Views on stablecoins

USDT

75.7 billion

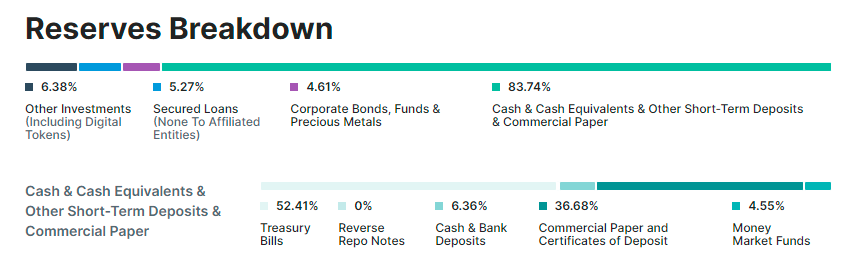

Commercial Paper and Certificates of Deposit: Commercial Paper and Term Deposits

Treasury Bills: Short-term non-coupon Treasury bills

The most important of which are short-term non-interest-bearing national bonds. Whether there are so many national bonds is the key. In addition to commercial paper and time deposits, whether commercial paper accounts for the majority or time deposits accounts for the majority, it is estimated that it is commercial paper.

When all markets are normal, there is no problem. Only when there is a black swan in the traditional financial market and everyone is tightening the market, problems such as commercial paper will occur. The key is to see whether there is really Treasury bonds.

USDT's view: The risk is small, but it does not mean that there is no risk. It cannot be said that the market is relatively large, and there is no problem with the first mover advantage, because the market of cryptocurrencies is not large enough, and the risk is only when the regulatory rules are detailed enough. can be reduced smaller.

USDC

77.1% of Circle's USDC stablecoin reserves are U.S. Treasury bonds and 22.9% are cash, with a market share of about 50 billion

How to Be Stable — USDC Transparency and Trust — Official Announcement Reserve

According to this description, the risk will be smaller than that of USDT. This risk lies in the risk of USD treasury bonds, but it is not 100% safe, because there may be a black swan in the market, and there will be a large short-term sell-off of U.S. dollar treasury bonds (the largest US creditor country sells off ), the long-term should not be a big problem.

BUSD

Stablecoin co-founded by Paxos and Binance, one of the few stablecoins that meets the strict regulatory standards of the NYDFS

Monthly reports: https://paxos.com/atttestations/

$17.4 billion in reserves: cash and cash equivalents (96%), 4% treasury bonds

low risk factor

Summarize

- At present, the traditional stablecoins USDC, USDT, and BUSD pegged to the US dollar at a ratio of 1:1 have a risk factor of BUSD>USDC>USDT, but the breadth of use is just the opposite. Traditional finance is relatively safe without black swans.

- For other stable coins that are not anchored to the US dollar, there may be uncertainties in the short term, especially in the case of market instability. To be honest, no currency or bank can withstand short-term runs, and can only be solved by relying on foreign objects these questions.

- Another point to note is that some stablecoins on different chains are not native stablecoins and need to be distinguished by themselves. The bridged stablecoins require the security of the bridge to ensure security.

- For the stablecoin development of the blockchain, it will definitely not be limited to this. I believe that there will be native stablecoins. Otherwise, it will be the product and extension of the dollar release.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More