A "big savings country" has become a "big debtor", with debts exceeding 200 trillion, where has the money gone?

Many people know that Chinese people are famous for "saving money", no matter how hard life is, many people will save some money "just in case". After all, there is a saying in the Chinese folk that "a penny beats a hero", which means that a hero who is heroic and hard-line has no money when he goes out, and he has to make trouble. This shows how important it is to have savings.

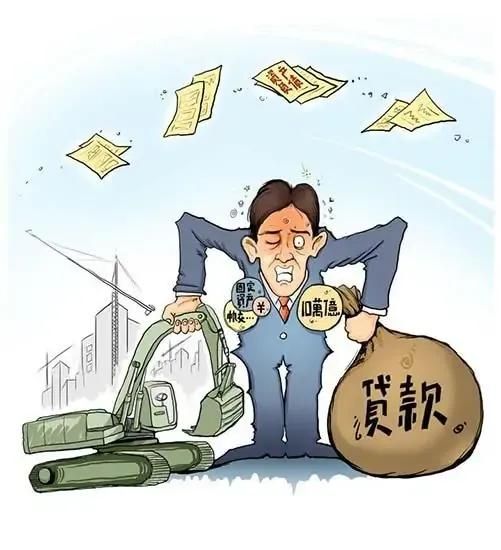

However, as time goes by, many young people no longer save money, and even advocate early consumption. Some of them took heavy mortgages in order to buy a house, but this is understandable. After all, a house is a "necessity" for young people today, and even debt has become an asset, but some of them are affected by credit cards, various The pressure of micro-loans and Alipay are obviously different in nature. Nowadays, many people like to show off their wealth in the circle of friends, but what most people don't know is that behind these shows of wealth is "a lot of debts", and gradually they have become the "borrowers" that people often say, even if they don't have savings. It must be consumed in advance to fulfill their various "desires"!

From 2017 to 2018, in just one year, my country's savings rate dropped by 10.2%, which is quite astonishing. In fact, falling savings rates are not the most serious problem. The rising debt ratio is a practical problem that we urgently need to solve. Up to now, my country's per capita debt has reached 133,400 yuan, and the total debt has exceeded 200 trillion yuan. my country has changed from the previous "national savings" to today's "national debt". ". So, what is the reason for this phenomenon? Where did the people's money go?

real estate

According to relevant statistics, the average age of Chinese people buying houses is 27 years old, while the average age of foreigners buying houses is generally 38 years old. Normally, a person is 38 years old. The career has stabilized, even if the savings are not much, the pressure to buy a house is also very high. However, in China, after 40 years of development, the real estate industry has become a "money swallowing" machine. Many families spend their whole life savings on buying a house.

Today, the average price of housing prices in first-tier cities is around 50,000 yuan, and housing prices in small third- and fourth-tier cities have basically exceeded the 10,000-yuan mark, and housing prices in some small counties have also risen. China's real estate industry seems to have grasped the Chinese people's consumption concept, and they are sure that parents will try their best to buy a house for the sake of their children, and it has become a "trend" to buy a house with loans. It is reported that in 2020, my country's residential housing loans have exceeded 36 trillion, and housing debts account for more than 50% of disposable income, indicating that the repayment pressure of ordinary people is very severe.

price rises due to inflation

In 2019, my country's inflation rate was 2.9%, which is within the normal fluctuation range. However, over the past two decades, our country's economic strength has continued to grow and has experienced several severe inflation. Inflation is the norm in any country. Simply put, there is too much currency in circulation, and the most direct result is rising prices. In the past, a family spent 100 yuan a week, but now there may be no meals. This is the devaluation of the currency caused by inflation.

At this time, maybe everyone will feel that wages are being spent less and less, and you often hear that what others say has been raised, as if wages are not going up. Some households in poor economic conditions are indeed heavily indebted due to rising prices. Most of the price increases start from daily necessities, such as rice, noodles, grain and oil, etc., and then some non-essential items, such as computers and cars. According to foreign media reports, 2021 is likely to usher in global inflation. However, we must maintain some confidence in our country's regulatory capabilities.

Consumption in advance

Nowadays, not only young people, but also many middle-aged people have the idea of consuming in advance. According to a group of statistics, 90% of the post-90s are in debt. The per capita debt is 130,000 yuan, which is 18.5 times the monthly income. According to big data statistics, a large lending institution in the society concluded that the post-90s generation in China accounted for 49.31% of the loan market, most of which were used for daily consumption, housing loans and auto loans. Today, high-end consumption is gradually "younger" and "aged", not just the generation born in the 90s.

Debt is not terrible, as long as you have the ability to make so much money, if you are just vanity, comparison, and use debt to satisfy the so-called face, then one day you will be crushed by debt and ruin your life. If it is not for the so-called "face", debt is not terrible, but people are afraid that once they fall into it, they will not be able to extricate themselves.

The question now is, what harm will it do to society and the economy if the debt ratio is too high (primarily home mortgages)?

Due to the high debt ratio and insufficient willingness of residents to consume in the future, the overall consumption capacity of the country cannot be activated. If the problem of economic structural imbalance is not resolved, economic recovery will be weak, residents' income will be reduced immediately, and consumption capacity will be further suppressed, forming a vicious circle. For residents, debt means their disposable income has also fallen.

With less money on hand, once major consumption expenditures such as unexpected risks or illnesses occur, it will bring a greater burden to the entire family and will not be able to better face the risks. Excessive debt will restrict the national monetary policy. When the debt of the whole society is too high, raising interest rates will increase the burden of household spending. Policymakers need to consider whether high-indebted social groups have the ability to raise interest rates. Loan abandoners increased.

Judging from the current situation, the primary problem that caused the current high housing prices and debt. However, the state is also curbing the rise in house prices, but it is still unknown how house prices can come down. Many people also suggested that housing prices should be reduced to the local monthly salary level to ensure that everyone can afford a house. In addition, it has also been suggested that the upper limit of medical insurance reimbursement should be raised, and different adjustments should be made according to different diseases, which can also reduce the burden on residents. What do you think about this?

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More