Using "this method" to select stocks, I live in a suite (Part 1)

Author: Happy Fawn 2022.06.24.

From childhood to adulthood, I often heard adults talk about the concept of "stocks give birth to shares, and shares give birth to grandchildren", which made me have a greater attachment to "dividend distribution".

In the past two years, I started to enter the stock market. Occasionally, it is fun to earn dozens of yuan from small purchases and sales. I enjoy the joy of "pick up the phone and press a few buttons to make money". I have never made a big deal, but I have never lost money. I have raised my confidence and my ambition.

Then got stuck.

First time stuck

When I heard about the benefits of "saving stock", I had a huge desire to save stock. Taking this as a starting point, I want to find a website that is easy to understand and allows me to see at a glance "what is the stock price", "when will each stock go ex-dividend", and "how much is the dividend to be distributed", so that I can easily select stocks. , quick deposit.

One day, I was pleasantly surprised to find that there is actually a website doing this: Hi Investment's "Latest Ex-dividend Schedule for Taiwan Stocks" .

At that time, I didn't even understand the yield rate, and my filter criteria were only the following:

- The lower the stock price, the better. (I have seen the results of Tai Jinbao’s 4 yuan per share. It turns out that four yuan can also buy stocks!)

- To allot + dividends, the allotment is the main, and the dividend is the sub. (I always think it is more cost-effective to buy chickens that can lay eggs.)

- The closer the ex-dividend date is, the better. (It's an urge to buy and profit.)

Under these various conditions, I quickly fell in love with the stock of Gongxin (5521).

At that time, Gongxin expected to have an ex-rights dividend on September 7, 2021 in a few days, and the stock price would be around 10 yuan. It was expected to distribute a stock dividend of 1.000 and a cash dividend of 0.130.

At that time, I didn't know how to calculate the allotment. I naively thought that the allotment algorithm was the same as the dividend, and 1.000 represented 1 share for 1 share.

Therefore, according to my "wrong algorithm", with this configuration of Gongxin, I only need to spend more than 10,000 yuan to buy a Gongxin, and in a few days, I can get "a Gongxin" and a dividend of 130 yuan. How beautiful!

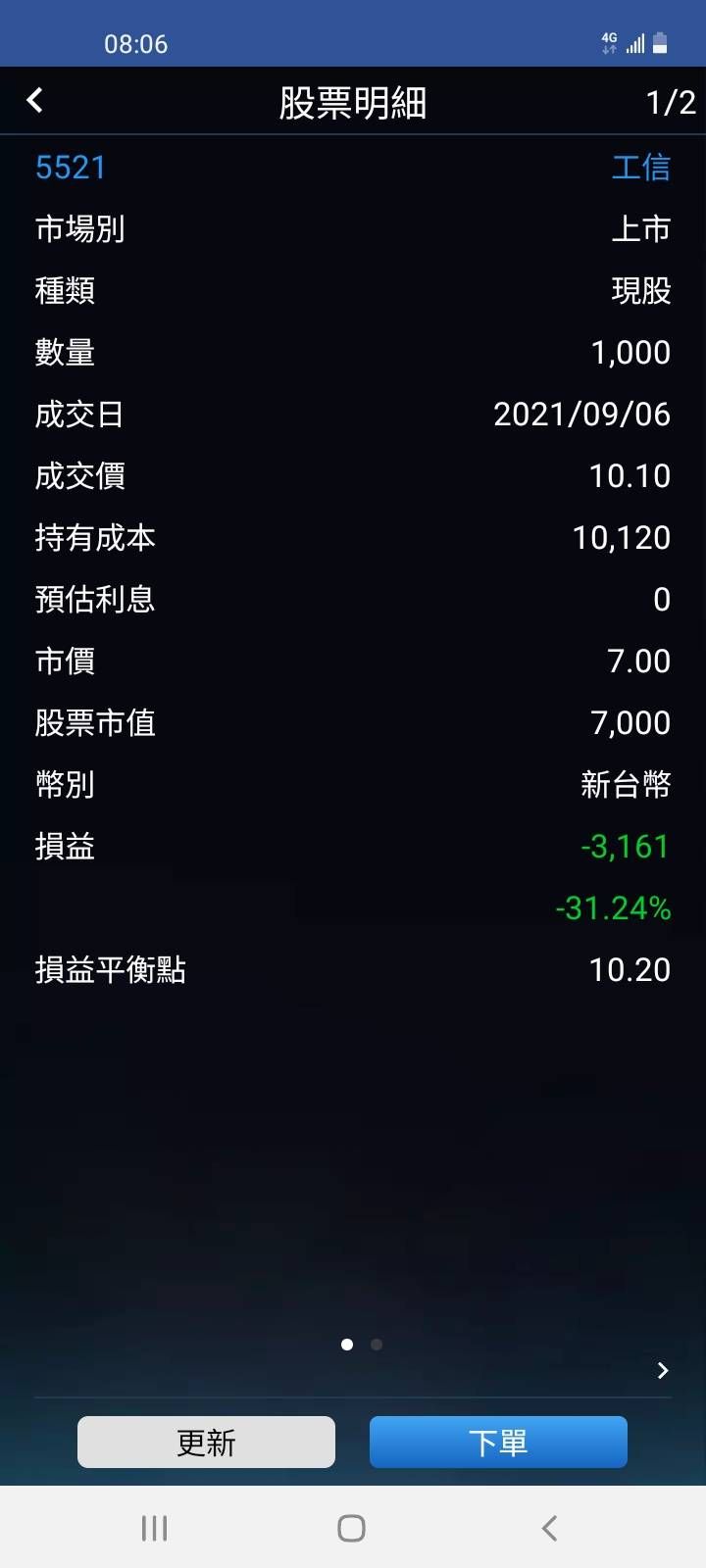

So, on September 6, 2021, I bought a “One Piece of Gongxin” at “10.10 yuan per share”, fantasizing about a bright future, and taking it for granted that “filling in the information can be filled back” is a matter of course.

In the end, during the whole process, I received a dividend of 130 yuan, allocated 100 shares of Industrial Information Technology, and a "Industry Information Stock that has not yet been filled in by June 24, 2022" , and its stock price It is still in decline, closing at 7.13 on June 24, 2022.

Unwilling to make a tragic loss, I can only continue to hold this stock and live in a suite, thinking about when the stock price will come back, I will sell it again, and deceive myself "just treat it as a deposit".

It wasn't until one day that I realized that if you want to go the route of depositing shares, and you don't want to play the rush and chase the price difference, the way to play more steadily and less heavily, is to buy the kind of "stable distribution of dividends every year" and "fill with interest." get back" stock.

However, Gongxin is a stock that does not have a stable dividend allotment every year.

Before the ex-dividend date on September 7, 2021, Gongxin has not distributed dividends or dividends for two years. In the previous two years, although there were distributions, there were only dividends and no distributions. The dividends were 0.2 in 2016, 0.6 in 2017, and 0.13 in 2020. The dividends are very unstable.

If I am stuck today, but the stocks that hold me still have a stable allotment or dividend every year, and the yield rate is high, for example, Fang Tulin (4257) has dividends from 2001 to 2021 (the rights issue is still in the early stage). Yes, none in the past ten years), and looking at the data of the past ten years (2012~2021), the dividend distribution is between 1.34 and 2.2, and the yield rate is almost above 6 points, only one year. It dropped to more than 4 points. It has been as high as 7 o'clock in a year. Even if the stock price falls below the stock price I bought at the beginning and never rises, I can still save it as a stock and receive dividends every year with peace of mind.

Of course, just because this stock has "allocated shares or dividends" every year in the past, it cannot be assumed that it will "definitely" allot shares or dividends in the next year or every year after that. But at least they have a higher chance of still paying out dividends or dividends than those stocks that have “allocated shares or dividends intermittently over the past few years,” or even “haven’t had any allotments or dividends at all.”

And this stable allotment of dividends, to some extent, can also better show the stability of a company, and it will be more reassuring for those who want to develop steadily in the stock market.

If I had done my homework seriously and had seen such concepts shared by others, I would not have lived in a suite until now, and I am even worried that one day the company would go public.

Write down your painful experience, hoping to save some of the tragedies that are about to fall into this wrong stock-picking thinking.

Note: The author is only a novice in the stock market, and has no intention to recommend readers to buy the stocks of any company . I only share the painful experience and reflection of personal buying stocks. If you want to buy the stock of any company, please do a lot of research and understanding of the company and the stock before making a decision, so as not to regret buying it like the author.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More