Opinion: The best valuation method for public chain tokens should not refer to "company", but to "country" pricing

Written by Tascha Che, founder of mysoundwise.com, PhD in Macroeconomics

Compilation: Perry Wang

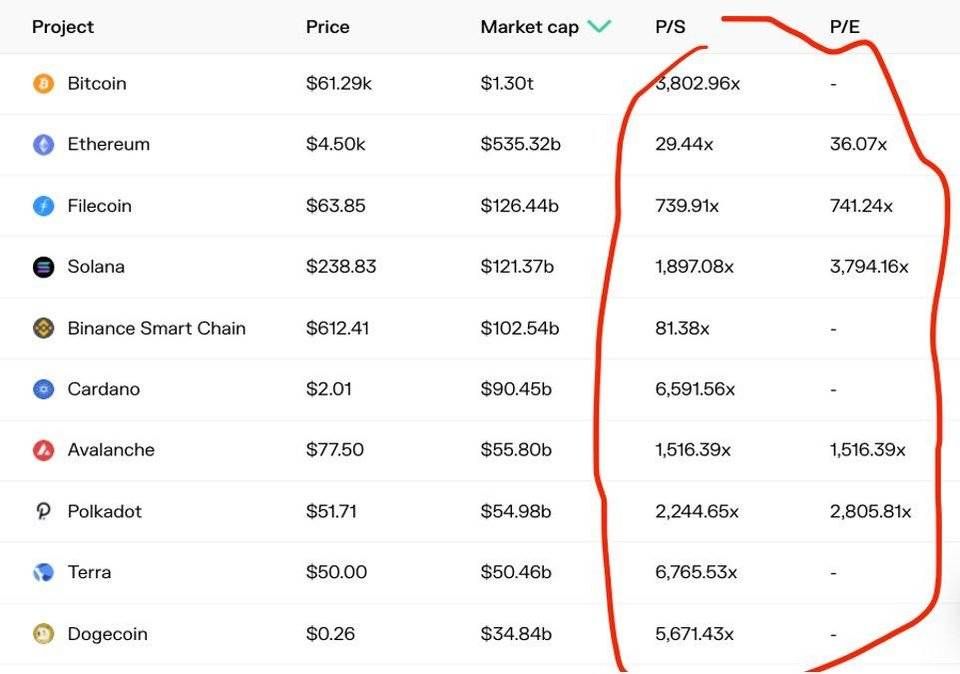

1/ Many people try to value the underlying public chain (L1) token like a stock.

This is ridiculous.

Don't price Ethereum , Solana , etc. like a "company", but price them like a "country".

That's it.

2/ The first wrong way to evaluate L1 tokens: Earnings multiples.

Some people apply the value investment framework of stocks to the blockchain, and propose concepts such as price-earnings ratio and price-sales ratio around ETH, SOL, AVAX, etc.

3/ Unsurprisingly, these ratios look surprisingly high. High enough to give any value investing enthusiast a heart attack.

4/ This is the problem. Earnings are the ultimate goal of company value. But they are not suitable for calculating value on public chains.

5/ If Ethereum halved the average gas fee tomorrow, factors like P/E would double. Does this mean that Ethereum was twice overvalued before? Do not. Instead, it will be a boon for platform growth.

6/ Since the value of the blockchain comes from how much economic activity the token holder supports, no matter what percentage of that activity is pocketed by the platform as "profit".

7/ The absurdity of the valuation ratio becomes apparent if you think of a public chain as a sovereign economic ecosystem akin to a country.

If the U.S. doubled all tax rates, the U.S. government's "price-to-earnings ratio" would halve. But is it good for the US economy? hardly.

8/ Structurally, some countries have a higher share of government activity in the economy than others. Other things being equal, China (with a relatively high share of state-owned assets) would have a lower P/E ratio than the United States (with a relatively low share of state-owned assets). Does this really speak to the economic value of these two economies? Meaningless.

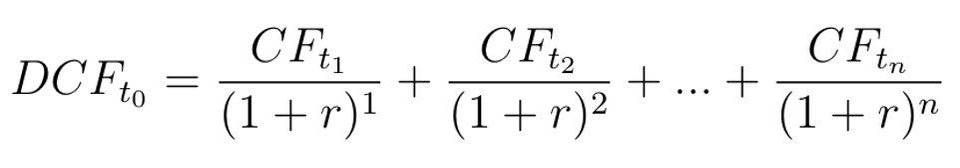

9/ The second wrong way to value L1 tokens: Discounted Cash Flow (DCF). DCF is another commonly used framework for borrowing stock valuations and is actually more absurd.

10/ The DCF model of a stock looks like this:

11/ This is a good approach because the company's future cash flows are in the same currency as its share price, such as the US dollar.

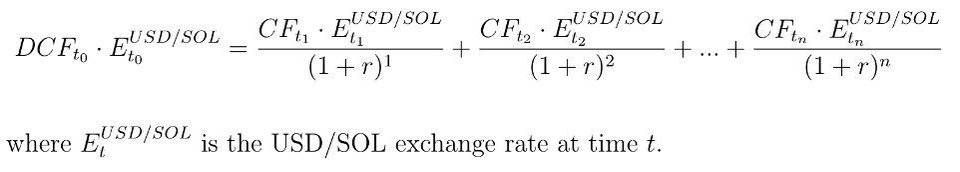

12/ But future cash flows for Solana and Ethereum are in SOL and ETH, not USD. So you need to make assumptions about the exchange rate for each future period to get the DCF in USD.

Solana's DCF model looks like this:

13/ This is completely useless because the USD/SOL exchange rate is calculated first.

The valuation of the L1 token should not adopt a company valuation model, but rather the L1 token should be valued as the currency of the "cryptocurrency nation".

14/ The L1 token is a new type of asset. They are some kind of stock, some kind of bond, some kind of currency. But the bigger the blockchain platform, the more it resembles a sovereign economy whose native token is a true currency.

15/ Therefore, the currency exchange rate model is more useful than the stock dividend model when valuing L1 tokens.

16/ Unfortunately, when you try to estimate the exchange rate, it's like poking a hornet's nest. With a million factors that affect the relative prices of different currencies, and hundreds of frameworks and assumptions, a library could be written full of books for a specific estimation process.

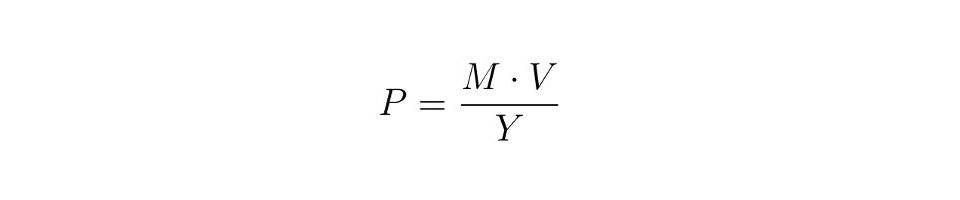

17/ But there is a simple and elegant framework - arguably the closest to "fundamental analysis", a quantitative model of money.

The specific formula is:

Money Supply (M) Velocity of Money (V) = Price (P) Real GDP (Y)

Rearranging the equation, you can express the price level as:

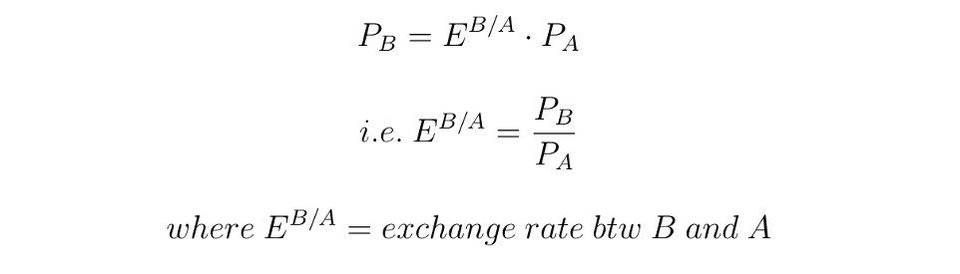

18/ What does this have to do with exchange rates?

A The relationship between the price levels of the currencies of country and country B is:

20/ A simple example: A burger costs 1 EUR in Germany and 1.5 USD in the US, so USD/EUR rate = 1.5.

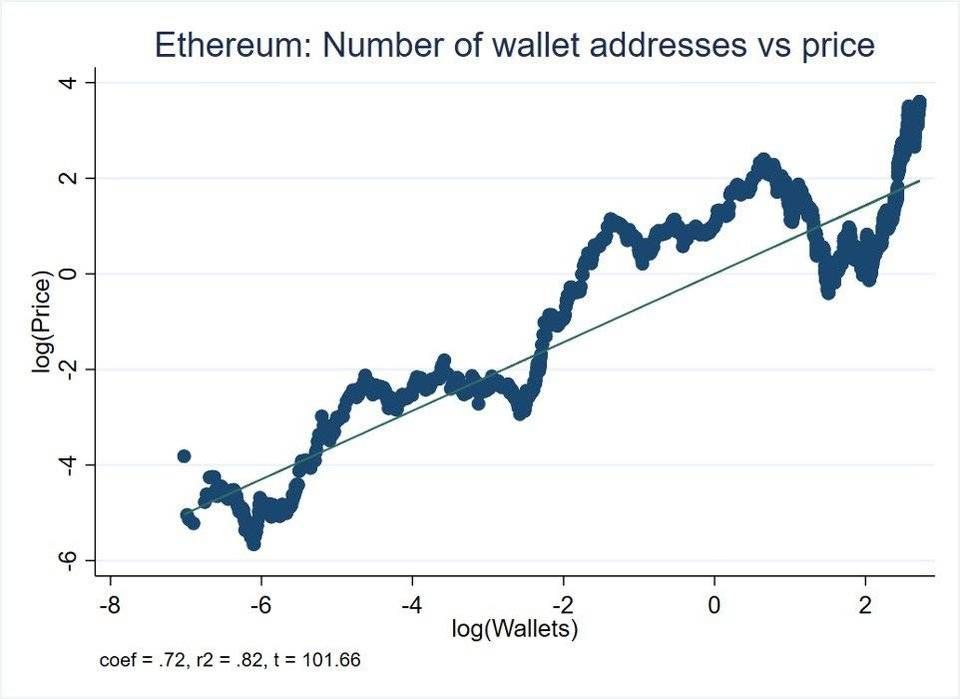

Substituting this equation back into the previous equation for the domestic price level, you get:

21/ If not clear, suppose

Country A = United States

Country B = Ethereum,

you get:

22/ This means that the ETH/USD exchange rate appreciates when:

- Ethereum GDP (Y_ETH) is growing faster than US GDP (Y_US)

- The U.S. money supply (M_US) is growing faster than the Ethereum money supply (M_ETH)

- USD currency velocity (V_US) is growing faster than ETH currency velocity (V_ETH)

23/ If you take this equation at face value, the growth rate of ETH price in USD should have a 1:1 relationship with the growth rate of the US money supply. The Fed’s balance sheet has expanded massively since last year, as evidenced by the changes in the price of ETH.

24/ But that's not the fun part.

Interestingly, the ETH price growth rate and Ethereum GDP growth rate (i.e. the total output of the Ethereum economy) should also have a 1:1 relationship.

25/ Apparently, there is no statistical office there to compile "GDP" for "Ethereum countries". But GDP growth can be inferred indirectly from the growth rate of transactions, wallets, total value locked (TVL), etc.

26/ Almost every transaction involves some additional economic output. The growth of wallets can be thought of as an increase in the "working population" of the country. Growth in TVL reflects growth in the financial sector of the economy.

27/ Of course, these are not perfect measures. But the point is that they are positively correlated with the additional economic output generated on the platform.

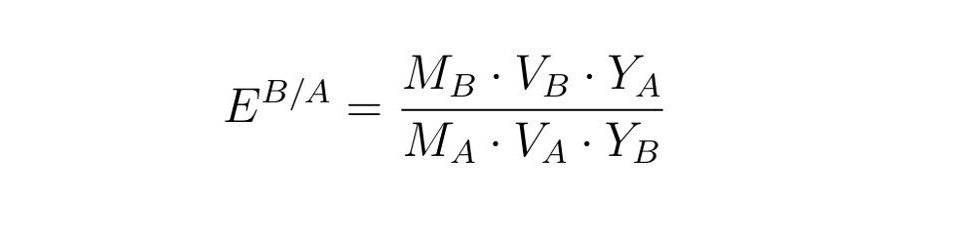

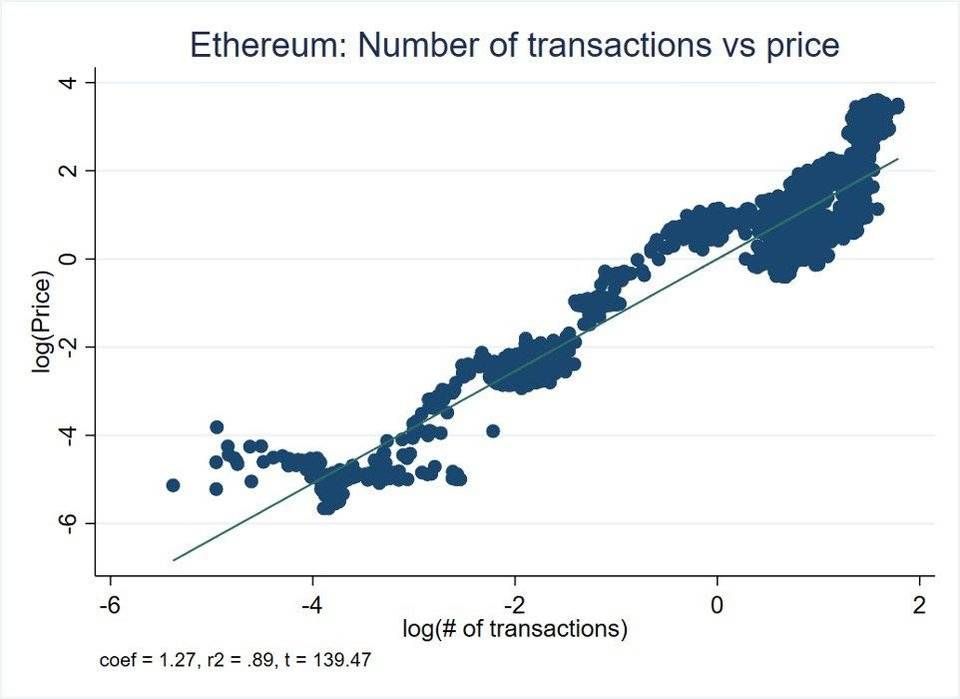

Actual data confirms the relationship between these variables and the Token/USD exchange rate.

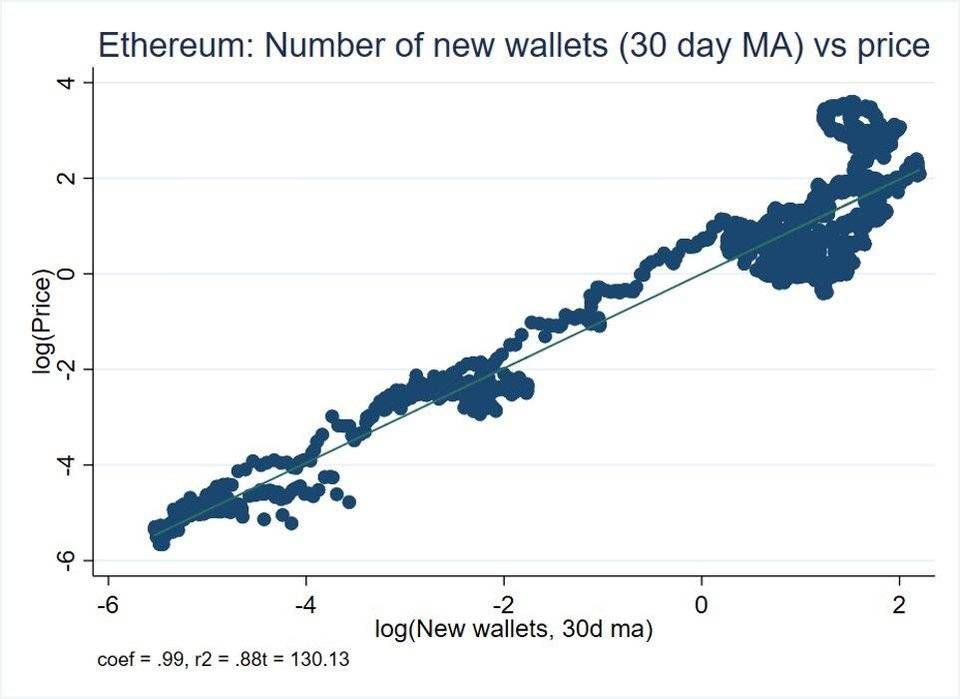

28/ By the way, the growth in transaction volume is nearly linearly correlated with the price growth of Ethereum and ETH: a 10% increase in transaction volume means an average price increase of 13%.

29/ Likewise, a 10% increase in the total number of wallets means an average price increase of 7%.

30/ The following one is even more striking. The acceleration of wallet growth (i.e. the growth rate of new wallets) has an almost 1:1 relationship with ETH price growth.

31/ More than that.

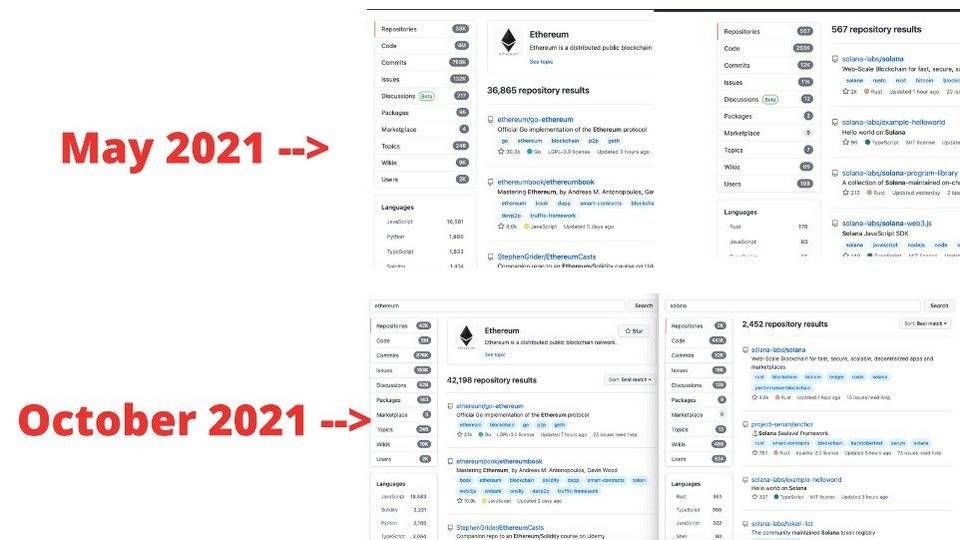

Software development in the virtual world is like construction in the real economy - a leading indicator of GDP growth. Arguably, developer activity on the L1 platform is more indicative of the upcoming economic expansion than transactions or wallets.

32/ Back in May, if you searched Github for "ethereum" and "solana", the former returned 65 times as many repo results as the latter. By October, the multiple had shrunk to 17 times - a positive correlation with the rapid growth of the "Solana Country".

33/ All this is not to say that the platform's own cash flow is not important.

This is important for the stability of the L1 token.

34/ It is no accident that the government becomes the monopoly issuer of money. There are many folk currencies throughout history. But they never lasted long, and were always swept away by government currency.

35/ Among the many problems of private currency, the lack of "fiscal foundation" is the most serious one.

36/ Governments can protect the value of their currency through taxes, the most stable and almost guaranteed income. Even if the fiat currency is "unbacked", the government can raise resources through taxation and use these resources to buy/sell its currency in order to defend its value.

37/ This is a big deal, and it brings confidence to currency holders.

The same can't be said for non-government currencies, well...until now.

38/ With transaction fees programmed into every economic activity on the platform and used for token burns or staking rewards, the currency of the "blockchain nation" is gaining financial support similar to government currency.

39/ As we have already discussed, while these cash flows do not determine the token price, they help keep the exchange rate stable in the long run.

40/ But the most important thing for the token price is still the GDP growth of the cryptocurrency "country". Since the Metaverse is only in its primitive stage, the story is just beginning.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!