「投資」是透過認知所做出的行為決策,通過對事物深入了解,才能掌握正確的抉擇方向。

What can we learn from the "Luna Incident"⁉️ Information on the Great Crash of the Century in the Currency Circle

▎Learn more about ZZW ➭ https://linktr.ee/zzw.cryptalk

"A Simple Understanding of Terra Ecology"

Terra is one of the hottest public chain projects in the past year. It was founded by Do Kwon and Daniel Shin in Terraform Labs in South Korea in 2018.

The on-chain ecosystem adopts a "dual-token mechanism", one is the "native token Luna" that plays the roles of governance, transaction fees, and pledge verification, and the other is used to balance supply and demand, and is linked to the fiat currencies of various countries. "Algorithmic stablecoin", among which "UST", which occupies the largest market and is the key to anchoring the US dollar, is also the third largest stablecoin in the currency circle.

"What is an algorithmic stablecoin?"

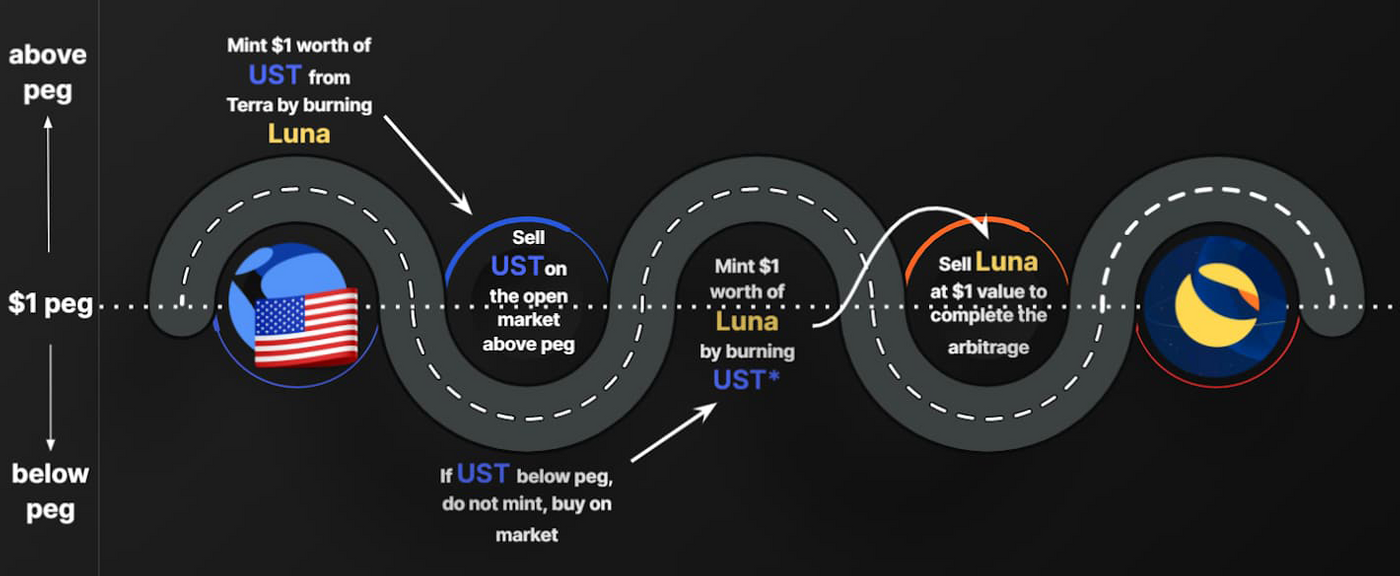

Speaking of Terra, the biggest feature of this project is the operation mode of its dual-token system, which is different from the well-known guaranteed reserve model of stable coins such as USDT, USDC, BUSD, etc. It is not in cash, commercial paper or equivalents, etc. Assets serve as the proof and support of their value, but ensure the stability of the currency price through the destruction and minting of Luna and UST.

Simply put, when UST "buys too many people" and its price is higher than $1, Luna holders can "exchange to UST to sell", earning the middle price difference, and at the same time increasing the circulation of UST in the market On the other hand, when the price of UST is lower than 1 USD due to "too few people buying", arbitrage traders can buy UST with a value of less than 1 USD and exchange it for UST with a value of 1 USD to sell it. ’, to get the spread reward.

Taking Coke and Sprite as an example from the actual figures, when UST (Coke) rises to $1.01, investors can use $1 to buy Luna (Sprite) and then sell it for UST (Coke) for $1.01, earning the middle. The difference of $0.01; when UST (Coke) falls to $0.99, investors can use $100 to buy 101 UST (Coke) and exchange it for Luna (Sprite), and then sell it back to $101 to earn the middle $1. Profit margins.

Although it may feel quite lenient, but in short, think of it as "two children playing on a seesaw", the whole process is to try to maintain balance, as long as one side "tilts", the other side can "eat candy" ”, through such an incentive model to maintain the stable state of UST and the growth of the value of the Luna ecosystem as much as possible, as long as the seesaw is not broken, two children can continue to have candy to eat.

But here comes the problem! The premise just mentioned above is that the seesaw is intact, but if there are several fat brothers riding on both sides at the same time, it will eventually break due to the unbearable weight.

"The Beginning of the Crash"

▪️ On May 8, 2022, 84 million UST was temporarily withdrawn from the liquidity pool. Maybe it was intentional or not. In short, the departure of the big players suddenly shattered the unprepared UST.

▪️ Investors began to buy a lot of UST and exchanged them for LUNA to cash out. However, the plan still could not keep up with the changes. Under the double pressure of the Fed's interest rate hike and the exchange of UST, the price of LUNA also began to plummet.

▪️ Everyone understands that "consensus" is the key factor for the success or failure of the project. At this time when "the market sentiment is in a downturn", the project party has begun to declare that "it is "rescue ”, is “holding up” not to let it fall”, which happens to convey a negative confidence that the project itself is no longer healthy.

▪️ In the face of the tragic situation of de-anchoring, although Terra is backed by the Singapore non-profit organization LFG (Luna Foundation Guard), it has about $3.5 billion worth of Bitcoin foreign exchange reserves and is the world's top ten Bitcoin holders. However, The average cost of holding a position is too high to cut the meat, but the tray needs financial assistance, so LFG had to mortgage BTC to the market maker to exchange fiat currency to support the price of UST.

▪️ Due to the low performance of the overall market, the situation has continued to deteriorate. The continuous decline of BTC has made the situation of LFG more dangerous. If UST continues to deteriorate, the mortgaged BTC will also have the risk of liquidation. Therefore, the market will soon see that LFG will take all the remaining BTC. The transfer of the fund address, however, further turbulent investors' confidence in the Terra project itself, and accelerated the selling pressure on both Luna and UST.

▪️ As we have seen in the end, in addition to easily wasting the silver bullet to save the market, under the lack of consensus and the collapse of traders, both Luna and UST as a stable currency can almost be said to be worthless. During the process, it plummeted by more than 98% within 24 hours, and nearly $30 billion was wiped out in just one week.

"What can we learn from this?"

Let's not dwell on whether the little fat brother mentioned in the second paragraph did it on purpose? Or just go with the flow? It can be seen that in the cryptocurrency market with "no" melt-off mechanism and price limit, there is an obvious truth that "the market often does not send money in the snow, but falls into the trap."

Why is the importance of "trend" often mentioned, because it can make us more effortless to reach the desired destination, which is the saying "even a pig can fly on the tuyere", it is not difficult to see many in the present In this incident, the "short sellers", "bottom hunters" and "watchers" who became rich, fell or stared blankly, and then review the reflection and observation of the three.

▪️ Short sellers – The biggest winners in this wave of slumps are undoubtedly the ones who seized the opportunity. However, you can still see many people sharing the experience of shorting and losing money. Why? Not because of missing the trend, but because of "misestimated risk", the leverage ratio is too large! Although the process is obviously a crazy downward trend, it does not mean that it will only go down. Some people often like to open a leverage of 50 times and 100 times, which means that as long as the rebound fluctuation exceeds 1% or 2%, it will be burst...

▪️ Dippers – still follow the 82 rule, some people have indeed made a lot of profits because of their successful dips. However, most people should be confused in this wave of dips. The biggest reason is the "misjudgment situation", Trying to go against the trend, because no one could have imagined that the former king could fall from the altar in such a short period of time, or simply want to bet on a big wave...

▪️ Watchers – These people have neither earned nor lost in this battle. At most, they may be affected by the prices of other holding currencies. They may be regarded as wise, or they may be missed opportunities. In any case, everyone Their thinking points are different. It can only be said that although they are watching tigers fight across the mountain, they are also a group of people who have witnessed history and learned a lesson from it.

"Ideal is full, the reality is very skinny"

Many mechanisms, modes, strategies, and attempts can run very smoothly in good times, so people often accidentally ignore the risks they are taking. When the sea recedes, we know who is not wearing pants, and this time it is A very realistic scene. The starting point of the project is not necessarily bad, but it is certain that there must be relatively serious problems that remain unsolved, including crisis management methods, favorable timing and location, and on-chain ecological projects such as Anchor's incentive model factors, etc. , this crash event will also occur, and it is called an accident when it is unexpected. All we can do is to take a warning and evaluate the "potential risks" and "strategies" more prudently in the next investment, transaction and operation. Misunderstandings,” “Risk-to-Reward Ratio” and “Self-tolerance”, start by not losing money.

Finally, could Luna come back to life? Most of the comments that can be heard have a slim chance, but I think no one will know the real answer, so I don't make more guesses, and let everyone make their own judgments!

▎ ZZW common exchanges

Binance ➭ The world's largest cryptocurrency exchange (spot, futures, grid):

https://accounts.binance.me/zh-TW/register?ref=O9MGXDHQ

BingX ➭ The world's top ten derivatives exchanges (spot, contracts):

https://bingx.com/invite/XHNE0MXV

Pionex ➭ The world's largest quantitative exchange (grid trading):

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…