Personal research analysis of GMX.io project

After a few days of laziness, I still can't get enough energy to write this article. I just want to sleep when I see the things to do in the dolist, but I think it's time to force myself to do things, otherwise I may live forever Can't finish writing. This article will basically be written based on the information in the reference materials, most of which are regurgitated content. If you write a horizontal comparison and competitor analysis, the scope is too large and the space will be more than doubled, so the existing information is simply written first. All right

GMX is a decentralized spot and futures exchange on the chain. You don't need to do KYC, you only need to hold a wallet connection to conduct transactions. It may be a good choice for Americans who have privacy needs and do not want KYC. On the two chains of AVAX and arbitrum, (because I am too lazy to cut wallets, the following information is mainly based on AVAX) to conduct spot or futures transactions on them, and the maximum leverage can be opened to 30X, which can make everyone accelerate suicide, which is different from DYDX. The reason is that DYDX exists in the form of an on-chain pending order book, while GMX exists in the form of AMM.

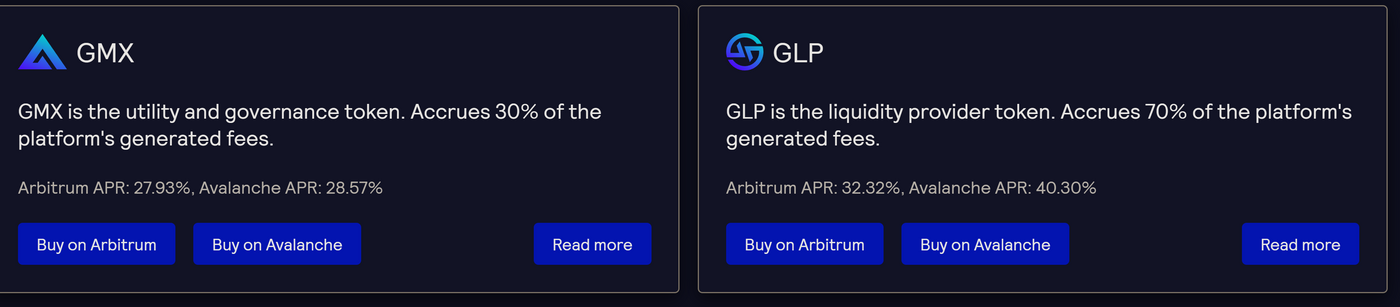

When analyzing GMX, it is necessary to mention its dual-token type GMX and GLP. GMX is simply a mining coin that can be voted and self-reproduced, and can share 30% of the transaction fees earned by the platform.

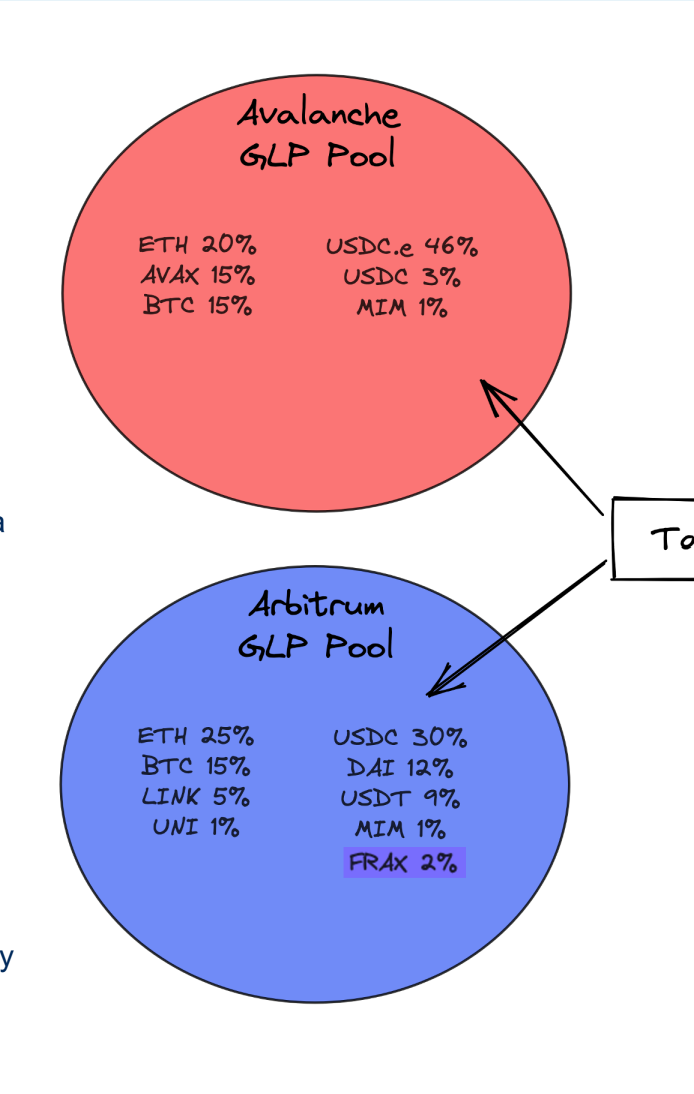

The interesting thing about GLP is that it is an LP TOKEN, which can share the fees earned by the 70ba platform. What is the composition? From the figure below, we can see that the composition of GLP on the two chains is different, basically a basket of currencies with different weights.

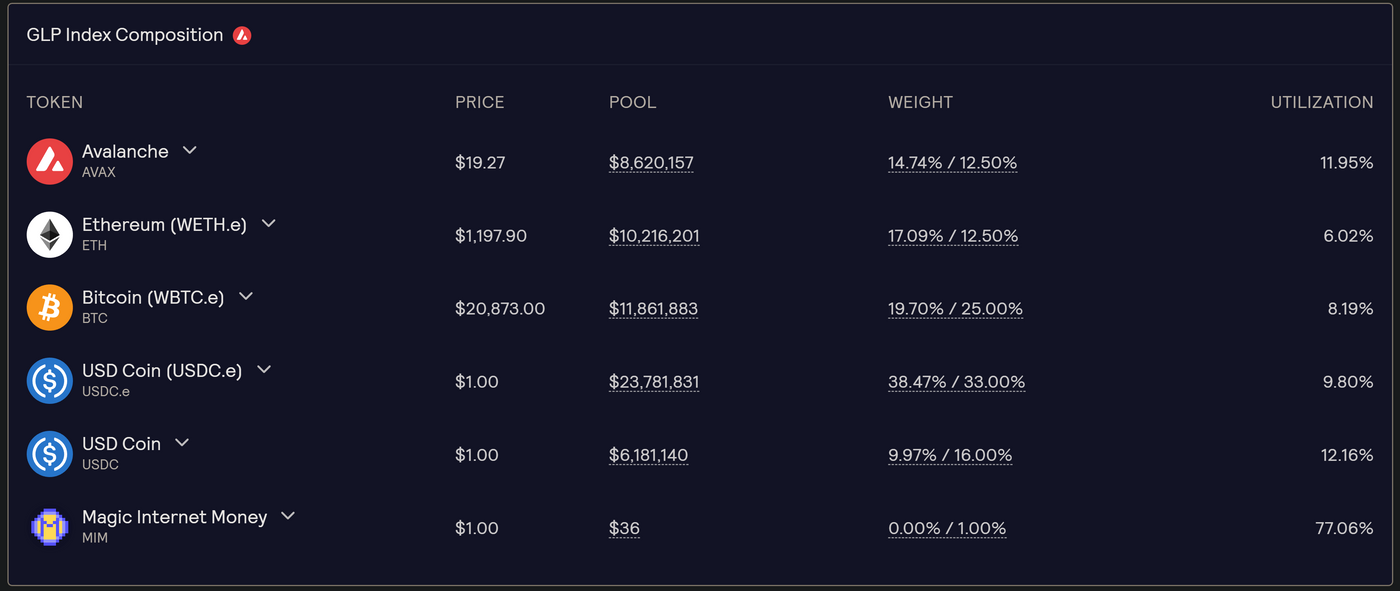

And we can look at the composition of the next screenshot of my GMX official website. First of all, we can see that the weight is different from the above picture. That is because the official can manually adjust the weight, which sounds very similar to ETF. Buy a basket of assets The proportion of asset weight is adjusted by the index or according to the strategy. According to the official GMX document, the weight will be changed due to the trader’s transaction behavior of GLP issuance and redemption. The left side of the weight is the current weight, and the right side is the target weight. You can see two There are differences between the indicators, and the target weight is set by the official, but they did not explain how this indicator is set, so I temporarily understand that they can set it subjectively. Therefore, GLP tokens can be regarded as a hybrid variant of balancer and ETF. If you want to buy a basket of assets, you can consider it, but don't rush in because of the 40% APR unless there is asset hedging.

Brief comment: The GMX project is basically based on the LEGO innovation of the previous DEFI project. It is not a flying auto-circulation model with left and right feet like the OHM system, and its sustainability will be better. Because of the relationship between the multi-currency model The depth is very good. The large-value exchange paths of transaction optimizers such as PARASWAP and 1INCH often pass through GMX, so the transaction fee is stably received. However, is there a majority or a minority of people who have privacy needs? TG's whale alerts all see that the coins are put into Binance or Luye, because the form of the pending order book can reduce the spread of a large number of transactions, and directly use the SWAP on the chain. Most likely there is a tendency to plate (or move bricks). The trading volume of the contract is also relatively bleak, and the number of tradable assets is too small, only BTC, ETH, AVAX, although I see her good potential in UI design. In addition, there is a large amount of USDC.E in GLP tokens. If the AVAX bridge is in an accident, it will probably be completely split, which is also a risk that cannot be ignored. From what I can see, the GMX team is relatively stable, but it is hard to say whether it can make a way in this market in the future. At present, I will not use this product form as a user. As an investor, if you want to buy this token, please be careful. consider. (If you buy GLP and then empty a basket of currencies, you can effectively reduce the risk) Insurace has insurance to buy.

The length of writing here is much shorter than I expected. It is not that I have completely analyzed the project. After all, there are still many things to write about, such as how GMX realizes the mechanism of futures trading on the chain, but the more I write, the less investment motivation I have. , this project is currently in the middle of stitching monsters and innovation. If it is a bull market, I might drop some bos and take a look. After all, the overall situation is not bad. If it is a bear market, I will wash and sleep first, and lie down until dawn.

Citation source: TAIKI video https://youtu.be/_J1FwwKk3HA

A 55-page analysis report written by someone else: GMX Research Report by Riley.pdf - Google Drive (https://bit.ly/3Nr9Y9s)

Project side files: https://gmxio.gitbook.io/gmx/

The bear market group is recruiting: https://t.me/wiwi995

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More