Bitcoin skyrockets which top 10 cryptocurrencies do you hold?

Do you have faith? Are you a devout apostle? Bitcoin rose to $20,000 in 2017, but then plunged 80% to $3,000 in a bubble-like slump. The US$10,000 fluctuated up and down, floating and sinking, until the last three months of 2020, with the outbreak of the COVID-19 epidemic, and the sluggish economy promoted by the mad money printing of various countries, all of which were the driving force behind this wave of Bitcoin’s rise. As of March 13, 2021, Bitcoin has also reached an all-time high of $60,076.18, and even some insiders predict that it may reach $200,000 by the end of 2021.

In order to prevent oversupply of Bitcoin, the Satoshi Nakamoto system is designed to automatically halve the reward output to avoid spam and establish scarcity . With the halving of Bitcoin output, when the mining cost (difficulty) is too high to be profitable, This will cause many miners to abandon the pit effect in 2018. It can be seen that the Bitcoin surge this time is no longer a hype by miners, but an effect driven by many investment legal persons.

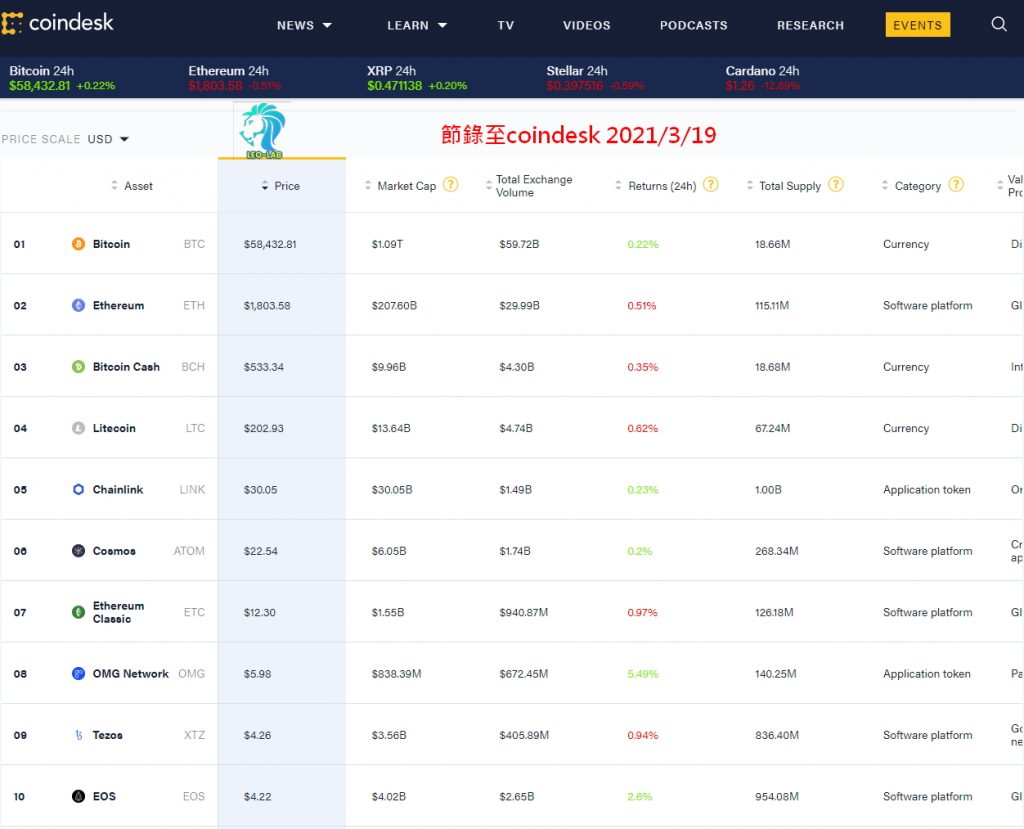

Also driven by the soaring rise of Bitcoin, some investors have turned to cryptocurrencies that are more accessible to the people because they can’t afford Bitcoin, and they also want to make a fortune, but there are thousands of cryptocurrencies, how to buy and invest honestly The reality is confusing. Here, LEO lists the top ten cryptocurrencies with trading volume and briefly introduces them, hoping to help those who want to invest in cryptocurrencies but have no access to it, as a reference.

Content directory

- TOP 10. EOS

- TOP 9. Tezos (XTZ)

- TOP 8. OMG Network(OMG)

- TOP 7. Ethereum Classic(ETC)

- Top 6. Cosmos (ATOM)

- Top 5. Chainlink (LINK)

- Top 4. Litecoin (LTC)

- Top 3. Bitcoin Cash(BCH)

- Top 2. Ethereum (ETH)

- Top 1. Bitcoin (BTC)

- in conclusion

TOP 10. EOS

Exchange rate: Click me to check the EOS exchange rate

Introduction to EOS: EOS Wikipedia

Released by Block.one in September 2017, EOS.IO facilitates developers to develop dApps , is more scalable than other blockchains, and can process up to one million transactions per second without charging any fees.

TOP 9. Tezos (XTZ)

Exchange rate: Click me to check the Tezos exchange rate

Introduction to Tezos: Tezos Wikipedia

Founded by Arthur and Kathleen Breitman in 2014, the main concept is a smart contract platform with a simple concept. Holders of XTZ cryptocurrency have the right to vote on whether to change the rules. Once the vote is passed, the software will be based on the rules. Update and upgrade, smart contracts will be widely used in the future, such as hotel Check in, bandwidth allocation... The future is bullish.

TOP 8. OMG Network(OMG)

Exchange rate: Click me to check OMG exchange rate

About OMG: OMG Network Wikipedia

Formerly known as OmiseGO, it was established in 2017. It is mainly used to alleviate the problems of high throughput, slow transaction speed and high transaction fees of Ethereum. The use of OMG Network technology can not only effectively save costs, but also improve transaction efficiency. OMG Network can be used for enterprise-level services.

TOP 7. Ethereum Classic(ETC)

Exchange rate: click me to check the ETC exchange rate

Introduction to ETC: ETC Wikipedia

The birth of Ethereum Classic was caused by the hacking of smart contracts in 2016, and the Ethereum Foundation had differences of opinion. The old Ethereum became today's Ethereum Classic, using the POW mining mechanism.

Top 6. Cosmos (ATOM)

Exchange rate: click me to check the ATOM exchange rate

Introduction to Cosmos:

Cosmos is a decentralized network that supports data exchange between different blockchains. The main goal is to create a "blockchain network" to solve the scalability and interoperability between blockchains. Interoperability issues . By deploying both the Tendermint Byzantine Fault Tolerant Consensus Protocol and the Inter-Blockchain Communication Protocol (IBC), blockchains built on top of Cosmos can retain their sovereignty when transacting with other blockchains.

Reference reading: Introduction to Cosmos that beginners can understand

Top 5. Chainlink (LINK)

Exchange rate: Click me to check LINK exchange rate

Introduction to Chianlink: Chainlink Wikipedia

Chainlink is a Tokenizd oracle network that mainly provides price and event data collected from the chain and the real world. In short, it can be regarded as the smart contract of smart contracts , the communication bridge between the blockchain and the real world.

Reference reading: The priceless oracle machine: Where is "Chainlink" "expensive"?

Top 4. Litecoin (LTC)

Exchange rate: Click me to check Litecoin exchange rate

Introduction to Litecoin: Litecoin Wikipedia

Litecoin was founded by former Google employee Charlie Lee in 2011. It is based on the original code structure of Bitcoin and modified to four times the circulation of Bitcoin. It is less vulnerable to 51% attacks and the transaction time is also the time of Bitcoin transaction. In 10, it is shortened to 1/4 2.5 minutes, but the mining cost is not cheap, and the mining value only requires professional mining machines.

Top 3. Bitcoin Cash(BCH)

Exchange rate: Click me to check the BCH exchange rate

Introduction to Bitcoin Cash: Bitcoin Cash Wikipedia

Basically, they all come from Bitcoin, mainly because the information capacity was only designed to be 1Mb when Satoshi Nakamoto founded Bitcoin, resulting in limited transaction volume. To this end, a proposal for an expansion plan was generated, and BCH was forked.

Reference reading: [Bitcoin Cash 1st Anniversary] One year later, Satoshi Nakamoto’s Bitcoin pure blood battle, who is orthodox, does it make sense?

Top 2. Ethereum (ETH)

Exchange rate: Click me to check the ETH exchange rate

Introduction to Ethereum: Ethereum Wikipedia

Both Ethereumc and Bitcoin are developed with blockchain technology, and are mainly dedicated to the development of smart contracts. Once the conditions are triggered, the contracts will be fully executed to reduce the impact of human factors. They are widely used and are currently the mainstream mining goals.

Reference reading: Ethereum (Ethereum) Ultimate Beginner's Manual - A must-read for beginners

Top 1. Bitcoin (BTC)

Exchange rate: Click me to check the BTC exchange rate

Introduction to Bitcoin: Bitcoin Wikipedia

Satoshi Nakamoto, a mathematician and computer genius, published the paper in November 2008 ⌈Bitcoin: A Peer-to-Peer Electronic Cash System⌋, which created the future mining mechanism, which can be said to be a discrepancy in the history of financial development. Only 21 million pieces are designed, which will not increase or be eliminated. To put it bluntly, Bitcoin is a ledger held by the whole world. Whoever grabs the newly derived block for accounting will get Bitcoin as a salary. Interesting It is the first transaction to use Bitcoin to order pizza, with a total of 10,000 Bitcoins, and the current breakthrough (2021/3/25 $53,000 to 1 Bitcoin) has a market value of more than $500 million.

Reference reading: [Understanding Bitcoin in 5 minutes] It was worthless back then, and now it is more profitable than real estate speculation

in conclusion

In addition to the first-ranked Bitcoin and the second-ranked ETH, there are many cryptocurrencies waiting to be listed for trading every day, and many people rush into the market with little understanding of the nature and technology of cryptocurrencies. If you bet on the right treasure, you may go to heaven in the future. If you bet wrong, you may lose everything. If you want to invest and evaluate a cryptocurrency, you still need to understand the characteristics of the currency from the fundamentals . The opportunity is always reserved for Those who are ready, otherwise they will enter the market with little knowledge, and in the end they will only be harvested by leeks and others. In the world of the currency circle, whoever can solve the problem will be the overlord of the next market . This is an unchanging iron law. The pursuit of getting rich overnight is just like buying a big hit and expecting to win the jackpot. Steady investment, always pay attention to and understand the technical aspects and beliefs, so that you have a chance to turn over.

Everyone should know that people who earn wealth in each era always have more knowledge and information than the average person. This is the so-called information gap. Information gap will cause wealth gap. This is also the reason why many people cannot become rich. Maybe you and I don't have a rich dad, nor a golden or silver spoon, but as long as you know more than others, when the opportunity comes, you can follow the trend and make your own fortune.

Further reading:

Free bitcoin mining web browser:⌈ [Make money online]Cryptotab web mining machine hangs up to earn bitcoins⌋

If you want to grow with LEO, please subscribe below and like my fan page, I will share the information and knowledge I have learned with you, grow together and create your own passive income.

The original link is Leo Leo - Internet Finance Lab

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More