记录一些东西。

0.01 yuan to buy bitcoin! EOS becomes a paradise for small bitcoin purchases! How to make dolls without loss?

I am the first saint, please give me more advice.

The epidemic has subsided, pay attention to protection!

in yesterday's article.

Many people don't actually understand.

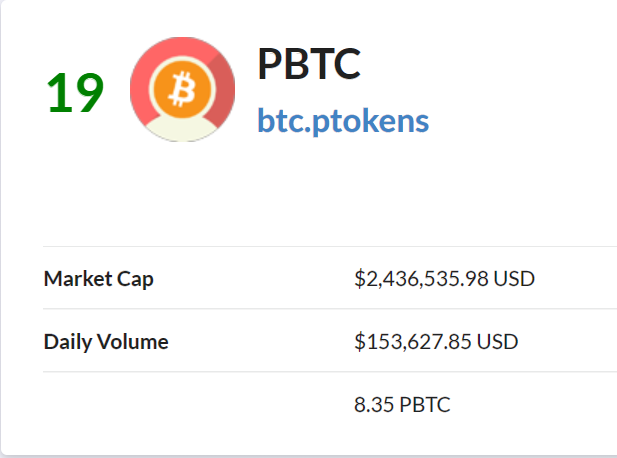

What is pbtc?

How to buy pbtc?

First introduce pbtc

It is a bitcoin mapping on ethereum and eos.

Every pbtc has a btc as a security mortgage.

Here we mainly introduce the PBTC on the eos chain.

The issued contract address is:

btc.ptokens

Be sure to check this address. All other addresses issue fake coins.

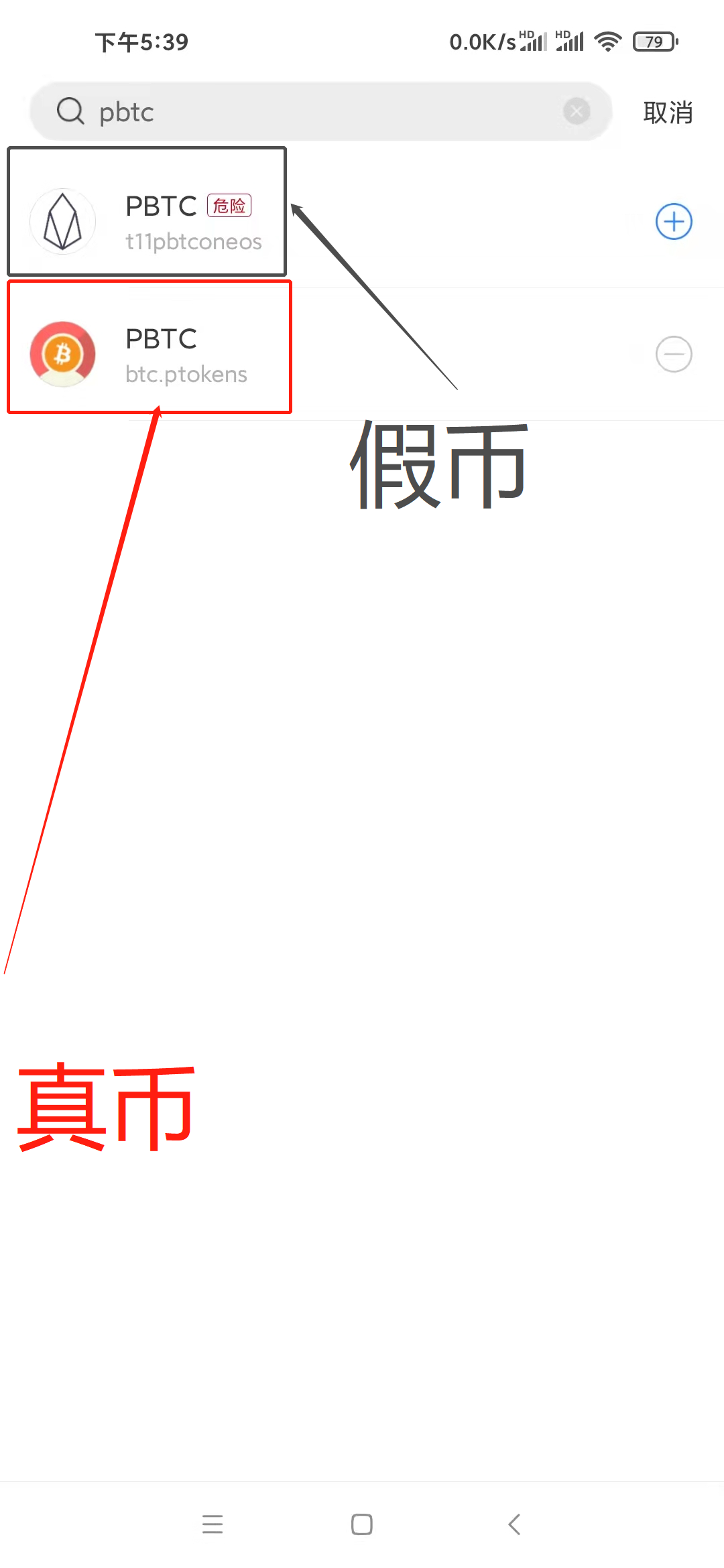

We can test it with mykey (or any other EOS wallet).

Let's try it with TP wallet.

The same can be searched for two results.

We still have to pay attention to the issued contract address.

If the contract address matches, it is the real currency.

Otherwise, other names with the same name are false.

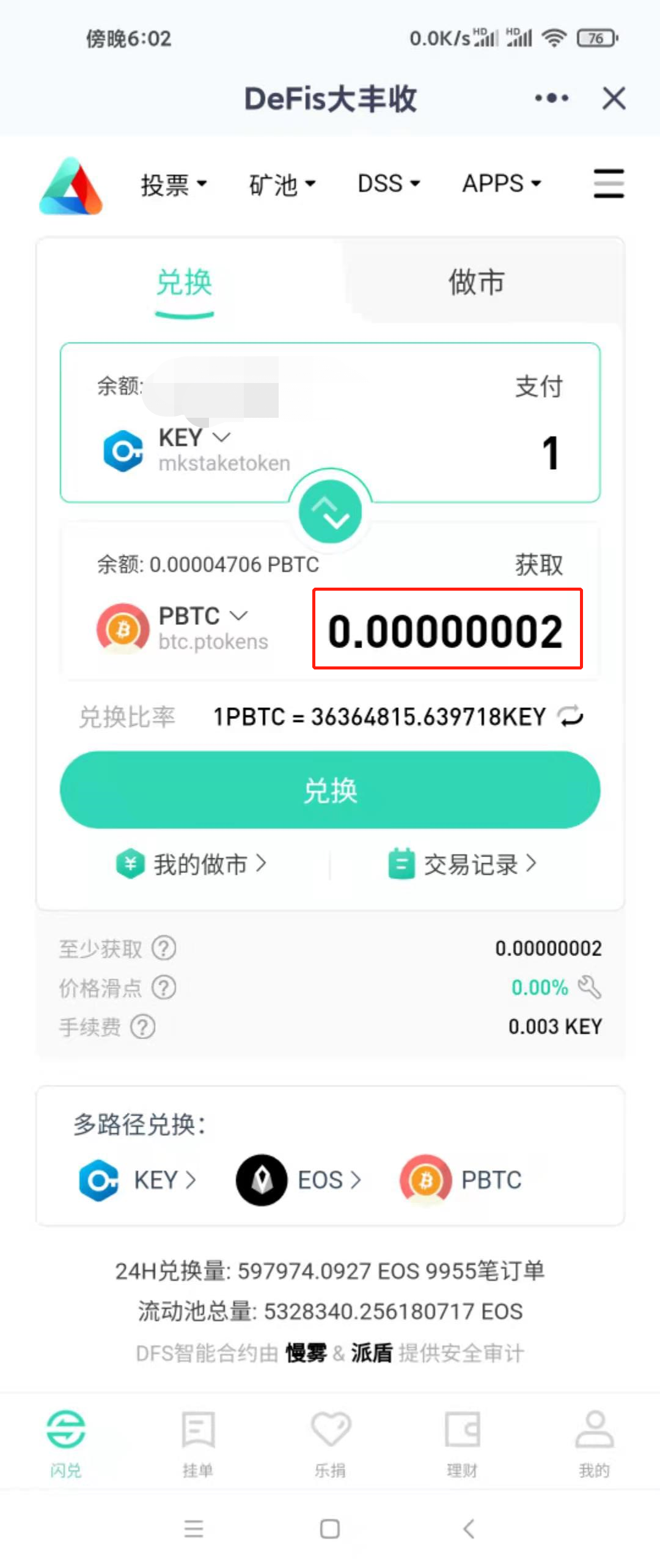

We can go to Dafengshou or Dabao to exchange pbtc.

They are all about the same depth.

I'll take screenshots to illustrate.

Harvest:

30PBTC

Dabao:

47PBTC

So look at the current situation.

In theory, if you exchange it in Dabao, the depth will be better.

If you want to go to market.

Compare yourself, the weight of both sides.

and the price of the mined mine.

Here we take the great harvest as an example:

First find Big Harvest in MYKEY wallet: then enter.

Let me test it directly with grapefruit.

It is calculated according to a grapefruit 20 yuan,

Then 0.01 yuan is 0.0005 EOS.

From the preview image above.

We can know that.

One penny can buy roughly 7 satoshis of bitcoin.

Because the exchange in the Great Harvest is free of charge (MYKEY wallet).

So we can try to initiate such a penny transaction.

In other cryptocurrencies, this is almost impossible to achieve. (Because the handling fee is far more than a penny)

That way you can do whatever you want.

Buy bitcoins with almost no restrictions.

Even just to try it out.

Just imagine the bitcoin you bought for a dollar 10 years ago.

It may be more than 10,000 yuan now.

Today, you can also buy small bitcoins for a dollar.

In 10 years, maybe he won't be a dollar.

Again, do a more extreme test.

Can I buy Bitcoin with 1 key?

If you don't see it, you can also exchange two satoshis for bitcoin.

In theory this is tradable.

But in reality, it will prompt you that the slippage is too high.

As long as you set the slippage at 80%.

Still tradable.

Although the transaction was successful.

But obviously lost money.

1 key for 1 satoshi.

Lost lost.

So, don't try too small. 😂😂😂 The above cases are for reference only.

I'm trying to transfer PBTC to an unfamiliar address. Take a look at how much network fees you need to consume.

I'm trying to transfer PBTC to an unfamiliar address.

Take a look at how much network fees you need to consume.

In fact, the consumption is indeed the lowest.

Two consecutive tests were conducted, both with a handling fee of $0.0002.

Maybe I'm lucky? Can't figure out why?

After all, shouldn't transferring money to a new account consume some ram first?

In fact, there is a very good lending pizza on EOS.

Always keep one thing in mind. The biggest risk of DEFI is the collapse of mining coins.

Therefore, the method I recommend is to borrow money for mining.

Don't be foolish enough to buy it yourself.

Can anyone catch a flying knife?

I found three at random.

EOS Lending Annualized 9.5%

DFS Lending Annualized 13.32%

TAG loan annualized 296.81%

understand? Deposit USDT or PBTC as collateral.

Then borrow the coins you need to market.

Of course, this needs to be calculated before.

TAG and EOS, market making annualized 798%

Subtract the interest on the loan, and the rest is profit.

EOS and DFS, market making annualized 56%

It also has higher interest than borrowing.

Of course, there are two issues to be aware of when implementing the above operations.

The 1st question is the annualized decline that could come if the mining coins plummet.

Because borrowing coins at pizza requires three thousandths of the loan fee.

If it is mined for a short time and the annualization is too low, it may cause some losses.

(When the profit is less than 3/1000 plus handling fee)

The second problem is that the currency of the loan has skyrocketed, resulting in insufficient collateral, which is liquidated and liquidated.

For example, I borrowed TAG,

Suddenly the tag doubled,

I didn't have time to replenish the margin.

Possibly unless the position is automatically liquidated.

At this time, please check the loan factor in time.

It is recommended that the number of factors not be too low.

When you pay attention to the above two problems.

After accurate calculation.

Feel free to do what you want.

DEFI is a process of taking money and printing money.

Finally, I wish you all the best of luck.

Closing remarks:

Only make money you know.

If you don't know enough, try to learn.

advertise:

SSS transaction address: https://www.matataki.io/exchange?output=SSS#swap

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…