[Web3 Study Notes] #4 Blockchain: From Genesis to Rainforest

In the study group last week, @MatDev gave a report titled Public Chains . The knowledge points are relatively "hard", and I struggled to learn. After writing this note for more than two weeks, I finally managed to sort out my understanding. Written, individual technical points may not be accurate, welcome students to correct.

Genesis

Historically, rice, silk, shells, precious metals... these items with a certain economic value themselves have all been used as currency. Paper whose own value is almost 0 has become a common currency. This is a major historical event that reveals the secret of money: what money looks like and what value it has is not important. As long as enough people believe in it, it will be worth it. it works. Our countless transactions today take place online, and money becomes a string of numbers in a computer. The reason we all believe that these numbers have real value is that they are backed by the central banks of each country. However, in the years from 2008 to 2010, when the subprime mortgage crisis in the United States and the European debt crisis broke out, the relevant government agencies did not punish the financial institutions that caused the crisis in a timely manner, but instead made ordinary taxpayers a big bait, and more and more people lost their interest in government-led financial institutions. system trust. The blockchain was born in this context: how to build a trusted pear-to-pear trading system without the endorsement of the central bank and the government?

Bitcoin is both the first implementation of blockchain technology and the first cryptocurrency used for transactions. Its design ensures at least two things: (1) According to its algorithm protocol, the total amount of Bitcoin has an upper limit, which ensures its scarcity as an asset, and is called " digital gold ", that is, it has a store of value. Ability. (2) The generation of new blocks requires a lot of computing resources, and requires the consensus of each node on the entire block network, so it is difficult to be attacked or faked by hackers and has credibility.

After the first batch of Bitcoin was created, its value was not clear. In May 2010, laszlo, who lives in Florida, said in a cryptocurrency forum that he was willing to pay 10,000 Bitcoins to buy two boxes of pizza for home delivery. Jercos, who lives in California, called Papa John's Pizza in Florida and ordered two boxes to be delivered to Laszlo's house, fulfilling the deal. This milestone symbolizes the completion of a physical transaction between two strangers based solely on mutual trust in the blockchain without the endorsement of a central authority . In 2011, Vitalik Buterin, a 17-year-old Russian-Canadian high school student, wrote a column for Bitcoin Weekly, earning 5 coins ($3.50 at the time) per article. Today, one Bitcoin is worth $42,350. (When will the Like Coins we earn in Matt City go up like this? 😂)

For the next few years, Vitalik pondered issues related to blockchain and cryptocurrencies while contributing to the weekly magazine. The functions of Bitcoin itself are very simple: payment, collection, and accounting. Vitalik proposed between 2013 and 2014 that blockchain technology can be used to execute software-defined contracts, so that the blockchain itself becomes a supercomputer, and the software running on it can rely on the characteristics of the blockchain , complex transactions can be completed without third-party intervention . The application scenarios envisaged at the time included buying and selling real estate, executing insurance claims, identity verification...etc. This is the concept of Smart Contract, the smart contract . The Etheruem blockchain (Ethereum), founded by Vitalik and his friends, is the forerunner of smart contracts. Many derivative applications today are built on Ethereum.

If the design idea of Bitcoin makes it digital gold , the vision of Ethereum is to become a digital fuel , providing empowerment and incentive mechanisms in various application scenarios. Since the concept of smart contracts appeared, the blockchain world has begun to see a hundred flowers bloom, and more and more applications have begun to enter the public's field of vision.

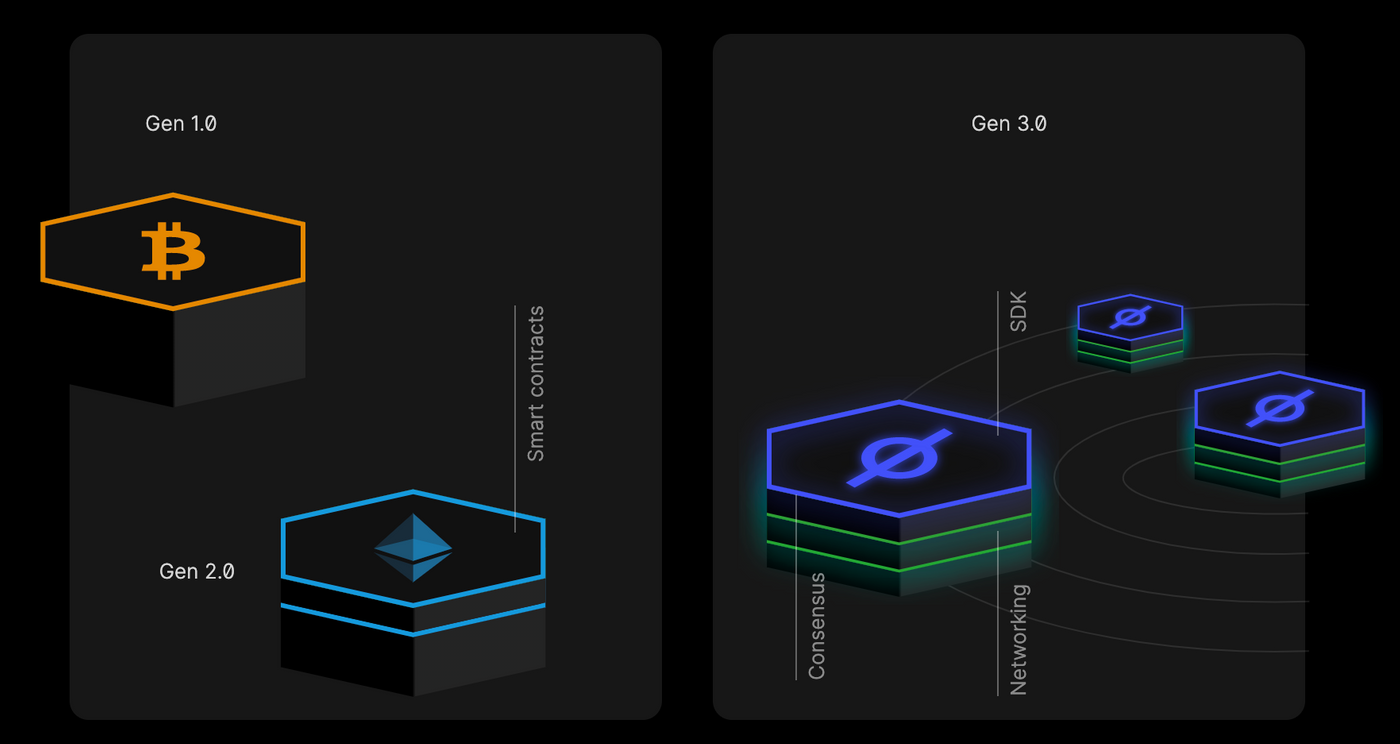

This picture captured from the Cosmos Network vividly summarizes this chapter: the first-generation blockchain Bitcoin solves the problem of decentralized pricing , and the second-generation blockchain Ethereum, in the pricing process. Based on the decentralized contract execution , the third-generation blockchain explores the possibility of decentralizing everything on the shoulders of the predecessor giants.

Rainforest

As soon as you enter the currency circle, it is as deep as the sea, and new chains are released every day, which makes people dazzled. This sight of a hundred schools of thought contending is both exciting and disorienting. To paraphrase a jargon in the period of China's hot money boom: standing on the wind, pigs can fly. Warren Buffett: Who is swimming naked when the tide goes out? We can only cross the river by feeling the stones, taking a step by step.

The blockchain technology itself has many technical problems, and there is still a long way to go to realize the various visions of smart contracts. Many blockchains that emerged later are using various methods to reduce energy consumption , increase computing speed , expand scale, and improve batch processing capabilities . I will list a few chains I know and compare their main problems and design ideas.

Scaling Ethereum: Polygon

Since the maturity of Ethereum, the price of ETH has become more and more expensive after a wave of NFT, DeFi, and Game Fi booms, and when the network is congested, the gas fee is also getting higher and higher, ranging from $25 to $70 per transaction. It is of course a small case for large customers, but when the NFT you buy is only about $100, this fuel cost is prohibitive. I first met Polygon when I bought NFTs on Open Sea and they introduced the Polygon network as a payment option.

Polygon is a secondary chain built on Ethereum (Proof of Work) with the Proof of Stake recognition mechanism. Its general principle is to collect multiple transactions on its own chain first, and then send it to Ethereum for verification at one time. Its transaction fee is a tenth of Ethereum’s gas fee plus a negligible amount of its own gas fee. (Read more: Polygon and Matic: What's the difference )

With a faster and cheaper network, Polygon attracts more app developers. The famous decentralized cryptocurrency exchange machine Uniswap is built on the Polygon network.

Note: The native coin on Polygon is called MATIC. We recently tested the Space Game in beta , and the test currency $SPACE used was exchanged with MATIC. So I guess Space Game is also built on the Polygon network? ( @Matty right? Right?)

Ethereum competitor: Solana

In addition to Polygon's idea of building a secondary chain on Ethereum, there is also a new first-level chain such as Solana to compete with Ethereum. When the NFT market on Ethereum was too hot last year, many artist friends turned to the trading market on Solana. Solana uses two recognition mechanisms, Proof of Stake and Proof of History . In terms of computing efficiency, it can reach 50,000 transactions per second (TPS), with an average fuel cost of $0.00025. No comparison no harm: Maximum Ethereum TPS, 15; Highest gas fee per transaction: $70.

Although Solana is full of momentum and has become the fifth largest public chain in a short period of time, Ethereum has the advantage of First Mover after all, and it still firmly occupies the position of the second largest public chain. At the same time, in the face of many competitions, Ethereum has already begun to transform from Proof of Work to Proof of Stake. According to the official broadcast , Ethereum is expected to be fully upgraded to PoS in the second quarter of this year. This upgrade is called The Merge.

Transportation hub, multi-chain ecosystem: Cosmos

Admiring citizens in Matt City should be no strangers to Cosmos😂 The Like Coin chain we are familiar with is a secondary chain built on Cosmos. Although Cosmos and Solana are both newly opened first-level chains outside of Ethereum, Cosmos does not intend to compete with Ethereum. From the beginning of its design, it was intended to be a transportation hub, so that various chains, applications, coins... can communicate with each other without a turnover center . Related to this is the Inter-Blockchain Communication protocol (IBC) it developed, which enables fast and cheap transfers of encrypted assets. ( more introduction )

Osmosis Exchange built on Cosmos, a decentralized exchange similar to Uniswap, adopts the IBC protocol to improve the efficiency of currency exchange. But Osmosis is not just an exchange, it also provides various mining and Stake functions. Regarding this, @Daisy has written a lot about Osmosis .

Private chain: Digital Yuan

All the examples we mentioned above are public chains, which means that anyone can participate in mining, and with a certain amount of savings, they can also participate in the management and voting of the network. This is an ideal that is almost utopian. However, the blockchain can also be used for internal accounting of private enterprises, and many public chains have also launched enterprise applications. Self-built private chain is contrary to the concept of openness and decentralization. There are many problems. For details, please refer to @徐明恩Why do you say that the private chain has no credibility?

If you don't open it, what's the point of the coins generated on your chain?

Hey, don't say it, unless you are a strong country! In this way, you can first make all the above public chains illegal, and then make your private blockchain into the ubiquitous censorship system in 1984. Transaction data and capital flows are all seen by your central bank. Coupled with face recognition, fixed-point tracking, and big data AI, criminals can be locked without knowing it, which is not only very conducive to maintaining financial stability and cracking down on illegal mobs trying to transfer funds overseas, but also the cornerstone of social stability.

book list:

The Infinite Machine: How an Army of Crypto-hackers Is Building the Next Internet with Ethereum

The Ascent of Money: A Financial History of the World

appendix:

Last week @zeckli introduced different Storage Systems , which is quite interesting, but there are too many underlying technologies involved.

When it comes to decentralized storage, it is easy to think of the ancient p2p document download protocol BitTorrent - as long as more computer nodes store a document and upload its metadata to the shared network, then people who want to download the document can Download this document faster and increase network data transfer speed by offloading. The Interstellar Storage IPFS network that appeared a few years ago has developed new technical support for this concept: cut a document into pieces, compile a password table (DHT: Distributed Hash Table), and distribute and store it on different IPFS nodes— - These nodes also include users who are using this document.

The difference between IPFS and Bittorrent is that in the past, we used Bittorrent to download the entire movie file to our own host to watch a movie - that is to say, the file itself exists completely in the BitTorrent network. But in the IPFS network, we can participate in the file distribution while watching the movie on the Internet - the movie file has been cut into small pieces at this time, so we do not need to download the entire video file.

The articles we write on Matters are stored in the IPFS network. With its distributed storage characteristics, it is not easy to lose all data because one server is attacked, so there is a talk about fighting against Chinese censorship.

NFTs derived from blockchain also have some perpetual storage characteristics, so the two are often compared. But they are actually completely different technologies. But they can complement each other: IPFS provides storage, blockchain provides incentives.

I don't know much about this, so just copy @刘国's speech on the Discord of our study meeting:

The core of Arweave is its incentive mechanism, which focuses on "permanent storage"; it also has a set of address data solutions, but IPFS can also be used, so Arweave can be used to pin data on IPFS. Arweave's "permanent storage" has many "unknowns", such as: 1. It first calculates the storage cost of 200 years for you to pay, and then it assumes that the future storage cost is infinitely close to 0, so this is called "permanent" (but Will it actually be stored free in the future?); 2. Recalling data blocks in blockweave is probabilistic, and the white paper believes that the packet loss rate can be reduced to a very low level through algorithms (but how to prove this, or calculate the loss rate in practice? What about the package rate?). The permanent storage here also means expensive storage price (because it has to pay 200 years), but the Arweave Foundation has invested in many projects through AR to let them deposit for users for free; at the same time, there are very few miners in Arweave, in fact All that serve data are Arweave's own servers.

So Arweave is more suitable to compare with Filecoin and Crust Network. The logic of the latter two is simpler, like the airbnb of storage space, and some people have implemented the "permanent" logic with Arweave on it; Arweave is more novel and has more unknowns.

From the user's point of view, developers themselves often choose IPFS, because they can understand its mechanism, it just works; and projects such as nft that require the concept of "permanent storage" often choose Arweave. I personally think that there are many loopholes in Arweave's design; if you want to balance reliability and the sense of security of "permanent storage", a good way is to use Arweave pin IPFS (provided you get money from the Arweave Foundation to help users save for free, otherwise Users will also not pay for themselves)

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!