AAX 是下一代加密貨幣交易所,由倫敦證券交易所集團技術驅動。 買賣比特幣及加密貨幣 | 理財 60% 年利率https://www.aax.com/

AAX Ben Caselin: A Meaningful Shift From Bitcoin Minimalism to Bitcoin Realism

There was a time when all cryptocurrencies were traded against Bitcoin (BTC). When speculators see solid token economics or promising hype, they venture into other coins, but Bitcoin is their settlement coin of choice.

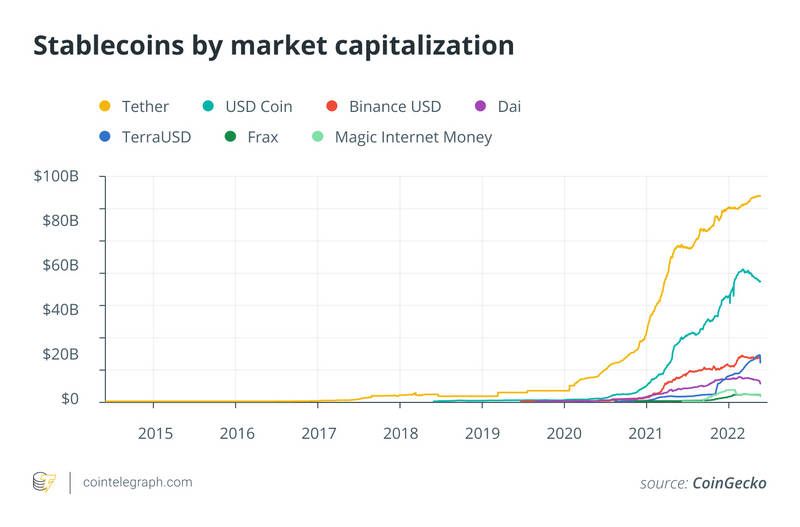

Things have changed. Stablecoins now form a key pillar of the $150 billion cryptocurrency market. Perpetual futures over-amplify market sentiment and tend to dominate price action. More funds, including institutional funds, have entered the market recently, with little impact on Bitcoin’s price. As a result, some former bulls now think Bitcoin is boring.

Is this the end of Bitcoin minimalism? maybe not. But, perhaps, it's time to be more realistic.

Related: Gold, Bitcoin or DeFi: How can investors hedge against inflation?

Bitcoin in a sea of memes

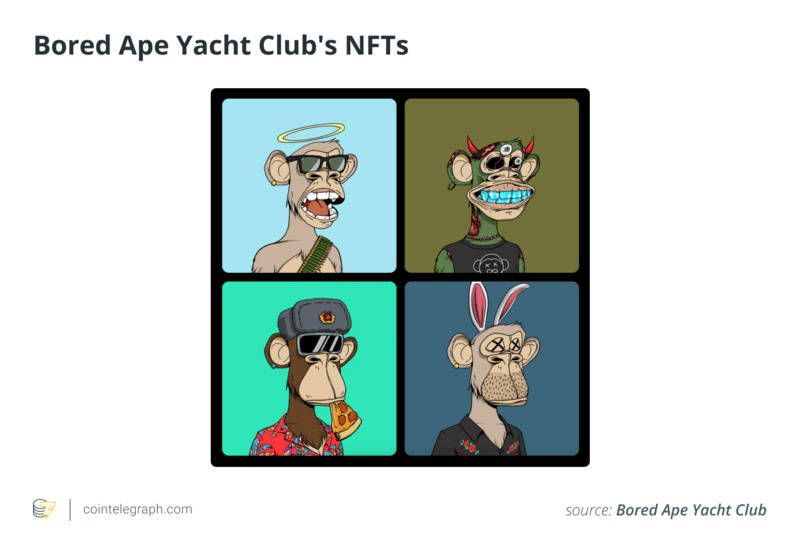

Just as Disney stock can hold value next to gold, new digitally native names like non-fungible token (NFT) project The Boring Ape Yacht Club (BAYC) can go head to head with Bitcoin in the digital asset space. And, just as investors are willing to claim the rights to the nearly century-old Mickey Mouse, BAYC represents a new approach to brand building. Also, it works.

However, it probably won't. It's speculative, which is what traders love.

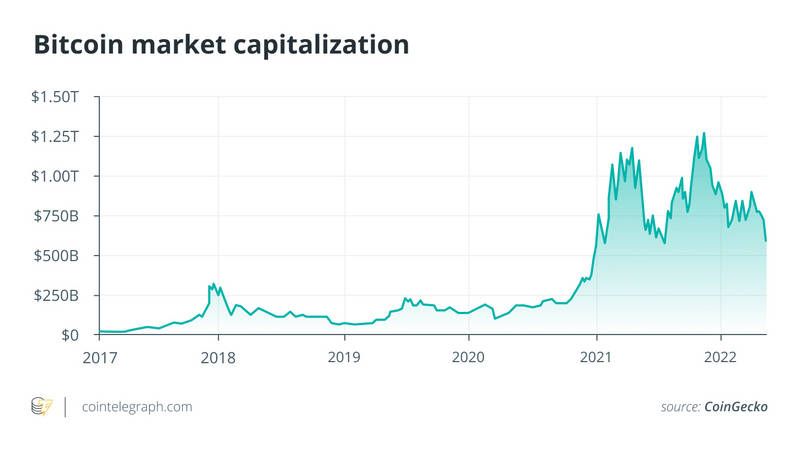

The volatility of ApeCoin (APE) is different from Bitcoin today. Orangutan tracks brand hype, and Bitcoin is now trading in a macroeconomic context. Arguably, Bitcoin is consolidating as a core asset, not only in the digital asset space, but even among some intrepid institutional investors who typically shy away from volatility. Bitcoin is an established base layer for digital asset markets, but will it also be the ultimate reserve asset?

In all fairness, it is not Ripple (XRP), Shiba Inu (SHIB) or Bitcoin Cash (BCH) that we see SWFs starting to hold. There is no serious retirement fund to pick them up either. Realists argue that Bitcoin is different from its competitors because it has proven itself to be resilient through multiple crises, and because it is truly decentralized and beyond the control of any single government.

We can see that in the "payments" space, Bitcoin's dominance with a market cap of $750 billion is evident as it dwarfs the next market. At the same time, however, we can’t dismiss other “cryptocurrencies” as futile to Bitcoin’s rise just because they’re not Bitcoin. Realism opens up dialogue and greater understanding, which is ultimately a key driver of adoption.

Bitcoin for Baby Boomers

From a price point of view, Bitcoin is only boring for those eager for a speculative trading roller coaster. Bitcoin is growing as this interest emerges elsewhere, which in itself could unleash more growth.

As YouTube influencers go from farming and breeding to staking and minting, are we also seeing conversations about Bitcoin become more mature and focused on first principles?

No, we don't see $100,000 in Bitcoin in 2021. But do we really need to be that greedy when we haven't even reached 5% global adoption? Yes, in a less boring world, Bitcoin could benefit from human greed and speculation - like all investments - but the same impulse can cause any asset to plummet in value.

Related: Boom or bust? Is there a way for Bitcoin price to hit $100,000 in 2022?

Bitcoin takes time

Bitcoin extremists generally want to have enough Bitcoins to do good things for themselves in time and space. They may also want to see a fair and more just economy - so they support Bitcoin in the first place. An extremist should also agree that it is better to see billions of people holding a little bit of bitcoin than millions of people holding all of it.

In fact, dip-buying moments are not only useful for those most loyal to Bitcoin, but they also contribute to further distribution as new entrants are attracted by buying opportunities. This is a good thing.

In this regard, it is helpful to ask yourself how much bitcoin you think you should own or aim for. Then act accordingly.

Most staunch Bitcoiners, including Michael Thaler, have taken time—perhaps years—to come up with their inspiring views. Famous financier Ray Dalio is still developing. Most politicians hardly know about Bitcoin, and I have to assume that sometimes El Salvador President Nayib Bukele makes Bitcoin legal tender in his country and he gets nervous staring at the charts.

Related: El Salvador’s Bitcoin Law: Understanding Alternatives to Government Intervention

Anyone entering the cryptocurrency space for the first time, as a funny dog or pixelated primate presents itself as a hypersonic asset, also takes time — a lot of time. However, the end result doesn’t have to be Bitcoin’s minimalism.

Still, as a core asset, most players in the space already know something about Bitcoin. Looking at game theory in emerging markets, in the context of the current sanctions regime and inflation, most digital asset investors know it's a good thing to hold "some bitcoin".

Too poisonous?

Some say Bitcoin extremists are toxic. However, people are poisonous everywhere. Also, what the maximalists in Bitcoin do well is reiterate first principles, which help anchor the conversation. Their motto is, Bitcoin doesn't need you, you need Bitcoin. real? Well, true or not, the point is: don't put your life savings in memecoin just because the community is being nice to you.

Let's be real. The world is dealing with currency devaluation, bitcoin mining can and does serve environmental goals, the US and its allies do freeze Russia's foreign reserves, the future is highly digital, inflation is not temporary, hold bitcoin under any of these conditions will make full sense.

The bear market shows the real building blocks of projects and protocols. Axie Infinity’s Smooth Love Potion (SLP) token is currently trading around 40 times below its all-time high. The price of Bitcoin is about 2x below its all-time high. An early break above $69,000 is not unreasonable or even unusual.

In the end, it's a bit contradictory that banks are "into Bitcoin", some might argue that Bitcoin doesn't need that, but it's also true that Bitcoin's integration with global finance and existing infrastructure makes the asset more resilient because it brings more stakeholders who will invest in the long term.

No one needs to be a Bitcoin extremist, but everyone should be a realist.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk and readers should do their own research when making a decision.

The views, thoughts and opinions expressed herein are those of the author alone and do not necessarily reflect or represent the views and opinions.

Ben Caselin is Head of Research and Strategy at AAX, a cryptocurrency exchange powered by London Stock Exchange Group's LSEG technology. Ben has a background in creative arts, social studies, and fintech, with an in-depth understanding of Bitcoin and decentralized finance, and provides strategic direction for AAX. He is also a working member of Global Digital Finance (GDF), a leading industry body dedicated to driving the acceleration and adoption of digital finance.

This article was first published on: Сointеlеgraph

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…