Sophisticated or funny to discover something behind. An artist and joint arrangement from Taiwan. 壓克力繪畫/數位繪畫/寶石飾品鑲嵌設計/NFT觀察 Gallery https://oncyber.io/tkwgallery02

Ethereum chain NFT 2022Q1 growth slows down, losses increase

After going through the 2021 Metaverse and NFT news explosion, how is the global NFT market now? Research firm NonFungible has just released its report for the first quarter of 2022, showing trends such as slower overall growth, lower market activity, and more investment losses. It is worth noting that the average unit price of NFT has increased, and the Asia-Pacific countries have accounted for the top few transactions.

The number of listings is reduced by 50%, and the transaction loss is increased by 50%

The total transaction value in Q1 2022 reached nearly $16.5 billion, an increase of 13.25% over the previous quarter, but excluding illegal or suspicious types of transactions, only known and legal project figures were used, and it was nearly $7.9 billion. , a decrease of 4.6% compared to the previous quarter. In addition, the number of listings, including secondary blockchains, dropped by nearly half to more than 7.4 million, the number of buyers decreased by nearly 30%, the number of sellers decreased by 15%, and the number of cryptocurrency wallets actively used was 1.45 million. , reduced by a quarter.

So what about the profit and loss situation? Judging from the overall resale market of secondary blockchain NFTs (non-first listing or purchase), the profit was US$3.3 billion, a slight decrease of 3.38%, while the scale of transaction losses increased to US$1.2 billion, an increase of nearly half . The average holding days per NFT increased from 25.6 days to 39.6 days, and the average price was $1,057, an increase of 80.07%.

Collectibles continue to sell well

It can be clearly seen from these figures that although the transaction volume has grown, the popularity and individual profits in the first quarter can be said to have declined significantly. The decrease in listed sales and the increase in the number of holding days may mean that they are reluctant to sell when they smell the market trend, or it may mean that they are sold stay home. However, it is worth noting that the amount of individual transactions has grown slightly, which means that the unit price of the item has increased.

NonFungible pointed out that the game "Axie Infinity", which will have a great impact on the market in 2021, will gradually lose its influence after entering 2022, which also indirectly represents the decline of the "Pay to Earn" model. But Collectibles still have potential, such as Invisible Friends, CloneX, Azuki, CyberBrokers, etc. These two trends can be said to be the factors driving up the price of NFTs.

Another trend is worth noting, virtual trading (Wash Trading, a transaction that is regarded as illegal, such as the buyer and the seller is the same person) and decentralized finance (DeFi) such as MEV Bot or UniSwar account for a large part shares, these are not considered NFT transactions.

Russia-Ukraine conflict draws attention

Further analysis pointed out that the Russian attack on Ukraine has greatly attracted the attention of Internet users to NFTs in Google search trends, while the media has been saturated with a large number of reports last year, and the news of the loss of speculative buyers has become the first. The reason for the market downturn in the first quarter.

From the perspective of regional development, East (South) Asian countries are the focus of growth momentum in the first quarter. The top five in the entire market are East Asian countries, including Singapore, Hong Kong, China, Taiwan, and the Philippines, followed by Canada, Afghanistan United, New Zealand, Australia, and the United States dropped from 8th to 12th.

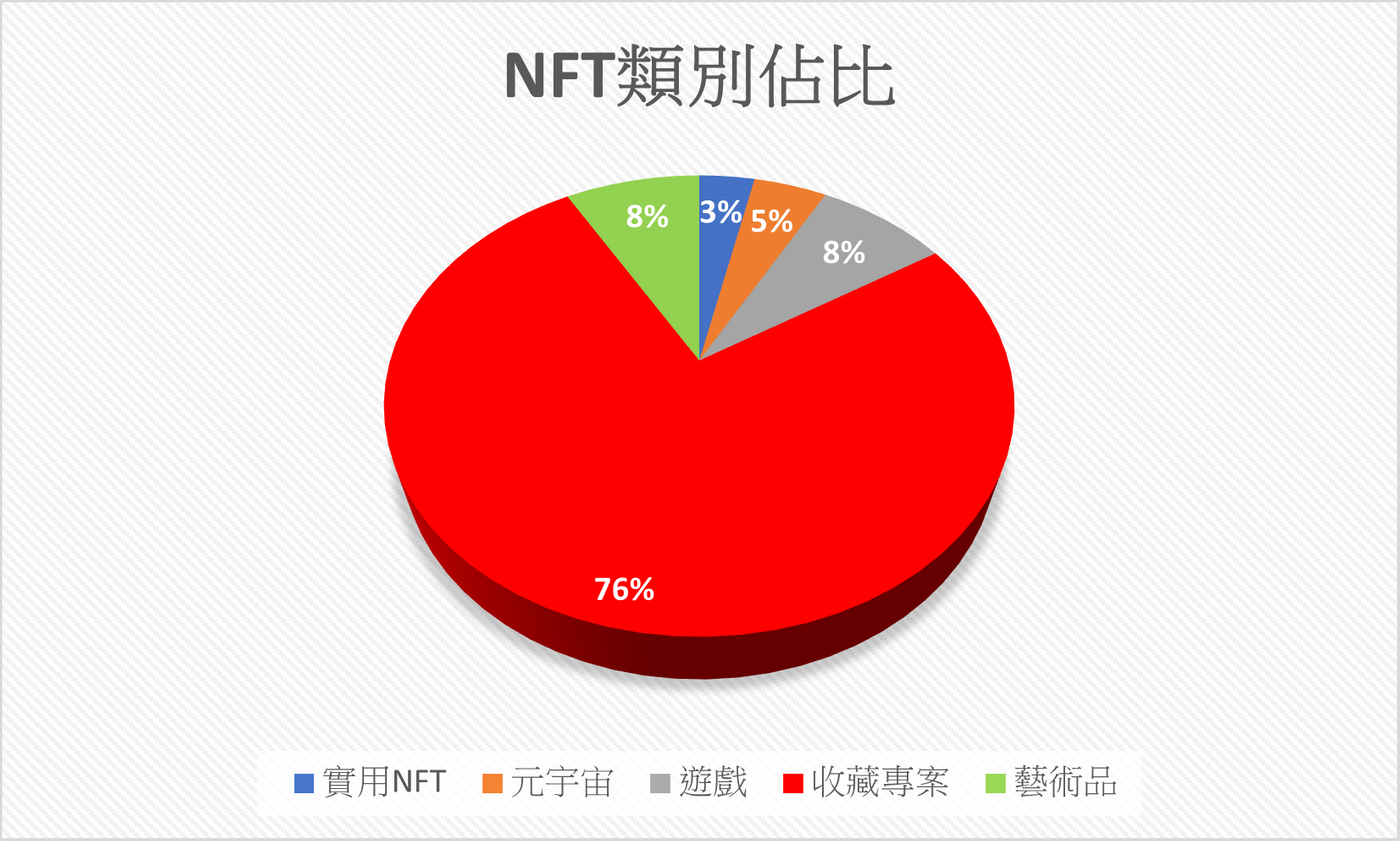

If analyzed by the category of NFT, collection projects still account for about 76% of the overall transaction volume, which is not much different from the past, with artworks and games accounting for almost 8%. The secondary blockchain is still growing compared to the main ether chain, although the overall growth is slowing.

This report is NonFungible's goal of data collection and analysis with ERC-721 NFT.

References

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…