內容工作者 IG - https://www.instagram.com/uncle_lashi/ FB - https://www.facebook.com/%E8%8F%88%E5%96%9C%E7%9A%84%E6%B8%9B%E6%B3%95%E7%94%9F%E6%B4%BB-149415249877359

[Binance Leverage Teaching] 5 minutes to understand the calculation of margin trading fees and interest 1 analysis

Binance Leverage Tutorial – What is Margin Trading? ( Intimate Link Referral ID – “T3TWUI2E” Online Up to 20% Rebate)

The great physicist Archimedes said: "Give me a place to stand on, and I will move the Earth."

The uncle of the house also said: "Give me infinite leverage, and I can become the richest person in the world."

I believe that most people have heard of the "Leverage Principle", but very few people consciously use it. Today, I will discuss how to use the leverage principle in cryptocurrency trading.

Explained by Binance, the world’s largest exchange by trading volume – “Leveraged trading is a way of trading assets using funds provided by third parties. Essentially, leveraged trading amplifies trading results, allowing traders to trade at a profit Get bigger profits. Leveraged trading is also used in stock, spot and cryptocurrency markets.”

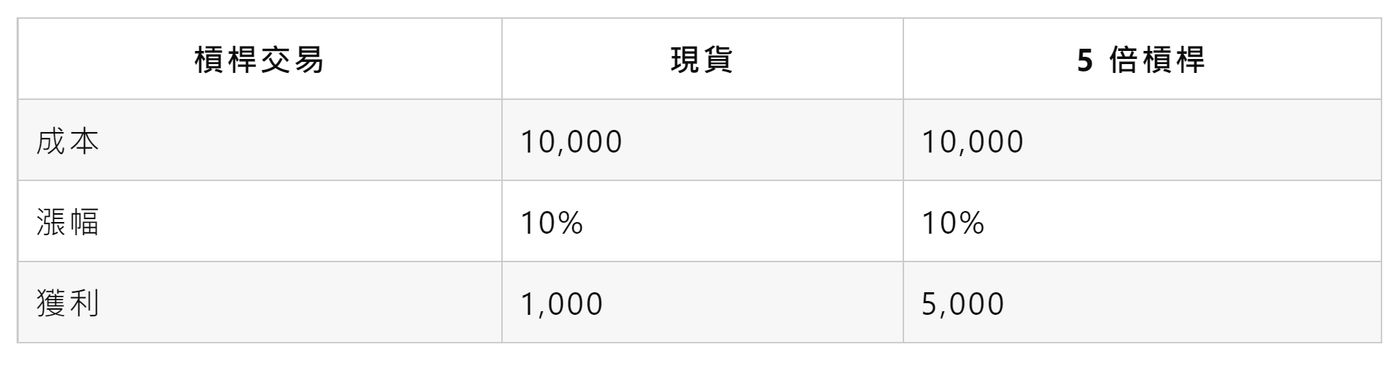

To put it simply, leveraged trading is a method for "small capital" to use "large leverage" to amplify trading results. For example, my uncle is buying Bitcoin with "five times leverage" today.

Suppose the current price of Bitcoin is $10,000 a piece, and my funds also have $10,000. If it is a spot transaction, I can only buy one Bitcoin, and a "five times leverage" transaction allows me to buy five Bitcoins.

Then you must be curious, how did you get the $40,000 you borrowed, and how did you calculate the interest?

If Bitcoin rises to $11,000 in the future, after we sell the 5 Bitcoins in our hands, after deducting the cost of 50,000, and excluding handling fees and interest, we will make a profit of $5,000.

As Binance puts it, leveraged trading amplifies the outcome of a trade, enabling traders to make bigger profits on their trades, but it doesn’t explain a few things.

When the market goes down and the trading result is a loss, there will also be greater risks, so leveraged trading is suitable for friends who can bear greater risks.

Fee and interest calculation

In another article of Uncle [How to Calculate Binance Fees] Fee reduction plus 20% The rebate code points out that the spot fee is calculated by the "orderer/order taker", and the basic fee is 0.1% / 0.1 % (Maker / Taker)

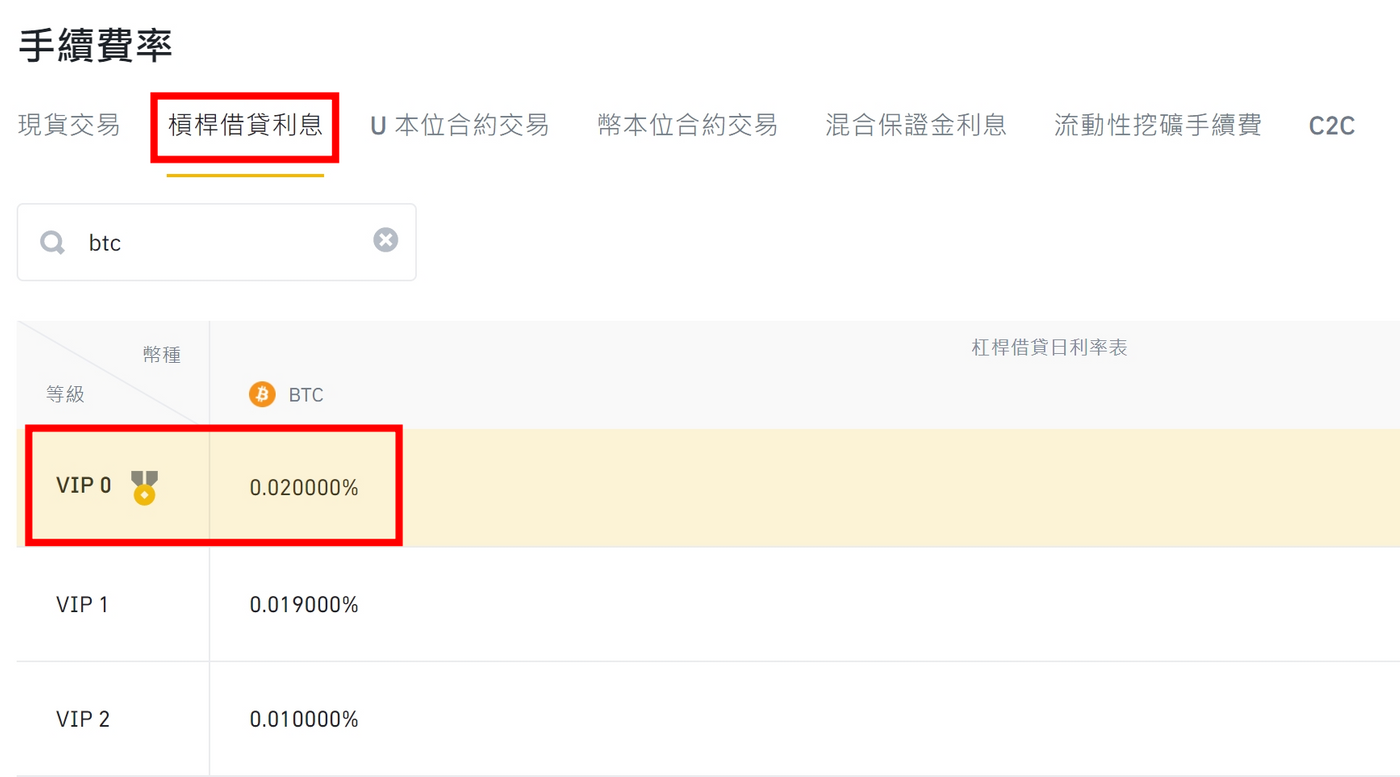

Of course it has something to do with your trading level, but like most of us we are VIP 0.

The calculation of the handling fee is basically the same as that of the spot, except that "interest" is added.

The calculation of interest depends on different currencies, and there will be different interest rates. According to the information provided by Binance official website ( intimate link ), Bitcoin BTC is 0.02% / day!! Yes, customers have not seen it, it is daily interest.

For example, if you borrow 100 BTC, the daily interest is 0.02 BTC. If you calculate it in one year, it is 0.02*365 = 7.3%/year. Seriously, this is not cheap.

Who should use leverage?

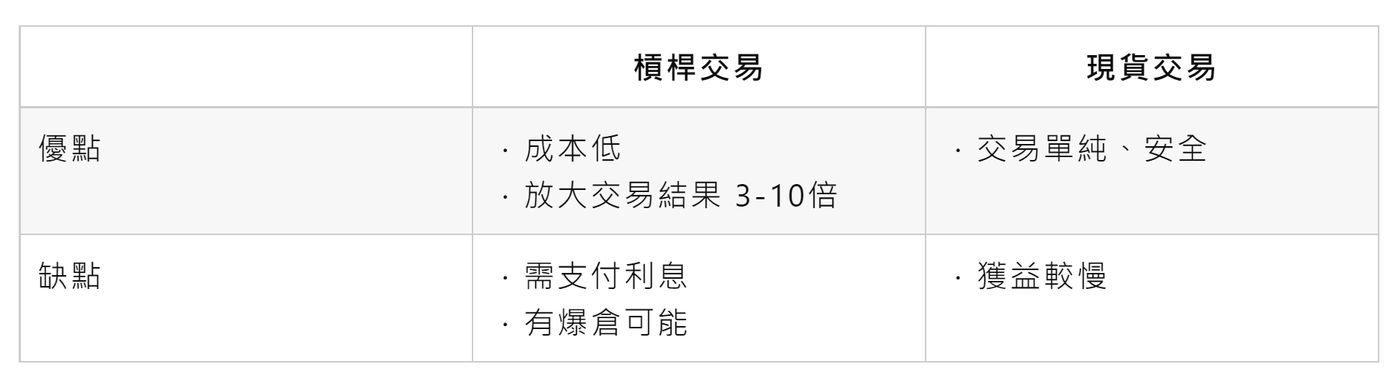

Since leveraged trading requires handling fees and interest, why are some people willing to open leverage?

This is related to the ratio of risk and reward. For example, in the flyover mission of the recent famous album "Squid Game", in the case of choosing 1 between ordinary glass and tempered glass, going in the wrong direction is life-threatening.

But if you are lucky, you will get a huge fortune that you will never earn in a lifetime.

Not everyone is born happy like Ji Hyo, the goddess of happiness, so please remember these two things before using "leveraged trading".

Before using leverage, please "rational assessment" and "repayment ability".

Leveraged trading vs spot trading

After we have a basic understanding of leveraged trading, let’s do a comparison of leveraged and spot –

How to profit from leveraged trading?

This unit will give an example of how to start earning more profit through leveraged trading.

- Sign up for Binance

- Start leveraged trading

- Build your own trading strategy checklist

1️⃣ Register on Binance Exchange (up to 20% rebate for the whole network with intimate links )

One of the most important things for registering an exchange is "real-name authentication (KYC)". In order to implement the laws and regulations of various countries and combat black money, most exchanges will require the action of "real-name authentication (KYC)".

Real-name authentication policies help combat money laundering, terrorist financing, fraud and illegal transfers of funds.

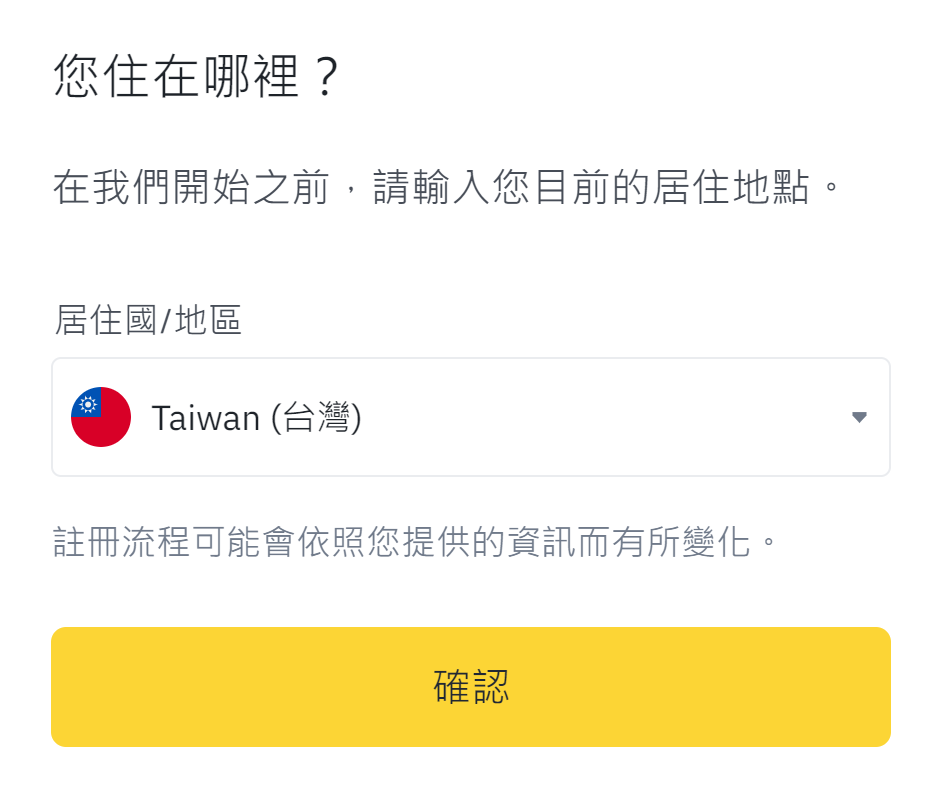

Step.1 - Choose a place of residence

Step.2 - Create a Binance Account (Email or Mobile)

You can complete the Binance account application by choosing Email or mobile phone number. Please fill in "T3TWUI2E" for the referrer ID. Each transaction will save you 20% of the handling fee, including contract transactions.

Don't let your rights fall asleep, it's just good to get a little fee back.

After creating a Binance account, there are 2 more verifications that need to be completed

- Authentication

- account security

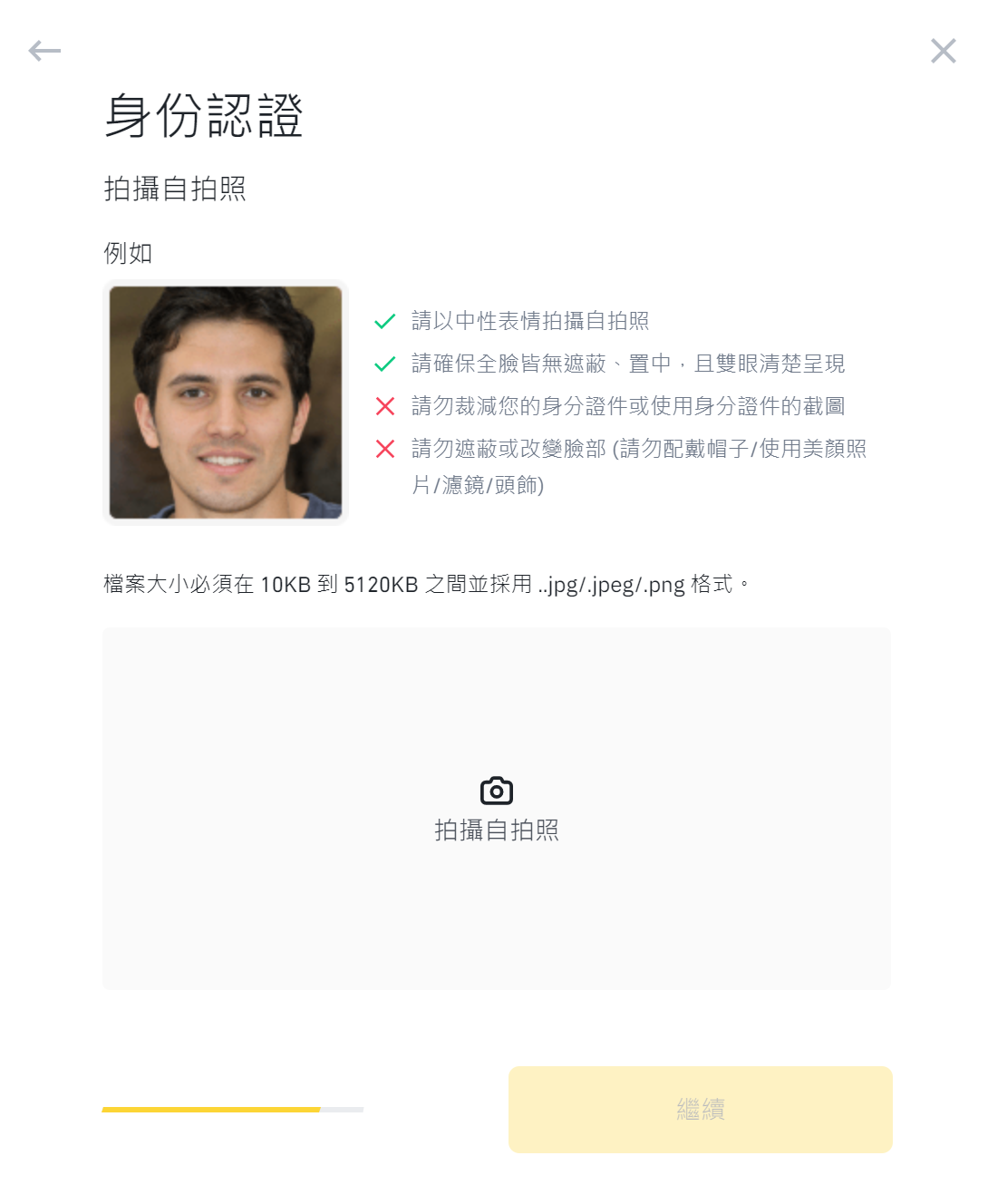

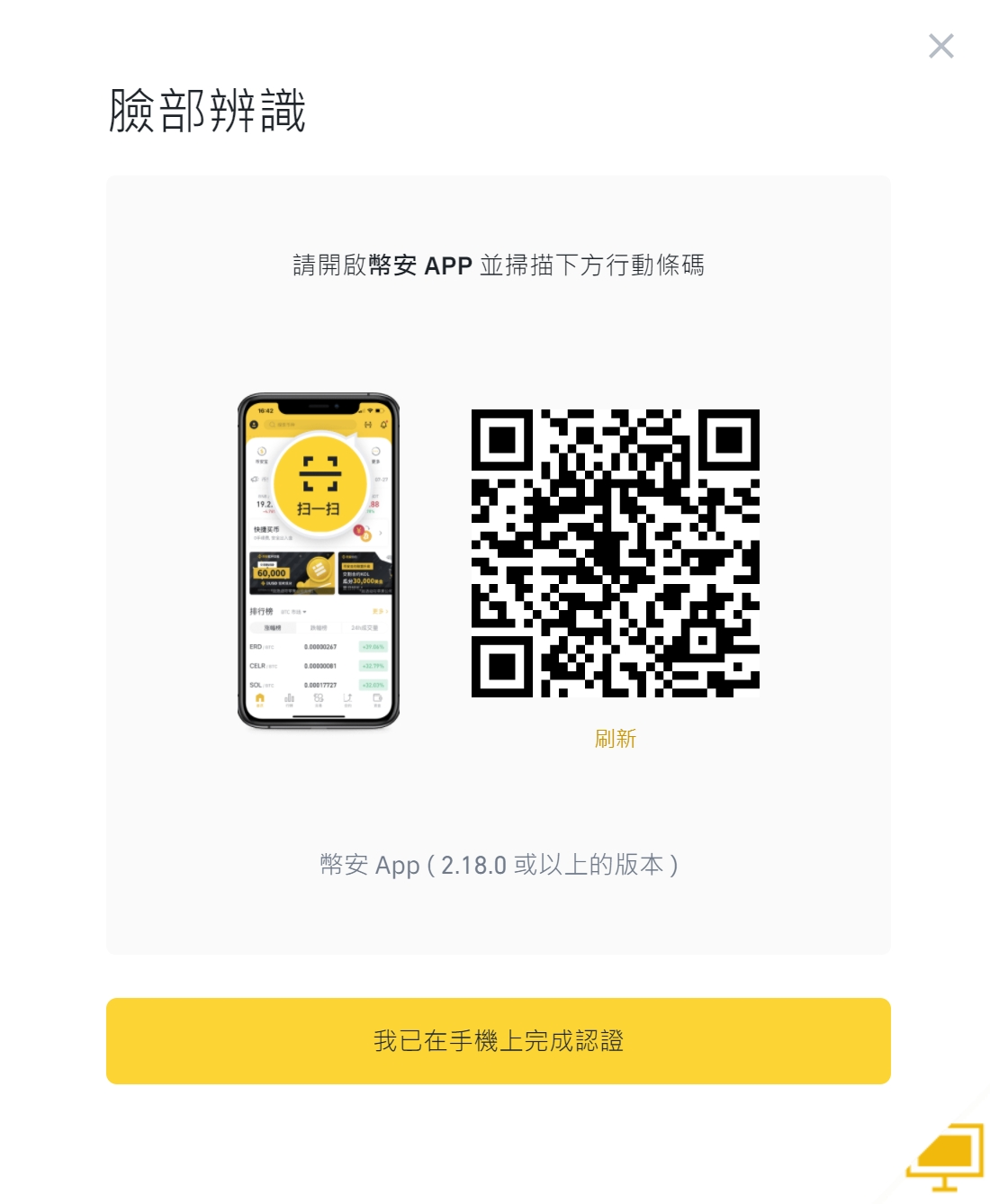

Step.3 – Intermediate identity verification (**From October 19, 2021,** you must complete the intermediate verification before you can use various products and services of Binance platform)

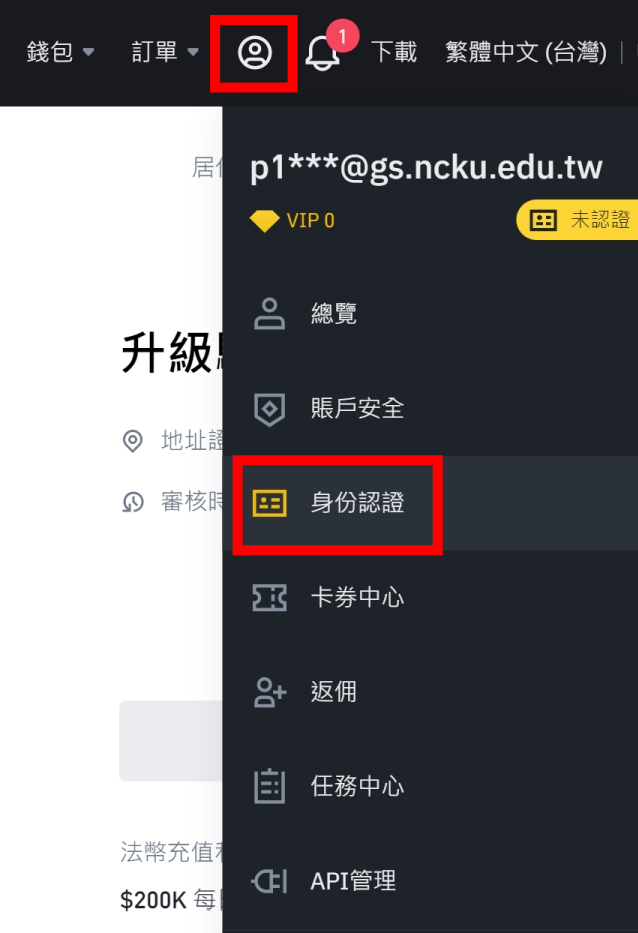

After logging in, click the portrait in the upper right corner of the homepage, and select "Identity Authentication" from the drop-down menu

Go to the page and click Get started now.

Fill in the personal information, and you will need to check whether the information on the ID card is correct later, so please fill it out!

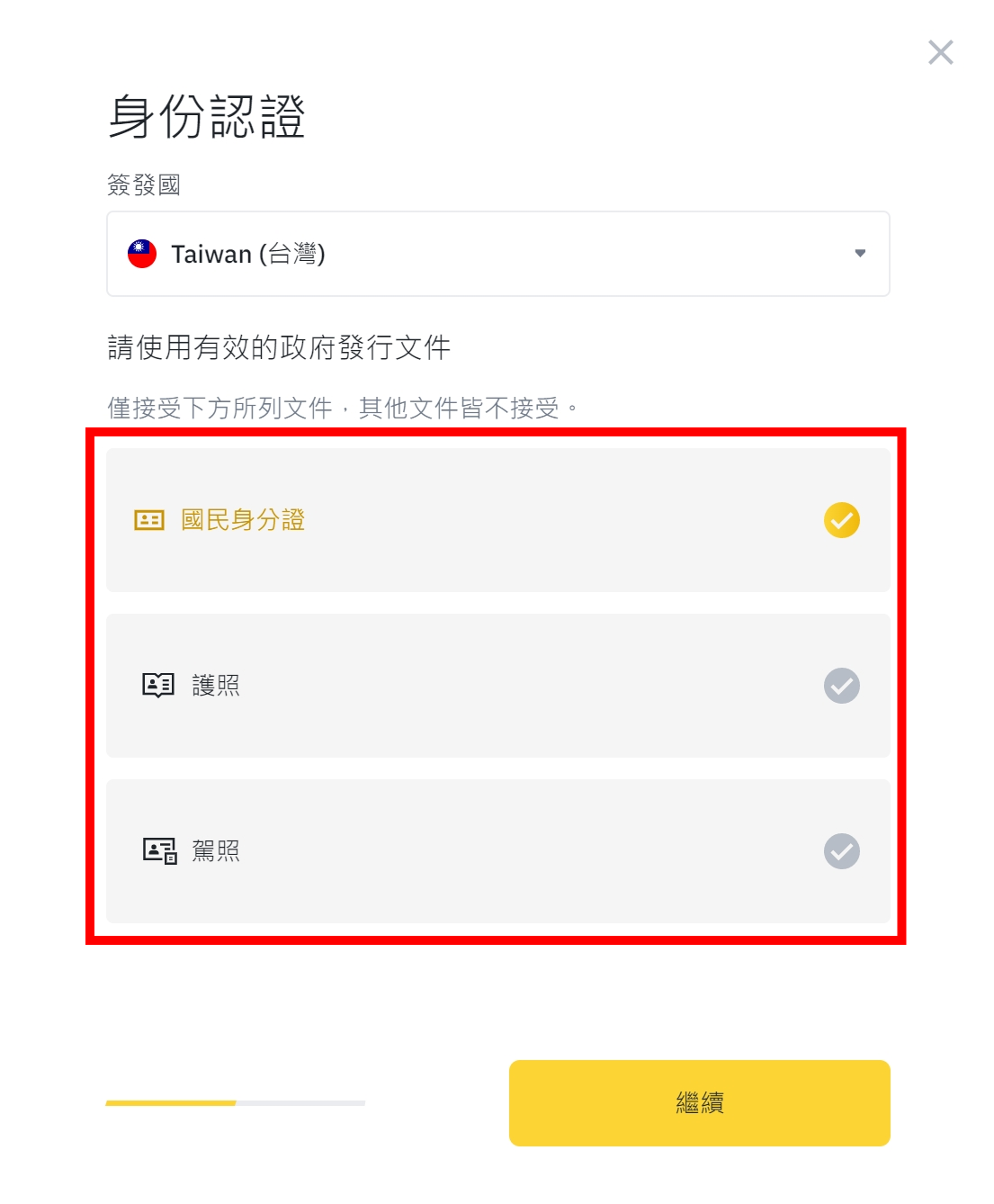

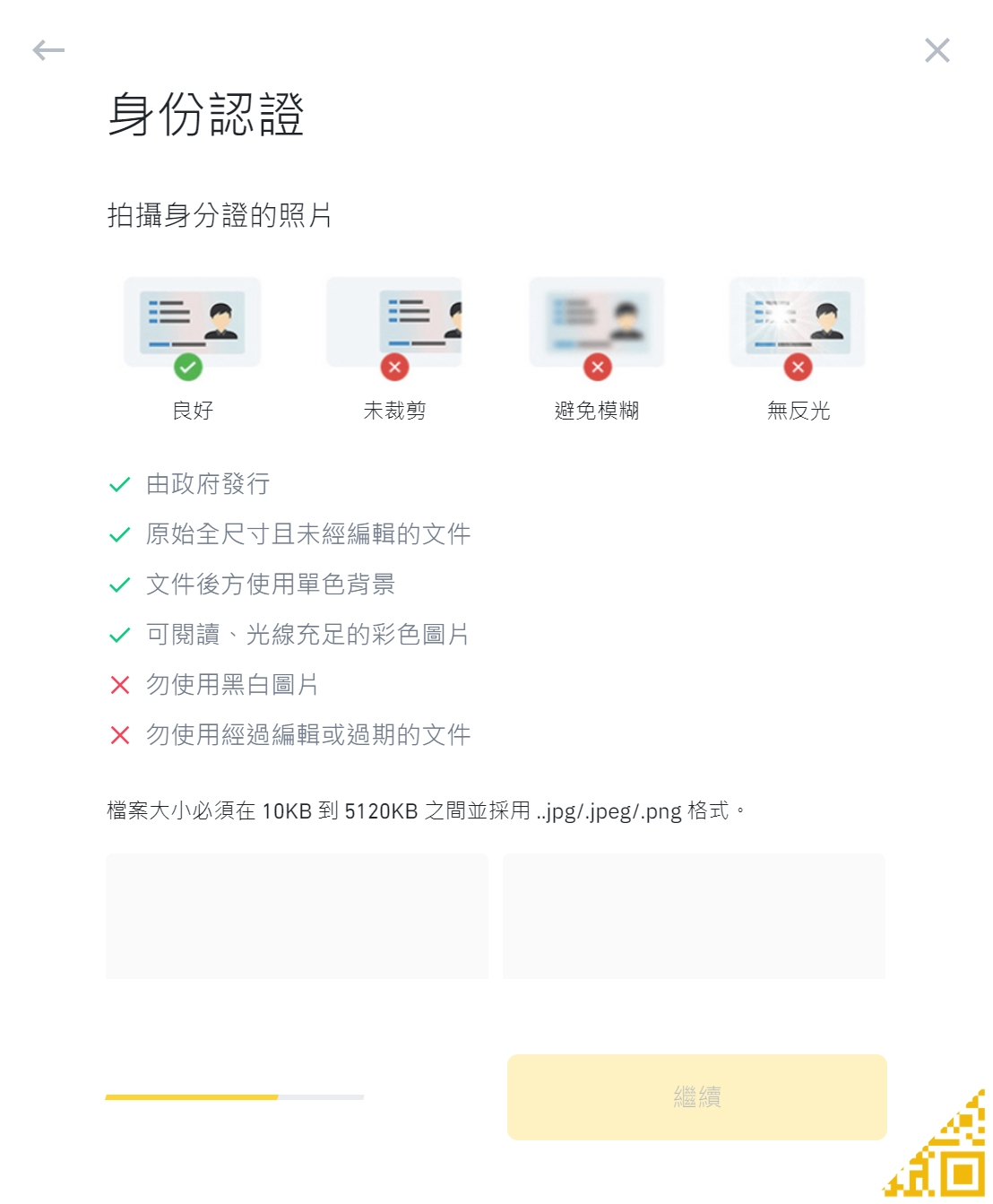

Choose 1 from 3 for real-name authentication, after that, please take a photo of the certificate and upload it.

A series of physical examinations are completed, just waiting for the review. According to experience, you will receive the completed Email in less than an hour.

Step.4 - Account Security Authentication ( 2FA )

It is recommended that you prepare at least 2 kinds of certifications, and the uncle has prepared 3 kinds.

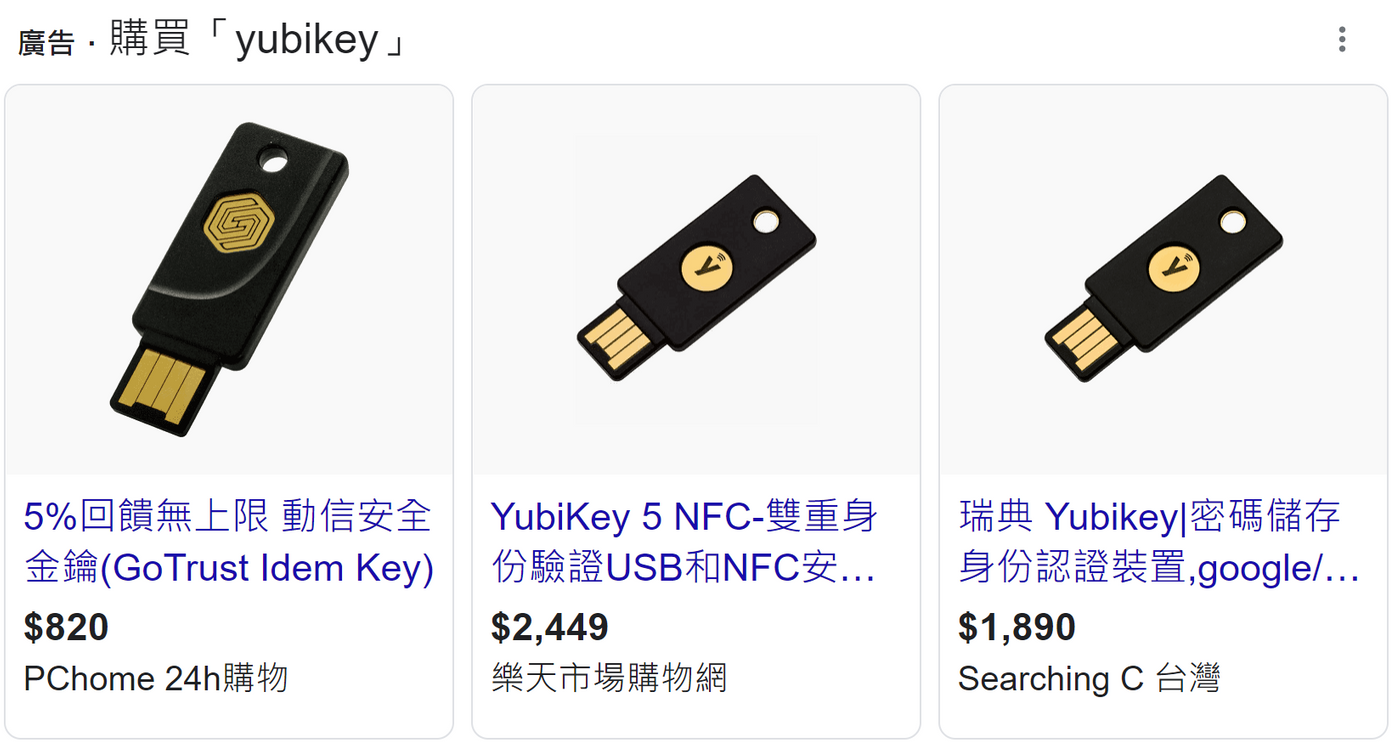

- safety equipment

- Google Authenticator

- Mobile number verification

- Email address verification

Security Device – It is a USB-like hardware authentication device. It is used as a secondary password function. After entering the account password, the system will ask to insert the device. After inserting it, it will be unlocked, which is a convenient and safe choice.

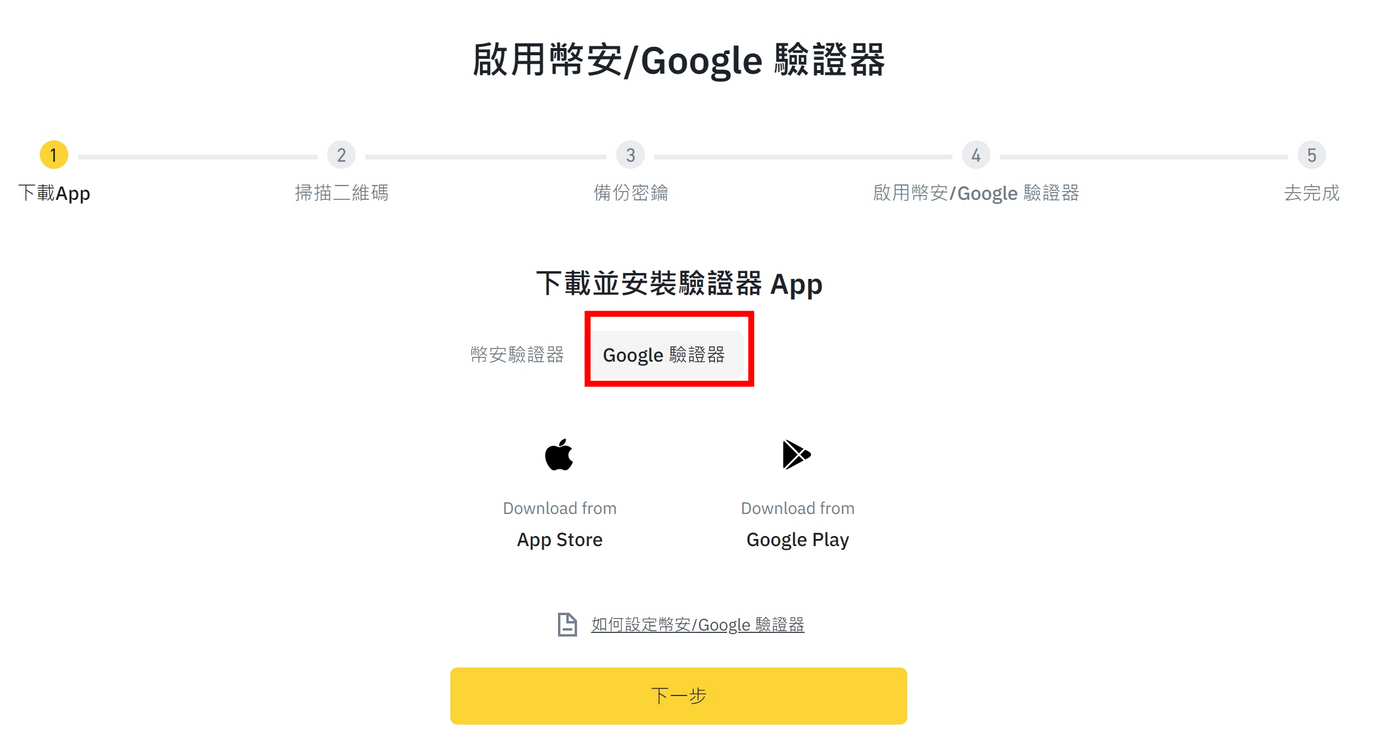

Google Authenticator –

It can be used with a mobile phone, a very convenient digital verification method, and uncles use this.

First click "Open", select Google Authenticator, and download the APP to the mobile phone to install.

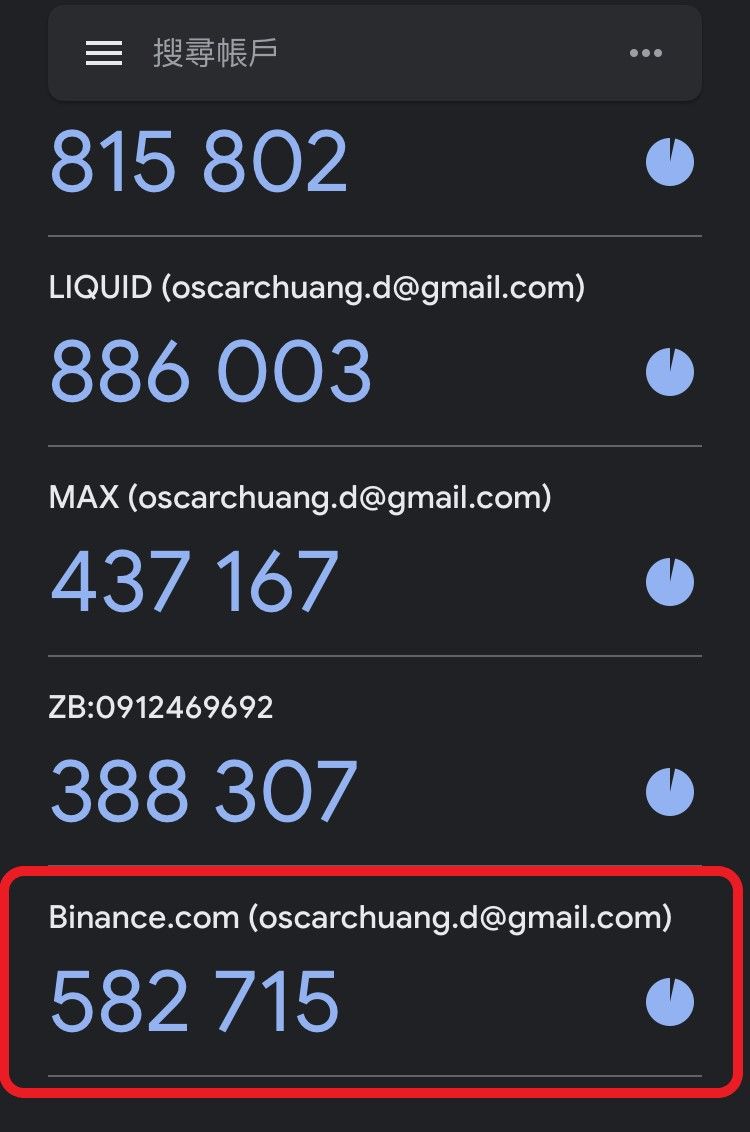

Open the APP, choose to scan or enter the setup key, after completing the setup, you will see a set of 6-digit "dynamic" passwords, which will be updated every minute. Next step, after which the key prompt will appear.

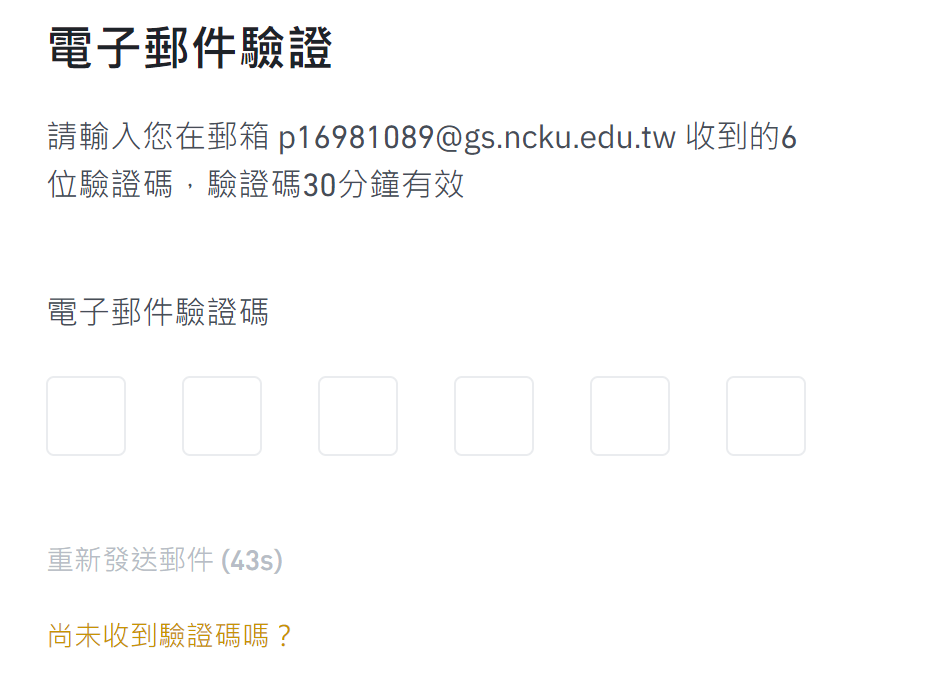

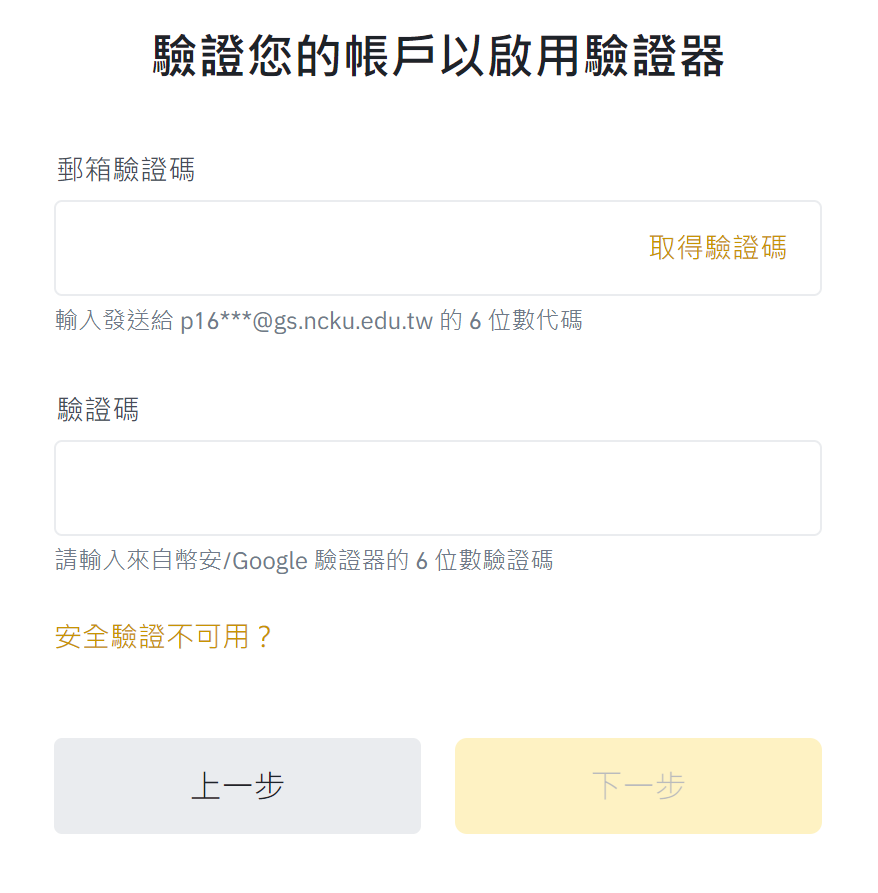

Finally, enter the email verification code and the 6-digit verification code of Google Authenticator to complete the setting.

After completing the registration, you must make a deposit. You can refer to another article [Binance Credit Card Recommendation] 2 must-learn golden rules for depositing money. Buy cheap and buy smart , and teach you how to choose the most suitable deposit method for Taiwanese.

2️⃣ Start leveraged trading

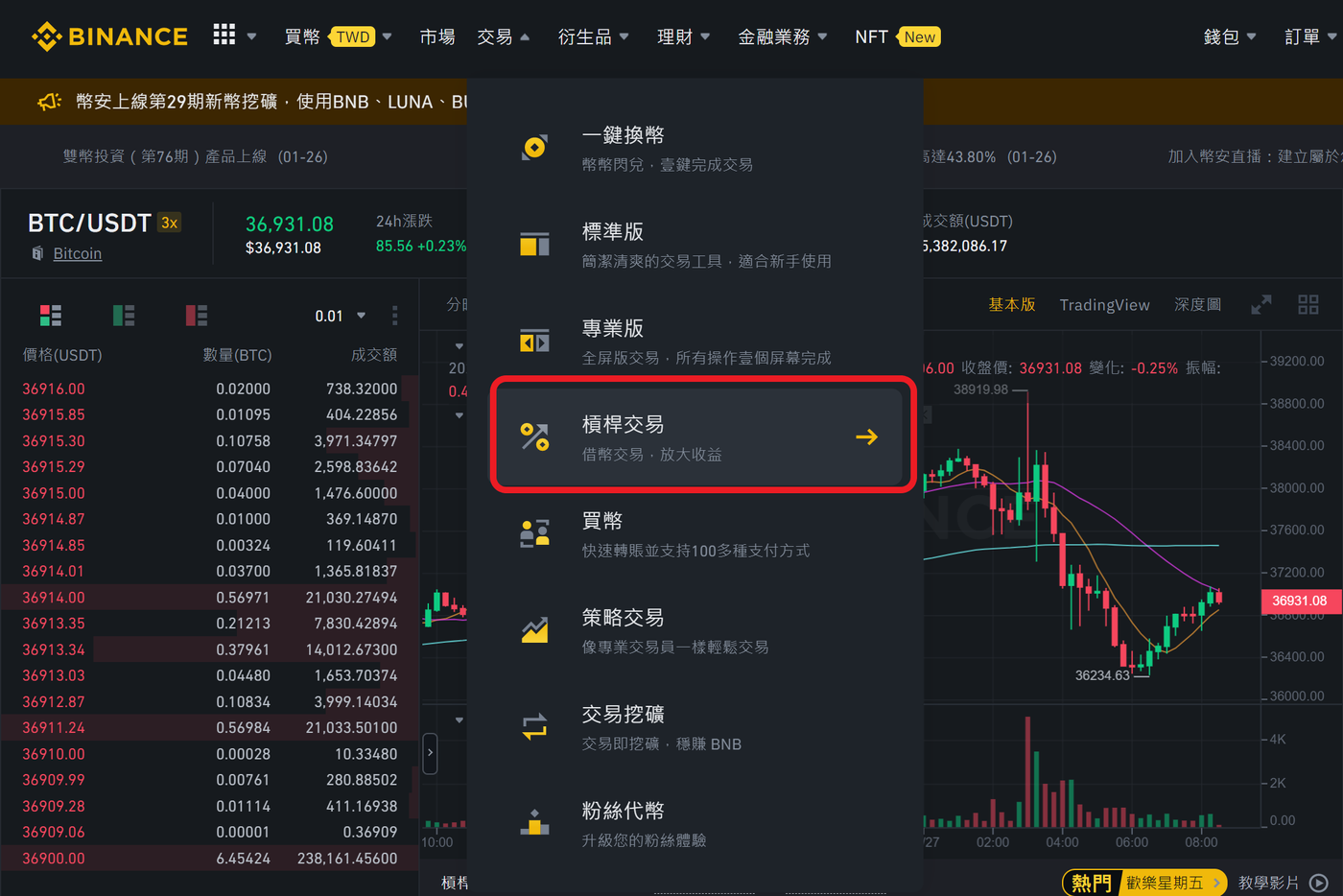

Enter the drop-down menu from the transaction, and click "Margin Trading" to enter the transaction page.

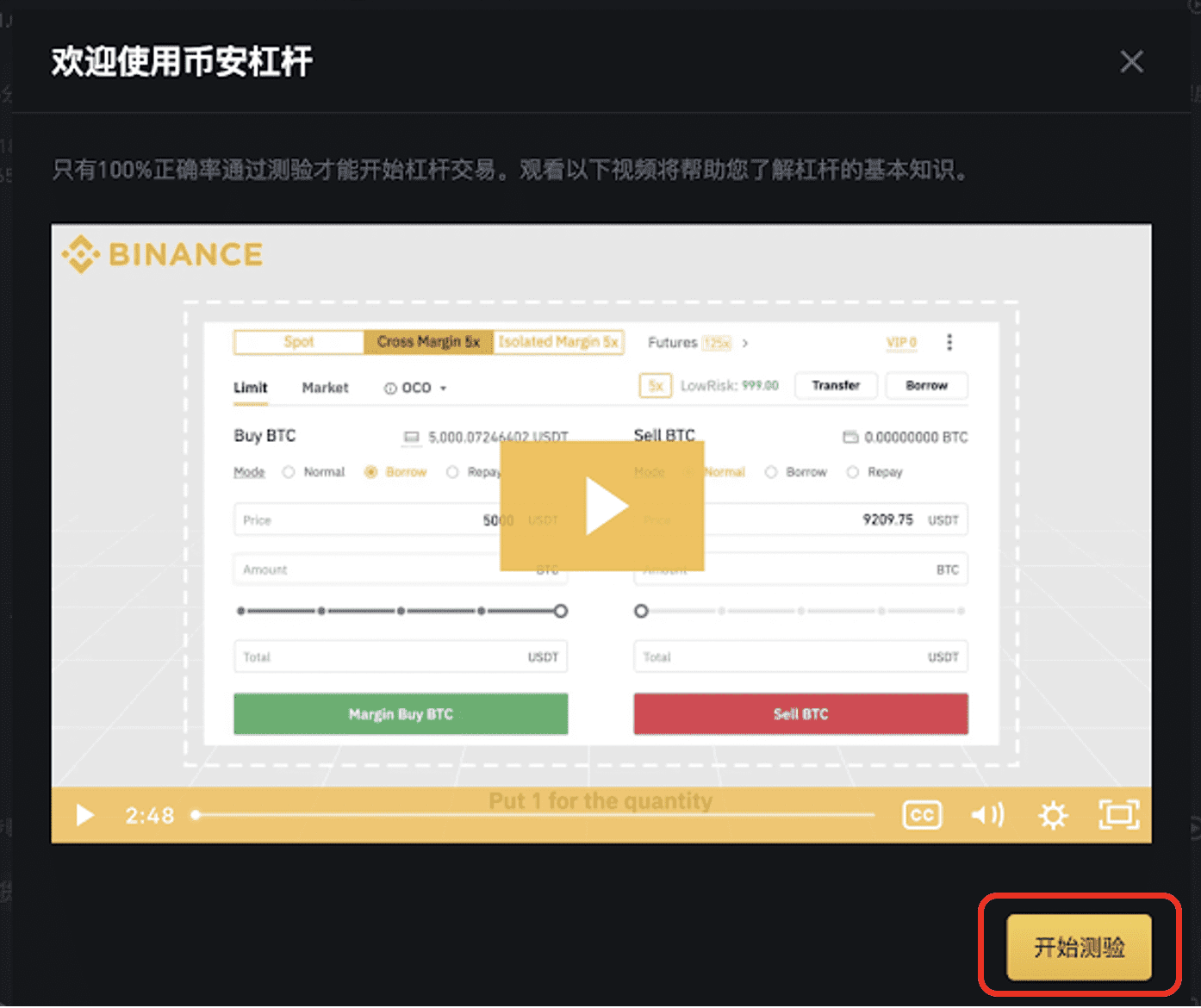

Step1. Complete the test first – this is a very interesting design on Binance, I think the purpose is to prevent novice Xiaobai from trading without any concept.

▼ Image provided by Binance Exchange

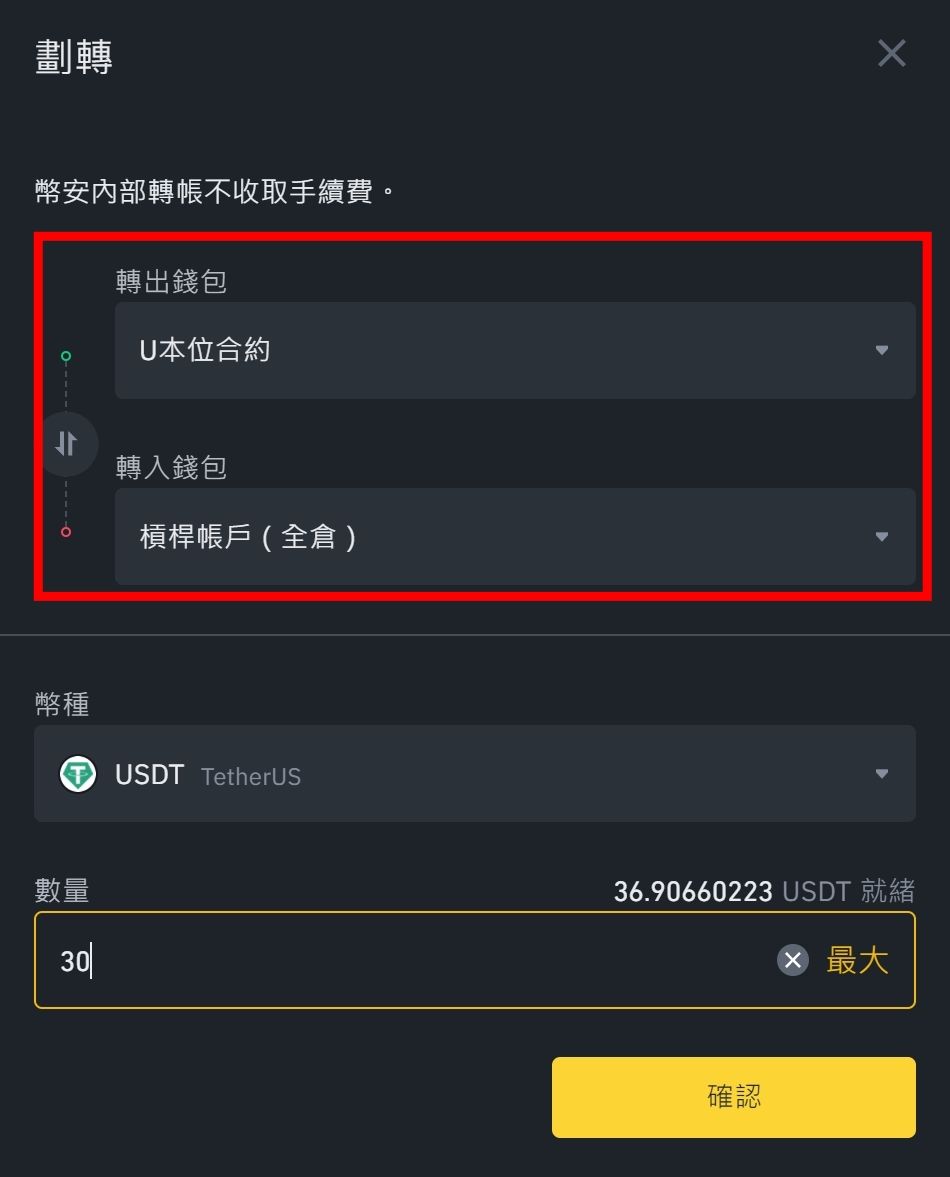

Step2. Transfer Margin-

Binance Wallet helps you to do a good job of classification, so the advantage is that you will not use other funds, and you can easily manage your funds.

Please click Transfer on the transaction box, and please complete the deposit action before.

After clicking the transfer, set the transfer out wallet to the transfer wallet, and the transfer wallet is divided into "full position" and "isolated position", what do these two mean?

- Cross position – the assets of the account can be shared and used.

- Isolated position - the assets of the account are calculated independently; that is, "sub-wallets" of different currencies are opened in the wallet to facilitate the management of risks and funds.

- Supplementary explanation – liquidation means that the “margin” in the account is insufficient, so the system will automatically sell the assets to repay. If a full-position user liquidates the position, all of them will disappear into the dust of the universe; and if an isolated user liquidates the position, only the sub-wallet will disappear, so there is a difference between a full position and an isolated position.

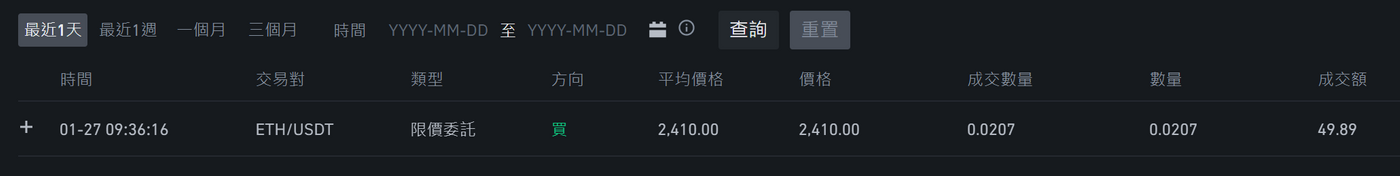

Step3. Place an order to buy-

There is a difference between a cross position and an isolated position. The isolated position has 10X leverage and the cross position has 3X leverage, which is also to ensure the safety of investment users' funds.

Here, the uncle chooses to buy ETH at the "limit price 2410". The limit price refers to a certain price that will trigger the purchase behavior.

After the purchase is completed, please leave your seat and do something else, such as drinking water or taking a nap. The uncle usually goes to pay homage to the ancestors, and there are blessings and blessings, do you think so? 😶🌫️

Step4. Place an order to sell –

When selling, please click "Automatic Repayment" first. The Chinese New Year is coming, and people have said that you have to repay the money before the year, otherwise it will be a whole year.

You can see the amount to be repaid at the place of repayment.

Basically this is a complete trade, but does it make money? Read on.

3️⃣ Build your own trading strategy checklist

As mentioned above, friends who are suitable for leveraged trading must make rational analysis and then use leverage to amplify profits.

Therefore, it is very important to establish a set of trading logic with a high win rate. The baseball theory of investment guru Warren Buffett - "Don't hit every ball." The way to increase the batting rate is to not "frequently swing the bat" first.

The next step is to find your own "sweet zone", which is the ball path that is easy for you to hit. To sum up –

Analyze → wait for a strike → swing hard

So first analyze and build your own trading strategy list is the first step to becoming a "good investor", sharing my list -

The above is the list I use to create contracts or leveraged transactions.

[Binance Leverage Teaching] 5 minutes to understand the calculation of margin trading fees and interest 1 analysis

[Binance credit card recommendation] 2 golden rules for depositing money that you must learn to buy cheap and buy smart

[Binance Contracts Teaching] Reflection on the five-character formula contract strategy commonly used by uncles after going bankrupt twice

[How to calculate Binance fees] Fee reduction plus 20% commission rebate code

[Is Binance Exchange Safe] 3 minutes to understand and join the digital investment life today

[Binance Exchange Teaching] Get back 20% of the handling fee before investing | Deposit and withdraw at one time

[Recommended by Taiwan Virtual Currency Exchange] 2022 Beginners must read Metaverse strikes first mover advantage

[Is MAX Exchange Safe] 3 Indicators Help Us Choose an Exchange

【MAX Exchange Tutorial】Taiwan's Best Cryptocurrency Platforms to Spend 5 Minutes Before Investing to Avoid Scams

[Likecoin Exchange] 3-minute teaching from wallet to ZB exchange to Taiwan bank

Binance Exchange FAQ

- What is Real Name Authentication (KYC)? If you have opened an account with a cryptocurrency exchange , there is a good chance that you will have to complete a real-name verification (KYC) review. Real-name authentication (KYC) requires financial service providers to collect and verify information about the identity of their customers. For example, this can be done via official identification or a bank statement. Like anti- money laundering regulations , real-name authentication (KYC) policies help combat money laundering, terrorist financing, fraud, and the illegal transfer of funds. Real-name authentication (KYC) is generally an active method, not a passive one. Most financial service providers obtain customer details as part of the registration process before the customer conducts a financial transaction. In some cases, it is possible to set up an account without real-name verification (KYC), but its functionality is limited. Binance, for example, allows users to open accounts but restricts transactions until real-name verification (KYC) is complete . When completing KYC, you may be asked to provide your:

- Government-issued ID

- driver's license

- In addition to verifying the identity of customers, passports are also important to confirm their location and address. Your ID will provide basic information such as your name and date of birth, but more information is required to determine your tax residence. You may need to complete more than one real-name verification (KYC) stage. Financial service providers are also often required to periodically re-verify their customers' identities.

- What are the benefits of real-name authentication (KYC)? The benefits of real-name authentication (KYC) are not all obvious. However, it does more than fight fraud and improves the entire financial system:

- By establishing a customer's identity and financial history, lenders can more easily assess their risk. This process leads to more responsible lending and risk management.

- Fight identity theft and other types of financial fraud.

- As a proactive measure, it reduces the risk of money laundering in the first place.

- Improve the trust, security and accountability of financial service providers. This reputation can have ripple effects across the financial industry and can incentivize investment.

- What is cryptocurrency contract trading? Cryptocurrency contracts are contracts that represent the value of a specific cryptocurrency. When you buy a futures contract, you do not own the underlying cryptocurrency. What you have is a contract that you agree to buy or sell a specific cryptocurrency at some point in the future.

- What is cryptocurrency spot trading? In the spot market, you buy and sell cryptocurrencies like Bitcoin and Ethereum with instant delivery. In other words, cryptocurrencies are transferred directly between market participants (buyers and sellers). In the spot market, you own the cryptocurrency directly and are entitled to financial benefits, such as voting for major forks or participating in staking.

Binance Exchange T3TWUI2E (Intimate Link)

More content related to "Binance Leverage Teaching" is in the subtraction life

Link to the original text [Subtraction Life Proposal] Your Uncle Subtraction - Laxi

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…