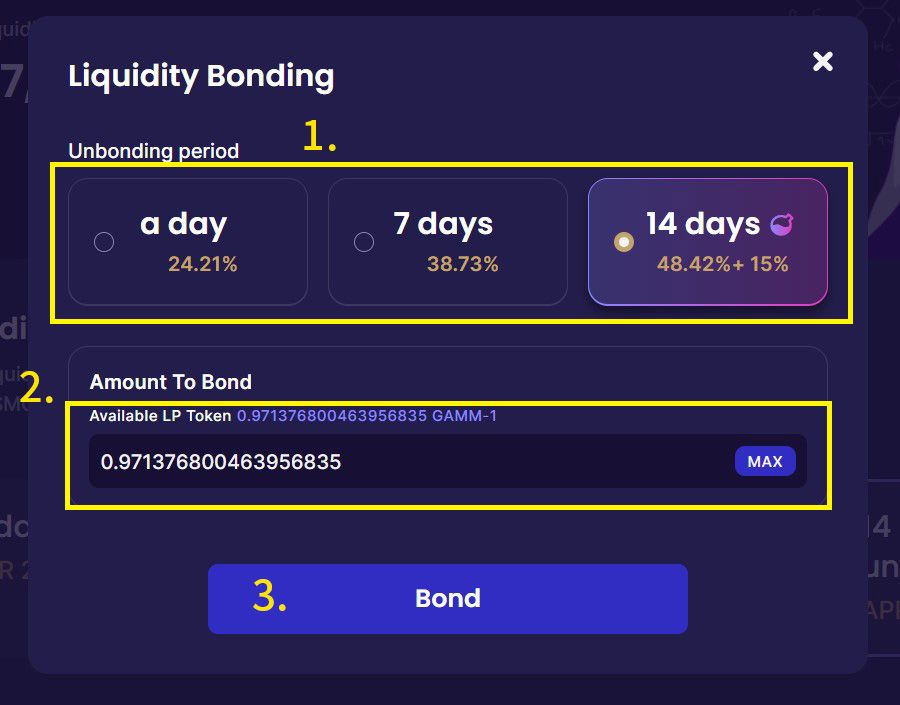

Clicking on Start Earning will pop up the window.

- Select the number of days.

- Enter the number of LP tokens.

- Press Bond.

Next, the confirmation window of Keplr will pop up, telling you the information and handling fee of this transaction, and click Approve to complete.

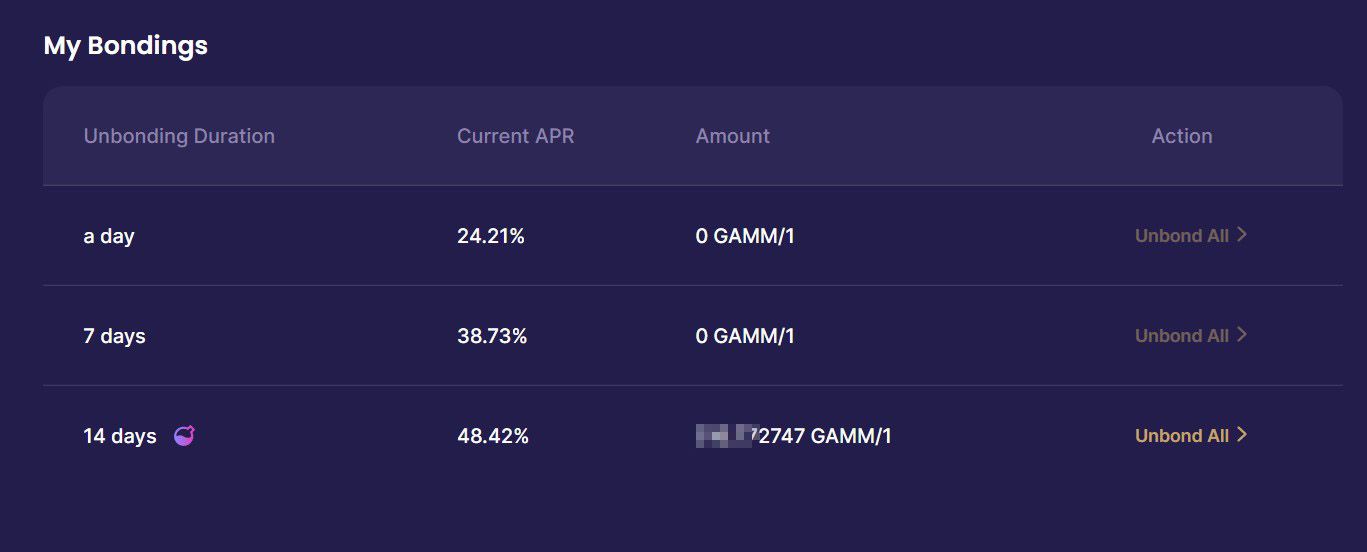

After completion, you can see the information of LP tokens bound in the pool in My Bondings below.

5. Superfluid pledge

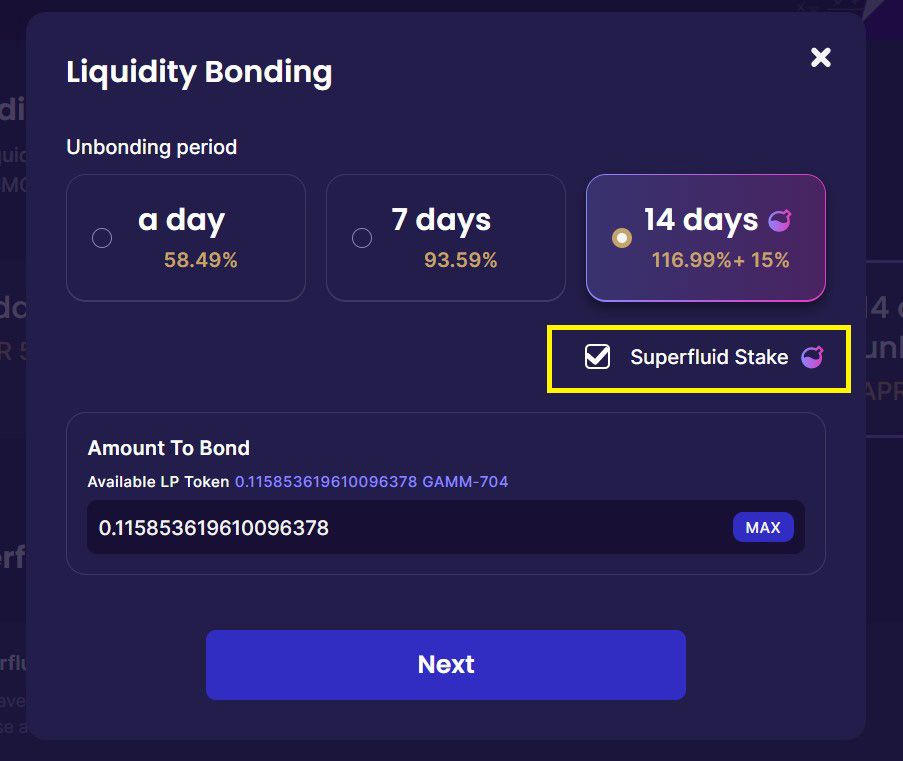

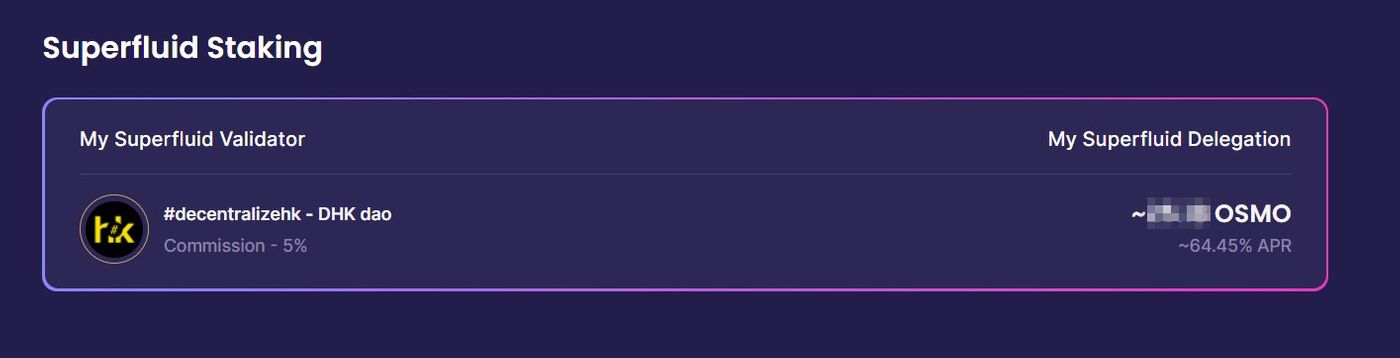

Overcurrent pledge [can obtain additional pledge income] Currently, only the pools of specific OSMO trading pairs have [not all of them], and at present, only after 14 days of binding can overcurrent pledge, as listed in the 14-day binding on Figure 22 The +15% of the 116.99% +15% is the additional benefit for this pool due to the overcurrent pledge.

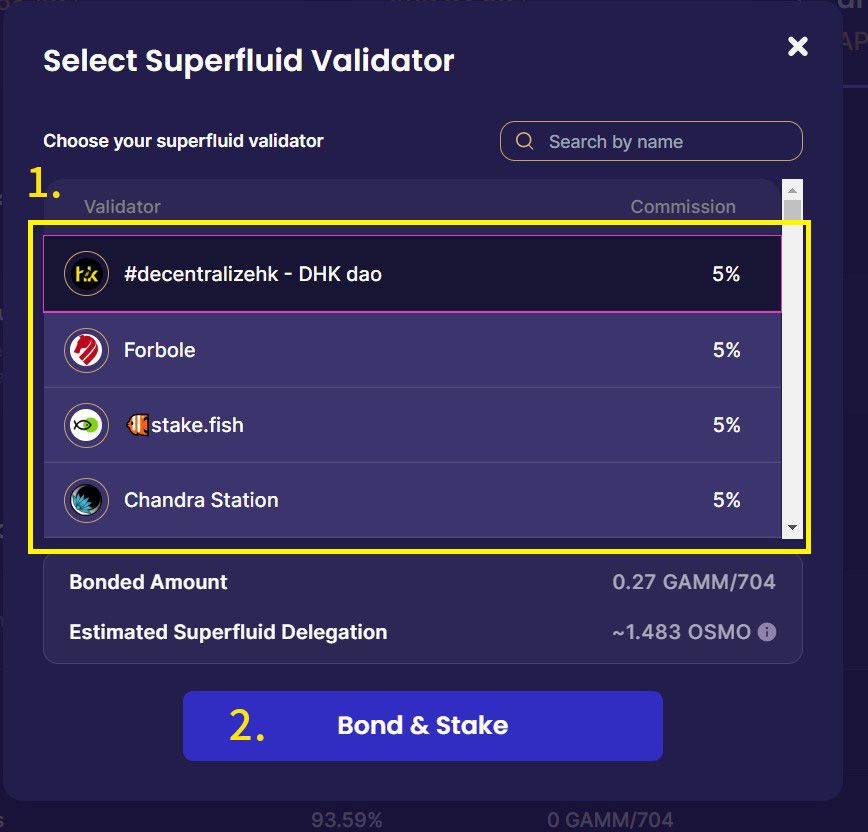

- Now only one validator can be selected.

- If the validator is imprisoned like a normal pledge, the pledger will also be punished.

- At present, you cannot change the validator pledge after binding, and you need to unbind to change, so please choose carefully.

The ATOM / OSMO pool has over-current pledge, but because I have selected validators to do over-current pledge before, there is no option to select the relevant option. If so, there will be an additional option [Superfluid Stake] on the binding screen [Figure 20] as shown below. The default is checked, and after checking it, you will enter the screen for selecting a superfluid pledge validator.

Click Next to enter the screen for selecting a pledge validator.

- Select the certifier (you can also search for the certifier by entering a string in Search by name above)

- Click Bond & Stake

After that, the wallet confirmation message will pop up as well, press Approve to complete.

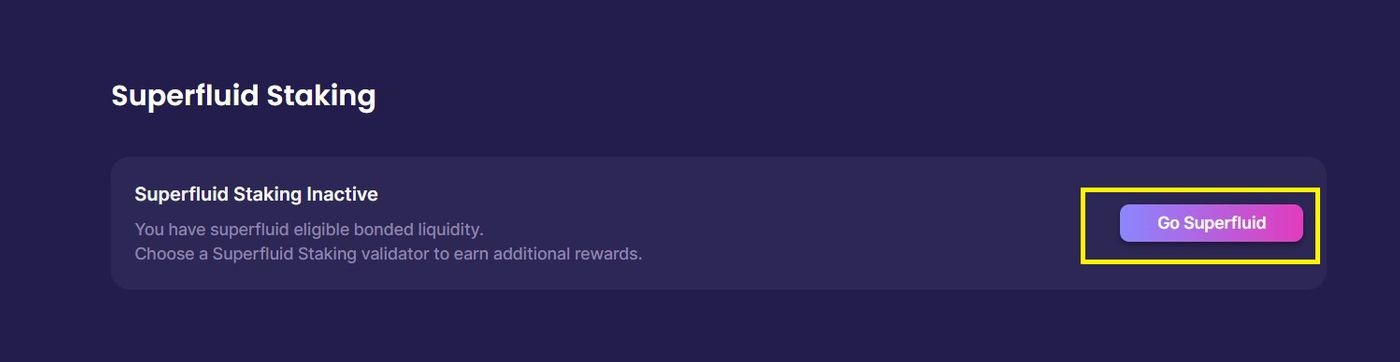

If the option of Superfluid Stake is checked and canceled, it will not jump to the screen of selecting validator superfluid pledge, and only do the binding action, but then you can still manually perform superfluid pledge, if the pool with superfluid pledge already exists If you invest, and the superfluid pledge is not executed, there will be an additional button Go Superfluid on the page. Clicking the button will enter the screen for selecting a validator, similar to Figure 23.

If the superfluid pledge has been made, the Go Superfluid button will not appear, but the validator who chooses the superfluid pledge will appear.

income distribution

The income will be distributed once a day [when everyone is asleep in the early morning], and then you will see that in your wallet every day, OSMO increases silently every day. . . There is no need to manually collect it, which is very different from other decentralized exchanges, so it also saves the handling fee for receiving the income once, but... How many coins you receive every day depends on yourself to record the changes in your wallet, and in addition ... Osmosis already has pools of BTC [Pool #712 : WBTC / OSMO] and ETH [Pool #704 : WETH / OSMO], those who are interested can also study it 🐈🐾.

unbind

In addition, when you need to get the coins back, click Unbond at My Bondings. After the unbonding period has passed, click Add / Remove Liquidity, switch to Remove Liquidity, you can change the LP tokens into the original two coins, and then exchange them for you You can transfer the coins you want. I have written relevant teachings, you can refer to:

Because this interface update has no effect on the unbinding steps, I will not re-write the unbinding!

Welcome to follow 【Cat Country】 , you can receive broadcast messages by following it! ! Small events will be held from time to time, if you want to subscribe, I have no objection! 〔〔Eh! ?

Validator Node: Coding Everyday|Coding League

My NFT works: OpenSea ︱ akaSwap

My NFT Collection: OpenSea

Two of my travel e-books: Croatian Bus Travel Diary , Go and Jump Okinawa. Traffic Raiders for Attractions

My personal blog: . Just go. Erica's. travel. experience. Living in the moment

Fan Page: Let's Go x Cat Traveling

You can also find me on other platforms: square grid | I have another Matters | Potato Media ︱ Noise.cash

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More