UST Stablecoin Decoupling: Price Wars, Death Spirals, and Irretrievable Confidence

The price of the currency has fallen recently, and the price of each bitcoin was once below $30,000. This makes many people believe that the bear market in the currency circle has arrived.

The bear market itself is not terrible, what really makes people sleepless is the uncertainty caused by the falling price of the currency. Exchanges, DeFi applications or cryptocurrencies that are widely trusted by people can all change in the blink of an eye. The feeling that nothing is reliable is the scary part of a bear market.

The price decoupling of the US dollar stablecoin UST this week is the most representative example. Many people have purchased UST and deposited Anchor Protocol in order to earn the legendary 20% annual interest rate. However, the price of UST, which was supposed to be pegged at 1:1 with the US dollar, fell to only US$0.2 this week.

Investors earn interest rates but lose principal. This article discusses why the UST price decoupled twice in the past week, what is the death spiral, and why the price stabilization mechanism designed in the first place failed to pull UST back to $1?

price war

Back on May 8th, a user suddenly siphoned $200 million of UST deposits from the Anchor Protocol fund pool, a DeFi application that focuses on a fixed rate of return. Subsequently, these USTs were transferred to the centralized exchange Binance and the decentralized exchange Curve to sell .

$200 million is no small amount for any exchange. Before the market could digest the order, the price of UST was decoupled, and each UST fell to only 0.9857 USDT. No one knows who this user is, nor his motives for selling coins. However, such a large-scale dumping of goods is generally regarded as malicious smashing in the trading market.

It's just that the gold master behind UST is not a fuel-efficient lamp. An hour later, another user (rumored to be market maker Jump Crypto) took out $200 million in USDT at a time and directly bought back the price of UST for $1. The rivalry between the two sides is very strong, deeper than whose pockets are.

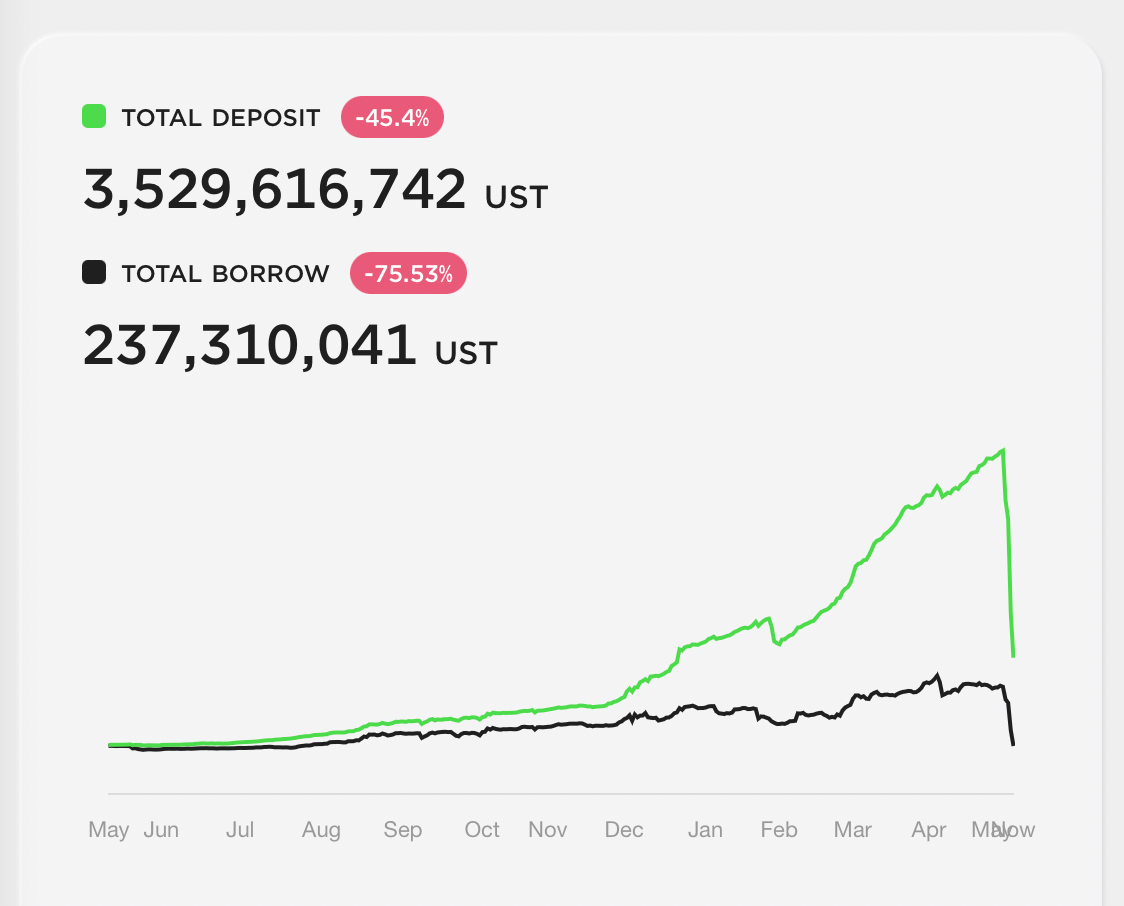

Although the price of UST quickly stabilized at $1, some investors have realized that the UST in their hands may be at risk of decoupling. Funds have started to leave. The total deposit of Anchor Protocol, which has only increased in the past, has shrunk rarely, from the original 14 billion US dollars to only 11 billion US dollars of UST.

People who don't know the situation may also think that these people are so stupid that they don't make a profit with the 18% yield. But sharp-smelling investors may have noticed something was amiss. And most of the $3 billion UST that was taken away will be sold on exchanges.

In the built-in price stabilization mechanism of UST, arbitrage opportunities are created whenever the price fluctuates. In the process of arbitrage, investors will automatically pull the price of UST back to $1. In the vast majority of cases, UST prices are not too far from a dollar.

The Luna Foundation Guard (LFG), an organization dedicated to maintaining the price stability of UST, also allocated $ 750 million in BTC and $750 million in stablecoins, a total of $1.5 billion in funds to maintain the price stability of UST in response to similar incidents. .

In other words, if someone wants to shake the price of UST in the future, but the pocket is not deeper than LFG, I am afraid it will only be like hitting a dog with a meat bun, and there will be no return. So far, most people have no idea where UST prices can fall. After all, UST has two layers of protection, the arbitrage mechanism deals with everyday situations, and LFG deals with emergencies.

But no one expected that the price of UST would be decoupled again in less than a day.

And this time UST went directly from $1 to $0.6, and the LUNA coin originally used as a UST shock absorber also fell from $80 to only $24. Many investors woke up and couldn't believe their eyes. It should be a stable currency with relatively low price risk, but it has fallen by as much as 40%.

This large price drop is unlikely to be the malicious manipulation of a single user, but the panic selling of the market. Even if LFG is rich, it cannot be more than the money in the market. As long as investor confidence collapses, a death spiral in UST could be triggered.

death spiral

To understand the horror of the death spiral, we must start with the price stabilization mechanism of UST.

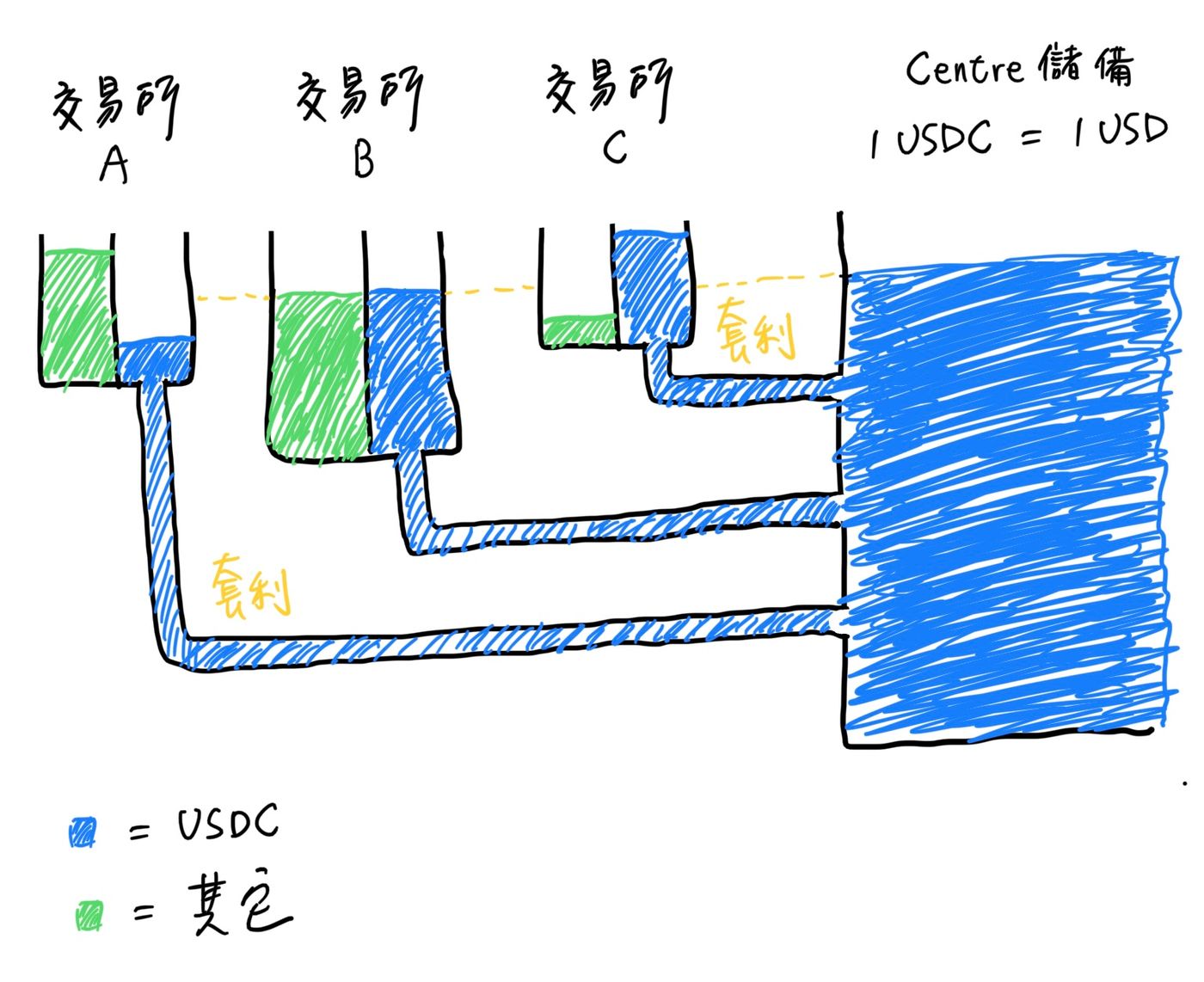

Each USD stablecoin will have its own 1:1 exchange rules. Take the USDC issuer Centre as an example. They promise that as long as you bring 1 USDC over, you can exchange it for 1 USD in cash and leave at any time. Therefore, they will regularly prove that they have sufficient asset reserves through third-party audit reports to demonstrate their credibility.

But most USDC holders don’t actually go to Centre to exchange for USD, but exchange them on exchanges they are familiar with (such as Binance, FTX or Crypto.com). The supply and demand of USDC on different exchanges are different, so the price will not really be exactly equal to 1 USD, but will fluctuate slightly. Whenever the market price of USDC deviates from 1 USD, in the eyes of investors who are familiar with price arbitrage, it is a good opportunity to make money.

If the current market price of USDC is $0.99, the arbitrageur can buy 100 USDC at $99 and exchange it for $100 in cash from the Centre. This is a successful arbitrage of $1. Conversely, if the market price of USDC is $1.01, the arbitrageur will transfer $100 to the Centre to mint 100 USDC and then sell it on the market, which can also arbitrage $1.

Unless the asset reserves of Centre are insufficient, every arbitrage behavior of investors is helping the USDC price stabilize by $1.

The protagonist of this article, UST, has a similar price stabilization mechanism. However, their 1:1 exchange rules are slightly different. They use a smart contract to stipulate that each UST can be exchanged for LUNA coins equivalent to 1 USD, but the exchange amount will vary with the price of LUNA.

LUNA is not a price stablecoin, so arbitrageurs must sell LUNA immediately to ensure successful arbitrage. Otherwise, the arbitrage amount may be eaten (or increased) by LUNA's currency price fluctuations.

The advantage of this design is that UST does not actually rely on legal currency support, and can operate normally as long as it relies on the arbitrage mechanism between LUNA currency and the market. Terraform Labs, the issuance team of UST, is quite proud of this, and said that decentralized stablecoins like DAI still have to rely on USDC support and are not "local" enough.

But the biggest weakness of this mechanism is that LUNA is too closely linked with UST and the currency circle. Assets that are closely linked are not suitable for hedging. The rise and fall of the US dollar price has little correlation with the currency circle, and few people will sell US dollar cash because of the sharp drop in the currency price. But investors saw the market value of UST shrink, and their intuitive reaction was to sell LUNA coins in their hands.

This is because whenever there is an oversupply of UST and the price becomes $0.99, arbitrageurs can buy 100 UST from the trading market for $99 and sell it to the smart contract for LUNA coins equivalent to $100. Now that LUNA prices are expected to fall, investors will of course sell first. This is only the ideal situation.

In the past few days, Binance and FTX exchanges have temporarily stopped accepting people’s transfer of LUNA coins or delayed arrival due to the traffic jam of the Terra blockchain, which is equivalent to interrupting an important arbitrage method for UST. Whether it is the inability to sell LUNA coins through centralized exchanges, or the traffic jam of the Terra chain, it will reduce the efficiency of market operation. This keeps the price of UST falling, and the price of LUNA is not immune.

Even if the exchange is not "closed", arbitrageurs find that the LUNA they exchange for UST is not worth $1 at all, and the next person can exchange the same amount of UST to smart contracts for more LUNA coins. Arbitrageurs might as well sit back and watch. Arbitrage acts like the heartbeat of stablecoins. If no one is willing to arbitrage in the market, UST and LUNA can almost be pronounced to enter a death spiral, and the end point is that the currency price returns to zero.

Terraform Labs is also very aware of this problem, so it chose to start to allocate some LUNA coins to Bitcoin this year, so as to reduce the impact of the death spiral. The correlation between Bitcoin and UST is much weaker, and few people will sell Bitcoin because the price of UST falls. This will stop the death spiral, unless the entire coin circle goes to zero. (Although not impossible?)

It was the right decision to make UST more robust, but the death spiral didn't come so quickly. The Bitcoin reserves held by Terraform Labs are "only" $2.7 billion, but the market value of UST exceeds $10 billion, and the rest is supported by LUNA. Far water cannot save near fire. I have previously used an airbed as an analogy to Terraform Labs' holdings of Bitcoin reserves. It's just that the price of the UST fell first before the air bed could be fully charged.

irreversible confidence

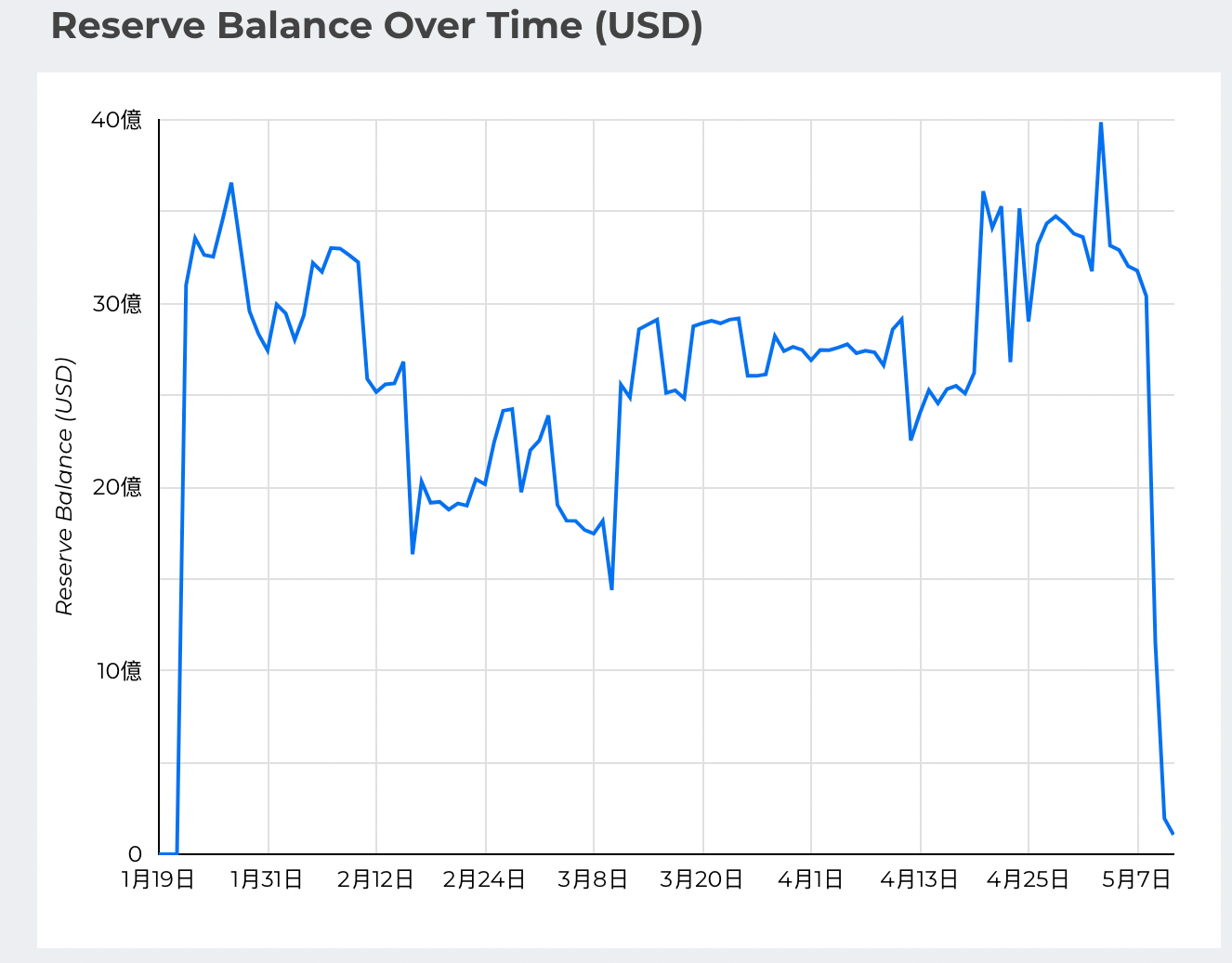

During the time I was writing the article, the price of UST fell from $0.8 all the way to $0.2, and then back to $0.5. It is obvious that there are several forces in the market tugging at each other. LFG simply disclosed the wallet address directly, so that everyone can witness how they tried their best to save the UST price.

From the change of wallet balance in the picture below , it can be seen that LFG's wallet is almost empty now, which can be said to be bankrupt to save the market. It is also widely rumored on the Internet that LFG has continued to raise an additional $1 billion from institutional investors, which it intends to use to boost the UST currency price. This shows their full confidence in UST. Otherwise, these asset reserves should be left for enjoyment, not spent.

It is still difficult to say how the price of the currency will develop in the future. But the dollar stablecoin will only have two stable states in the end, one is to maintain a peg to $1, and the other is to return to zero. In between, it can only be said to be a transition period. Although the UST currency price may still recover, the confidence of investors may be irreversible.

Going back to a week ago, both LUNA and UST were still the top 10 currencies in the world by market capitalization, which is quite beautiful. But no one expected that they are now facing the fate of life and death. UST hovered at $0.5, while LUNA also fell from the original $80 to only $0.6. The feeling that nothing is reliable is the scary part of a bear market. Conversely, exchanges, DeFi apps or cryptocurrencies that survive the bear market are more trustworthy. The test is just beginning.

Block Potential is an independent media that is maintained by readers' paid subscriptions, and the content does not accept factory or commercial distribution. If you think the block potential article is good, please share it. If the bank has spare capacity, it can also support the block potential operation with a regular quota. To view the content of past publications, you can refer to the article list .

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More