Huawei and foreign trade and other issues

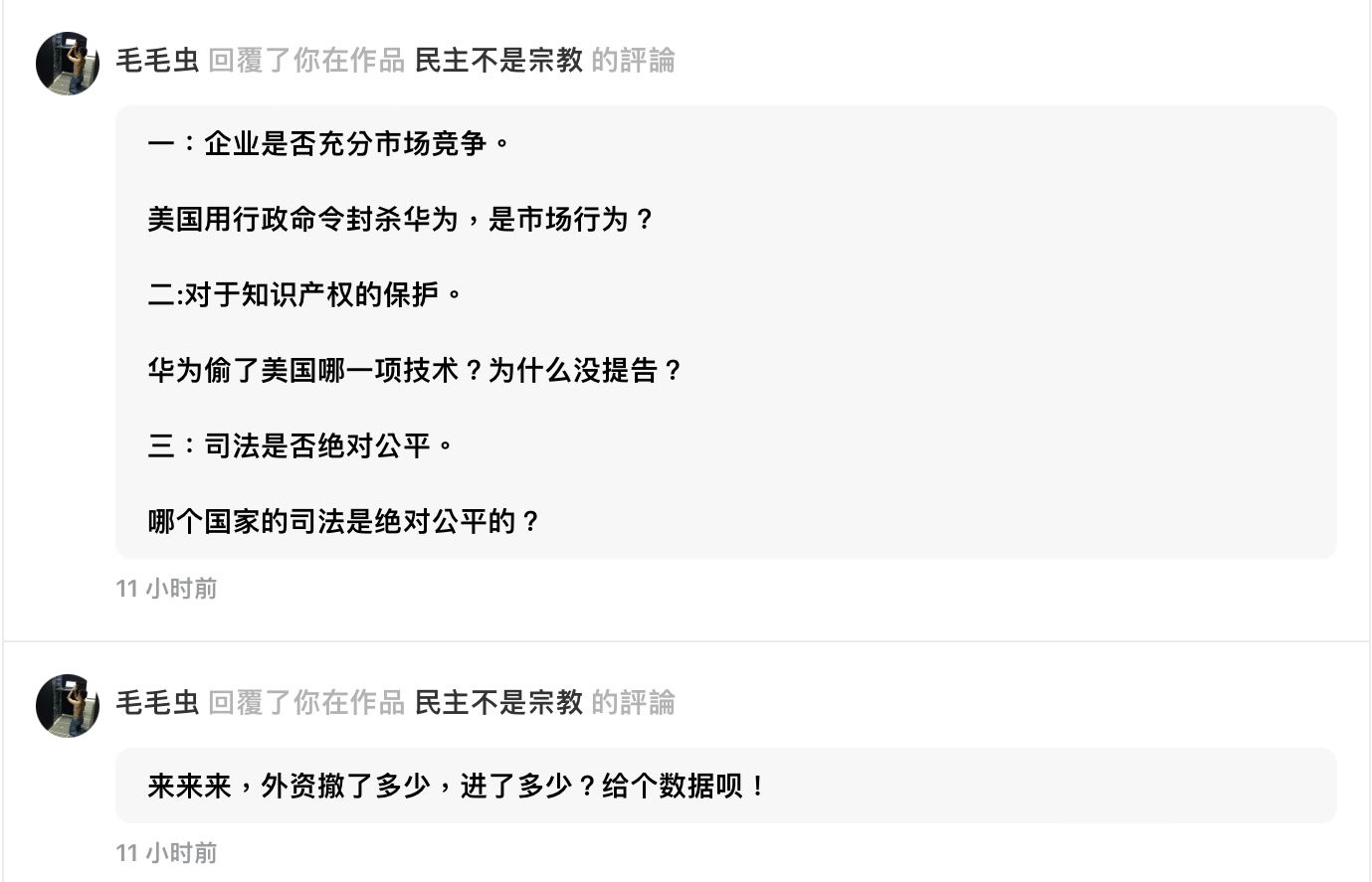

1: The United States used administrative means to block Huawei, is it a market behavior? What technology did Huawei steal, and why was it not prosecuted?

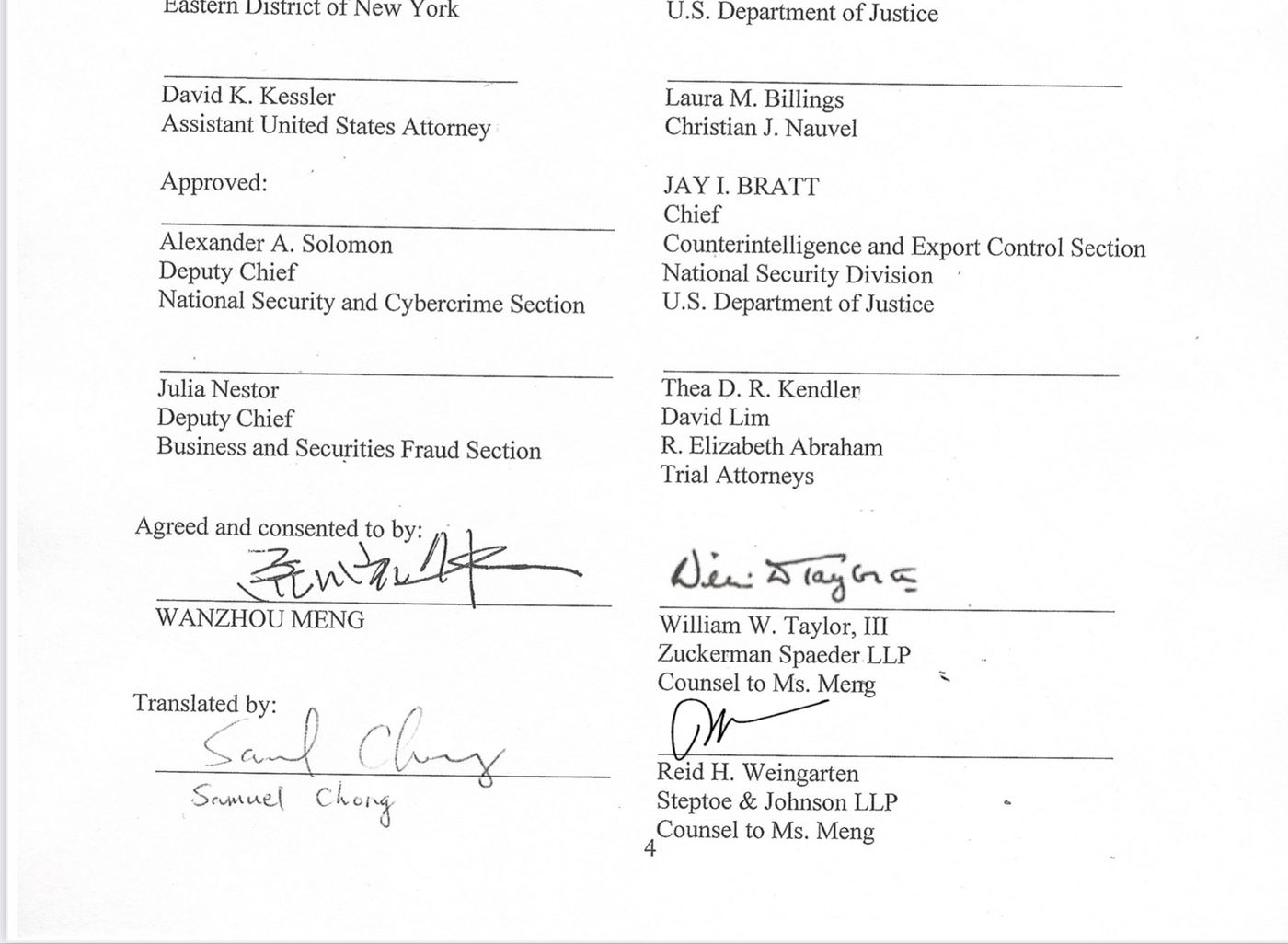

<Meng Wanzhou admits to financial fraud> Public information on the US judicial website (link)

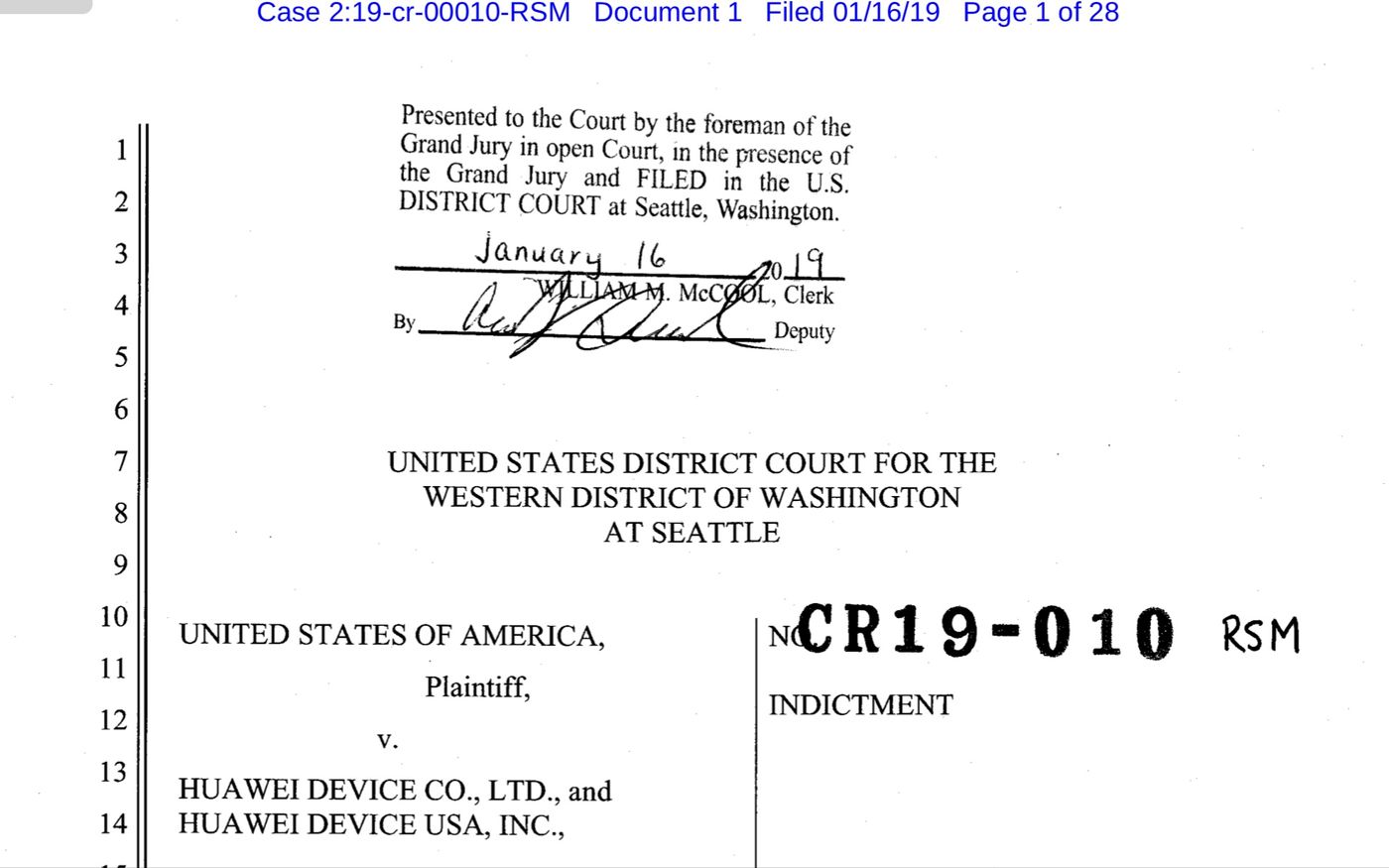

Chinese Telecommunications Device Manufacturer and its US Affiliate Indicted for Theft of Trade Secrets, Wire Fraud, and Obstruction Of Justice

Huawei corporate entities conspire to steal trade secret technology and offer bonuses to employees who stole confidential company information around the world

Like the ZTE case, simply put, ZTE violated the regulations of the US Department of Commerce, stole trade secrets, and sold high-tech components to Iran. Like a public-to-public contract, it generally involves confidentiality clauses, and there are related contracts for software, equipment processing, and manufacturing. Leakage, copying, or cracking of these are all technology thefts and crimes. Huawei's crimes involve the U.S. embargo on sales to Iran.

Ruixing Coffee’s financial fraud in the US stock market, Huawei steals US commercial technology, and even involves national defense security. Apple is in the mainland, and its servers are located in Guizhou (Guizhou on the cloud), including the Didi data incident that was raging some time ago, the large-scale smearing of Tesla, the fine against the Far East Group, and the suppression of the Lotte Group in South Korea...

If the netizen caterpillar thinks these things can be compared, then I don't need to say much. In short, since the country is governed by law, there must be laws to abide by, whether it is the so-called national interests or foreign relations. Whether it is the Communist Party or the U.S. government, there is no Communist government without any "countermeasures", and the Communist government is often more ruthless. Just like the "Thousand Talents Plan", it is obvious to steal American science and technology.

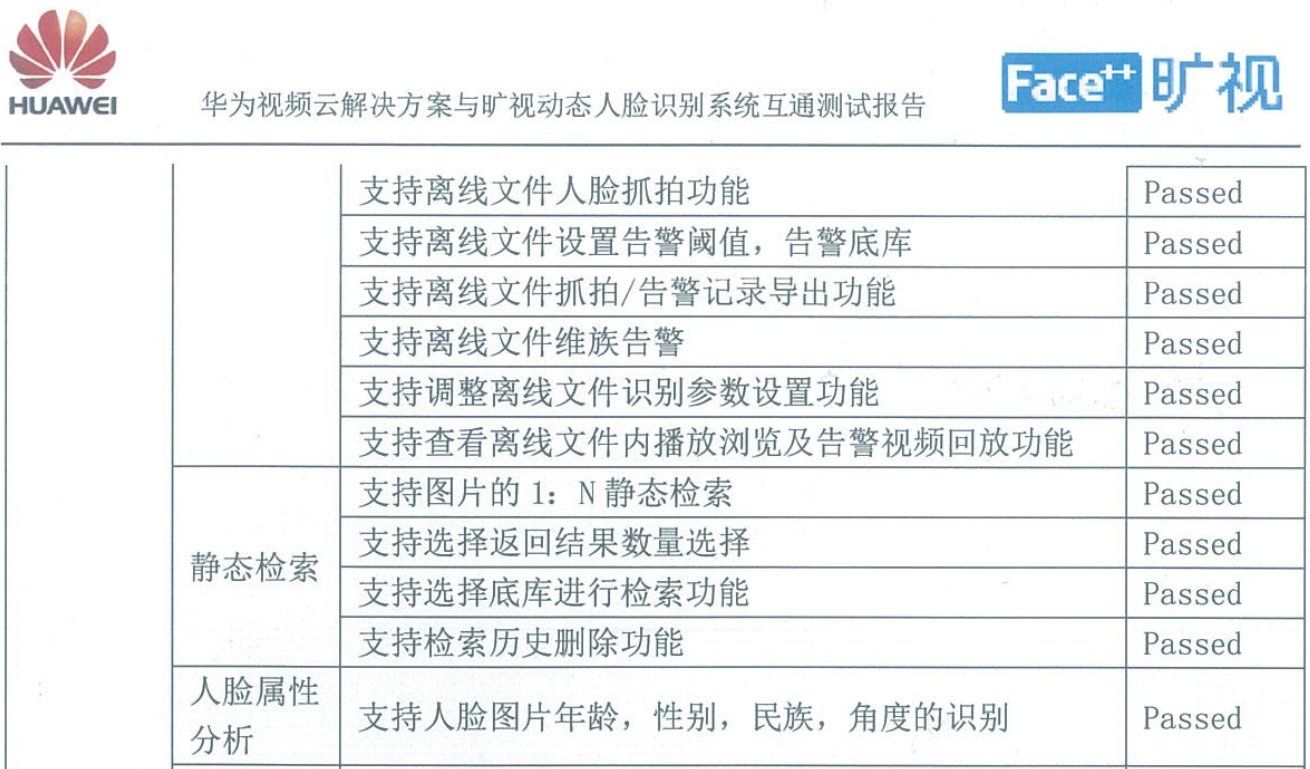

In my eyes, it has been shown many times that the U.S. government and the CCP are almost the same pair of pants. It's just a matter of distribution of interests. If it weren't for the United States, there would be no so-called "reform and opening up". This is also the dilemma faced by dissidents in the United States. The lifting of the ban on Huawei is also supported by pro-China lawmakers (mainly the Congress) in the U.S. government. As we talk about the U.S. government today, obviously unlike the Communist government, it emphasizes the "central" authority. Its group game has always been fierce. As a military enterprise, Huawei's inferiority is obviously more than that. Even Hongmeng OS is suspected of plagiarism, not to mention other fields. My impression of Huawei is not too negative. When I was in China, where I worked was very close to Huawei, I also had friends who worked for Huawei and opened a Huawei mobile phone store (authorized store), but about information engineering, monitoring , and suspected of stealing technology and using it in the maintenance of the Communist regime. To be honest, there is really nothing that ordinary people can do. Huawei 251 is a warning to every migrant worker, and it is also an event that makes the hidden voice recorder popular. Nimba is run by a good company. In fact, as long as you have work experience in China, as well as experience in investing and opening a company, I believe that many things do not need to be said too clearly, and everyone knows it well.

If you insist that the United States is suppressing it, I really don’t understand. If you get stuck, you will immediately retreat from 5G to 4G. If you really master the core technology, how can you be suppressed? Today's predicament for the Communist Party is entirely caused by its perverse actions. After the 1989, the West extended an olive branch and gave up sanctions on China. Now that the world has decoupled, shouldn't we find the reason from ourselves, and who else should we rely on? Especially when it comes to these issues, it is obvious that some groups in the West are in unison with the CCP. Huawei's ban has not been fully enforced.

Japan, Taiwan, Europe and the United States have been providing various economic support and investment loans to the mainland. It can be said that the Communist Party is eating European and American rice and smashing the pot of Europe and the United States. Today, under the new system structure, decoupling is inevitable. This is the credit of Xi Jinping's chief accelerator. If you can't see through this, it can be said to be futile.

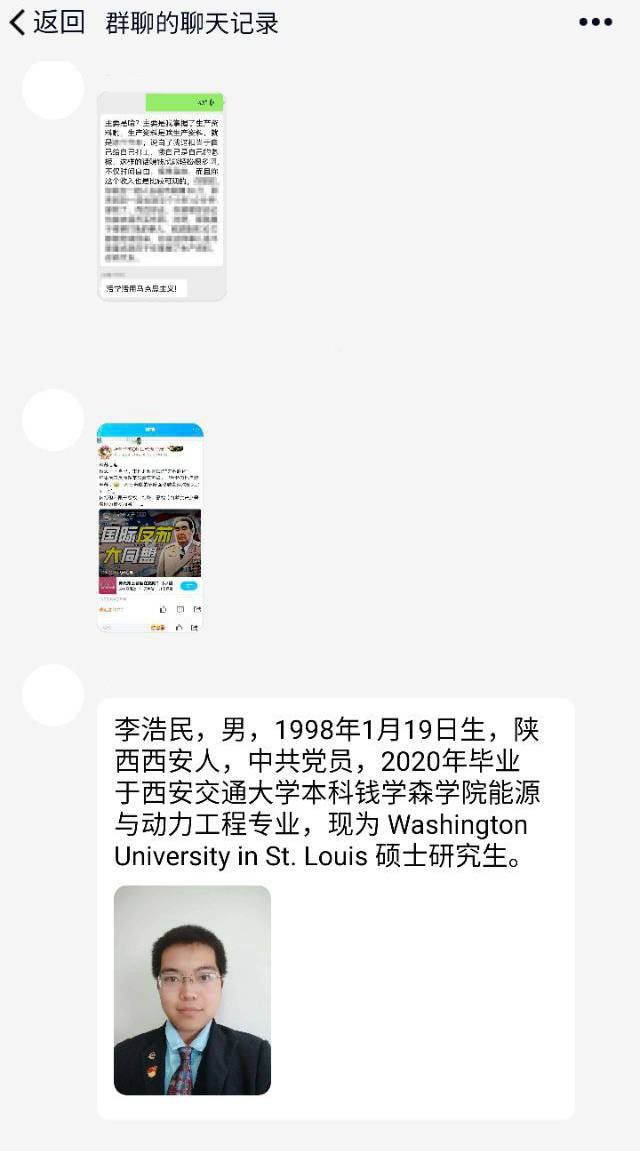

In 2021, a case broke out on Chinese social media Qzone for allegedly stealing technology from a US company.

Cases of intellectual property infringement by Chinese companies have not been isolated nor "small-scale" acts. In industries such as the film and television industry, game industry, entertainment culture and other industries, such as music plagiarism, it is basically impossible for foreign businessmen to defend their rights.

Second, which country's justice is absolutely fair?

It's a bit philosophical. Freedom is not absolute, democracy is not absolute, fairness is not absolute, and justice cannot be absolute. I really don't know what's the point of asking this kind of question, is it because people don't do it because it's not perfect?

Socialism cannot be achieved, and the rule of law cannot be perfect (so people are cured?). I think these words are meaningless in reality. You also know that the Communist Party is obviously not communism, but it says that it is communism. I would like to ask that normal countries can question the government and can ask officials to answer these questions. Do you question the Chinese government and try it?

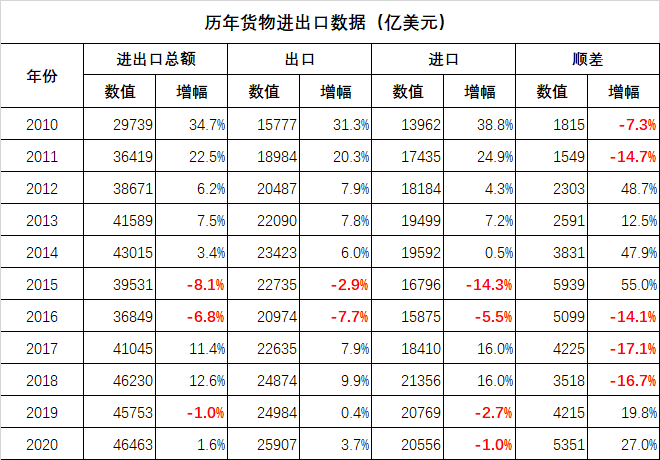

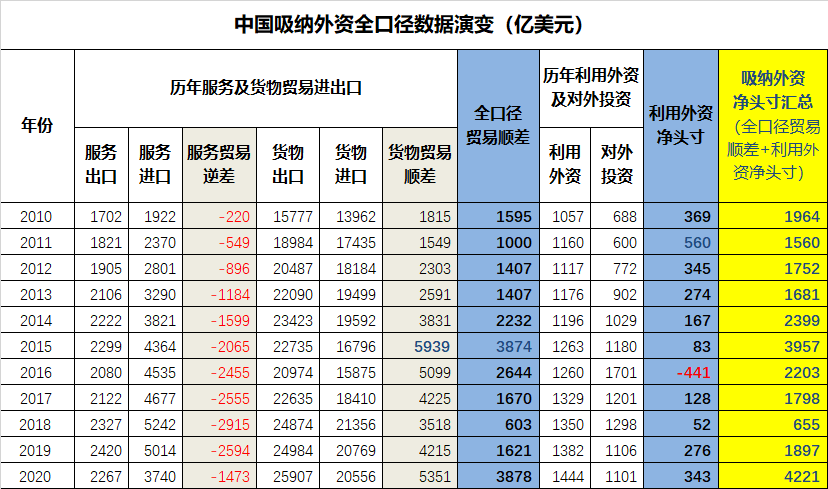

Third, the issue of foreign capital and foreign trade

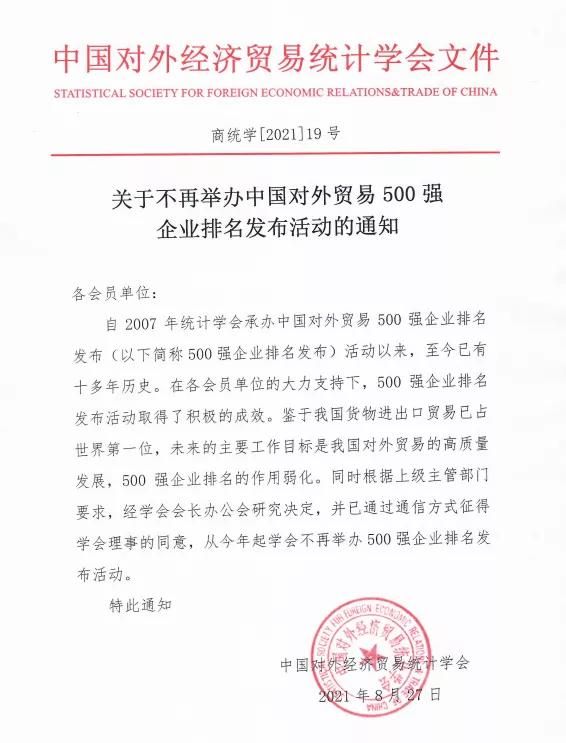

It can be seen that 70% of the companies are Taiwan-funded enterprises. The reasons for the market position of Taiwan-funded enterprises in the mainland are as follows.

China's export statistics in 2020

- 1. Electronic components (such as circuit boards) were US$192.1 billion, a year-on-year increase of 33.2%;

- 2. Clothing was 112.4 billion US dollars, a year-on-year increase of 25.3%;

- 3. Computers amounted to US$103.7 billion, a year-on-year increase of 22.2%;

- 4. Electrical equipment (such as transformers) was US$98.4 billion, a year-on-year increase of 39.3%;

- 5. Mobile phones were US$96.3 billion, a year-on-year increase of 24.0%;

- 6. Steel was US$59 billion, a year-on-year increase of 78.1%;

- 7. Drugs were US$36.5 billion, a year-on-year increase of 125.5%, of which vaccine exports were US$11.7 billion, a year-on-year increase of 14.5 times.

China's import statistics in 2020

- 1. Electronic components (such as circuit boards) were US$362.9 billion, a year-on-year increase of 24.9%;

- 2. Crude oil was US$184.5 billion, a year-on-year increase of 33.8%;

- 3. Iron ore was US$150.9 billion, a year-on-year increase of 76.0%;

- 4. Grain was US$56.7 billion, a year-on-year increase of 59.9%;

- 5. Computers were US$49 billion, a year-on-year increase of 22.4%;

- 6. The copper mine was 41.7 billion US dollars, a year-on-year increase of 62.5%;

- 7. Automobiles amounted to US$41.7 billion, a year-on-year increase of 39.1%.

China is not only a big exporter of mechanical and electrical products, but also a big importer of mechanical and electrical products. Taiwan-funded enterprises take the mainland as their production base, collect all kinds of high-precision mechanical and electrical products from all over the world, assemble the finished products and then export them. This is the truth of China's so-called manufacturing power.

It can be seen that places with a high concentration of foreign investment such as Beijing, Shanghai, Guangzhou and Shenzhen are also places with higher fiscal revenue.

China FAW Group, the import value is 11.119 billion US dollars, the export value is 288 million US dollars, and the net export value is -10.8 billion US dollars (deficit); BMW Brilliance, the import value is 7.724 billion US dollars, the export value is 39 million US dollars, and the net export value is -7.685 billion US dollars; Jinzhou State Reserve Petroleum Base Co., Ltd., Jinzhou Port Co., Ltd., Heilongjiang United Petrochemical Co., Ltd., and Panjin North Asphalt Fuel Co., Ltd. have zero exports. These companies with zero exports can be listed on China's top 500 foreign trade companies only because of their large "import quota". With two super ports of Dalian and Yingkou, adjacent to Russia, Japan and South Korea, it is rich in resources, but it has become a short-board area for foreign trade.

The basic monopoly state-owned enterprises' export trade statistics: Sinopec's net export value - 88.796 billion US dollars; PetroChina's net export value - 40.677 billion US dollars; CNOOC's net export value - 15.782 billion US dollars; Sinochem Group's (Sinochem) net export - 15.111 billion US dollars; COFCO's net exports - $10.73 billion.

For example, Chinese mainland exports peaked in 2020, but the containers stayed there. This year, the sea freight has risen sharply, and the freight container fee has risen sharply. As a result, on the surface, the export data of Chinese enterprises is gratifying, but the profits are on Weibo. After deducting shipping costs, how much surplus is left? In many cases, the amount has gone up, but the related costs of the enterprise and the future prospects are not optimistic. In Europe, America, Taiwan and other countries, the industrial chain has moved out. It is not just the mainland's economy that is hit, but also Hong Kong.

Take the boycott of Xinjiang cotton this year as an example. The Chinese government detained Uyghurs in Xinjiang manufacturing concentration camps and forced labor. Against this background, Western human rights organizations began to call for a boycott of Xinjiang cotton products. Impact on mainland light industry.

- The annual output of cotton in the mainland is about 6.5 million tons. The main producing area is Xinjiang, and the import volume is about 2 million tons, with a total of about 8.5 million tons. More than 8 million tons of cotton are used to spin into yarn. If it is pure cotton yarn, the conversion rate is roughly 96%, which is basically one ton of yarn produced from one ton of cotton. There are very few pure cotton products now, and various chemical fiber raw materials or wool materials are generally added, and the proportion of addition is still large. After the large-scale addition, the yarn production is roughly around 30 million tons. The mainland will import about 2 million tons of various high-grade yarns.

- From the processing of raw materials to the sale of ready-made garments, in the clothing field: the annual retail sales are roughly maintained at about 1 trillion yuan, and the export volume is roughly maintained at about 120 billion US dollars, equivalent to about 840 billion yuan. Exports accounted for 46% of total garment production. In the field of home textiles, the annual domestic retail sales is about 200 billion yuan, and the export value is about 42 billion US dollars, which is equivalent to about 300 billion yuan. The export of home textiles accounts for as high as 60% . For industrial textiles, the retail sales is about 80 billion yuan, and the export is about 27 billion US dollars, which is equivalent to 190 billion yuan, and the export ratio reaches 70% .

- The three major textile product industries combined, the total export scale is close to 190 billion US dollars, and the ratio of export to total output is about 50% .

That is to say, China's gauze must rely on export to maintain production capacity and operation. In the apparel field, Chinese brands basically have no export capacity. Although the production capacity is huge, the export must be affixed with the brand of a foreign brand, which is regarded as the export of foreign-funded enterprises. Xinjiang cotton was rejected by foreign-funded enterprises, which means that 50% of the terminal production capacity must be replaced by new raw materials. If the existing production capacity remains unchanged, in the field of raw materials, the import scale must rise to 50%.

To be honest, it is not just a problem of foreign capital, local companies are also facing an unprecedented crisis and increasingly cruel regulation.

The introduction of one policy after another has never been able to save the adjustment of the industrial layout of foreign investment. The era of great decoupling has arrived.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More