How far are we from developed countries?

The word developed country has always given people a sense of superiority. We are now the world's second largest economy, but it has never been a developed country, and is still the largest developing country on the planet.

So when will we become a developed country? Let me start with the conclusion. As long as we successfully cross the middle-income trap, we may become the largest developed country in the world within 5-10 years.

Portugal and Greece, two European countries, have always been called the goalkeepers of developed countries. Their per capita GDP is just over 20,000 US dollars. Portugal ranks 39th in the world and Greece 43rd.

In theory, as long as we can surpass Portugal and Greece and squeeze into the top 40 in the world, we are considered a developed country. At present, our per capita GDP is more than 10,000 US dollars, only half of that of Portugal, ranking 59th in the world, 20 places lower than Portugal, and we seem to be far from developed countries.

However, if you look at the speed of our development in recent years, you will find that we are not far from developed countries. In 2005, our per capita GDP ranked 132 in the world, but by 2020, we will be squeezed into the top 60 in the world, and we have improved 73 places in 2015, and we can improve by four or five places almost every year.

At this rate of development, in another five years, that is, 2025, or a little more conservative, by 2030, we will be able to enter the top 40 in the world, surpassing the two goalkeepers of Portugal and Greece, and become a tall developed country.

In 2019, our per capita GDP reached the threshold of 10,000 US dollars for the first time, and 10,000 US dollars can be regarded as the threshold for middle-income countries.

There have been many countries in history that, after reaching the middle-income level, stopped developing and fell into a trap. This is the famous middle-income trap. Brazil, Argentina, Mexico, Malaysia, Thailand, South Africa and many other countries are trapped in the middle-income trap, with their economies stagnant.

Why is there a middle-income trap?

Let's take Thailand as an example. Thailand's economic take-off relies on low-cost labor. The products produced by low labor wages are cheaper and have a competitive advantage.

By exporting cheap goods, Thailand has gradually become rich, and the wages of workers have gradually increased. When Thailand's economy has developed to a middle-income level, the advantage of cheap labor will be lost.

At this time, Thailand could neither compete with backward countries for labor costs, nor with developed countries for high-tech products. If the industry cannot upgrade, it can only produce low-end products, and the production cost of low-end products is higher than that of other countries. In this way, Thailand is stuck in the middle and falls into the middle-income trap.

How to become a developed country?

We are also a middle-income country. In the next 5-10 years, if we can go further, we will become a developed country with a population of 1.4 billion, which is definitely an unprecedented miracle; , Argentina, and Malaysia, falling into the middle-income trap.

The development in the next 5-10 years is very important, and it concerns each of us. In this video, we will focus on the analysis: What problems will we encounter in the future? How to solve these problems?

Let’s talk about the problems encountered first, there are three major problems:

First, the trend of hindered globalization is difficult to reverse in the short term.

Export, investment and consumption are the troika that drives economic growth and are also the three components of total demand. We are one of the most trade-dependent countries in the world, with exports accounting for 20% of GDP. Since our trade with developed countries has been blocked for 18 years, and developed countries such as the United States, Europe, and Japan are our main trading partners, in the future, finding new markets to replace developed countries is the first problem we have to solve. .

The second problem, the investment in the troika, the marginal return is getting lower and lower.

In the past two decades, local governments have invested in many infrastructure projects, relying on the support of land finance. After good projects have been invested, they have invested in some relatively poor projects ahead of schedule. Construction time was ten years earlier.

Investment is about return on investment. With the overcapacity of infrastructure investment, there are fewer and fewer good projects that can make money. It is not easy to rely on investment to drive economic growth in the future.

The third problem is the technical stuck neck.

To make the economic pie bigger, there must be continuous technological innovation. Technological progress brings industrial revolution and higher production efficiency, so as to make the global wealth pie bigger.

However, global technological innovation has been stagnant for many years, which has led to the current global economy entering the stage of the game of stock. The cake is not big enough, and everyone can only compete for each other's share of the cake. This is involution.

In the future, which country can take the lead in making breakthroughs in technological innovation, which country's economy will stand out. Technological innovation not only solves the problem of stuck necks, but also depends on who can get the first move in development.

At this point, the problems we will encounter in the future will be made clear. If you think my analysis is reasonable, you can like and follow, and support me.

How to solve these problems?

Let’s talk about the problem of trade obstruction and excess investment. To solve this problem, we need to start from two aspects:

The first is to stabilize the fundamentals of exports and investment.

The recently popular RCEP agreement and the ongoing China-EU trade agreement are actually trying to stabilize the fundamentals of our foreign trade. The investment in new infrastructure such as 5G base stations and charging piles for new energy vehicles is also to replace the excess investment in old infrastructure and stabilize the fundamentals of our investment.

The second is to stimulate domestic consumption.

When exports and investment are weak, consumption is the biggest hope to drive economic growth, which is also the reason for the smooth internal circulation and demand-side reform.

To stimulate domestic demand, we must expand the size of the middle-income group. The rich have spending power, but their desire to consume is limited, while the low-income group has a strong desire to consume, but has no spending power. Only by turning more low-income groups into middle-income groups can consumption be stimulated.

The concepts of RCEP and new infrastructure mentioned above are a bit far from the common people, but stimulating consumption and expanding the middle-income group is related to each of us, and will have two most direct impacts:

The first is price. The richer the family, the more real estate, and the rise in housing prices will make wealthy families richer, widen the gap between the rich and the poor, and reduce the size of the middle-income group. In addition, high housing prices have also caused many families to collect mortgages and repay loans. No money to spend. If you want to unblock the internal circulation and let the people have money to spend, they will definitely insist on housing and not speculating.

The second effect is to prevent the uncontrolled expansion of capital, which is also a hot news recently. The listing of an Internet company will create a large number of multi-millionaires and billionaires, while small and medium-sized enterprises and self-employed individuals outside the Internet company have difficulty even maintaining operations because of the squeeze from giants. The unrestrained expansion of capital giants will only benefit a few people, but make more people bear the losses, which will also exacerbate the gap between the rich and the poor. In order to expand domestic demand or for common prosperity, capital giants must take on more social responsibilities in the future.

Then there is the problem of the core technology stuck in the neck, which is the biggest problem in front of us. As mentioned earlier, countries that fall into the middle-income trap are not doing a good job in technological innovation when labor costs are rising, and they cannot produce high-tech products that can compete with developed countries. Doing scientific and technological innovation requires a large amount of investment, and only countries that are willing to spend money can produce high-tech.

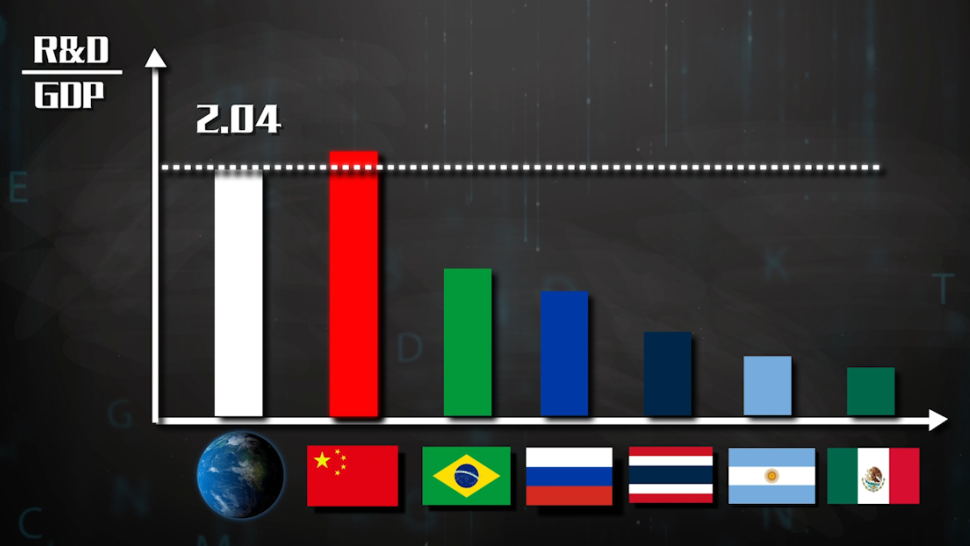

Let’s take a look at the current R&D spending in middle-income countries as a percentage of GDP:

The dotted line is the world average. The following is the investment ratio of China, Brazil, Russia, Thailand, Argentina, and Mexico. It can be seen that China's R&D investment is the best among middle-income countries, higher than the world average. We are very willing to invest in scientific research, and we have made many achievements in scientific and technological innovation.

According to data from Harvard University, the sophistication index, or technological content, of China's exports rose from 39th in the world in 2000 to 18th in 2018.

Let's take a look at the low-income India, as well as the high-income Japan and the United States, the proportion of R&D spending.

India's investment is very low, but the US and Japan's investment ratio is much higher than ours. Developed countries are willing to spend money in order to maintain their technological advantages.

Two conditions for doing well in innovation

Doing a good job in technological innovation not only requires a lot of money, but also requires two conditions:

The first is to have a large enough market. The money invested in R&D has to be earned back. Only when the R&D results piled up with money can be sold to a large enough market, the R&D cost can be diluted.

If Apple's smartphones can only sell tens of thousands of units, then Apple will definitely not engage in research and development. Only when doing research can make a lot of money can companies have the motivation to continue investing. A large enough market is a prerequisite for innovation. This goes back to the issue of expanding domestic demand. Only when ordinary people have money to spend can scientific research results be converted into enough profits.

The second condition required for innovation is a developed capital market. The risks of innovation are very high. Not all innovations will be fruitful, and a large part of scientific and technological research and development will fail, that is, money is wasted.

Innovation cannot rely on bank loans. Banks themselves dare not lend, nor do R&D people dare to borrow. Supporting technological innovation is venture capital such as VC and PE. Equity investment institutions will burn money for targeted technology companies. Once the money is successfully burned, the company will go public, and VC and PE can also make a lot of money.

Technological innovation requires a developed capital market. Only when the capital market is developed can companies easily go public and the exit channels for VC/PE can be smooth. Our domestic financing system dominated by banks is very developed, but the capital market is not developed enough. Compared with the United States, our financial system is not conducive to innovation. The capital market in the United States is developed, and technology companies are easy to go public and financing, so the development of American technology companies is better.

Unprecedented rise miracle

If you want to expand the capital market, you must turn residents' deposits into fund shares, which requires enough reliable institutional investors. Only when the fund companies are reliable can ordinary people dare to buy funds, and the capital market can grow.

The population of the developed countries in the world is not as large as ours. If we become a developed country, it means that there are more than double the number of people living in developed countries on the earth.

Our current per capita GDP is 10,000 US dollars, and the total economic volume is 66% of that of the United States. If our per capita GDP is doubled to 20,000 US dollars, our economic volume will also double, and the economic volume will become 132% of the United States is the world's largest economy.

A big man in the United States once said: If more than one billion Chinese people are allowed to live the lives of Americans or Australians, then everyone will be tragic.

We have a nickname called the developed country shredder, because the size is too large. Once we rush into the ranks of developed countries, the status of many old developed countries may not be guaranteed, so some people do not want us to develop too fast.

The problems of blocked trade and blocked technology are all imposed on us from the outside. Whether it is to become a developed country or become the largest economy, our road to development will certainly not be smooth.

If we can be smart enough to maintain the current speed of development, then in 5-10 years, we will really create an unprecedented miracle of rise.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More