軟體工程師,加密貨幣基金管理者,遊戲玩家。 近期興趣是 Elden Ring! https://twitter.com/michael_icwang https://medium.com/@michael_icwang

Observe market changes and re-plan

I started a weekly rise on 9/8 , and the beginning was smooth. However, on the evening of 9/13, the US announced the price index, and inflation concerns were still there. The index is back at its recent high (110).

I used to buy long positions on the weekly line. Later, I judged that the increase was too fast, and I sold them in two batches (since it is still in a bear market, I will be conservative with long positions, and usually sell them actively. If in a bull market, this way operation will miss many opportunities).

When I sold it, I was thinking of waiting for the market to cool down a bit before picking it up, because at the time I was still bullish on the weekly chart. But after the 9/13 crash, I tried to connect low as originally planned, but after the market calmed down a bit with me, my analysis came to a bearish judgment, so I canceled the weekly rise plan and connected low. The parts were later sold at a small loss.

Market situation

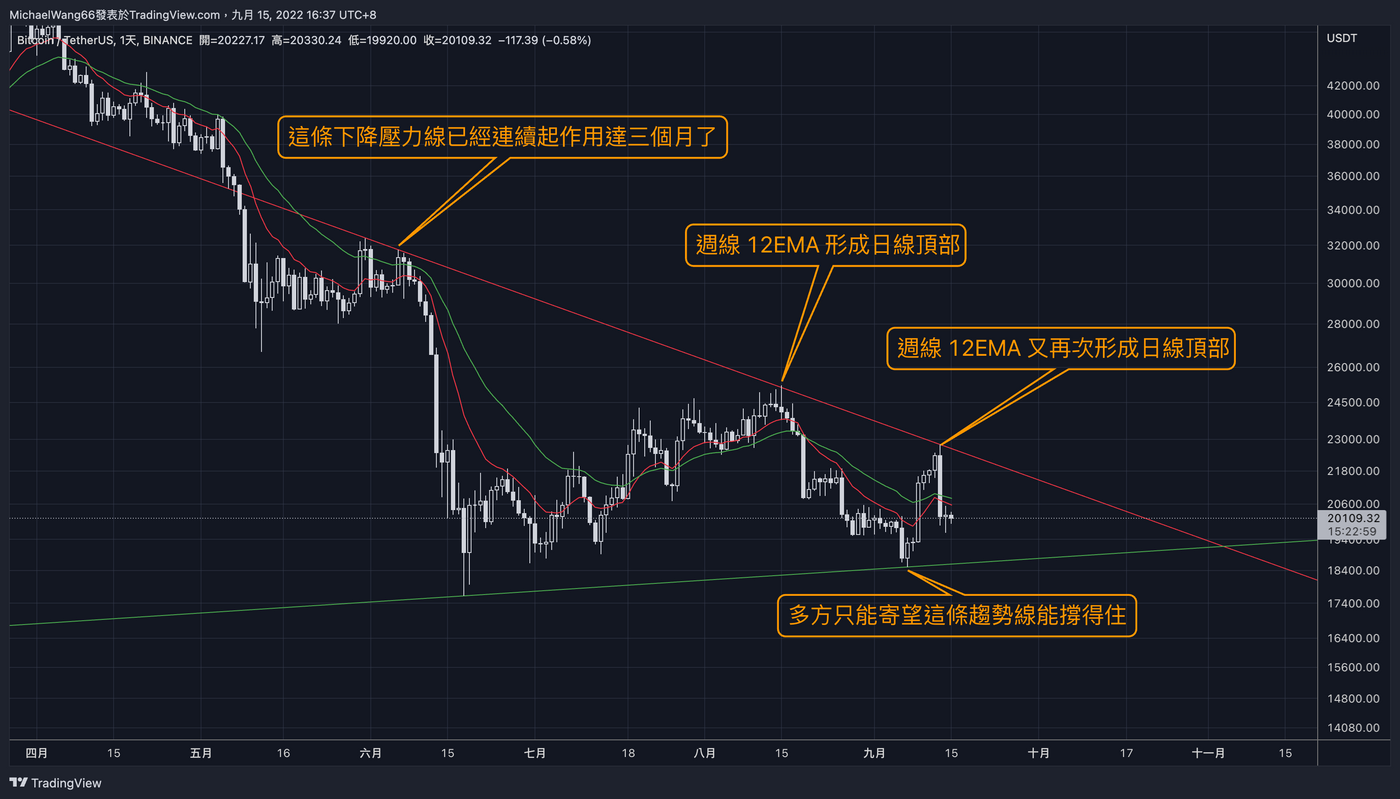

Let’s first sort out the trend of BTC on various time scales:

- month line down

- Weekly confirmation

- The daily line is confirmed, but bearish, because the increase since 9/7 has fallen by 70+% (within 38.2% is regarded as overly, 50% is neutral, and over 61.8% is regarded as bearish)

As can be seen from the above picture : the red descending pressure line has been confirmed three times, and the last two times even overlapped with the weekly 12EMA, which shows that the pressure from the weekly moving average is very obvious.

On the daily line, it can be seen that the rally since 9/7 has been very fierce, and no support has been established during this period. Therefore, when the market falls sharply, there is no resistance to quickly fall back to the starting point.

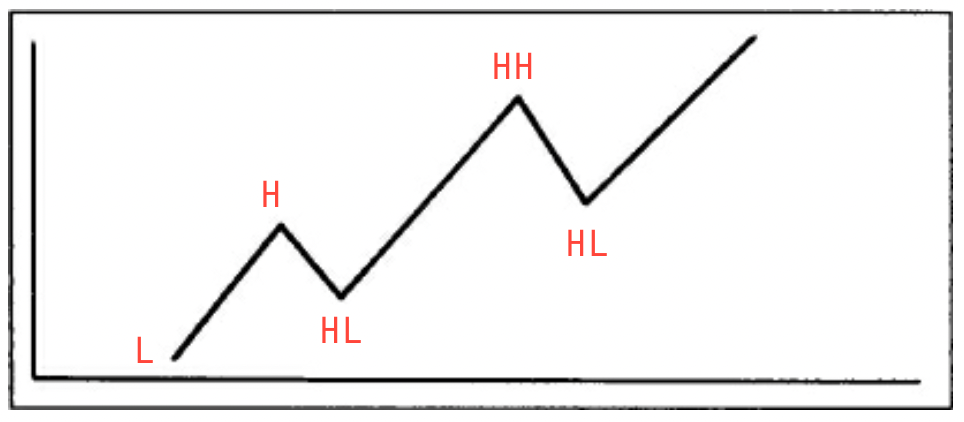

Here I would like to review a basic concept. The establishment of an upward price trend requires: Low, High, Higher Low, and Higher High:

In the price action since 9/7, there are only L and H, and HL has not yet appeared, so it cannot be said that an upward trend has formed. This is the main reason why I gave up the weekly upward plan: there must be a daily upward trend before it is possible. Weekly uptrend.

Of course, you can say that it is possible to form HL in the past two days, but from the perspective of the magnitude of the fall, the chance is not large. The only hope for the bulls here is that there are buying orders below $20,000, but from the price behavior of BTC itself, to the stock market, to the changes in the US dollar index, all the negative factors are currently seen.

Here I would like to remind that in the modern trading market, technical analysis cannot only look at a single asset, because there are programmed transactions. Many funds are now traded through programs, and these programs will look at the price linkage between different assets. For example: BTC has obviously been negatively correlated with DXY for more than a year, so when DXY goes up, you will see BTC Unexpectedly, it was sold. In addition, I have observed many times that the US stock SPX line rose sharply in five minutes, and BTC also rose in less than five minutes. I think these are the results of programmed trading.

So some BTC fundamentalists will cry out: Bitcoin "should not" follow the stock market up and down, but the reality is "will" follow the stock market up and down. Maybe one day these linkages will disappear or even the other way around, but it hasn't happened yet.

So we have to pay attention to US stocks :

The trend of U.S. stocks is actually the same as BTC (to be precise, BTC is the same as U.S. stocks): the monthly line is down, the weekly line is unclear, and the daily line is unclear. With inflation concerns still lingering, if the Fed raises interest rates in September or even all the way to the end of the year, it is unlikely that the bottom will be here for the stock market. What the stock market rose last week was the advance plan of "cooling inflation and cutting US dollar interest rates", and now it seems that the pressure is wrong.

The dollar is undoubtedly in an uptrend :

The monthly, weekly, and daily lines are all in an upward trend. From 9/12 to 13, it was about to fall below the daily low, but as soon as the CPI price index came out, it immediately bounced. Look back, unless 9/21 The daily FOMC interest rate decision can be lower than three yards, otherwise there is no opportunity for the dollar to weaken.

my action plan

Observed.

I know that rewards come from risk, but professional traders should choose to play in their favor. After the 9/13 slump, the favorable situation in the short term is: if the price rebounds, find a 4H or 1D high and sell short.

However, my own short trading record is not good, and BTC has been in a bear market for more than nine months. I think the risk-reward ratio is not high for shorting here. So I choose to watch, watch the market reverse there, and after the reversal I buy and go long.

I used to make the mistake of thinking that the market had "fallen enough" after a slump, and even took the RSI to boost my confidence. Then add all the way down, until you can't bear to give up and sell, and then it's amazing, the low comes soon, and the market quickly reverses upward.

Now I would say:

- After the price enters a downtrend, it is impossible to guess in advance how long the trend can continue.

- The RSI in the downtrend is useless at all, the RSI can be as low as 20 or even 10, and then the price hovers for a while, just to let the RSI warm up and continue to fall.

- Only when the RSIs on multiple time scales reach the sell timeout at the same time, the market is prone to buying (because the experts and the program trader are looking at the combination of these conditions). Therefore, the most ideal overselling at present is weekly, daily, 4H, 1H, or even 15min, 5min RSI overselling at the same time, and now the daily RSI is still above 40, which is far from overselling.

So if I'm not sure about the market outlook, I'll lower the spot ratio, by how much? Everyone's standards are different. Some people are only willing to keep 30% of the total funds, some people choose 50%, and some even say that Bitcoin is only reserved and not sold, so he chooses 100%.

I think about it like this: keep 70% in the bull market (the risk of the bull market is to miss the price increase, so choose to keep more positions in the spot), and keep 50% at other times, regardless of the bear market or uncertainty.

a little emotion

Trading has been difficult since the beginning of this year, especially for stock market traders, because the stock market has basically risen year after year in the past ten years. If you buy the wrong ones at the beginning of the year, most of them will rise back at the end of the year, but this year is a relatively rare year of decline. You have to do the opposite of previous years to make money easily: don’t buy easily unless there is a clear bottom, but you must be aggressive in selling, and you must run if it rises for a week or two.

In Taiwan, I was very impressed. Last year, everyone was talking about TSMC (2330), and young people talked about it the most, and they often heard about depositing shares. I always think that it is because the stock market has risen ten times due to the printing of money by the central banks of various countries. For a few years, it seemed reasonable to save stocks, but now the evil effect of money printing has emerged, inflation has emerged, the central bank has been forced to tighten currency, and the stock market has entered a downward trend. Who knows how long it will take, take a look at the Japanese stock market :

Thirty-two years have passed since the economic bubble burst in 1990, and the broader market has not even returned to its highs and lows. Think about the young people who started to "save stocks" in the 1990s. They should be in their 50s or 60s this year. I don't know what they have saved...

Ah, are you talking about cryptocurrencies? We in the currency circle will only smile contemptuously when we see the Nikkei stock price chart. This chart is still healthy in our currency circle. It is healthy to put on a respirator and still breathe. A file for your reference:

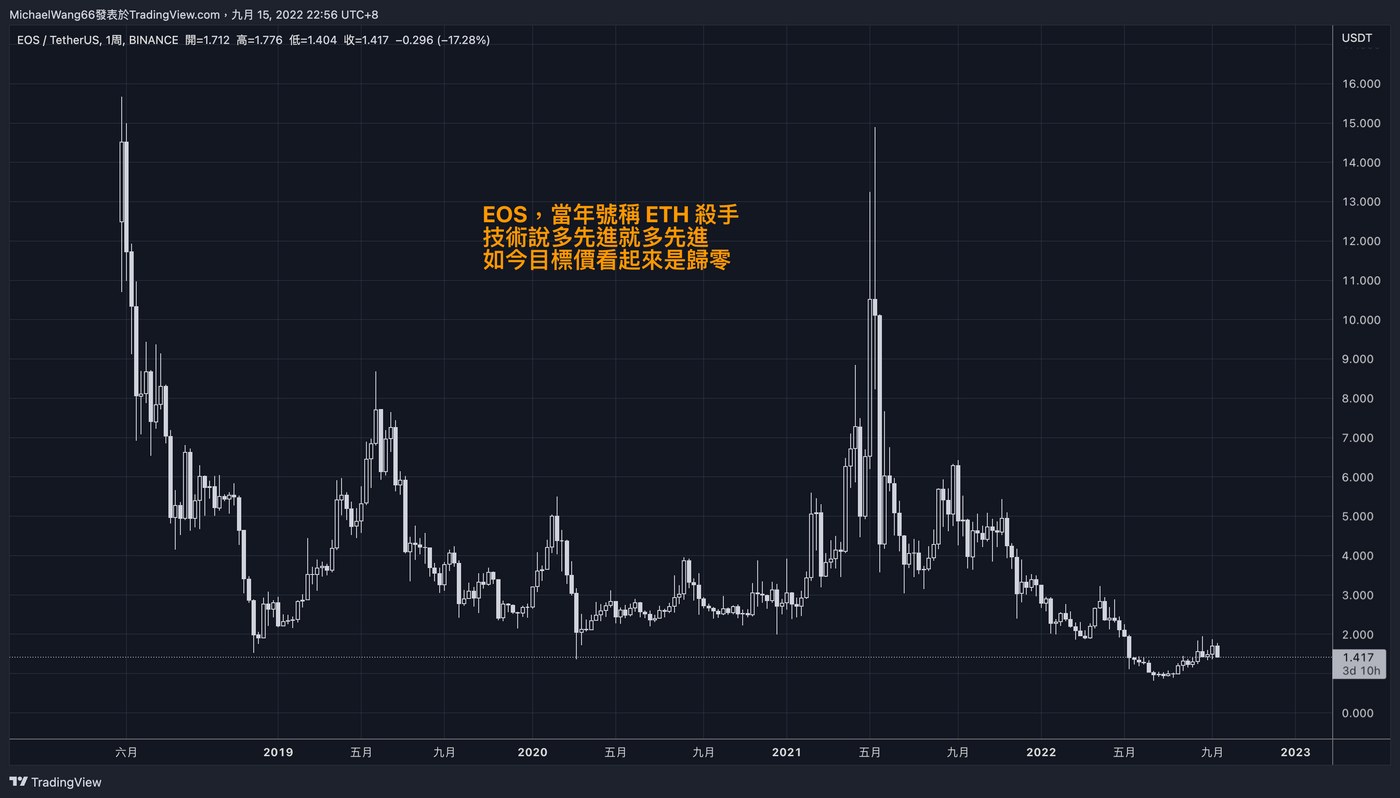

EOS, known as the killer of Ethereum back then, said how fast the block speed is, the faster the transaction speed, and how convenient it is to develop smart programs on it, but after more than three years, it is obvious that the target price is zero.

In fact, in the currency circle, very few people really know the value of the things they buy. I have known about Bitcoin since 2017 (it's very late, I know), and I studied it carefully in 2019. The white paper written by Satoshi Nakamoto found If I read it carefully, I still only vaguely know the concept of decentralization, and probably know what problem I want to solve. I read Lyn Alden's article A Look at the Lightning Network in 2022, and I am still surprised that I can learn a lot of in-depth Concept, the most basic BTC has such a steep learning curve, not to mention the advanced Ethereum, and thousands of cryptocurrency projects.

I rarely talk about fundamentals now. Trading is about looking at price action and using technical analysis. However, with the recent changes in the world situation, please allow me to say a few more things about fundamentals. In this era of a strong dollar, many national currencies have reached a historical juncture, and the Japanese government with unlimited quantitative easing cannot help but intervene. The yen has depreciated, and we seem to have come to the end of the big debt cycle. I don't know when the US dollar will go bankrupt, but I know that the situation of currencies other than the US dollar will only get more and more difficult.

In the era of globalization in the past, as long as major countries held a summit together, they usually compromised to reach a solution, whether it was the Bretton Woods agreement after World War II, the US dollar abandoned the gold standard in 1970, and the IMF intervened in the Asian financial crisis in 1997. Finally, in the 2008 global financial crisis, the global central bank entered the era of money printing, and there is no going back.

In the epidemic that started in 2020, the central banks increased their efforts to print more money, and banknotes finally flowed into the real economy from the investment market, and inflation came. From many perspectives, from countries to corporations to individuals, we've all eaten up our capital, and what follows is an era of bankruptcy: central banks can't print more money, and can't really tighten money because of inflation , because the fiscal deficits of various countries are extremely high, raising interest rates means that the interest paid by bonds will increase, and in the era of low economic growth, paying interest is more and more difficult for companies and even countries.

Conflict between major powers is on the rise, globalization is disintegrating, and human beings are replacing "negotiation" with "conflict" to solve problems, and we all know that conflicts can only create new problems.

Many people will say that in such an era, "guaranteeing capital" is more important than making money, but what capital do you want to protect? The global reserve currency, the U.S. dollar, has already reached the end of the big debt cycle. How can the currency in your hands and me preserve capital?

Modern currency cannot guarantee capital. Scholars have invented a very magical theory called Modern Monetary Theory (MMT for short). It is a genius to assume that the economy will grow forever, so currency can always be printed, as long as there is demand in the market . They forget that there is only one earth and limited resources, and we are far from colonizing other planets, the government is happy to accept MMT, because it is none of my business to keep children and grandchildren in debt.

And I just want to remind the world of this obviously unreasonable fact.

To preserve capital, you must first know that “what is rare is precious”, real estate is limited, so capital can be preserved. There is a cap on the amount of gold that can be mined each year, so capital can be preserved. Under the premise that the network can operate, Bitcoin can be guaranteed.

Although these things can preserve capital, prices are fluctuating under the open market, real estate prices can be cut in half, gold prices can rise and fall, Bitcoin... you know. Guarantee means that the giant ship of the times changes chapters forward. Only when the real chapter is seen will we know who can guarantee the capital, and the value of these things will only emerge at that time.

I used to talk about these concepts more often, but as the situation has changed, it has become more and more dangerous to talk about them. Emphasize that inflation is only temporary (transitory), this year the Fed will tell people to tighten their belts to prevent inflation, please, everyone knows that the Fed is behind reality, and next year it will say that the recession is serious, and it will be sharp rate cut.

The fact is that monetary policy has long been out of touch with reality. It has been since 2008. In Taiwan, the government told me that inflation is 2% - 3%. The truth is that this year alone, food will rise by at least 5%, and oil prices will definitely rise by more than 10%. , Business people feel more that the cost of raw materials is rising by 10% - 30%.

The facts are clear, officials and scholars are out of touch with reality.

It's dangerous to talk about this in some places, and you can talk about it in some places, but it's usually just a pair of blank eyes in exchange. I'm just a peasant, I just want to take care of my family. Since you read my article, you should be reluctant to listen to it, think about it, and thank you for your support.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…