Use Argo to stake CRO on the chain but still be able to play DEFI

Foreword: Since I received a letter from the CDC yesterday, I learned that the benefits of the CRO debit card will be changed again. I feel very sad that the 100-party feedback of Netflix and SPOTIFY has been cancelled. Although I always have a hunch that this day will come, I did not expect it. It will be so fast. I thought that the correction might be done before and after the expiration of the first wave of card-issuing users in 2024-2025. However, the speed of face slaps is so fast, and I am also looking for a way out for CRO to activate assets. Also saw a decent option.

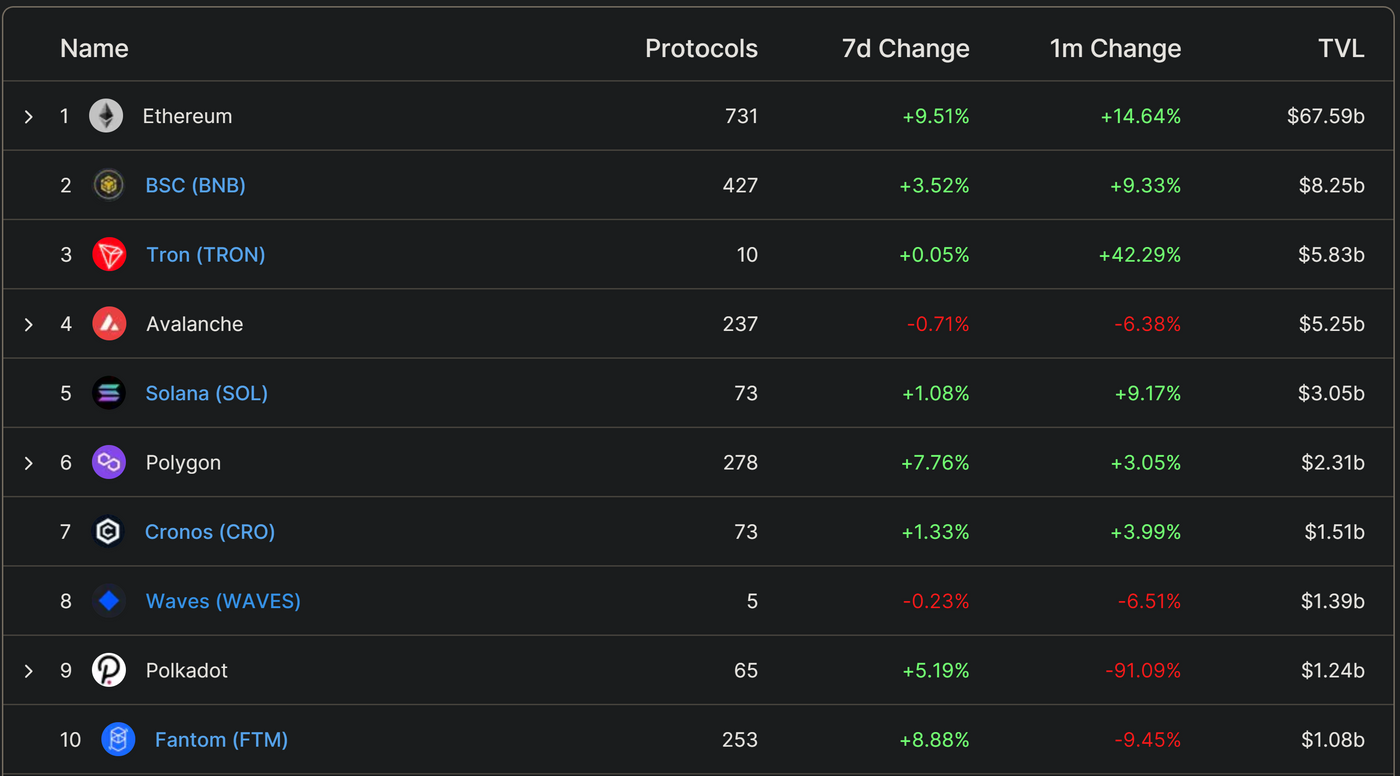

As the platform token of crypto.com, in addition to being able to apply for a card and get the benefits that can be changed at any time, CRO is also the chain currency of the two chains of CRO.org and cronos. cro.org is born out of the cosmos SDK Just like BNB, although CRO.org has been able to connect to the ibc bridge to swim in the cosmos universe, it is much better than BNB in this respect, but the various applications in the cosmos ecosystem are still better than the major chains of the EVM system. There are many gaps, so on this basis, the cronos chain is online, and it can run various APPs compatible with EVM, just like BNB, but the performance is much worse, and like BSC, there is no seriousness on cronos. The cross-chain bridge can be used, but you can only use the crypto.com app or exchange for cross-training and withdrawal of gold. With such centralization concerns but no resources like Binance, cornos TVL performance since its launch It has always been tepid and has nothing to do with it, as if the chain was just doing it for the sake of doing it. As of 2022/07/24, the data cronos on defi Llama ranks seventh. In the past six months, there have been more than two opponents, one is the AC chain fanton with its own traffic super run, and the other is the super super led by Sasha. The toilet chain waves, these two chains have performed far worse than other competitors in the past six months, so they were surpassed by cronos, which did not perform very well in the ranking.

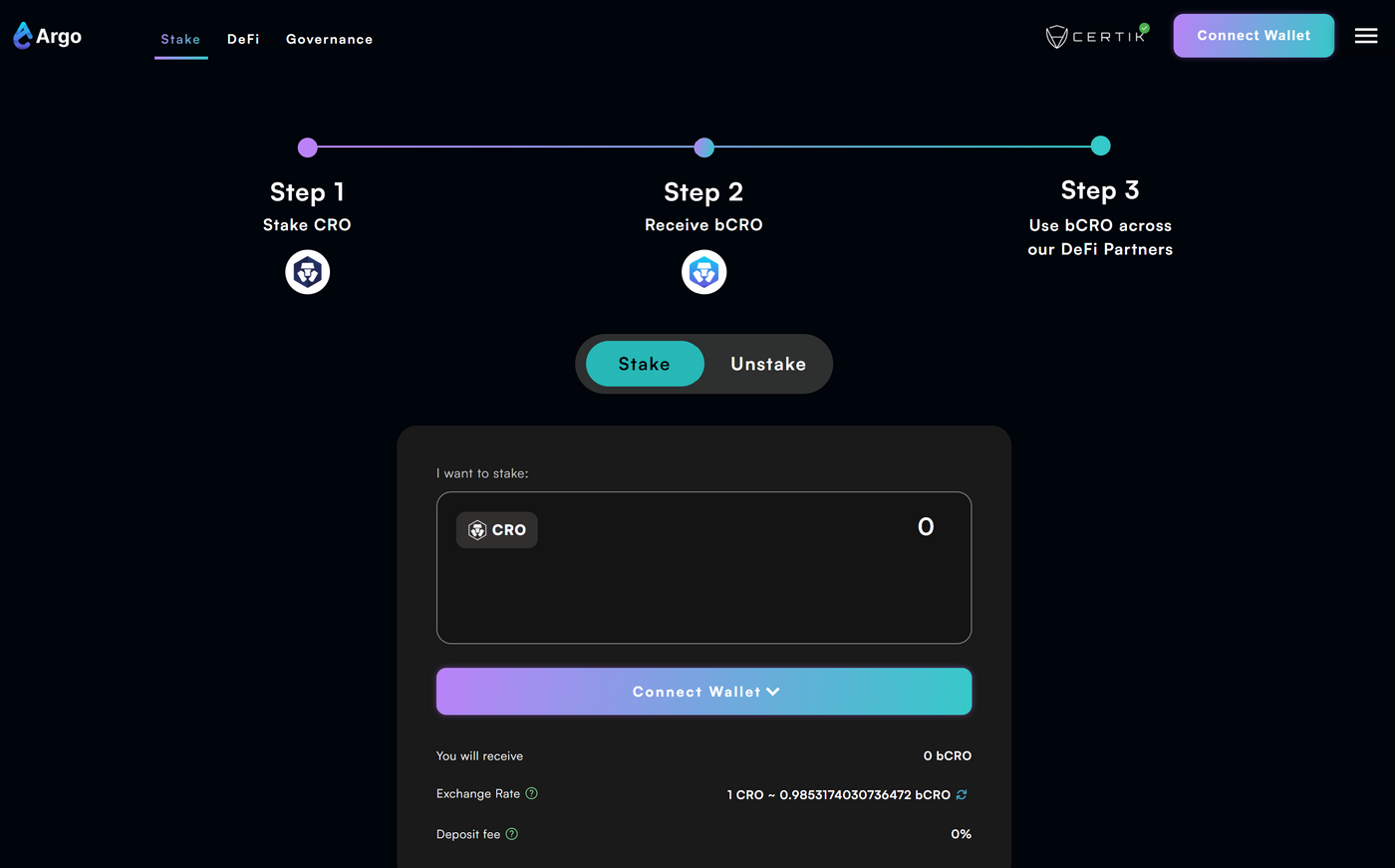

Under the same multi-chain architecture, like other tokens BNB or AVAX, CRO can also face a problem, that is, if it is to be pledged on the main network on the cro.org network, it cannot be used in cronos and EVM systems. defi application interaction, which is a pity. Of course, AVAX already has another solution. Let’s not mention it for now, and cro has also come up with a solution. Argo users can interact with this project on CRONOS, get the token bCRO by staking CRO, and use bcro to communicate with other Dapps. interact.

At present, the income of pledged cro in argo is about 11.98 per year.

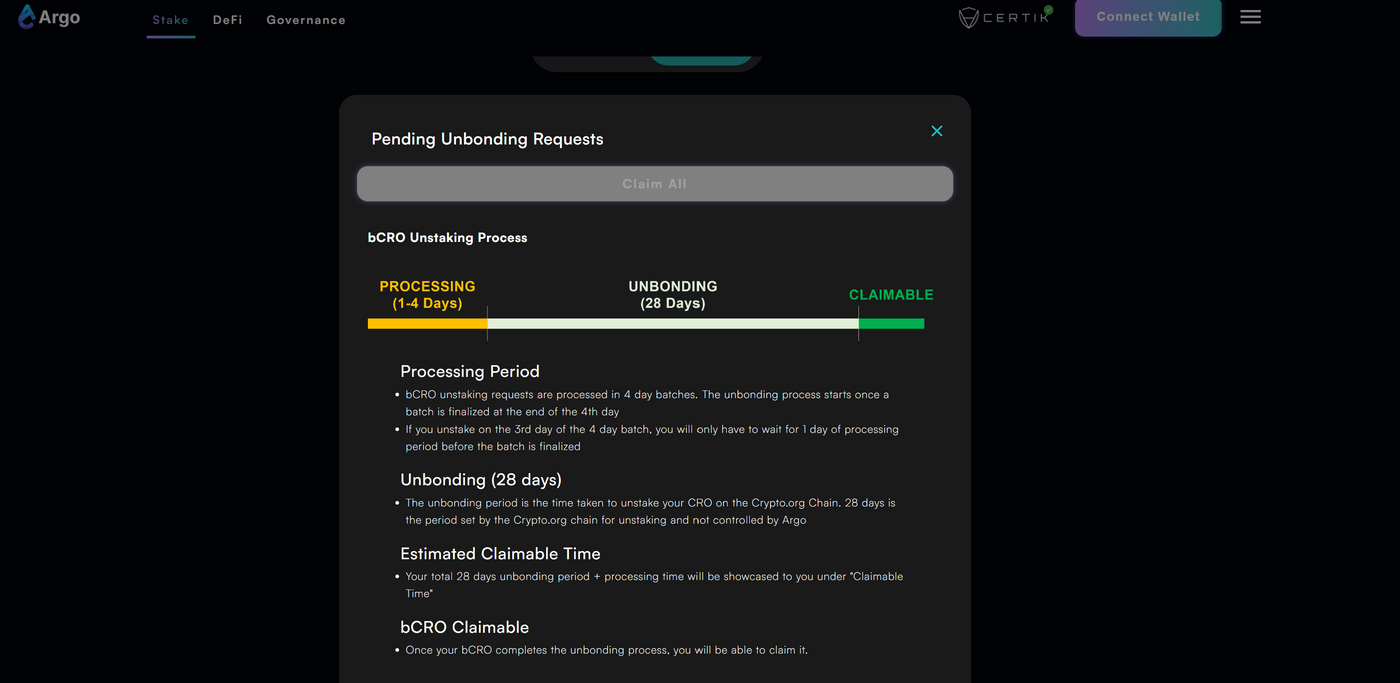

If people who do not want to continue to hold bcro can leave in two ways, one is to use the official argo page to cancel the pledge. According to the official page, it generally takes 28 days to process the cancellation of the pledge (cosmos-flavored toilet) , and it will take an additional four days to cancel the pledge contract in argo. For details, please refer to the figure below.

However, for people with toilet phobia, 32 days is like sitting on pins and needles, and it is basically difficult to wait that long. Then you can choose another way. In VVS or MMF , there will be a stable swap flow pool with a good depth so that people can exchange BCRO Convert to CRO or other tokens so you can avoid the 32-day super toilet. It is also worth noting that BCRO and CRO did not steal the algorithm for hooking, so there is no risk of decoupling. As long as BCRO de-stakes on the argo page, there will be no loss, but if a large number of people switch through the SWAP mechanism , it may temporarily cause huge fluctuations in the price. Fortunately, the BCRO liquidity pools on VVS and MMF currently have a depth of 4M and 2M respectively, so nano retail investors such as me do not have to worry that they will have a strong influence on the price. .

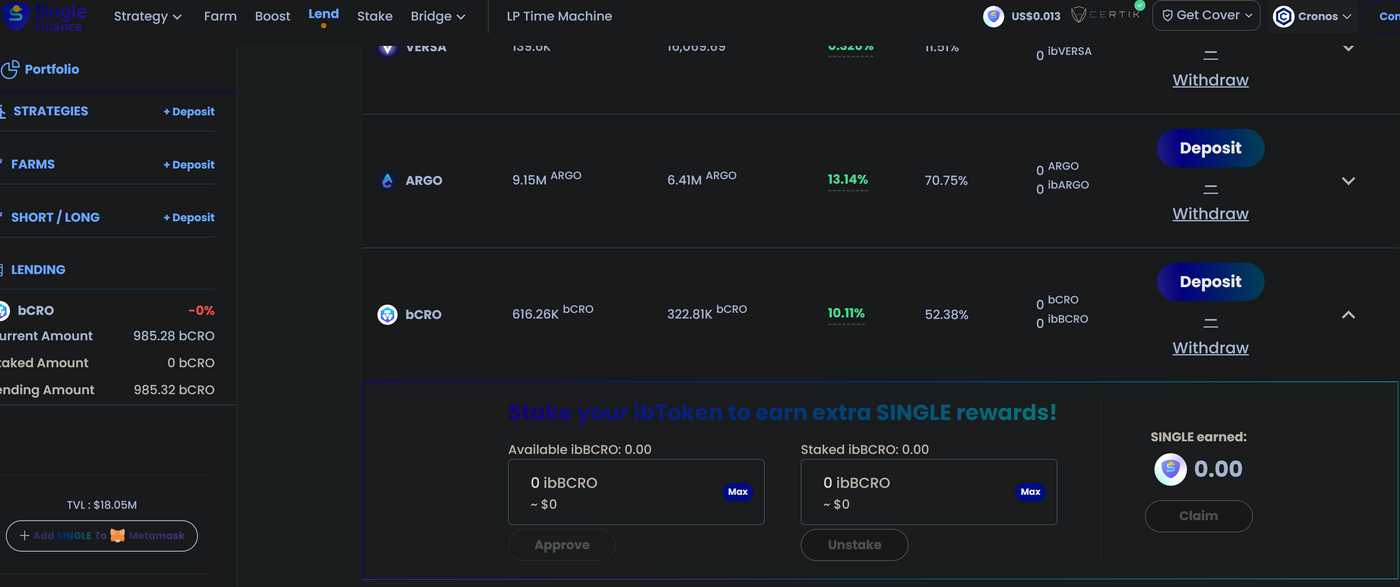

At present, bcro has been used in the DAPP of cronos. It can be used as collateral or deposits on many lending platforms such as tonic, and I myself put it on single finance to earn about 10 or so. APY, of course, people with better risk tolerance can also engage in leveraged mining. In short, they can spend money on DEFI Lego.

This is almost the end of writing. I am not promoting CRO or giving investment advice. I am just activating the assets I have locked up. I don’t think any cryptocurrency can be low-grade and mindless. It is very likely to copy the whole person on the mountainside. was buried. FFTB can only speak out from the living people. It is still recommended to maintain a certain amount of cash level to maintain profitability, work in McDonald's, and obtain stable cash flow. This is the way to cope with the bear market.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More