在紐約的金融業工程師,分享我的美股財報筆記 Blog: YC's Weekly Journal ( https://ycjhuo.gitlab.io/ )

Announced the fourth quarter and full year 2020 financial report, how did Tencent, which was sold by major shareholders, perform?

Chinese social giant Tencent (Tencent, US stock code: TCEHY) was sold by its major shareholder Naspers last Thursday (04/08), causing Tencent to plummet 9.65% at the opening of the day.

Does this mean that Tencent is going downhill? In the past year, Tencent's performance was slightly behind the Nasdaq index.

Let's take a look at Tencent's 2020 Q4 and full-year financial reports released on 03/24 to decide whether Tencent is still a good investment target

Tencent (TCEHY) Q4 quarterly and full-year earnings

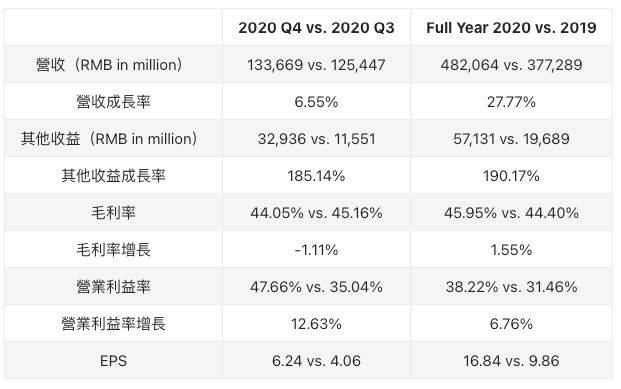

- In terms of revenue, compared with Q3, Q4 revenue increased by 6.55%, annual revenue increased by 27.8%, and gross profit margin did not change much; all were around 44-45%

- Operating profit margin: Benefiting from the impact of other gains, Q4's operating profit margin (47.66%) is even higher than Q4's gross margin (44.05%)

- EPS: It is also because of other income, which increased by 13.41% and 70.9% respectively compared with Q3 and 2019

It can be seen that the biggest growth in this financial report is undoubtedly other gains:

- Compared with Q3, Q4 increased by 185.14%; in the 2020 annual financial report, it also increased by 190.17% compared with 2019

- And other income is about 25% of total revenue and 56% of gross profit in Q4; in the 2020 annual financial report, it is about 12% of revenue and 26% of gross profit

However, because other income is not a project that can continue to grow, there is no guarantee that such high other income can be maintained in the future.

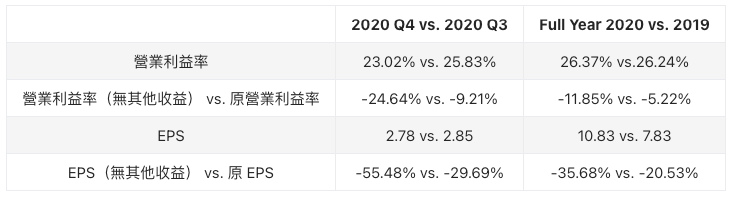

So what happens to the values if we remove the other benefits?

Financial indicators (net of other income)

The following table directly treats other income as 0. Without considering the tax rate, the after-tax net profit (Profit for the period) is directly subtracted from other income, and the new EPS is obtained.

It can be seen that the operating profit ratio has decreased by 5% - 24.64%, and the EPS has also decreased by 20% - 55% after excluding other income.

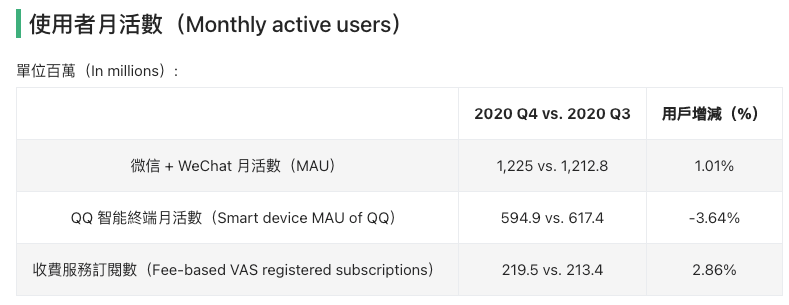

Monthly active users

In terms of monthly active users: the current population of China is about 1.4 billion, while the number of WeChat users has reached 1.225 billion (although it includes WeChat, the overseas version of WeChat)

However, if the users of WeChat are also regarded as part of the Chinese population (Chinese living or studying), the penetration rate of WeChat reaches 87.5% of the Chinese population

The global social leader Facebook has 2.8 billion monthly active users, and Facebook Family (Facebook + Instagram + What's App) has 3.3 billion monthly active users

postscript

As a leader in China's social and gaming industry, Tencent can still maintain its own gross profit margin despite revenue growth

This shows that Tencent has a dominant position in the market and does not need to increase revenue by reducing gross profit margins

In the case of excluding other income, the operating profit rate can also be maintained at about 25% (adding other income, it can be about 35%)

Facebook's operating profit rate is 37%, but because Facebook's business is relatively concentrated, and it does not have as much reinvestment as Tencent

Tencent still has growth momentum in the industry, and there are also many successful cases in terms of reinvestment (so if other income is directly excluded, it is actually a bit harsh to Tencent)

At present, Tencent's more noteworthy investments are:

- 17% stake in Pinduoduo (PDD)

- Holds about 10% of Didi Chuxing (expected to IPO in the United States in July)

- Grab (the Southeast Asian version of Uber), is expected to IPO in the United States in April; Didi Chuxing is its top three shareholders, while Tencent holds a stake in Didi

At present, Tencent's price-earnings ratio is 32.96, which is not too expensive (during the 2020/03 epidemic, the price-earnings ratio was 31.81)

The current price-earnings ratio of Facebook is 30.96, showing that investors have higher expectations for Tencent (another Chinese giant Alibaba BABA currently has a price-earnings ratio of 26.34).

To sum up, when Tencent's stock price is currently sluggish, it is actually a good opportunity to enter Tencent

However, because TCEHY is Tencent's ADR in the US market, ADR management fee is automatically charged by the brokerage every year.

ADR management fee will be charged at each dividend (Qualified Dividend), approximately 12% of the dividend

The following table is the record I have been charged for holding Tencent for about four years:

source:

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…