Introduction of cosmos eco-shade protocol

Introduction to Shade Protocol

Shade Protocol is a collection of connected privacy-preserving DeFi applications built on Secret Network. These key applications include stablecoins, governance, bonds, collateralized derivatives, insurance, synthetics, lending, DEXs, and more.

Shade Protocol exists to solve the following (but not limited to) core problems in Web3 DeFi:

● Transparent DeFi applications

● Broken application layer ecosystem

● User experience that confuses multiple primitives

● Stablecoins pegged to sovereign currencies

● Governance scalability

● The overcollateralization model is inefficient

● Stablecoin legal environment

SHD is Shade Protocol's treasury, governance and revenue sharing token. It is used for staking, governance advice, liquidity provision, trading, bonds, etc.

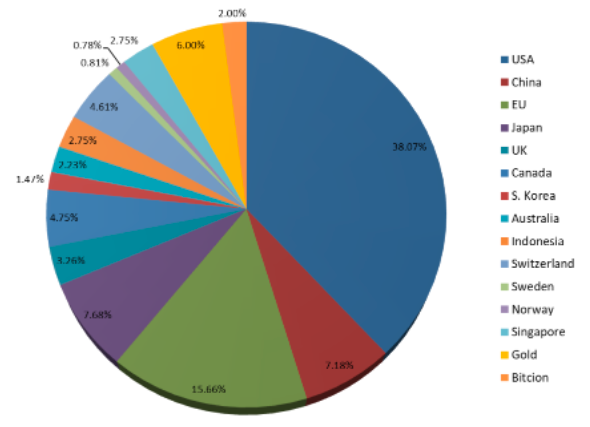

SILK is Shade Protocol's privacy-preserving stablecoin. SILK uses the algorithmic stablecoin model pioneered by Terra/Luna, pegged to a basket of global currencies and commodities, including gold, Bitcoin, USD, EUR, JPY, etc., as a permanent hedge against global fluctuations. Will allow ordinary people to interact with merchants and platforms around the world, with transactions that are both private and auditable at the same time, taking about 6 seconds to execute on the Secret Network.

Shade Protocol set out to build Silk into the following:

- (1) Privacy Protection

- (2) Auditable

- (3) Permanent hedge against global volatility

- (4) Decentralization

- (5) Algorithm

- (6) Fast

As Shade Protocol rolls out other key primitives (collateralized derivatives, bonds, lending, insurance, synthetics, DEX, etc.), no new unique application tokens will be launched per application, 100% The revenue stream will be returned to the Shade Treasury as well as to Shade stakers.

Source of income

Shade Protocol will enable the following revenue streams:

- (1) Silk transaction fee

- (2) Silk ← →SHD conversion minting fee

- (3) 10-year SHD pledge reward

- (4) Shade Treasury L1 Staking Rewards

- (5) Shade Treasury LP Participation Rewards

- (6) stkd-SCRT Liquid Collateral Derivatives Fee Flow

- (7) stkd-SHD Liquid Collateral Derivatives Fee Flow

- (8) Synthetic conversion minting fee (future)

- (9) Stablecoin airdrop (future)

Governance

Shade Protocol governance consists of three distinct parts (1) token holders (2) representatives (3) branches

There will likely be multiple branches working on extending different components of the Shade protocol: Silk, Treasury Management, HumanDAO, Grants Program, and more. A delegate is just an address with voting rights in SHD. Any SHD staker can contribute their votes to any address. Delegates have no financial incentive as they are purely in the public interest to vote on proposals. Users can always vote themselves, and can always vote separately from delegate voting.

synthetic assets

Shade Protocol aims to reduce the underlying risk premium by using an algorithmic stablecoin model for synthetic assets. With this brand new model, there will be synthetic and stable tokens paired

legal environment

Since Silk is not directly pegged to any given sovereign currency, it is completely immune to most regulatory scrutiny as Silk is not an underlying fiat derivative.

Censorship inevitably revolves around the following variables:

- KYC/AML/Cybercrime

- tax compliance

token economy

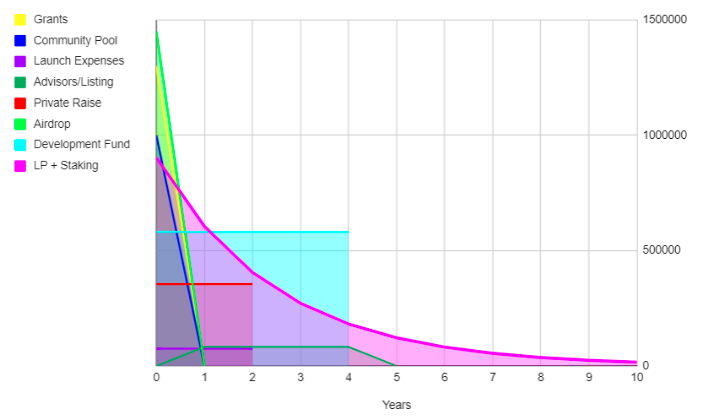

100 million SHD tokens in 10 years

Note that grants, community pools, and airdrops go to 0 in the second year should be interpreted as no new additional SHD issued to these categories, rather than those categories going to 0 in terms of supply. Likewise, the suspension of private raising and start-up fees for the second year means that there are no additional emissions in these categories after the second year.

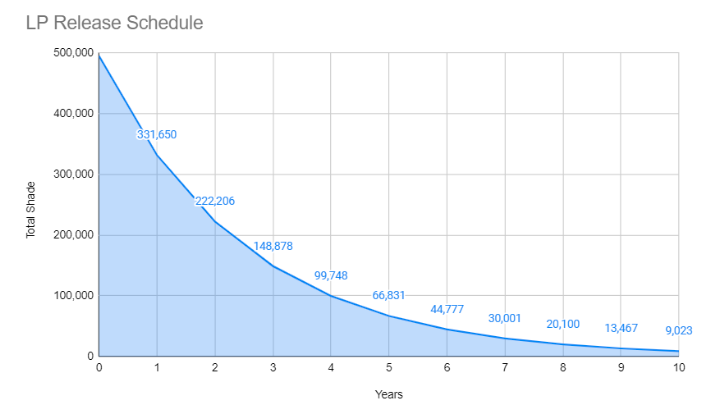

Staking & LP rewards (27.36%)

Using the penetration release model, about 1/3 of the LP and staking rewards will be released in the first year (decrease by ⅓ every year thereafter)

Incentive Silk and SHD LP pool, 15%

12.36% 21-day unbinding period

Airdrop (14.5%)

14.5% of the SHD supply will be airdropped to incentivized testnet contributors and community members staking on SCRT

Of which 13% goes to stakers and 1.5% to testers

Initially, 20% of the 13% airdrop supply will be available to claim when it first launches on February 21st (2.6%), and the remaining 80% (10.4%) of the airdrop will be available to users when SHD staking launches

Community Pool (10%)

Grants (12.34%)

Used to accelerate the development of key Shade Protocol DeFi primitives, Silk adoption and community growth, with 100% of the value returned directly to the Shade Treasury and SHD stakers.

After the implementation of mainnet governance, the grant pool will be migrated to the community pool

Development Fund (23.25%)

The core contributors currently consist of 10+ people - with the goal of scaling to more than 25+ as soon as possible, this portion of the capital and token distribution provides long-term sustainability and builder incentives for any original or new Shade Protocol core contributors. The entire life cycle of the agreement.

Development funds are committed to participating in over-the-counter transactions that result in buyers locking in liquidity and vesting periods rather than selling directly on the open market. This is standard practice, as maintaining open market sales of core builders' operations could negatively impact the long-term health of the protocol.

Startup fee (1.5%)

For marketing, influencers, brands, events, key community contributors and part-time builders to help promote or build Shade Protocol.

Private placement (7.75%)

$5M

Tokens are issued using a linear vesting schedule over 24 months, unlocking ~1,061 SHD per day, distributed among 25 different organizations and individuals (average 42.44 SHD per investor per day)

Advisor + Listing (3.3%)

Advisors are on a 6-month cliff before starting a 4-6 year vesting plan.

Derivatives

https://app.shadeprotocol.io/staking-derivatives

To mint stkd tokens, users must deposit pledgeable collateral (such as SCRT or SHD) into a pledged derivatives contract

SCRT ←→stkd-SCRT (real time)

SHD←→stkd-SHD (in development)

Minted stkd tokens represent a redeemable claim on the deposited collateral, as well as the rewards generated by the respective collateralized collateral.

Derivatives charge 0.20% for minting and 0.05% for redemption

After 21 days of redemption, the number of original tokens that can be received from the pledged stkd tokens will gradually increase over time.

roadmap

- Q1 2022: stkd-SCRT

- Q1 2022: stkd-SHD

- Q1 2022: Integration with lending products

- 2022 Q4: Governance + Cross-chain Staking Derivatives

website

https://twitter.com/Shade_Protocol

https://medium.com/@shadeprotocoldevs

https://app.shadeprotocol.io/staking-derivatives

refer to

Shade Protocol Silk Peg Research Channel

Welcome to communicate: personal twitter matters personal sharing TG channel

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More