Позже...

CEX or DEX: which is right for you?

Hi all! Let's look at the two types of cryptocurrency exchanges with an open mind, I'll just talk about some of their features, and it's up to you to decide which one to choose.

When it comes to buying and selling digital currencies, which is better? Centralized exchange or its computer copy, decentralized exchange?

If you are a hardened crypto, you might think that decentralization is a "panacea" for all ailments. You may even start to choke when someone whispers the words CEX in your ear. Uhhh...hot??? Come on, we're not talking about that now!

But let's not jump to conclusions here. Instead, let's put on our space helmets and take a closer look, shall we?!

CEX vs DEX: how do they work?

Centralized exchanges operate like traditional order book based funds. It is an open market with a central authority that matches buyers and sellers. On the CEX, it is standard for all users to be able to see the full order book (i.e., all buy and sell orders that appear on the exchange). These two features facilitate what is known as "price detection" where any user can determine the "last price made" or "market price" as well as the depth of the order book. In exchange for simplifying the work on the market, the exchange takes a small percentage of each transaction.

Centralized crypto exchanges like Binance or Huobi also use the order book and retain many of the features offered by traditional CEXs.

What is a decentralized exchange, let's see!

Because it doesn't have a central authority to track the order book and match them, DEX had to develop a different approach to make it easier to discover prices. This was made possible thanks to a new innovative mechanism, commonly known today as the AMM model or automated market maker. Uniswap was the first DEX to use this model.

AMM DEXs are powered by an underlying pool of liquidity available for each trading pair. For example, POOL #1 ATOM-OSMO on DEX OSMOSIS will have an underlying liquidity pool with ATOM and OSMO tokens. The total number of tokens in the liquidity pool represents, as the name suggests, the total amount of liquidity for a trading pair, similar to how you look at order book depth on CEX.

But how are prices determined? Well, it's pretty simple, actually. The current market price of a trading pair is the ratio between the number of tokens in its liquidity pool. For example, if the current market price of ATOM is $30 and OSMO is $10, then the current ATOM:OSMO ratio in the ATOM-OSMO liquidity pool should be 1:3 (i.e., there should be 3 OSMOs for every 1 ATOM).

Here's the math, folks!

Main differences between CEX and DEX.

Exchange functions

CEX has a long history that boasts many innovative features over the years. For example, they offer a range of order types for different types of traders, from the simplest market and limit orders to the more complex ones.

A good CEX is also capable of providing deep liquidity through collaboration with market makers and is typically designed to support very high throughput (i.e. transactions per second).

Most DEXs currently only support instant swaps, but decentralized exchanges are also starting to include order books to provide the best financial solutions of both worlds!

Trading volumes

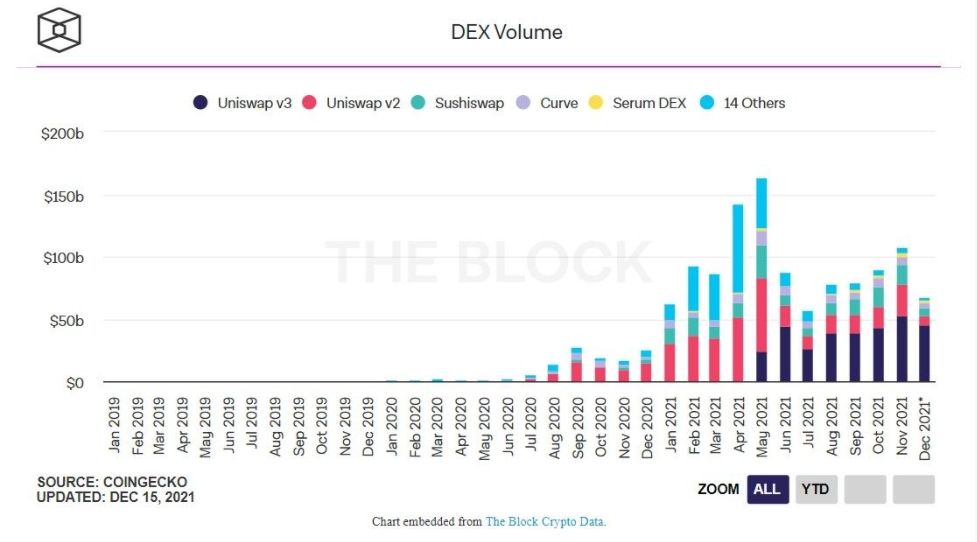

Trading volume is an important indicator of financial activity on the platform. Not to mention, tracking trading volume helps measure the wider adoption of DeFi.

No matter how impressive the data looks, but the main burden falls on one exchange. Uniswap has only been around for a few years longer than its other brethren, and yet it's largely because of it that DEXs are eating up their market share.

Here I can’t help but mention DEXs on the Cosmos blockchain, such as Osmosis, Junoswap, Sifchaine, which quickly broke into the race for liquidity and have already taken their niche here, and their native tokens are successfully entering the top 100 in trading.

Transaction fees

The transaction fee of a DEX depends on the chain it is on. For example, Uniswap running on Ethereum can cost you $60 depending on network load, and traffic on Ethereum remains the highest so far. Since Ethereum operates on an auction model, users must bid on their transactions in order to gain access to the next block. This is why a high workload leads to increasingly costly bidding wars, hence high commissions.

Compare this to Cosmos, which charges pennies for every transaction. Or how about Osmosis? So far, the commission on this DEX when choosing an average processing speed is zero and a convenient user interface is offered as a bonus!

By the way, this is where DEXs have a clear advantage over CEXs. CEXs collect trading fees, while DEXs seek to minimize economic rents.

passive income

Besides trading, many well-known CEXs have tried to offer more products and offerings in response to increased competition not only from other CEXs but also from DEXs. For example, many exchanges now offer some form of margin trading. CEXs are also starting to offer "Earn" products where investors can temporarily lock up their cryptocurrency with CEX in exchange for a fixed income. Finally, some CEXs have also created "Launchpad" offerings to help new projects launch their own tokens directly on their exchanges.

We have already established that liquidity pools are critical to DEX AMMs, so it is not surprising that DEXs are willing to reward liquidity providers generously (sometimes up to two to three digit APYs) for providing liquidity in their trading pairs. If you have an extra cryptocurrency, consider providing liquidity to the DEX trading pair. By locking tokens in a smart contract representing a pool of liquidity, you will be rewarded with a percentage of the transaction fee.

But don't forget about the risks in liquidity pools!

While providing liquidity may seem like a good deal, as a general rule, the better the deal, the higher the risk. And in this case, the main risk associated with these excellent returns is Impermanent loss, literally an irretrievable loss. This is when the liquidity you provided has less exit value. You see, AMMs rely on a mathematical formula to ensure they always have liquidity for a pair of tokens. This formula is expressed as x * y = k, where x and y represent separate paired tokens. To ensure that k remains a fixed constant, when someone buys quantity x, its price increases accordingly, thus keeping the cost of k fixed.

Let's look at an example:

Let's say we have a LUNA-UST pair with $1,000 in LUNA and the equivalent amount in UST (i.e. your UST, a stablecoin, is also worth $1,000). But what if, the price of LUNA doubles to $2,000.

In this case, you will have a lot more UST and a lot less LUNA than you put in at the beginning because k is the same value.

If you were to simply hold your LUNA and UST without providing any liquidity, you would have $3,000, so you would have received an additional $1,000.

Of course, you can try to wait until the price falls before exiting the position. If you don't, your fickle loss will become permanent, it happens...

Not your keys, not your coins

One thing to consider when using DEX versus CEX is how convenient it is to leave your crypto assets on the exchange. You see, when you lock your crypto assets on the CEX, they are essentially locked in a hot wallet owned by the exchange. In other words, you can no longer manage your assets and are NOT the owner of this wallet!!!

We can compare this to the DEX, where all you have to do is connect your crypto wallet to interact with the protocol. In other words, the funds are at your complete disposal.

But let's add "a fly in the ointment in a barrel of honey." Hacks, bugs in smart contracts!

Very fast: can CEX be hacked? Of course. The same can be said about DEX. After all, smart contracts are not immune to errors. At the very least, CEXs can provide some form of insurance, which is usually quite vague and often well-veiled in service contracts.

But in fairness, some DEX protocols returned funds to their users after the "fatal hack", not all...

Outcome:

Centralization gives us many great benefits such as speed and convenience, but there is one major benefit that decentralized crypto exchanges provide! They do not require any security measures. In particular, there are no "Know Your Customer" or know your customer procedures. So don't hold onto your passport and today's date like it's in some hostage video. What are we doing instead? Just connect your wallet containing digital assets and go to the first million!

The future will look like individual empowerment. DEX is just one type of DeFi protocol that gives you the ability to squeeze more juice and profit. Other DeFi tools that we haven't even thought of yet will allow us to do even more. The crypto space will form a financial center where all characters from all walks of life will become crypto enthusiasts to make our world a better place!

.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…