心流浪在法爾斯、黎凡特與尼羅河三角洲之間。人目前躲在台北小公寓裡。work in web3。

Mutiny in Russia, all air tickets in Moscow sold out, can cryptocurrency become a small wallet for fleeing?

This article is from the "Tianfang Chain Talk" e-newsletter. It talks about the business, application and development of Web3 in a vivid way. Welcome to subscribe.

The most dramatic day of the Russo-Ukrainian war occurred last weekend. The Wagner Mercenary Corps, which assisted Russia in its invasion of Ukraine, announced on June 23 local time that it would turn around and attack Moscow. The reason may be that it was attacked by Russian troops from behind. Wagner demanded the replacement of the Minister of Defense and Chief of Staff of the Russian Army, and then in just 12 hours, he went all the way from southern Russia to Moscow less than 200 kilometers away, as if a Moscow siege was on the line.

The head of the mercenary group, Prigozhin, who is also Putin's personal chef, called it not a "coup" but a "march for justice". However, just as they were about to enter Moscow, Prigozhin announced that he would accept the mediation of Belarusian President Lukashenko, and the mercenary group immediately "turned back" and returned to the Ukrainian front. This "coup" suddenly ended.

During these dramatic 24 hours, it was reported that all air tickets were sold out at Moscow Airport.

It is conceivable that some Russians worried that the situation might get out of hand, so they hurriedly bought air tickets to escape. (Although judging from many live videos, there is no mass panic at all)

This begs the question, could cryptocurrencies be an asset transfer tool for Russians fleeing abroad?

Such a topic actually arose when Putin announced the "partial military mobilization of the whole people" in 2022. At that time, many young Russians fled overseas, fearing that they would be drafted to the front line. At this point in less than a year, we will see again whether this is feasible.

The intuitive answer is: yes on a small scale, hard on a large scale. Why, let's dig deeper.

feasibility

For readers who are not familiar with cryptocurrencies, let’s briefly talk about what it means to use cryptocurrencies to transfer assets overseas. To put it simply, it is to turn the "legal currency" such as the New Taiwan dollar and ruble in your hand into a cryptocurrency. As long as a decentralized wallet is opened for cryptocurrency, it can be operated anywhere. After the conversion, it goes overseas and finds someone to exchange it into the local currency, which is considered a process of asset transfer. The advantage of this method is that if your country is sanctioned, your bank may not be able to transfer money overseas, but the cryptocurrency may still be taken away, and if it is stored in a decentralized wallet, the government cannot freeze your assets. .

Theoretically, for ordinary users, this process is like this, where the first step and the third step involve centralized services, which represent two key points for the smooth completion of this process:

Buy cryptocurrencies with rubles on Russian exchanges

Transfer to a decentralized wallet (this step can be skipped, this step is to worry about getting stuck in the first two steps)

After landing overseas, find someone who is willing to exchange the local currency, and then exchange the cryptocurrency in the wallet

The Russians are indeed facing such a situation.

After Putin invaded Ukraine, Western countries imposed economic sanctions on Russia one after another. European countries even cut off the connection of seven Russian banks with the SWIFT international financial telecommunications system in May 2022, which means that the services of these banks cannot be exported overseas. Use, especially transfers and credit cards.

Bringing money abroad has to find another way, cash is one way, so is it feasible to switch to cryptocurrency? The Russians also face two challenges, the first being mobility. In the process of buying coins on exchanges, there may be quota restrictions (for example, Maicoin in Taiwan is about 2 million a day, 10 million Taiwan dollars a month), and local local exchanges may not have enough cryptocurrencies to provide a large number of large-scale exchanges. Depositing with a credit card is limited by the credit card limit.

What is more difficult is the sanctions. The EU's financial sanctions have also been extended to the encryption field. The EU first restricted encrypted payments between Russia and the EU to within 10,000 euros in February 2022, and later tightened it in October of the same year, completely prohibiting any transactions between institutions in the EU and wallets in Russia. Several exchanges stopped serving Russian users, but several international exchanges continued to provide services. This means that the channels for Russians to buy cryptocurrencies are beginning to be limited, and people in the European Union may have to seek illegal channels to exchange local currencies.

However, this does not affect the cash-out of existing encrypted assets by the rich, and they can naturally find special services. A cryptocurrency company in Dubai admitted to helping Russian customers cash out billions of dollars in encrypted assets to real estate. And these are not displayed on the data.

In addition to the fact that some exchanges have stopped serving Russian users due to sanctions, the wallet addresses of some suspicious users have also been marked as prohibited from trading with them. The US exchange Coinbase has marked 25,000 addresses. Although the government cannot freeze the assets in these wallets (probably most decentralized wallets), they can limit the ease with which they can move assets through tokens.

Is there really a lot of transactions

So did ordinary Russian users buy cryptocurrencies in large quantities?

Judging from the key time points in the past year, in February 2022, when Russia officially invaded Ukraine, the data shows that the number of bitcoins purchased with rubles has surged by 260% within a month, but considering the sharp depreciation of the ruble and the global Bitcoin transaction volume, these rising numbers cannot have any significant impact on the price of Bitcoin. The number of bitcoin wallets in Russia has not increased significantly, and the average transaction volume per bitcoin is only $580, compared with more than $2,100 in the United States.

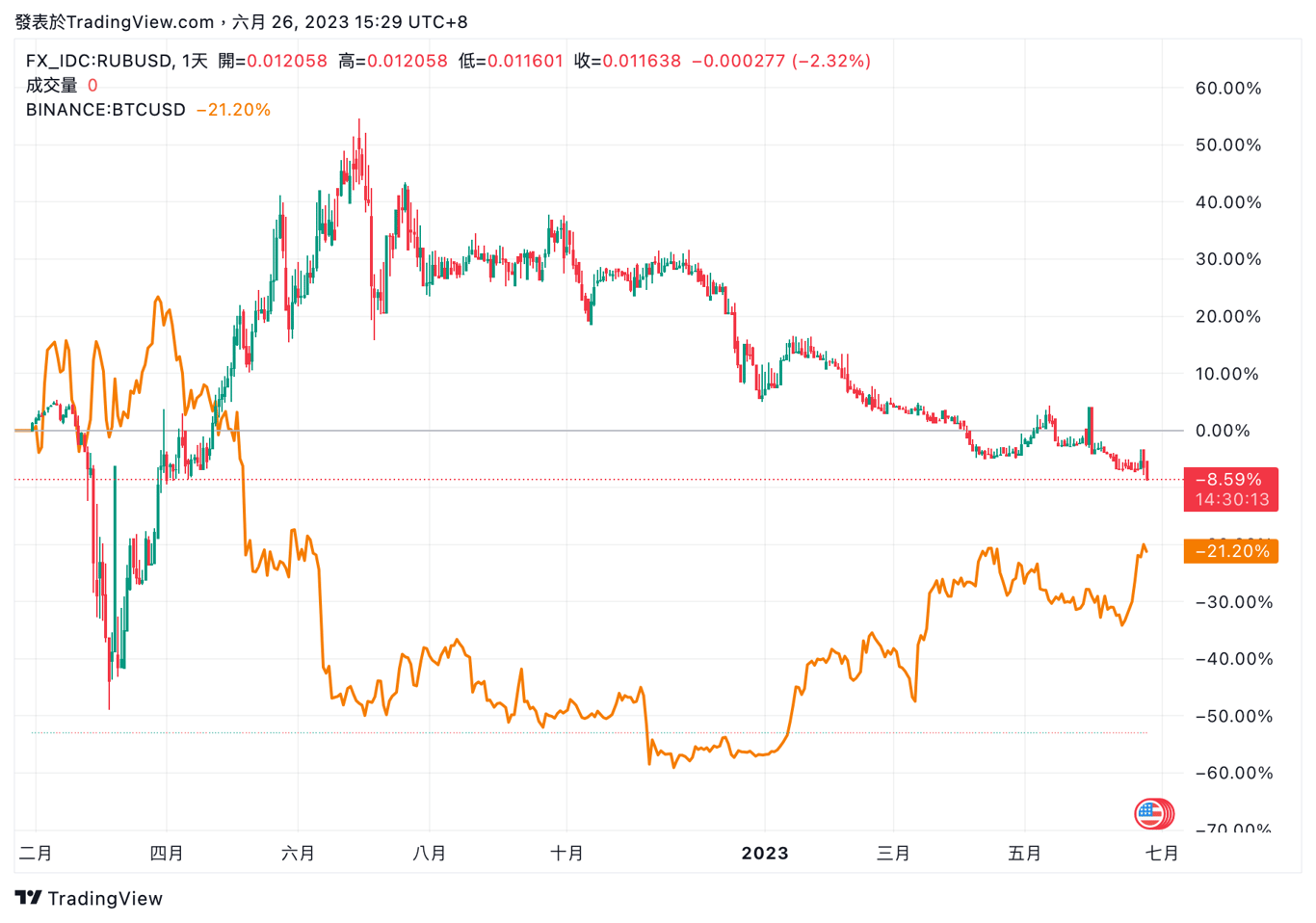

Looking at the price of Bitcoin and the fluctuation of the ruble exchange rate against the U.S. dollar in the past year, it can also be found that there is no obvious relationship between the two (the chart below is only for reference to the trend of the ruble and Bitcoin against the U.S. dollar).

Chainalysis, a well-known on-chain data analysis company, released a report in February 2023, showing that when Putin announced military mobilization in September 2022, the trading volume of Russia's overall encryption market surged to more than $100 million a day, but soon after Back to about $75 million.

There is an interesting data that shows that the total flow of the three major assets in the overall encryption market (Bitcoin, Ethereum, and USDT) is 300 billion U.S. dollars globally, but the assets owned by Russian oligarchs exceed 800 billion U.S. dollars, which is not enough for Russian oligarchs to transfer assets. In the case of Bitcoin, the daily transaction volume is only 0.65% of that of SWIFT. It is undoubtedly unsupportable to use Bitcoin to transfer a huge amount of assets. Moreover, the Bitcoin network is a public ledger, and large transfers are easy to attract attention.

This is not surprising, even after the war broke out, Ukraine received a large amount of cryptocurrency donations (the author also donated), only more than 60 million U.S. dollars, while the United States alone donated 3.9 billion U.S. dollars in humanitarian aid, and military support reached 46 billion U.S. dollars. Cryptocurrencies look a bit odd in comparison.

But this is not to say that cryptocurrency donations are not important to Ukraine. The Ukrainian government still used the money to buy a lot of supplies. (For the role of cryptocurrencies in the Ukrainian war, please refer to the previous article )

Therefore, if Russians want to flee overseas, it is still possible to convert tens of thousands of dollars of change into tens of thousands of dollars in cryptocurrency. If they sell their houses and exchange them for cryptocurrency to take away, they will undoubtedly encounter difficulties. A few people may find special channels, but it is impossible to achieve it on a large scale. Even so, cryptocurrencies have indeed become a conduit for money transfers.

escape hot spot

This brings to the third question. If there are Russians who exchanged their rubles for cryptocurrencies and fled abroad, where did they go, and are those countries convenient to use cryptocurrencies?

According to a Reuters survey, the top countries include Turkey, Georgia, and Kazakhstan, which are all around Russia, and visa-free or low-threshold. In addition to these three, Israel, Azerbaijan, Dubai, Serbia, Kyrgyzstan, Thailand, Vietnam, etc. are also popular locations.

As far as the top three countries are concerned, both Turkey and Kazakhstan are cryptocurrency hotspots.

Cryptocurrency is quite popular in Turkey, mainly because Turkey has experienced a sharp depreciation of the lira in the past two years, and cryptocurrency has become a means of "anti-inflation" for many Turks. In the Chainalyis 2022 global cryptocurrency acceptance ranking, Turkey ranks 12th (Russia 9th). Although the Turkish government prohibits cryptocurrency from being used for daily purchases, it is still very popular. For example, Turkey is a cryptocurrency payment provider in Singapore, Function X One of the largest markets.

Likewise, Kazakhstan is experiencing an influx of Russians, many of whom arrive with cryptocurrencies. After Putin announced the conscription, Kazakhstan was rumored to be considering legalizing cryptocurrencies (although this has not happened a year later).

Even though Kazakhstan has yet to legalize cryptocurrencies, Kazakhstan is also a bitcoin mining powerhouse, mainly thanks to cheap electricity. According to statistics , around the middle of 2021, Kazakhstan will rank second in the world in mining Bitcoin hash power (a measure of how much computing power is used to mine Bitcoin). mine. I personally met a Kazakh in Vietnam. He said that he owned a mining machine room in Kazakhstan, but the government has banned it. I don’t know if the mine he owns is legal.

The irony is that these mines went north to Russia instead, and Russia became the second largest mining country in the world for the first time this year, second only to the United States.

Although mining is banned in Kazakhstan, the Kazakh government welcomes cryptocurrency exchanges with open arms. For example, Binance will obtain a license to operate legally in 2022. It means that when Russians began to flee to Kazakhstan, Kazakhstan was going through the process of changing from a mining power to a cryptocurrency innovation base. In this way, it may be much easier for Russians to exchange their cryptocurrency for local legal currency.

In addition to these two countries, I heard that there are many Russians in Vietnam and Thailand in Southeast Asia. It is very convenient for Russians to enter these two countries. Thailand has legal exchanges, and Vietnamese cryptocurrency is also very popular. There are a large number of small businesses that provide peer-to-peer transactions. Merchants exchange currency and cryptocurrencies back and forth. We will not discuss these two countries. If you are interested, you can read the previous two articles ( Thailand and Vietnam ).

in conclusion

For the conclusion, please refer to the "Tianfang Chain Talk" website to read the original text.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…