Cathy Tsai | 蔡凱西 台北人 / 不專業旅人 / 流浪中的學術人 / 研究旅行史與旅行文化的不良歷史學徒/《後綴》假掰文青誌編輯群 在出門旅行、閱讀,與作古的旅記文本中持續穿越 佛系粉專:https://www.facebook.com/travelhistorystory 合作邀約:misiaa2001@gmail.com

Stunned by the mobile phone tax declaration

It's been many years since I got a tax return trial calculation form and sent it directly online after confirming it online. I didn't receive the trial bill this year, so I wondered, and I thought it was due to the fact that it was due to the Labor Day holiday, so it would be sent more slowly.

From the netizens on the noise side, I learned that it is not simple to not receive the trial calculation sheet, and not everyone is eligible for the trial calculation. I went to the official website of the Internal Revenue Service to check. I didn't receive the trial bill because I had "business income" (authority fees and speech fees) last year. In fact, I also received the announcement and wrote the manuscript the year before last, but I also received the trial bill, what the hell?

In short, I made sure that the trial calculation sheet will not be sent to me, so this year I have to open the software to declare it.

So these days I have been thinking, should I use my mobile phone to file tax returns, or should I download online tax filing software?

Back then, I was still working as a tool for reporting/tax rebates. When I reported parent support, the most annoying thing was the deductions for medicine and insurance, because the elderly had a lot of medical and insurance documents, each of which had to be entered manually. Whether to use the standard deduction or the enumerated deduction, and which one can get more tax rebates, must be actuated.

The most irritating part of being a tax filing/tax refund tool is here. If I don’t get the adults’ satisfaction, I will be questioned immediately:

How is it possible to withdraw so little, did you make a mistake?

Can't even do this well!

Because after my siblings got married and had children, I no longer played the role of a tax reporting/tax refund tool, but my parents automatically became tool workers, reporting to support their parents for daughters who work and have a family, and got a "no need to pay the treasury". tax refund. A single tax refund tool, like me, did not have this kind of good health back then. After the declaration, my mother would keep asking about the progress of the tax refund, and kept thinking:

The mother on the fourth floor has received the tax refund notice, why haven't we received it yet?

Are you wrong? Otherwise, why haven't we received it yet?

In fact, I didn't want to smear the tax rebate, and he didn't lack the tax rebate to buy vegetables. I don't know why he asked so urgently.

Although I have become a retired tax tool person, the historical memory of tax filing is still in the era when listing deductions required a lump-sum input.

Thinking of last year, my arm was strained and I went to traditional Chinese medicine for acupuncture every week; I went to the emergency room during the three-level alert period, and I had laparoscopic surgery at National Taiwan University. I left a bunch of bills for medical treatment, which should all be deductible, so I downloaded the computer version first. software, ready to enter data.

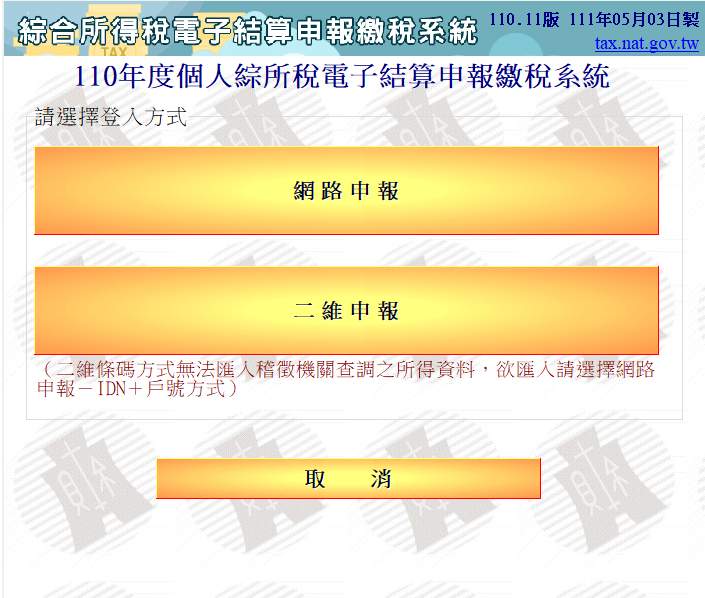

After opening the software, I found that the interface of this thing is no different from the time when I was still a tool person. Even the QR code tax declaration still exists. A few days ago in Xiangte City, I chatted with @Chin about 2D declaration. . In the morning, I chose to file tax returns online.

After reading the information that was automatically brought in for a while, I jumped to the deduction section. Compared with the tax declaration software of the year, I had to input the amount of the documents one by one and then try to calculate. This time, I found that, including health insurance premiums, private insurance, and medical expenses, all can be brought with me. When I entered the information, especially when I saw that the amount of the surgery fee was exactly the same, I knew that I didn't need to be as rigid as before.

However, the computer version has to be archived and sent online, as well as printed paper delivery. I currently don’t have a printer to print a ghost. So I thought about it, since any income and expenditure information can be automatically brought in, let's try to file tax returns on the mobile phone.

Use your mobile phone to connect to the 4G network, verify the phone number, and you can use it. The first screen will immediately display the tax refund amount for this year, which is the same as the amount calculated by the computer version software, and then confirm your personal information a little, fill in the tax refund account number, and three Minutes are over, download the receipt, and you're done. So far north! Also too far north for the convenience. The tax declaration interface of the mobile phone is so amazing to me that I am terrified!

Next year's tax return, I decided to continue to be you!

If you are free, pay the tax quickly! Time to sit on the toilet can be done.

- Appreciate Citizen 2.0 Subscription Sponsorship: https://liker.land/cathytsai/civic

- A Buddhist fan who doesn't work hard on Facebook: " Those things travel history taught me "

- You'll see me here too:Checkered VOCUS | Medium | hkese.net

- If you want to cooperate, you can come to me here: misiaa2001@gmail.com

- Welcome to my share referral link: MAX Exchange | Noise.cash

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…