Omplexity顾问团队参与过全球超过六十个系统图绘製的大型专案,过往的合作客户包含Google, Hitachi, 广达, Nike, 微星科技, 联合国, 世界银行及世界经济论坛等机构等客户。 创办人薛乔仁博士毕业于哈佛大学与麻省理工学院,是国际知名的系统变革专家。 http://www.omplexity.com

System Archetype - Growth and Underinvestment (Part 2)

In the last article, we introduced the basic structure and related diagrams of the growth and underinvestment paradigm. In this article, we will show you how to apply it to the actual situation, and how to deal with it if it actually happens.

The Story of Electric House

Electric House is a manufacturer dedicated to the production of capital equipment. In the recession of the industry, the company has left a lot of energy. As the CEO of Electric House, Mark is also very cautious about the decision of whether to expand the company. Faced with the rising sales of the company's products, the undelivered orders began to increase gradually, from three months to four or five months. Mark believes that it is only a short-term improvement, and he does not want to increase investment. When the order had accumulated to six months, he finally agreed to increase the production line and expand the capacity.

However, it will take a year and a half to increase the volume, and customers in need have also found alternative resources. Although Electric House gradually got rid of the backlog of orders during this period, the increased sales volume is not the same as the original decision to expand production. Estimated sales vary. Later, when the economy got a little better, orders finally continued to pour in. Years later, when the company faced the same situation, Mark was even more reluctant to invest in capacity because he believed that demand could increase and decrease unpredictably.

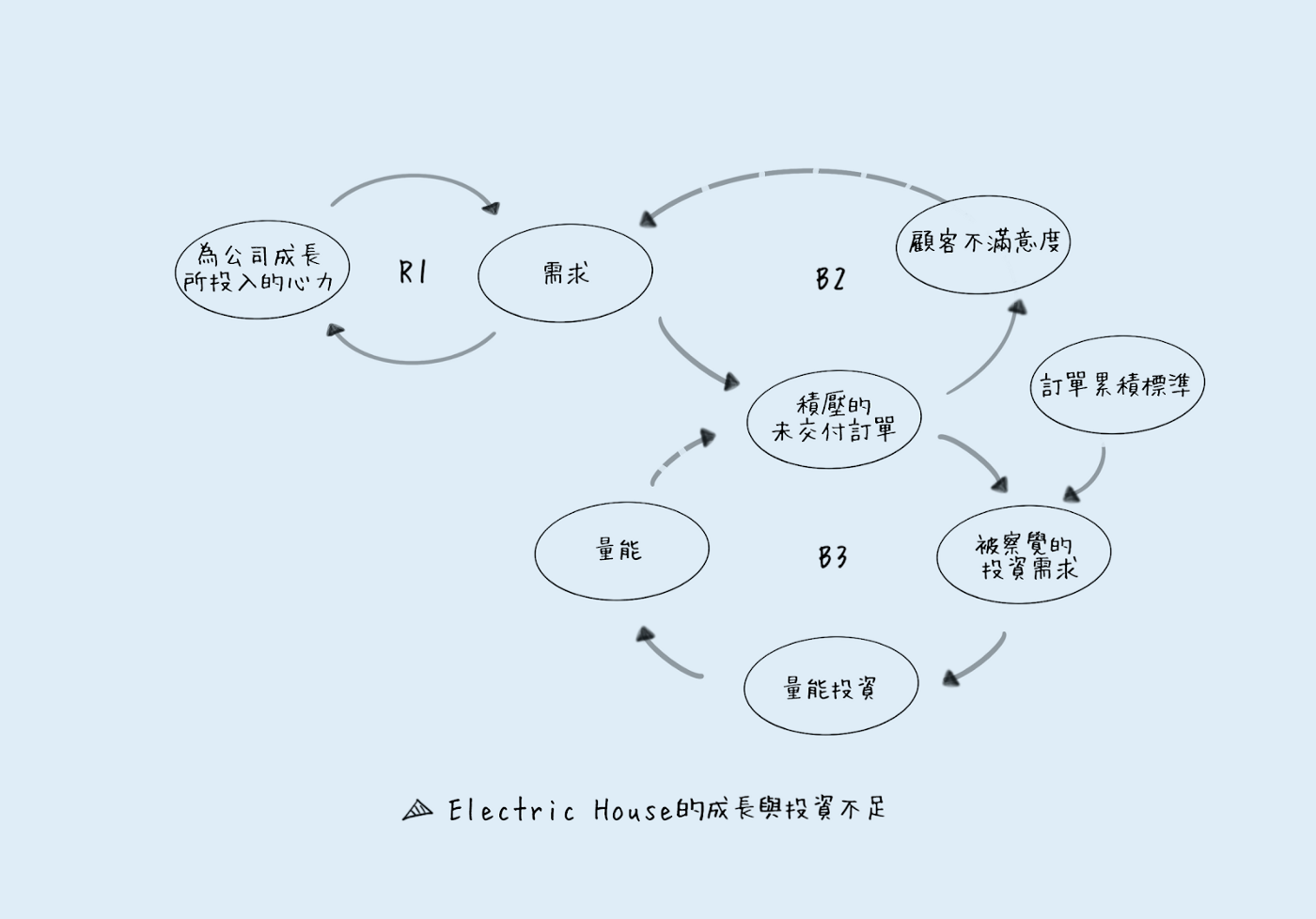

What if we applied the above story to the system archetype of growth and underinvestment? From R1 in Figure (1), we can see that in the past, Electric House put a lot of effort into the company's continuous growth, and the demand for the company's products began to rise, which stimulated Electric House to make more efforts. However, the growth in sales also increases the backlog of orders. When the demand continues to increase, Electric House's existing capacity will be even more impossible to meet the demand, and the undelivered orders will continue to accumulate. Disappointed, sales eventually began to decline (loop B2 in Figure (1)).

Electric House finally found that they needed to increase the supply of production capacity, but because there was a delay between the time when the production capacity was finally able to meet the demand, the consumer decided to invest, and then the actual output. Have left to choose other manufacturers. After a while, the increased capacity still solves the backlog problem, customers start returning, and even more customers are attracted, while the cycle of rising and falling demand and backlog continues.

Managing Growth and Underinvestment

To avoid a cycle of growth and underinvestment, we cannot let the system dictate the constraints we face, but rather the ability to anticipate and choose. That is, we need to have the ability to remove the constraints we face in the system in a timely manner. In practice, however, the system is also more difficult to process because it faces both the delay from when the energy investment is perceived to the decision to actually increase the investment and the delay between the decision and the actual change in the energy. Teach you how to deal with these two different time delays.

The delay from “the perception of volume investment” to the “decision to actually increase the investment”:

This lag involves recognizing whether current performance requires action and whether additional energy investment is needed. The following are some guidelines for managing such time lag.

1. Identify potential constraints early in the growth stage, especially in terms of volume and energy. Ask yourself "What will happen if our sales continue to increase? How should we respond in production, customer service, and delivery capacity?" On the other hand, if sales decline, what should we do?”

2. Make sure your internal systems are ready for growth If you have a more aggressive growth strategy, and your internal systems are slow and uncooperative, you may struggle to support continued production growth. For example, how long does it take your manufacturing team to ramp up production? If your salespeople can increase sales by 40% in a quarter, and your factory can only increase volumes by 20% in a quarter, you'll know that orders will be backlogged quickly.

3. Discuss the assumptions behind quantitative investment decisions. Past performance may be a reference when making a decision but should not be the main factor driving your decision. Instead, what you should do is to identify what market factors are driving growth now. If it is only a vague reference to past experience, it will be difficult to connect with current and future trends and needs.

4. Make sure everyone involved is aware of the assumptions behind the size of the potential market (mental model)

The above four points are factors that affect investment decisions.

Delay from "decision" to "actual quantity can change":

Once the investment is decided, the second lag occurs, which is the time it takes to convert the investment decision into action and allow the actual volume to increase. In many cases, things can turn bad before they get better. Underestimating how long it will take to lag may lead you to choose immature countermeasures that make the situation worse, for example, you may end up with too many orders by taking too many orders while waiting for capacity to come online required capacity.

market

Managing this archetype requires a correct and clear understanding of the stage the market is in. For example, is the decrease in demand due to a change in the market? Or is the market potential down because of the steps you took? When you're reviewing your company's performance, how do you identify whether the drop in sales is due to a problem with your company's strategy, or is it a phenomenon that's caused by changes in the market?

Traditional accounting methods and measures of business performance are mostly based on the assumption that organizations need to work hard to respond to various external events in the market that affect the state of the company. To know how our actions affect the external environment, we need to identify feedback loops that link our actions to market reactions. This process requires a deep understanding of the actual needs of customers and a sound preparation for the needs of the market we face. We must establish a link between customer needs and internal company standards. This link can remind us early when to invest and shorten the time lag between the detection of needs and the decision to invest. We can also shorten the time from decision-making to substantial change in volume, but in implementation we need to invest before we actually perceive demand, so we need a very clear understanding of the market, such as market factors (such as shipping, service, quality, etc.) , price, etc.) affect demand, possible constraints, competitor behavior, and key investment decisions (capacity, training, R&D, manufacturing processes, etc.) that affect system constraints.

Epilogue

Growth and underinvestment is a fairly complex schema in which time lag plays a key role. The system also incorporates many different dynamics, such as growth engines, constraints, and balance loops of goals. The growth and underinvestment archetype is actually a combination of the growth cap archetype and the drift target archetype.

Because growth and underinvestment describe the effort put into growth and investment decisions that involve different areas of the organization, from sales and marketing to manufacturing, it is important to think holistically to show the potential for bad outcomes. valuable.

If you are interested in systems thinking, please refer to our official website: Omplexity Systems Thinking Consulting Company

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…