看看、试试、想想

Rare earths – a trade war weapon? (an old article)

Looking at the entire history of the development of the rare earth industry, it feels a bit like reading a novel. The main line is the development of the rare earth industry, and the hidden line is the subsequent pollution and corruption. The bright line is the game between China's rare earth industry and the international rare earth industry, and the dark line is the international rare earth industry. Continuous exploration of resources.

I will only list the facts and data, leaving it up to the readers to make their own judgment on whether it is feasible to use rare earths as weapons in a trade war.

Rare earth basics:

definition

"Rare earth" refers to the lanthanide elements in the periodic table of chemical elements - lanthanum (La, atomic number 57), cerium (Ce, 58), praseodymium (Pr, 59), neodymium (Nd, 60), promethium (Pm, 61) , Samarium (Sm, 62), Europium (Eu, 63), Gadolinium (Gd, 64), Terbium (Tb, 65), Dysprosium (Dy, 66), Holmium (Ho, 67), Erbium (Er, 68), There are 17 types of thulium (Tm,69), ytterbium (Yb,70), lutetium (Lu,71), and two elements with similar chemical properties to the lanthanide series - scandium (Sc,21) and yttrium (Y,39) The general name of elements, English is: Rare Earth or Rare Earth Elements.

As the name suggests, "rare earth" should be very rare, but in fact the content of rare earth elements in the earth's crust is roughly on the same order of magnitude as copper. The only truly rare element is reflective and unstable promethium. The reason why copper is common and rare earths are scarce in the impression is mainly because copper mines are concentrated, while rare earths are dispersed, and the difficulty of refining is also very different.

Classification

Rare earth elements can generally be divided into two groups:

Light rare earths (also known as the cerium group) include: lanthanum, cerium, praseodymium, neodymium, promethium, samarium, europium, and gadolinium

Heavy rare earths (also known as the yttrium group) include: terbium, dysprosium, holmium, erbium, thulium, ytterbium, lutetium, scandium, yttrium

Or divided into light, medium and heavy,

Light rare earths: lanthanum, cerium, praseodymium, neodymium, promethium

Medium rare earths: samarium, europium, gadolinium, terbium, dysprosium, holmium

Heavy rare earths: erbium, thulium, ytterbium, lutetium, scandium, yttrium

However, there are slight differences in the specific divisions between different domestic departments or internationally.

Heavy rare earths have much less reserves than light rare earths, but on the other hand they play an irreplaceable role in military industry and other fields.

characteristic

Rare earth elements are typical metallic elements. Their metal activity is second only to alkali metals (lithium, sodium, potassium, etc.), but more active than other metal elements (aluminum, zinc, iron, etc.).

Excellent optical, electromagnetic and other physical properties mean that when trace amounts of rare earth elements are added to other materials, the quality and performance of products can often be greatly improved. Therefore, they are known as the "vitamins" of modern industry and are widely used in aerospace, electronic information, and new technologies. Materials (especially permanent magnet materials) and high-tech fields such as new energy and nuclear industry, especially the military industry, none of the ten key areas proposed by the "Made in China 2025" strategy can be developed without rare earths.

In the past, industrial products such as catalysts, polishing, ceramics, and phosphors consumed the vast majority of rare earth materials. After entering the 21st century, the demand for permanent magnets, rare earth alloys, batteries and other products closely related to clean technology and high-tech has increased rapidly. Energy-saving lamps, smartphones, tablets, DVD players, almost all fluorescent lamps, most offshore wind turbines, electric/hybrid cars, DVD players, smartphones and personal electronic devices.

Moreover, their performance and applications are still under further development, and as technology advances, their strategic importance will be further highlighted.

Storage capacity:

According to the white paper "China's Rare Earth Situation and Policies" released by the State Council Information Office on June 20, 2012, my country's rare earth industrial reserves are approximately 52 million tons, accounting for approximately 23% of the world's total reserves.

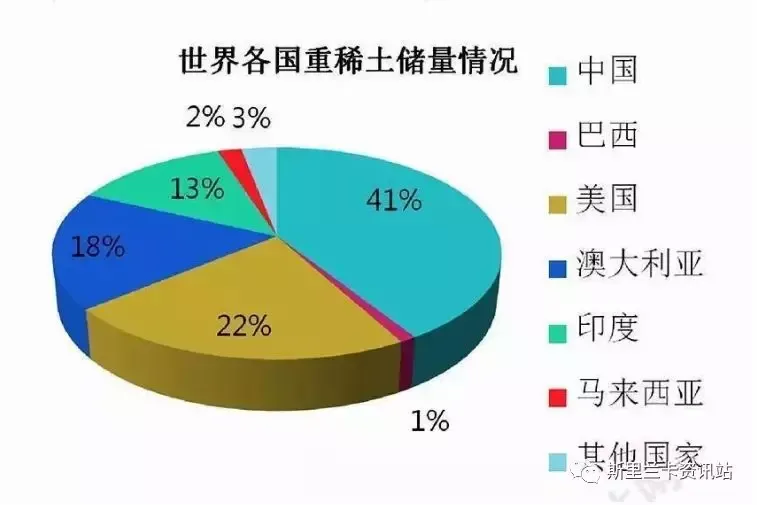

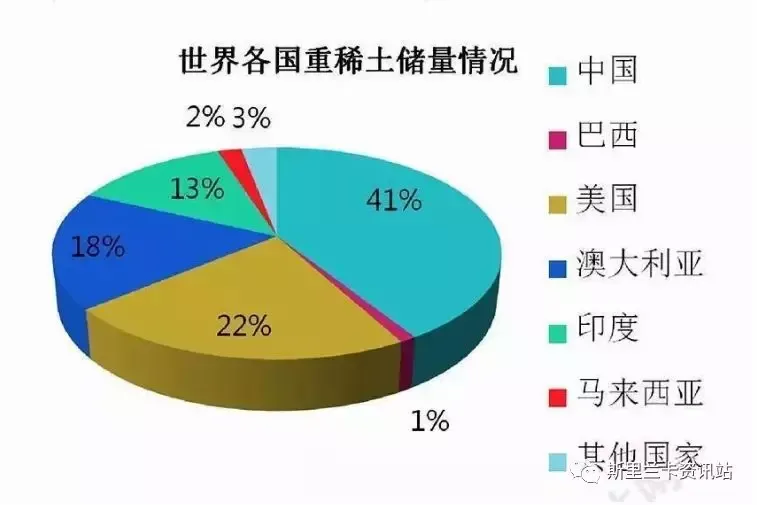

The distribution of world rare earth reserves on the website of the Rare Earth Industry Association is shown in the figure below:

However, data generally given by the United States or internationally believe that China's reserves account for about 40%.

The 2019 U.S. Geological Survey report shows that global reserves are 120 million tons, with China having 44 million tons, Brazil and Vietnam each having 22 million tons, Russia 12 million tons, India 6.9 million tons, Australia 3.4 million tons, and the United States. 1.4 million tons, Malaysia 300,000 tons, and other countries 4.4 million tons.

Generally speaking, the storage and distribution of rare earths in China is "light in the north and heavy in the south" because light rare earths are mainly distributed in the north and heavy rare earths in the south. China is currently the only country in the world that can supply all rare earth elements.

Light rare earth mines are mainly distributed in northern areas such as Baotou, Inner Mongolia and Liangshan, Sichuan. Among them, the Bayan Obo mine in Baotou, Inner Mongolia has 43.5 million tons. According to incomplete statistics, Baotou City's current rare earth reserves account for 87% of China's, and its exports of rare earth products account for half of the country's total. Baotou City has the only national high-tech zone named after rare earths in the country - Rare Earth High-tech Zone. At the same time, as the largest single rare earth production and processing enterprise in China and even the world, Baotou Steel Group, the controlling shareholder of Baotou Steel Rare Earth, owns the world's largest rare earth mineral deposits. On August 8, 2012, at the China Baotou Rare Earth Industry (International) Forum, Baotou City was officially named the "Rare Earth Capital".

The reserves of medium and heavy rare earth minerals are 1.5 million tons, mainly distributed in Ganzhou, Jiangxi, Longyan, Fujian, and southern regions such as Guangdong, Guangxi, Hunan, Sichuan, and Yunnan, of which Ganzhou, Jiangxi accounts for 36%. Ganzhou is the second largest concentration of rare earth mineral resources in the country. It has 80% of the country's heavy rare earth reserves and more than 30% of the country's ionic rare earth mineral reserves. It has a complete range of categories and superior grades. It is known as the "Kingdom of Rare Earths" and is home to 70% of the world's % of medium and heavy metals are produced here. In recent years, the proportion of medium and heavy rare earths in rare earth production has become larger and larger, so national policies are increasingly tilted towards medium and heavy rare earths. As of 2013, these provinces have a total of 67 mining rights licenses, of which 45 are in Jiangxi and 44 are concentrated in Jiangxi. Ganzhou area. More than 70% of the medium and heavy rare earth mining quota issued by the state is allocated to Ganzhou.

Ionic rare earth mines in the south are the world's most important source of medium and heavy rare earths. Medium and heavy rare earth elements such as europium (Eu), dysprosium (Dy), thulium (Tm), terbium (Tb), and yttrium (Y) are currently only mined in China.

Production:

Rare earth mining in China began in Bayan Obo in the 1950s. But by the end of the 1970s, China's rare earth output was only more than 1,000 tons.

According to data from the United States Geological Survey (USGS), since 2005, China's rare earth production has continuously exceeded 100,000 tons, accounting for more than 90% of global production, even as high as 97.5% at one time, and it was not until 2013 that the share dropped to 90%. Below, the proportion has dropped to 70.58% in 2018. In 2018, global production was 170,000 tons, of which China's production quota was 120,000 tons (taking into account illegal production and illegal mining, the actual production volume should be greater than this figure, but it cannot be effectively calculated), Australia's output was 20,000 tons, and the United States' 15,000 tons tons, Myanmar 5,000 tons, Russia 2,600 tons, India 1,800 tons, Thailand and Burundi 1,000 tons each.

In 2018, the United States imported a total of 15,000 tons of rare earths. Rare earth imports from China accounted for 80% of all imports, 6% from Estonia, 3% each from France and Japan, and 8% from other sources.

The United States did not mine any rare earths in 2016 and 2017, and produced a small amount from 2013 to 2015.

USGS website

https://www.usgs.gov/centers/nmic/rare-earths-statistics-and-information

Industry development history:

In 1794 scientists discovered the first rare earth element - yttrium

In 1927, geologist Ding Daoheng discovered the Bayan Obo iron ore.

In 1947, scientists discovered the last rare earth element - promethium

Before 1948, India and Brazil were the major producers

In the 1950s, South Africa became a major producer

In 1958, the Sino-Soviet joint scientific expedition team confirmed that Baiyun Obo contained a large amount of rare earths, with reserves reaching 80% of the world's proven reserves at that time.

In 1961, rare earth elements were used in the construction of lasers, and the application of rare earth elements began to accelerate.

In 1961, the Bayan Obo Mine established the "8861 Rare Earth Experimental Plant"

In the late 1960s, Chinese geologists discovered a unique rare earth mineral in Longnan County, Ganzhou City. This new mineral, named "ion-adsorbable rare earth mineral", made large-scale commercial mining of medium and heavy rare earths possible. .

In August 1975, chemist Xu Guangxian proposed his "Rare Earth Cascade Extraction" theory at the first National Rare Earth Conference, making a decisive breakthrough in China's rare earth separation and purification technology.

From the 1960s to the 1980s, the Mountain Pass mine in California, USA, supplied most of the world’s rare earths.

In 1985, China implemented a rare earth export tax rebate policy.

In 1988, Xu Guangxian, Li Biaoguo, Yan Chunhua and others successfully researched the one-step amplification technology of the rare earth extraction and separation process. The traditional cascade extraction small-scale test was replaced by computer simulation, which enabled the rare earth production to achieve fool-proof automation, marking that China's rare earth production technology began to surpass the international level. level, a single high-purity rare earth begins to be produced in large quantities at low cost

During his tour in 1992, Deng Nan said: The Middle East has oil; China has rare earths... Its status is comparable to that of oil in the Middle East, and it has extremely important strategic significance. We must do a good job in the matter of rare earths. (He also said that he should "keep his reputation secret" and "unchange for 50 years", spreading his hands)

In the 1990s, due to China's large exports, international rare earth prices dropped sharply. Some foreign rare earth manufacturers that had long monopolized the international rare earth market had to reduce production, switch production, or even suspend production.

According to data from the U.S. Bureau of Investigation, China's rare earth production reached 30,700 tons in 1994, nearly half of global production. Since then, China's rare earth market share and absolute production have grown dramatically, doubling production in just five years.

In 1995, a Chinese company acquired " Magnequench ", the largest rare earth magnet manufacturer in the United States, through an agent and transferred the production line to China three years later.

In 1998, the Mountain Pass Mine in California, USA, stopped refining rare earth elements and only produced bastnaesite concentrate.

In 1998, China began to implement a quota management system for the export of rare earth products, and the total rare earth quotas decreased year by year.

In 1999, China's rare earth production accounted for 86% of the global share. In the same year, Jiang Quanlong's "Yixing Xinwei" became the first mainland company to be listed in Hong Kong. It was later renamed "China Rare Earth". In September 2018, it was named after his son Jiang Quanlong. Xin’s sky-high bill caused waves

In 2002, the Mountain Pass Mine in California, USA, completely ceased operations.

In May 2005, China canceled the export tax rebate policy for rare earth smelting and separation products.

In May 2005, China Nonferrous Mining Group Co., Ltd. offered US$252 million to acquire 51.6% of the shares of Lynas in Australia, but was blocked by the Australian Foreign Investment Review Board.

In September 2005, 15 academicians including Xu Guangxian jointly issued an "Emergency Appeal on Protecting the Thorium and Rare Earth Resources of the Bayan Obo Mine and Preventing Radioactive Contamination of the Yellow River and Baotou" to the State Council, pointing out that: the most important rare earth and thorium mines are in Baotou, Inner Mongolia. The main mine of Bayan Obo and the East Mine have been mined 40% as iron ore, but the utilization rate of rare earths is less than 10%, and the utilization rate of thorium is 0% . At the same time, thorium has caused radioactive and other waste pollution to the Baotou area and the Yellow River. If no measures are taken, all the mineral deposits will be mined in 35 years , which will further intensify the pollution of the Yellow River. The situation is very urgent.

In 2005, according to the United States Geological Survey, China’s rare earth production accounted for 97% of global production.

On June 19, 2006, Xu Guangxian reported to Premier Wen again

In 2006, the Micro High-Strength Magnet Research Institute under General Motors was closed and moved entirely to China.

In November 2006, China began to impose an additional 15%-25% tariff on rare earth exports, and 41 types of rare earth products including raw rare earth ores were included in the catalog of prohibited commodities for processing trade.

On September 1, 2009, China announced plans to reduce export quotas to 35,000 tons per year from 2010 to 2015 to protect scarce resources and the environment.

In October 2009, Xu Guangxian, who has been revered as the "Father of Rare Earths", pointed out in an interview with the media that China's five southern provinces contain very valuable medium and heavy rare earths, with industrial reserves of 1.5 million tons, but more than 900,000 tons have been mined. , only 600,000 tons are left. According to the current mining rate, it will be mined in 10 years . At that time, we will have to buy from the United States and Japan. They may "sell" rare earth materials at hundreds or thousands of times the price...

On May 17, 2010, the Ministry of Land and Resources reviewed and approved the "Action Plan for Special Rectification of the Development Order of Rare Earth and Other Minerals". On May 18, the Ministry of Land and Resources issued the "Notice on Carrying out a National Special Action for the Development Order of Rare Earth and Other Minerals": From 2010 From June to November this year, special rectification of the development order of rare earth and other minerals was carried out.

In September 2010, a Chinese fishing boat and a Japanese patrol boat collided on the Diaoyu Islands, causing a diplomatic dispute. Subsequently, China suspended high-level talks with Japan, suspended tourism exchanges, conducted tax investigations on Japanese companies, and suspended exports of rare earth metals to Japan (Chinese officials denied that the government authorized enterprises).

In October 2010, Vietnam and Japan signed a rare earth supply agreement.

In November 2010, Australia's Lynas and Japan's Sojitz Corporation signed an

In December 2010, Molycorp of the United States signed rare earth supply agreements worth 450 million euros with Sumitomo Corporation and Mitsubishi Corporation of Japan respectively.

At the end of 2010, China announced that the first round of rare earth export quotas for 2011 was 14,446 tons, a 35% decrease from the first round of quotas in 2010.

In April 2011, Molycorp of the United States acquired a 90% stake in the Estonian rare earth refining company Silmet for US$89 million, and in October it acquired the remaining 10% stake.

In May 2011, the "State Council's Several Opinions on Promoting the Sustained and Healthy Development of the Rare Earth Industry" was issued, which proposed the establishment of a rare earth strategic reserve system.

On August 8, 2011, six departments including the Ministry of Industry and Information Technology, the Ministry of Supervision, the Ministry of Environmental Protection, the State Administration of Taxation, the State Administration for Industry and Commerce, and the State Administration of Work Safety jointly issued the "Operation on Carrying out Special Rectification Actions for the National Rare Earth Production Order" Notice", it was decided to carry out a four-month special rectification operation of rare earth production order from August 1 to December 31, 2011. The final report shows that during this special rectification operation, more than 600 illegal rare earth exploration and mining behaviors were investigated and corrected, and 89 rare earth mines and smelting separation companies were suspended for rectification. In addition, more than 10 criminal cases of rare earth smuggling were uncovered across the country.

In September 2011, China announced that it would cease production at three of its eight major rare earth mines, accounting for nearly 40% of China's total rare earth production.

In 2012, the rare earth refinery (The Lynas Advance Materials Plant, LAMP) invested by the Australian Lynas Company in Kuantan, Malaysia, began operations and was officially put into production in 2013, with a planned annual production capacity of 11,000 tons.

In March 2012, the United States, the European Union and Japan filed a lawsuit with the WTO against China's restrictions on rare earth exports and production, which violated the WTO's free and equal trade regulations. China responded that the restrictions were based on environmental protection considerations.

On March 11, 2012, Miao Wei, a representative of the National People's Congress and Minister of Industry and Information Technology, said in an interview with reporters at the Great Hall of the People that the purpose of rare earth integration is to cherish resources. After the rare earth production companies are successfully established in the future, only 2 to 3 large rare earth companies will remain.

On April 8, 2012, the China Rare Earth Industry Association was established in Beijing. At the founding meeting, Su Bo, Vice Minister of the Ministry of Industry and Information Technology, said: The cost of rare earth pollution in my country is shocking. In Jiangxi Province, which is rich in rare earth resources, the main revenue from rare earth operations in 2011 was 32.9 billion yuan and the profit was 6.4 billion yuan. However, due to environmental pollution caused by rare earth mining in Ganzhou alone, the cost of restoring the mine environment was as high as 38 billion yuan.

On April 20, 2012, "Daily Economic News" published a report --- Rare earth pollution investigation in Ganzhou, Jiangxi: It will take 70 years to treat 190 million tons of waste residue

"

In June 2012, the State Council of China released the white paper "China's Rare Earth Situation and Policies", which stated: The reserve-to-production ratio of ionic rare earth mines in the south has dropped from 50 20 years ago to the current 15 (that is, based on the current year's mining volume, It can also be mined for 50 years and 15 years respectively)

In May 2012, researchers from two Japanese universities announced that they had discovered rare earths in Ehime Prefecture, Japan.

In June 2012, Molycorp of the United States acquired Canada's Neo Material Technologies (a joint venture established in 2006 by Magnequench and Canada's AMR Technologies)

In July 2012, the strategic collection and storage of rare earths was launched, and national financial funds will be collected and stored through enterprises. This is the first time that China has launched a strategic purchase and storage of rare earths.

On August 8, 2012, China’s first rare earth products trading platform was listed in Baotou, Inner Mongolia.

In August 2012, China announced a further 20% production cut.

On August 27, 2012, the Mountain Pass Mine in California, USA, resumed production after it was purchased by Molycorp.

On October 15, 2012, the General Office of the Ministry of Industry and Information Technology issued the "Notice on Verification and Rectification of Rare Earth Violations and Violations."

In January 2013, Japan announced the discovery of rare earth mineral resources in the deep sea about 250 kilometers (160 miles) south of Minami-Tori-Shima Island. The concentration of rare earth oxides as high as 0.66% is higher than the grade of 0.05% to 0.5% of the southern China deposits. higher.

In March 2013, Zhang Zhong, general manager of Baotou Steel Rare Earth High-Tech Co., Ltd. (now Northern Rare Earth Group High-Tech Co., Ltd., SH: 600111), stated at the International Rare Earth Summit that the mining cost of foreign heavy rare earths is about 20 per ton. More than 10,000 yuan (approximately 34,000 US dollars). At that time, the cost of mining in China was reported to be only about 30,000 yuan.

In April 2013, the Ministry of Land and Resources published an article on its official website, "Five leading companies identified for rare earth industry integration". The article mentioned that "my country's rare earth integration plan may initially identify five leading companies, including Baotou Steel Rare Earth, Guangsheng Nonferrous Metals, and Chinalco Group, China Minmetals Corporation and Ganzhou Rare Earth Group, and then the integration of local rare earth companies and the five leading companies has become the key to further integration of the rare earth industry."

In June 2013, the Jiangxi Provincial Party Committee held a special coordination meeting to deploy special rectification work in Ganzhou, the "Kingdom of Rare Earths", during which 104 illegal mining sites in Anyuan County were eliminated.

On August 5, 2013, the General Office of the Ministry of Industry and Information Technology issued the "Letter on Organizing and Carrying out Special Actions to Combat Illegal Activities in Rare Earth Mining, Production, and Circulation", which will be carried out from August 15 to November 15, 2013. A three-month special operation to crack down on illegal activities in rare earth mining, production and circulation.

In October 2013, Anyuan County Party Committee Secretary Kuang Guanghua was “double-regulated”

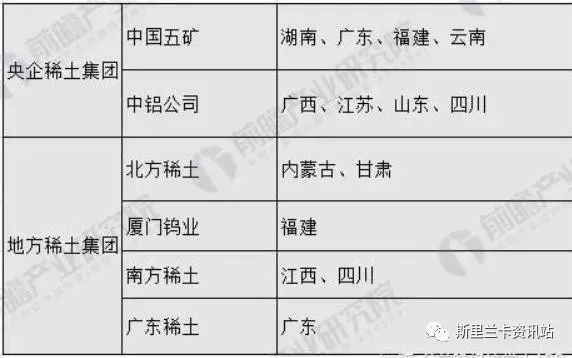

In January 2014, the State Council approved the formation of a "1+5" pattern in accordance with the plan. The "1" refers to northern rare earths, with the focus on integrating rare earth resources and enterprises in Inner Mongolia and Gansu. The "5" refers to Chalco, Xiamen Tungsten, China Minmetals, Guangdong Rare Earth and Southern Rare Earth. The focus is on integrating rare earths in Jiangxi, Hunan, Guangdong, Fujian, Yunnan, Guangxi, Jiangsu, Shandong, Sichuan and other places. resources and businesses.

In March 2014, the WTO ruled that China lost the case and required China to cancel rare earth export quotas that violated WTO rules.

amount and export duties.

On April 7, 2014, China appealed some arguments and related findings in the WTO ruling, but did not challenge the final conclusion.

The national procurement and storage completed the bidding on July 31, 2014, and shipped it from Ganzhou in September. The total national procurement and storage volume was 10,000 tons, which was completed by 6 companies including Minmetals Rare Earth and Northern Rare Earth. The acquisition was roughly 10% higher than the market price. . In addition, the six companies participating in the purchase and storage have added an additional 3,000 tons of commercial reserves. The product structure of purchasing and storage is biased toward medium and heavy rare earths.

On August 5, 2014, the "Special Action Plan to Combat Illegal Activities in Rare Earth Mining, Production, and Circulation" was jointly promulgated by eight ministries and commissions. This is the second round of the country's special action to crack down on the black rare earth industry chain since January 2014. The content is that from August 15 to November 15, eight ministries and commissions jointly launched a special operation to crack down on illegal activities in rare earth mining, production, and circulation.

On August 14, 2014, when Kuang Guanghua, the former secretary of the Anyuan County Party Committee in Jiangxi Province, was tried in court, he reported in court that the family members of Su Rong, the former vice chairman of Zheng Xie, were suspected of meddling in the rare earth mine in Anyuan County through the main leaders of Ganzhou City.

(Related reports: Uncovering the black interest chain of Jiangxi Anyuan Rare Earth: Involving the wife of a deputy national leader

http://finance.sina.com.cn/360desktop/china/20141117/222420842322.shtml

)

On August 29, 2014, the WTO rejected China's appeal. One of the reasons was that statistics showed that China's rare earth production had not decreased significantly.

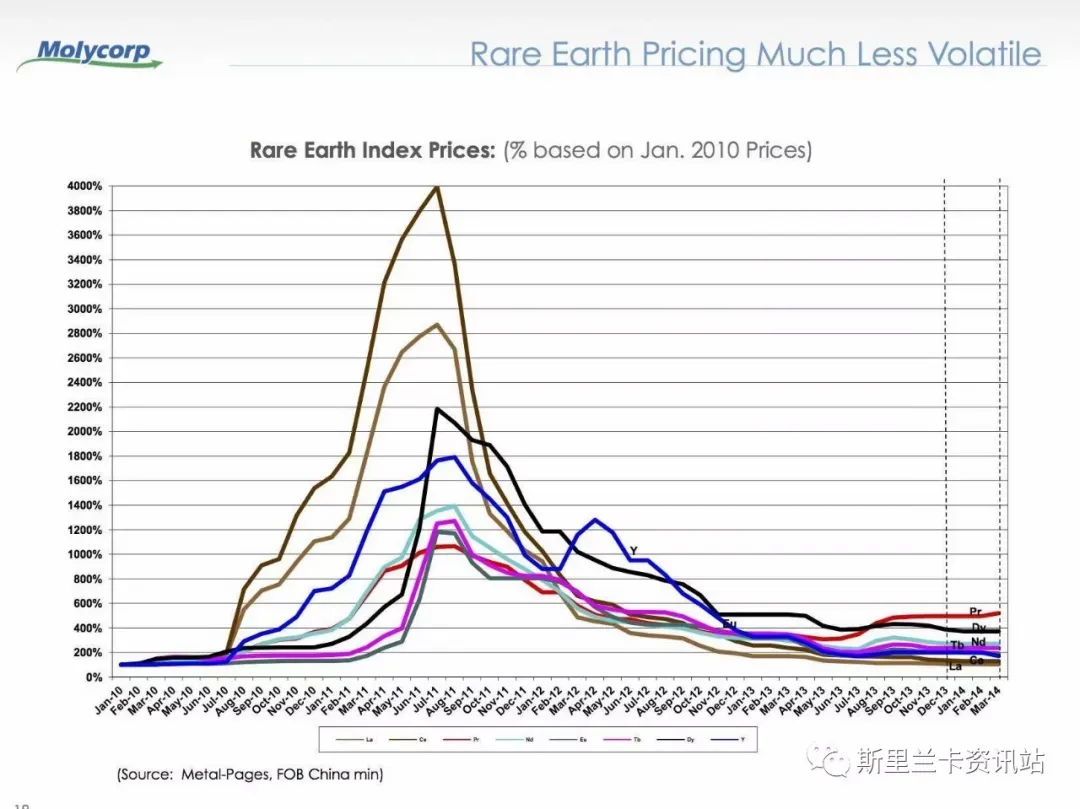

According to estimates from the China Rare Earth Industry Association, due to rampant illegal mining, black markets and smuggling, the actual supply of Nanfang Mine was more than 50,000 tons in 2013 and more than 40,000 tons in 2014. During the same period, the legal production quota of Nanfang Mine issued by the Ministry of Land and Resources was only 17,900 tons. This means that the illegal market may have reached 2.2 to 2.8 times the size of the legal market. In addition, similar conclusions can be drawn by comparing the difference between the total amount of rare earths exported by China and the total amount of imports declared by other countries' customs. For example, from 2006 to 2008, the import volume of rare earths from China according to foreign customs statistics was 35%, 59% and 36% higher than the export volume according to Chinese customs statistics. In 2011, when the rare earth black market was the most rampant, it was even higher by 1.2%. times. Therefore, in the years from 2010 to 2014, rare earth prices experienced a sharp rise and then plummeted quickly. For example, the price of dysprosium oxide was US$994/kg in 2011, but dropped to US$265/kg in 2014.

Schematic diagram of rare earth price changes from 2010 to 2014

China’s rare earth export quotas from 2008 to 2014

On January 5, 2015, China canceled all quotas for rare earth exports (export licenses required).

In April 2015, China announced that it would officially abolish export tariffs on rare earths after May 2, 2015.

On May 14, 2015, according to the notice issued by the Ministry of Land and Resources on the total amount of rare earth ore tungsten mining control targets for 2015, China Minmetals Corporation, China Aluminum Corporation, Baotou Iron and Steel (Group) Co., Ltd., Xiamen Tungsten The integration and reorganization plans of the six rare earth groups Co., Ltd., Ganzhou Rare Earth Group Co., Ltd., and Guangdong Rare Earth Industry Group Co., Ltd. have been approved and filed by relevant departments.

The main integration areas of the six major rare earth groups

In August 2015, Morlycorp in the United States filed for bankruptcy protection and the Mountain Pass mine in California ceased production.

In December 2015, the Ministry of Environmental Protection issued the "Comprehensive Directory of Environmental Protection (2015 Edition)", which listed ionic rare earth concentrates and rare earth oxides as "high pollution and high environmental risk products" (referred to as "double high" products).

According to data from the Ministry of Industry and Information Technology, in the first half of 2016, 99.9% of the country’s rare earth production quota was allocated to six major companies.

In September 2016, Morlycorp was acquired by Oaktree Capital Management and reorganized into Neo Performance Materials (the company's website shows that there is an executive vice president named Shannon Song in the management. Public information shows that Shannon Song graduated in 1982 NTU, executive vice president of Magnequench from 1995 to present ) . Molycorp 's Mount Pass mine was divested and auctioned in bankruptcy court in March of the following year.

In July 2017, MP Materials, established by Sichuan Leshan Shenghe Resources Holdings as a minority shareholder (without voting rights) and two American companies, JHL Capital Group LLC and QVT Financial LP, purchased the Mount Pass mine.

In 2017, Shenghe Resources Holdings became a shareholder of Australia’s Greenland Minerals

In January 2018, the Mountain Pass Mine in California, USA, restarted production and refining operations.

On April 5, 2018, the rare earth industry associations of the three provinces of China jointly issued a proposal to the entire rare earth industry, pointing out that the black industry chain is becoming more and more intense, especially the illegal mining of ionic rare earth resources is spreading, and the output of ionic rare earth concentrates and The market supply far exceeds the mandatory plan indicators... The annual output of ionic rare earth concentrate is 50,000-80,000 tons, which is more than three times the mandatory plan of 17,900 tons per year. The direct consequence is to disrupt the supply and demand pattern of the rare earth market, resulting in a large backlog of my country's heavy rare earth products represented by yttrium oxide, which are sold at low prices. Rare earth exports increase at low prices. Products such as praseodymium and neodymium are imported at high prices, and heavy rare earths such as yttrium are sold at low prices. reverse interaction situation

In May 2018, at the "Seminar on How to Cope with the Impact of Sino-US Trade Friction on the Rare Earth Industry" held by the Shanghai Rare Earth Association, Zhu Mingyue, Honorary President of the Shanghai Rare Earth Association, spoke: China's rare earth separation technology is currently the world's largest First, it is 5-10 years ahead of foreign technology. All rare earth separations are inseparable from Chinese technology.

In June 2018, Meng Qingjiang, secretary of the Alloy Branch of the China Rare Earth Industry Association and executive deputy secretary-general of the Jiangxi Rare Earth Society, publicly stated that illegal mining has exacerbated the imbalance in the market for medium and heavy rare earth elements. China’s rare earth elements, represented by yttrium and samarium, have There is a massive surplus and backlog of heavy rare earth products, almost becoming junk products.

On October 17, 2018, People's Daily Online reported: The restoration and management of rare earth mines in Ganzhou, Jiangxi are not strict and the comprehensive management plan is fraudulent.

Specific report: http://env.people.com.cn/n1/2018/1017/c1010-30346342.html

On April 29, 2019, 12 departments of Anhui Province issued a notice on continuing to strengthen the order and rectification of the rare earth industry.

On May 9, 2019, the United States announced that it would raise tariffs from 10% to 25% on $200 billion worth of goods imported from China. The 11th round of trade negotiations between China and the United States failed.

On May 20, 2019, Xi Jinping went to Ganzhou, Jiangxi Province to investigate relevant rare earth companies.

On May 28, 2019, the National Development and Reform Commission responded to reporters’ questions on the development of the rare earth industry and said that in 2018, Ganzhou rare earth industry enterprises above designated size achieved main business income of 26 billion yuan (which can be compared with Su, Vice Minister of the Ministry of Industry a few years ago). (Comparison of data mentioned by Bo), and said, “If anyone wants to use the products made by our export of rare earths to contain and suppress China’s development, then I think the people of the Central Soviet Area in southern Jiangxi and the Chinese people will be unhappy. "

On May 31, 2019, the Ministry of Commerce of China announced that it would establish an “unreliable entity list”.

On June 1, 2019, China imposed additional tariffs on $60 billion in U.S. goods.

On June 2, 2019, the State Council of China released the white paper "China's Position on China-US Economic and Trade Consultations."

On June 3, 2019, Science and Technology Daily reported that "China is no longer a global leader in rare earth mining and separation technology". The report stated that the new separation technology invented by Sun Xiaoqi's team at the Chinese Academy of Sciences has enabled my country to continue to maintain a global leadership in rare earth mining and separation technology. status.

Rare earth operations outside China:

Mount Pass Mine in California, USA: annual output of 15,000 tons.

The Australian Lynas Company is mainly divided into two parts: the Mount rare earth mine in Western Australia and the refining plant in Kuantan Island, Malaysia. Weldshan rare earth mine is famous for its huge storage capacity, high grade and low thorium content. The annual output in 2014 was 11,000 tons.

Arafura Resources, Australia: The Nolans Project in northern Australia is expected to be put into production in 2020, with an annual output of 4,360 tons of neodymium and praseodymium oxides and 600 tons of medium and heavy rare earths.

PR NG Minerals, controlled by Australia's Peak Resources Company, fully owns the Ngualla rare earth mine in Tanzania, which contains 6 types of heavy rare earth elements. The annual output is expected to be 6,720 tons and can be mined for 31 years.

Estonia Silmet Rare Earth Refining Company: annual production of 3,000 tons

Canada's GreatWestern Minerals Group: The Hoidas Lake rare earth mine in northern Canada is said to have at least 286,000 tons of rare earth ore and has not yet been put into production.

Bokan Mountain project in Alaska, USA: The heavy rare earth content is as high as 40%, compared with 1% in Mount Pass. , the annual output is expected to be 2,250 tons, but it has not yet been put into production.

Australia's Greenland Minerals' Kvanefjeld mine in southern Greenland is said to be the world's second-largest rare earth mine and sixth-largest uranium mine, but has not yet been mined.

NioCorp Development Ltd of the United States produces 100 tons of scandium trioxide annually at its Elk Creek plant in Nebraska.

Other means of obtaining rare earth elements are currently being studied:

The global recycling rate of rare earths was said to be less than 1% in 2014, while an estimated 300,000 tonnes of rare earths were stored in unused electronic equipment.

The French Rhodia Group is building two factories in La Rochelle and Saint-Fons, which will produce 200 tons of rare earths per year from second-hand fluorescent lamps, magnets and batteries.

It is said that a Japanese company is also carrying out related projects, but the details are unknown.

Another source of rare earths being studied includes extraction of rare earth elements from coal and coal by-products.

Strategic reserves of rare earth elements in various countries: unknown

pollution problem:

According to the China Rare Earth Society, 9,600 to 12,000 cubic meters (340,000 to 420,000 cubic feet) of dust containing exhaust gases, hydrofluoric acid, sulfur dioxide and sulfuric acid are mined per ton of rare metals, and about 75 cubic meters (2,600 cubic feet) of Acidic wastewater, plus about 1 ton of radioactive waste residue.

There are reports that people living near mines in China have many times higher levels of rare earth elements in their blood, urine, bones and hair than controls far away from mining areas. The group most at risk is children, as rare earth elements can affect children's neurodevelopment, impact their IQ, and may cause memory loss.

In the north, the "mine lakes" that appear around some rare earth mines (the largest one is in Baotou) have also given the nearby villages a disgraceful name: Cancer Village. Some media once reported that local farmers in the southern ionic rare earth mining area reported: "It is very strange that the rice here grows very well without fertilizing, but there is no harvest; when it rains, the water washed down from the mountains reaches the fish. In the pond, all the fish died the next day.”

On May 16, 2018, the Chaling County People’s Court publicly heard the case of a Jiangxi gang illegally mining rare earths and damaging the environment in Chaling. A gang in Jiangxi illegally mined more than 500 tons of rare earths in Chaling, making a profit of more than 10 million yuan. The sewage caused ammonia nitrogen and heavy metal manganese in downstream surface water to seriously exceed the standards. The maximum exceedance multiples were as high as 384 times and 92.25 times, causing major damage to the ecological environment and residents. Don’t dare to drink water, the ecological environment damage repair cost will be 3.1701 million yuan

The respective uses of 17 rare earth elements (for reference only, you can skip it):

Lanthanum (La): widely used in piezoelectric materials, electrothermal materials, thermoelectric materials, magnetoresistive materials, luminescent materials (blue powder), hydrogen storage materials, optical glass, laser materials, various alloy materials, etc., and is also used in the preparation of many Among the catalysts of organic chemical products, it is known as "super calcium" because of its influence on crops.

Cerium (Ce): widely used in glass additives to absorb ultraviolet and infrared rays, automobile exhaust purification catalysts, making non-toxic pigments, plastic coloring, coatings, inks and papers, polishing powder, hydrogen storage materials, thermoelectric materials, cerium-tungsten electrodes, ceramics Capacitors, piezoelectric ceramics, cerium silicon carbide abrasives, fuel cell raw materials, gasoline catalysts, permanent magnet materials, various alloy steels and non-ferrous metals, etc.

Praseodymium (Pr): Mainly used in glass, ceramics, permanent magnet materials, petroleum cracking catalysts, abrasive polishing, optical fibers and other fields

Neodymium (Nd): Mainly used in NdFeB permanent magnet materials, non-ferrous metal materials, garnet lasers, and also used in the coloring of glass and ceramic materials and as additives in rubber products.

Promethium (Pm): It is reflective and is mainly used as a heat source to provide auxiliary energy for vacuum detection and artificial satellites, to manufacture promethium batteries as a power supply for missile guidance instruments, and is also used in portable X-ray instruments, preparation of phosphors, etc.

Samarium (Sm): Mainly used in the manufacture of samarium-cobalt permanent magnets. It is also used in ceramic capacitors, catalysts, structural materials, shielding materials and control materials for atomic energy reactors.

Europium (Eu): Mainly used in the manufacture of phosphors, but also in the manufacture of colored lenses, optical filters, magnetic bubble storage and structural materials, shielding materials and control materials for atomic reactors.

Gadolinium (Gd): Mainly used to improve the human body's nuclear magnetic resonance (NMR) imaging signal, special brightness oscilloscope tubes and matrix grids of x-ray fluorescent screens, single substrates of magnetic bubble memory memories, solid-state magnetic refrigeration media, and control It is used as a chain reaction-level inhibitor in nuclear power plants and as an additive in samarium cobalt magnets. It can also be used to improve the thermal stability of glass, make capacitors and x-ray intensifying screens.

Terbium (Tb): Mainly used in green phosphors, magneto-optical memory materials, magneto-optical glass, sonar, etc.

Dysprosium (Dy): Mainly used as an additive and three-primary color phosphor for NdFeB permanent magnets. Large magnetostrictive alloy terbium-dysprosium alloy (Terfenol) alloy, magneto-optical storage materials, dysprosium lamps, measuring neutron energy spectrum or making neutron absorbers, magnetic working substances for magnetic refrigeration, etc.; key elements necessary for building electric vehicles , each vehicle uses more than 100 grams of rare earth elements

Holmium (Ho): Mainly used in: metal halide lamp additives, yttrium iron or yttrium aluminum garnet additives; yttrium aluminum garnet (Ho:YAG) medical lasers, magnetostrictive alloys, fiber lasers, fiber amplifiers, fiber sensors, etc. .

Erbium (Er): Mainly used in: Erbium-doped fiber amplifiers, portable laser rangefinders, rare earth glass laser materials, activated ions for conversion of laser materials, eyeglass lens glass, decolorization and coloring of crystallized glass, etc.

Thulium (Tm): Mainly used in: portable medical

Ytterbium (Yb): Mainly used in: heat shielding coating materials, magnetostrictive materials, phosphor activators, radio ceramics, magnetic bubble additives, glass fiber fluxes and optical glass additives, etc.

Lutetium (Lu): Mainly used in: manufacturing certain special alloys, catalysts for petroleum cracking, alkylation, hydrogenation and polymerization reactions, additive elements to improve the performance of yttrium iron or yttrium aluminum garnet, magnetic bubble storage, and also used Energy battery technology and activators for phosphors, etc.

Yttrium (Y): Main uses include: additives for steel and non-ferrous alloys, silicon nitride ceramic materials that can be used to develop engine parts, neodymium yttrium aluminum garnet lasers, electron microscope fluorescent screens, high-yttrium structural alloys, high-temperature proton conductive materials, and It is used in high-temperature resistant spray materials, diluents for atomic reactor fuels, additives for permanent magnet materials, and as getters in the electronics industry.

Scandium (Sc): Mainly used in: additives for manufacturing alloys, semiconductor devices, scandium compounds as alcohol dehydrogenation and dehydration agents, high-efficiency catalysts, special glasses, scandium sodium lamps, etc.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…