全球领先的加密资产交易平台和Web3平台。#OKX #OKXEarn #OKXNFT #OKXChain @mancity 唯一加密平台赞助商, @mclarenf1 首席赞助商。 欧易OKX中文注册:https://www.okx.com/join/HG888

What does contract trading mean? Are contract transactions futures?

Contract trading appeared in the currency circle in 2013, but only a few investors were interested in the currency circle at that time. With the rise of Bitcoin in recent years, more and more investors are interested in virtual currency, which also makes the contract Trading followed, and even so, most newbies in the currency circle know nothing about contract trading. So, what does contract trading mean? Are contract transactions futures? In response to these problems, the editor of the currency circle will tell you about contract transactions in detail.

Recommended by the webmaster: The top three cryptocurrency transaction registrations in the world can get a permanent 20% commission rebate, which can save a lot of transaction fees in normal transactions.

Ouyi OKX registration alternate address book: https://awesome-snowstorm-339.notion.site/OKX_OKEx-fd9b3009a1e54c90af022a162f63747d [Copy the link to the browser to open the registration]

About Ouyi APP download, Android can click the link above to download the APP, Apple mobile phone needs an overseas Apple ID~ You can search for Apple's overseas ID on a treasure, a certain degree, buy one for a few dollars, and then log in to the mall to download the APP~ After downloading, change back to your Apple ID.

What does contract trading mean?

The principle of contract trading is the same as that of futures trading. Two-way trading can be done both long and short. Before there is no transaction, the two parties should submit matters such as digital currency to the agreement, and then trade at the agreed time. Regardless of whether the digital currency has risen or fallen at the trading time, and whether the result is a profit or a loss, the transaction must be carried out according to the previous agreement. (Singapore Uranus digital currency trading platform, contract-based trading, 100% position, return after closing, WeChat phone: 17862513013) For example, I think that Bitcoin is on the rise in a short period of time, so I do long operations. The coin only needs to pay a certain margin to the platform and add 50 times leverage, so that the funds can be fully utilized. When the price rises, the coin will be sold again. After deducting the transaction fee, the rest is coin. Earned; for the same reason, shorting is the same.

Are contract transactions futures?

Contract transactions include futures transactions, and it can also be said that futures contracts are contract transactions.

Contract transactions are divided into delivery contracts and perpetual contracts. It can also be understood from the literal meaning that the "delivery contract" has a delivery date, and the "perpetual contract" has no expiration time, so there is no restriction on the holding time. When the market reaches the investor's expectations, delivery can be made.

According to the different delivery methods, contracts can be divided into perpetual contracts and fixed-term contracts.

The main difference between the two is that the term contract has a fixed delivery date, while the perpetual contract does not. The fixed-term contracts are divided into three categories according to the delivery time: current-week contracts, next-week contracts and quarterly contracts.

A Beginner's Tutorial for Contract Trading

Take Eurex Exchange perpetual contracts as an example. Ouyi OKX perpetual contract is a contract product settled by digital assets. Investors can buy long or sell short to obtain income from the rise or fall of the price of digital assets. The perpetual contract has no expiry delivery date. Does not expire.

1. Fund transfer

1. Before conducting perpetual contract transactions, you need to transfer funds first, and transfer the currency of other accounts to the perpetual contract account before you can do perpetual contract transactions.

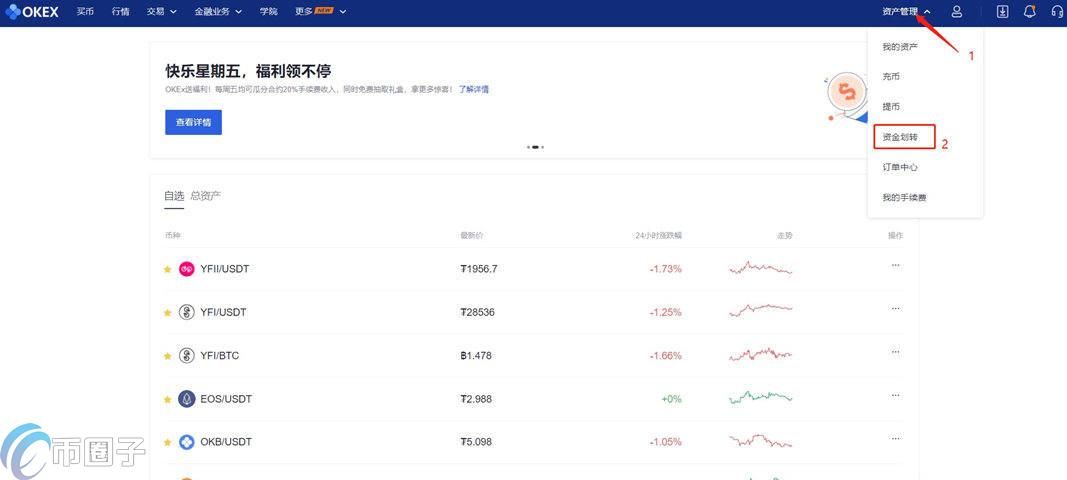

Open OKX official website, if you do not have an account, you can click here to register a new account, click Asset Management in the upper right corner of the page, select Fund Transfer, and enter the Fund Transfer page.

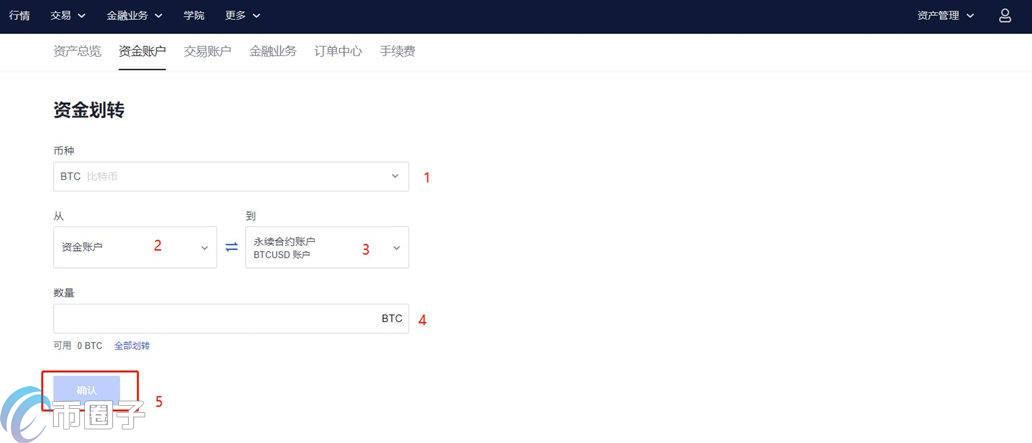

2. Select the currency you want to transfer, transfer the digital assets from the capital account/Yubibao and other accounts to the perpetual contract account, enter the amount to be transferred or click to transfer all, and click OK.

2. Select the contract type

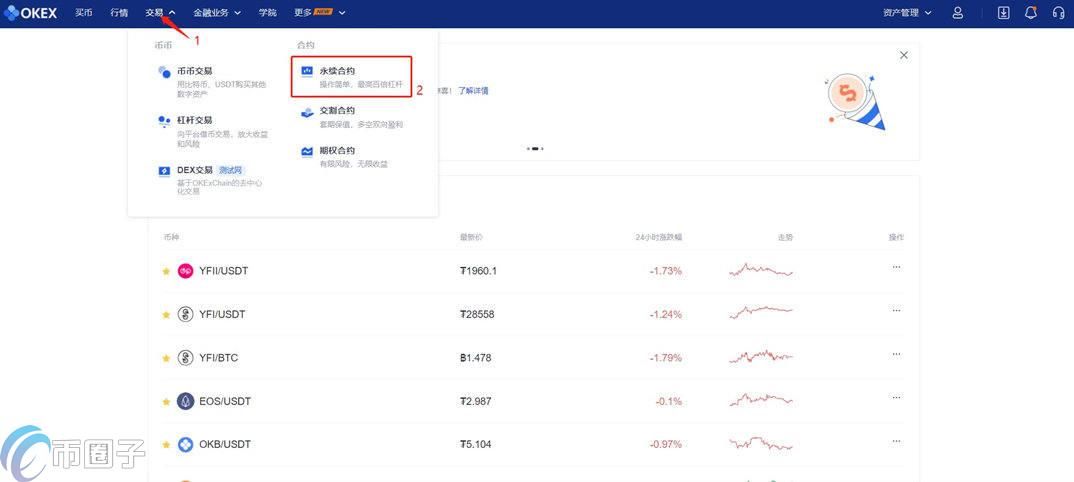

1. Click Trading at the top left of the official website homepage, select Perpetual Swap, and enter the perpetual swap trading interface.

2. Perpetual contracts are further divided into currency-based margin contracts and USDT margin contracts. Select the contract type and currency you want to trade.

3. Set account mode

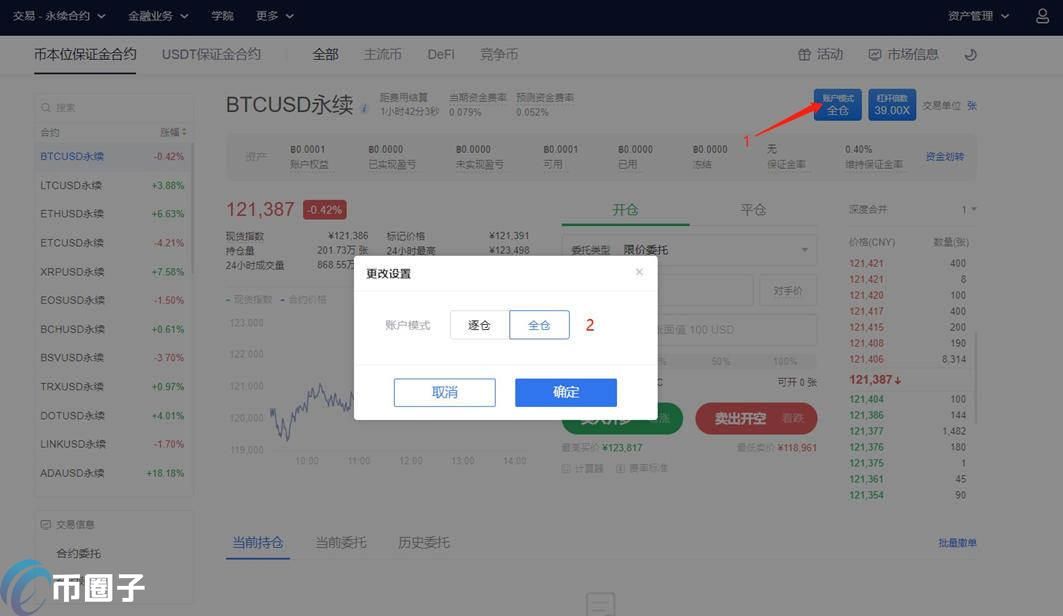

1. Click the account mode button in the upper right corner of the page, you can choose isolated position or full position. For full position, all assets in the account after opening the position are used as the position margin, and for the isolated position, only the part occupied by the position is used as the position margin.

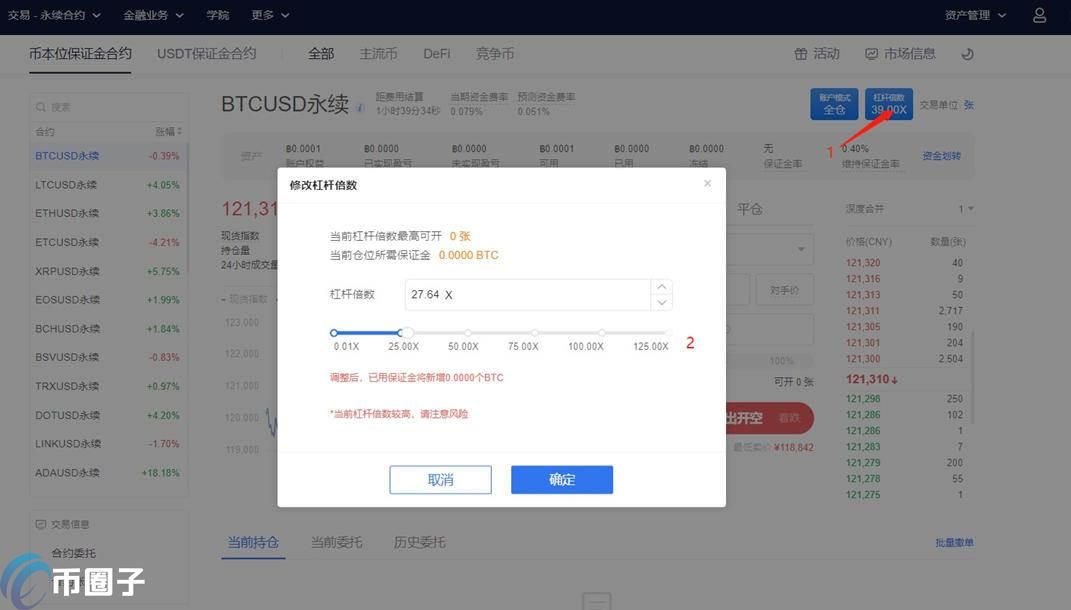

2. The leverage ratio can also be adjusted by yourself. Click the leverage ratio in the upper right corner of the page, the minimum is 0.01 times, and the maximum is 125 times.

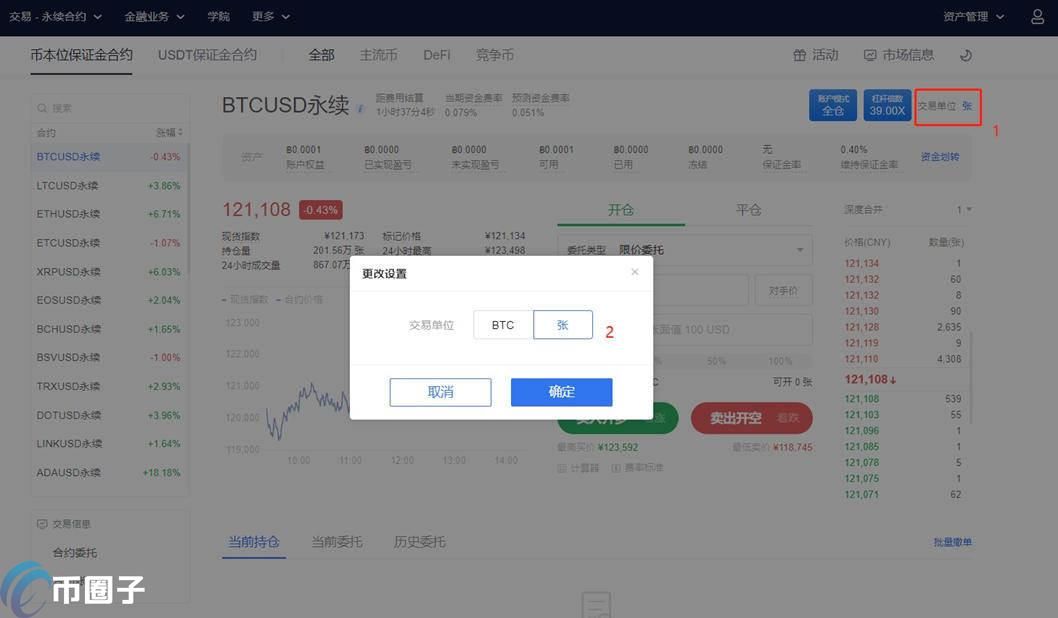

3. The transaction unit can be changed to the number of sheets or coins according to personal habits.

4. Opening and closing positions

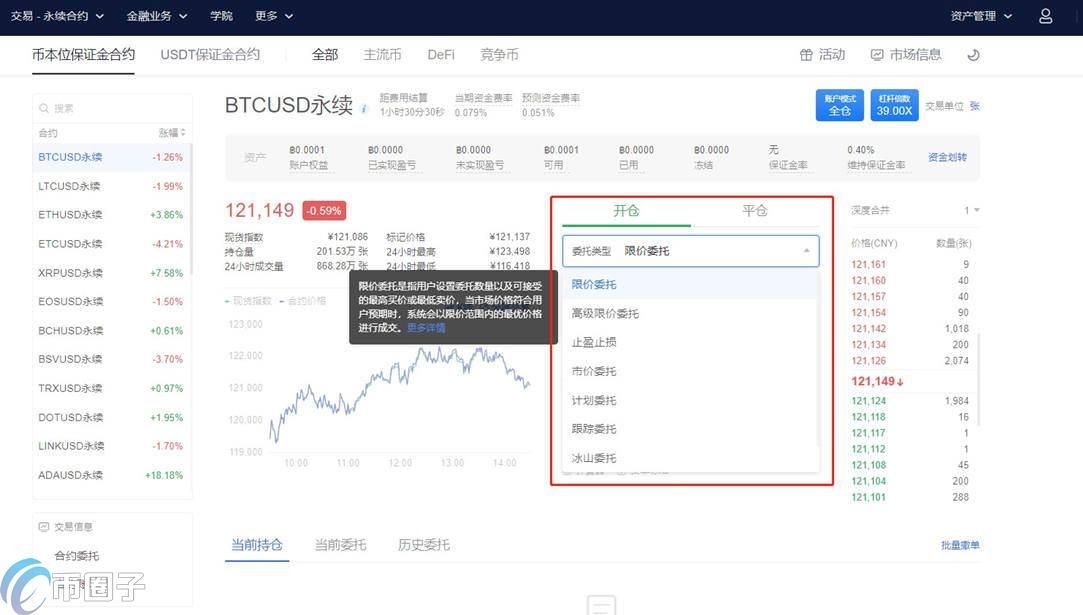

1. As shown in the figure below, this is the page for opening and closing positions. You can choose order types such as limit order, advanced limit order, take profit and stop loss, or you can choose the counterparty price or choose other quotations for trading.

2. Enter your ideal price and quantity on the trading page, and click Buy to open long or open short.

V. Differences between perpetual contracts and delivery contracts

Expiration date: There is a fixed expiry delivery date for each delivery contract, and the delivery price is the arithmetic average of the BTC (LTC and other currencies) US dollar index in the last hour as the delivery price. position; perpetual contracts have no expiry delivery date and will never expire;

Funding cost: Since there is no expiry delivery date, perpetual contracts need to use the "funding cost mechanism" to anchor the contract price to the spot price;

Marked price: The perpetual contract uses the marked price to calculate the user's unrealized profit and loss, effectively reducing unnecessary frequent liquidation when the market fluctuates;

Through the above introduction, I believe that everyone has some understanding of the meaning of contract trading. The editor of the currency circle reminds investors that investing in virtual currency must find a formal large trading platform, and the trading time must not be frequent transactions, especially in big news Before coming out, it is recommended to wait and see, do not bet on news, it is easy to get yourself stuck and cause huge economic losses. If you want to learn more about contract trading, you can follow the currency circle. The editor of the currency circle will continue to update relevant reports later!

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…