野生咨询|内容教练|🎙空无一物/有效失败 亲密关系|多元思维|认知升级|成人教育 DAO/Crypto|🌍 世界公民 B站/公众号:范米索| 微博:斜杠少女范米索

Investors and Speculators

Two days ago, I posted a status on the social platform, talking about some people who are clearly doing "speculation" but don't think so.

I don’t intend to offend anyone by writing this article, but I just feel that the recent articles are just talking about my own investment thinking . This article also talks about “investment” and “speculation”, so that everyone can refer to some of their own decision-making behaviors. Whether it is investment or speculation.

Of course, I don't have any tendency to like or step down on these two words, because according to the following definition, some of my trading behaviors are also "speculative" behaviors, and "speculation" is not a derogatory meaning in my eyes. Words, but I will not belittle those "speculators" by touting that I am doing "investment" seriously, after all, I will slap me in the face in the end.

I always feel that being a human being must be honest with yourself. Even if you lie to the outside world, at least you must be basically honest with yourself. If you don't think you are a speculator, you might as well see what is investment and what is speculation.

(1)

Before understanding why "investment" and "speculation" are so indistinguishable, let's take a closer look at the historical origins of these two terms.

The words "investment" and "speculation" are both rooted in Latin.

"Investment" comes from the Latin investire , which means "to wear clothes". This meaning is preserved in the word "investiture" for the appointment of a new pope. The word "investment" literally means wrapping yourself in an asset.

According to the Oxford English Dictionary, this usage first appeared in English when Thomas Aldworth, an agent of the East India Company, wrote in a letter in 1613 about "goods and monies to bee inuested in commodities fitt for Englande." (Goods and money are invested in UK-appropriate goods).

While the term "investment value" was frequently used in the UK as early as 1720, it was not until the mid-19th century that the term "investment" was widely used for financial assets in either the UK or the US.

"Speculation" comes from the Latin specula , which means "lookout" or "tower", and from specere, which means "to see" (such as "foreground", "bystander" and "spectacle" and other related words, all related to seeing ). The earliest use of the term in the OED was Thomas Jefferson and Alexander Hamilton, who, in the late 1680s, discussed speculators who traded in the distressed debt of 13 colonies.

By the late 19th and early 20th centuries, most people saw bonds as investments and stocks as speculation. No matter how cheap or promising a stock is, this popular view of differentiation exists —

Stocks are considered inherently risky to the point that nothing can turn them into an "investment".

In an excellent 2006 article published in The History of Finance, the American Museum of Finance magazine, money manager Dennis Butler explores the historical context of Graham's distinction between investing and speculation.

Before the 1920s, Butler explained, investors were "people whose goal was to ensure absolute safety of income and principal." "Only bonds ... meet those requirements."

A speculator is anyone who seeks to "profit from changes in market value". Since stock prices change more than bond prices, stocks are a natural source of speculation.

In an article that Graham wrote for Wall Street Magazine around 1918, it was this distinction that manifested itself. Many investors told the author: "I never buy stocks. Let others speculate. All my money is in bonds."

In other words, today we speak of "investment" (assessing market prices based on fundamental values and then holding financial assets, especially stocks for years) and "speculation" (trading any financial asset for a short period of time, mainly The traditional definition of hoping for a better price from a "dumber fool") didn't exist in the early 20th century.

Back then, investors were people who bought and held bonds; speculators were people who traded stocks.

(2)

After the 1929-1932 crash, things changed a bit, although as Graham previously wrote:

"All common stocks are widely regarded as speculative in nature."

However, he wanted people to look at things differently, so Graham insisted—

Stocks can be investments, bonds can be speculative, everything depends on the price.

A stock is an investment if its price is cheap relative to its underlying value as a cash-generating business.

A bond is speculative if it trades above its maturity value and all future interest payments combined.

In Graham's further explanation, this definition evolved into-

All assets are "investments" when their market prices are cheap relative to their underlying value, and "speculations" once their prices climb well above their value.

He even pointed out on page 12 of his 1963 speech that the same asset can be both investment and speculation : stocks have fundamental investment value, often overlaid in a speculative bubble.

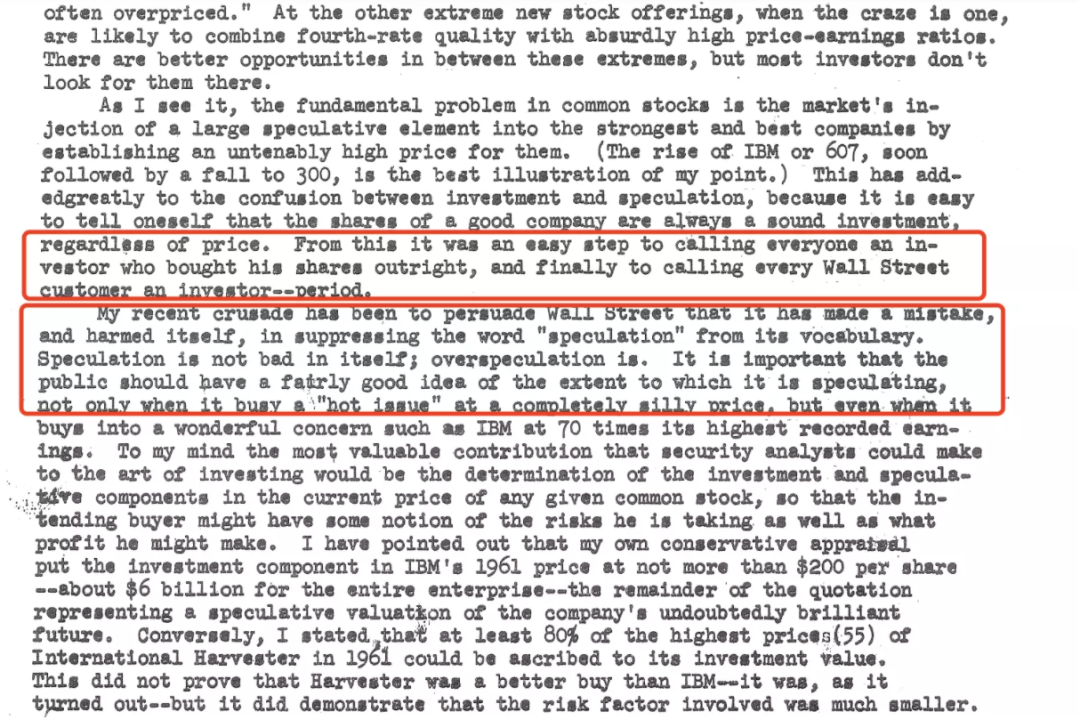

You can carefully watch the red part of the 1963 speech

Included at the end of this 1963 lecture summary, Graham mentions:

"Investors have to recognize that there is uncertainty and speculative elements in any policy he follows - even a whole-of-government bond program."

In this sense, Graham has even blurred the distinction between the two, but Graham has always insisted that investors and speculators should not be mistaken for each other.

The Wall Street Journal itself has long confused investors with traders or speculators, and continues to do so today.

On July 12, 1962, the Wall Street Journal published a letter from Graham criticizing an article the paper published the previous month titled "Many Small Investors Bet on Further Falls, Intensify Short Selling."

The report made Graham furious, and said: "If these people are investors, how should 'speculation' and 'speculators' be defined? There is currently no distinction between investment and speculation, not only for individuals, but for the whole The financial world could do serious damage -- as it did in the late 1920s."

What's even more interesting is that just two days ago, exactly one piece of news triggered violent fluctuations in the stock market for a few hours-

"Securities Times" reported: After the news came out, there was a panic sell-off after 9:30, and technology stocks led by Alibaba plummeted. Among them , Alibaba once fell by more than 9%, Jingdong Group fell by more than 8%, and Xiaomi Group fell by more than 6%. The Hang Seng Technology Index tumbled more than 4% at one point.

If you choose to tighten your belt and sell stocks just because of the Ma news, do you consider yourself an investor? Of course even the smartest investors can be tainted by speculative thinking.

In their seminal book, Security Analysis (1934), Graham and David Dodd attempted to define investment and speculation precisely. "An investment business is one that has been thoroughly analyzed to guarantee the safety of principal and a satisfactory return. Operations that do not meet these requirements are speculation."

Investors will never buy just because the price of an asset is rising, nor will it sell just because the price of an asset is falling. Investors use internal sources of return—dividends, future profits, or asset values—to estimate the value of an investment.

Speculators buy and sell based on recent price movements. A speculator uses external sources of returns—primarily what he thinks others are likely to pay—to estimate the value of speculation.

(3)

Regarding the definitions of "investment" and "speculation", he has been constantly adding explanations from his speeches and books. I think it is difficult for even an investment guru like Graham to define these terms strictly.

Graham's best student, Warren Buffett, has a definition I agree with:

An investor is someone who seeks a return from the underlying asset itself, be it stock gains/dividends from the underlying company, or rent from real estate (in the case of real estate). Speculators, on the other hand, seek returns from pure price appreciation.

Also in my opinion, investors see stocks as a business and speculators see stocks as a ticker symbol. In the investor's mind, he/she is the owner of a sound and profitable business, while in the speculator's mind, he/she is playing a zero-sum game trying to beat the rest of the market. Investing means long-term ownership, while speculation is more of a short-term trade.

Harindra, president of Analytic Investors, has a point that I think is interesting, he said, the key difference between the two is that investors calculate expected value: weighing how much you will earn if you are right, and if you are wrong, you How much will be lost.

If we flip a coin, assuming it's heads, I'll pay you $200, and assuming it's tails, I'll charge you $100, which has a positive expected value of $50 for you.

50% chance to win $200 = $100.

50% chance to lose $100 = -$50.

[$100 + -$50] = expected value of $50.

If you make a bet with a negative expected value, say, playing roulette, then you are speculating, and even if you hit the jackpot, that doesn't make it an investment.

If the expected value is positive across all possible outcomes, it is an investment. But you have to be clear about doing these calculations to be able to say that its expected value is positive.

In short, if you only ask how much you'll make if you're right, but not how much you'll lose if you're wrong, then you're speculating, not investing. You can buy lottery tickets to make money. But you can't say it's an investment.

That doesn't mean speculation itself is a bad thing, though.

Who would investors buy from or sell to if there were no speculators? How can risk move quickly and cheaply from those who don't want to take it to those who do?

Coincidentally, Graham also warned in "The Intelligent Investor",

The most "unsmart" thing you can do is "speculate when you think you're investing, because the resulting losses may keep you from participating in the market at all.

Of course he also gave advice:

"Set aside a portion of the smaller the better in a separate fund for this purpose. Never add more money to this account, never mix your speculative and investing businesses in the same account, and never mixed in any part of your mind. "

Back to myself, I don't think "investment" and "speculation" are completely opposites, they have the same goal, they both have the instinct of capital to chase profits.

Investing includes speculation, and speculation includes investment. The main focus of investing is the value of the asset against which it is invested and the expectation that it will yield the expected return (i.e. profit), with less emphasis on price volatility (which is the speculative component).

Speculation, on the other hand, focuses primarily on price fluctuations in the expectation that it will generate a desired return (i.e. profit), rather than valuing the asset.

In our real life, if the investment behavior is not implemented in place, it will become a speculative behavior; if the speculative behavior encounters a coincidence, it can also become an investment behavior.

You can invest or you can speculate/speculation can be a serious business and not just gambling. For example, Wall Street legend Jesse Livermore, although his ending is regrettable, his personal experience and the trading skills and methods he shared are of extraordinary and unique value to novice or veteran investors.

But looking back, I think the revelation of what Graham said still holds true today—

“speculating when you think you are investing”

(Speculate when you think you are investing)

“Never mingle your speculative and investment operations in the same account, nor in any part of your thinking.”

(Don't mix your speculating and investing operations in the same account, or in any part of your thinking.)

The popular interpretation of his words is nothing more than to see whether you are investing or speculating, and adopting corresponding strategies will greatly help you avoid the risk of property loss.

I think whether you are "investing" or "speculating" at the moment, putting aside your prejudice against parts of speech and re-examining your behavior may, to a certain extent, allow you to avoid falling into some unknown pits and rethink your own Strategy.

Weibo @ slash girl Fan Misuo

Immediately @fanmisso

Podcast @Nothing

Telegram group: https://t.me/misso0513

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…