Fund, ETF, US stock investment - personal opinion 6/14 - happy

Thai Fund

Oil energy is soaring, continue to wait for a tourism eruption~

Energy and New Energy Fund

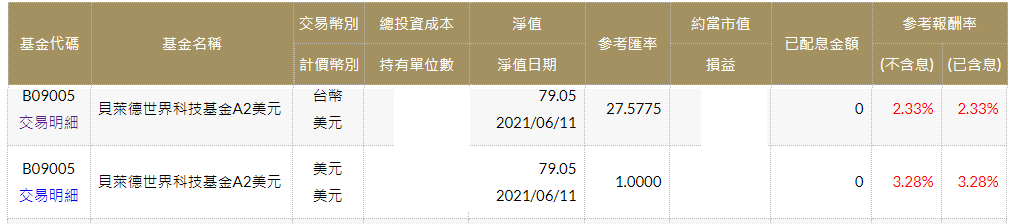

BlackRock Energy Fund was emptied, switched to World Technology, and took over to New Energy Fund, future development trends

Technology Fund

The view remains the same, capital is gradually flowing from cyclical stocks back to technology stocks,

- see more reasons

- Earnings performance in financial reports is dazzling, leading companies with a high proportion of cash carry out treasury, and after the price-earnings ratio is expected to converge, the stock price will rise

- The U.S. economy has entered the early stage of growth. According to the past economic cycle theory, the spinning giant wheel of growth will not reverse instantly.

- The recent high inflation factor has been suppressed, and it is about to enter the plateau period of inflation. The inflation problem will ease in the same period next year. The most serious reason for the correction will be the fuel for the next outbreak of technology stocks.

- Technology is what human beings will continue to pursue in the future, because new things are interesting and everyone wants to have them. This is human nature

- Reason for short correction

- The valuation is too high. It can be solved by lowering the price-earnings ratio after the revenue and profit are raised and the treasury stock strategy is implemented.

- The inflation factor is the cause of the serious short-term impact. The sudden increase in the inflation rate makes the public think that the interest rate will be raised. In fact, the annual inflation rate has soared due to the low base period last year. Changes, in addition, the bond purchase will be reduced before entering the interest rate hike. It is currently estimated that the scale of bond purchase may be reduced in 2021Q4

- The stock price is too high due to psychological factors. The technology stocks that will soar in 2020 may be difficult to see in the future, but in the growth stage, the stock price is still optimistic for a long time, and there is no anchoring psychology.

The reason there will be two is that one was bought in USD denominated in Taiwan dollars, and the other was bought in U.S. dollars and was converted from the BlackRock Latin America Fund.

Latin America Fund

Take profit and switch to BlackRock World Technology, the rate of return is about 5%.

Global Equity Fund

slowly rising

Japan Fund

wait~

Consumer Discretionary Fund

Continue to consume, continue to consume, the more I buy, the happier I am~

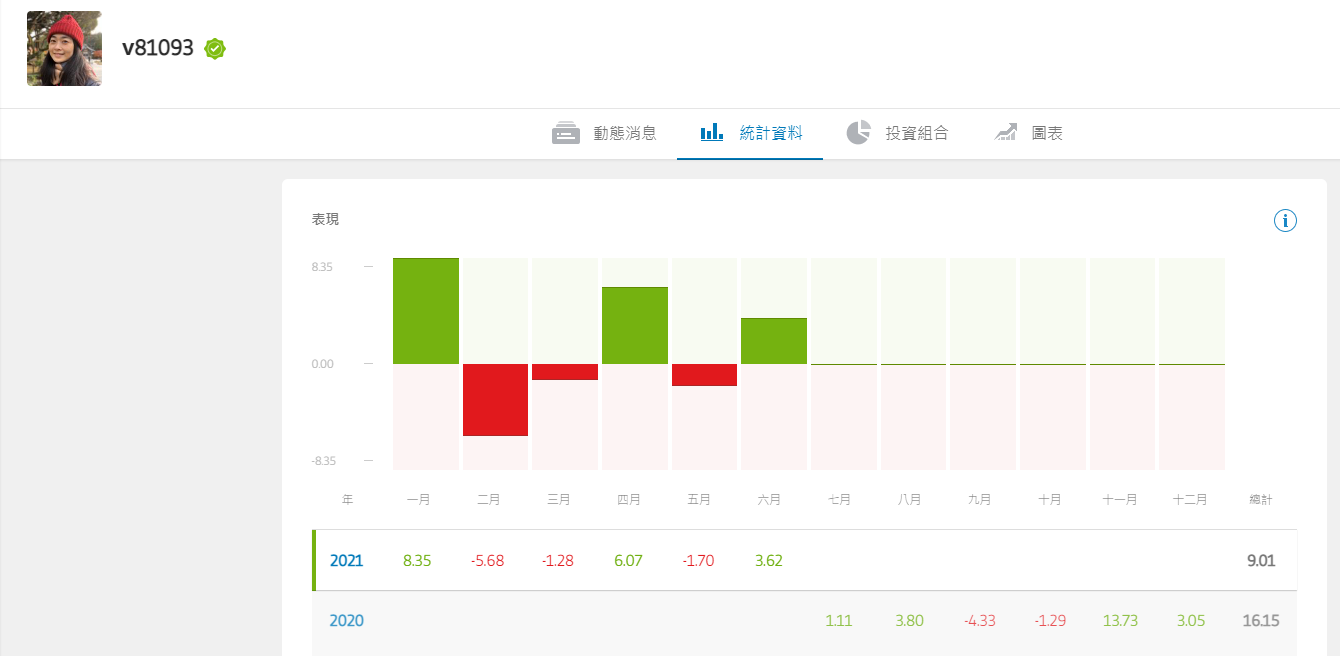

ETORO Investment

- Go to ETORO -> smalljohn90342

- -Go to apply for a free eToro demo account-

In just one month, there are 4 replicators missing. It seems that the wave of technology stocks in May was washed away. Be confident. Unfortunately, these few people have lost about 5% of their remuneration, but if you find them Congrats to the place where the pay is higher~

- Go to ETORO -> V81093

- -Go to apply for a free eToro demo account-

Active stock selection plus cryptocurrencies, it seems that the volatility is really violent. This wave of shocks is twice as bad as passive ETFs. The reason is that the main holding NVDA has been reported for a period of time.

The above is a personal experience sharing, for reference only, not investment advice.

Investment is risky, you should read the prospectus carefully before purchasing.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More