馬克解讀金融科技 | MarkReadFintech https://www.instagram.com/markreadfintech/ 轉帳幫 TransferHelper - Co-founder & CEO。 用簡單的方式介紹金融科技,希望大家都能享受金融科技帶來的方便與效率。

Cryptocurrency Investing in Hedge Funds? — Performance by @Bincentive

Previous Article - Cryptocurrency Investing in Hedge Funds?

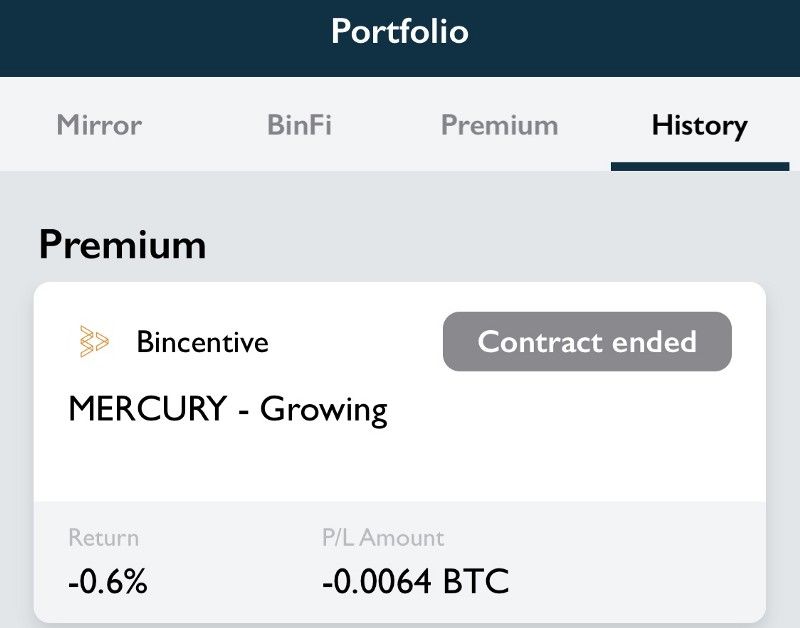

Investment time: 2019/10/1–2019/12/31

Expected annual rate of return: 92.5%

Actual performance: -0.64%

There are profits and losses in investment. Although it does not meet expectations, through such participation, you can more practically understand the differences between virtual currency-like financial products and general financial products, or what can be improved. The following is Some of my views:

1. Daily net worth disclosure is not accurate enough

On the 5th of each month, we can know how the performance of the previous month was. The change of the net worth every day in the last month is impossible to know. After all, the fund that can be invested with 1,000 yuan can update the net value every day, and the minimum 0.5 bitcoin can be used. The performance of the invested products is updated once a month, which is indeed a bit troublesome for users, and even causes anxiety.

Bincentive has put forward an explanation on this point. Since the cooperative Lucy Labs only provides performance once a month, it will cause a breakpoint in information. This has been improved in future cooperation, and it can provide daily changes in net worth.

2. The performance report lacks professionalism

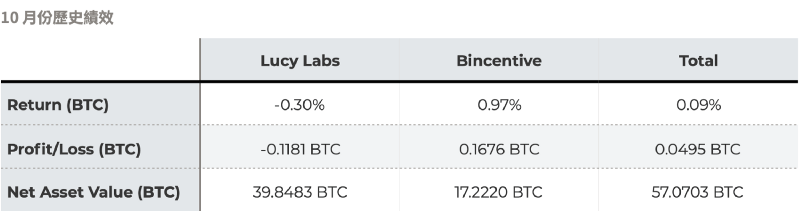

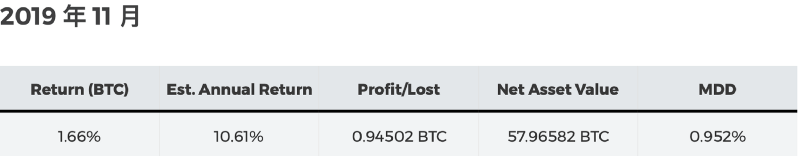

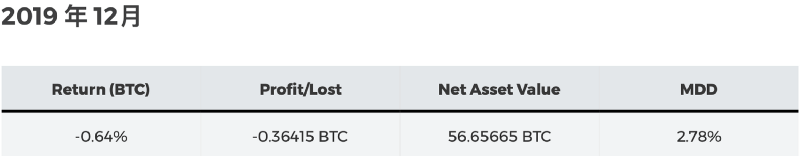

Here's how the October, November, and December performance statements are tabulated

Three months, three formats. In other words, before generating the performance report, it is not clear what information to give users, or the information of poor performance is covered up. Although all current financial services tend to give users the simplest and clearest expression, for investment products, users still want to see simple analysis and comparison. These comparisons are not only to understand the quality of performance, but also to One point is to assess whether it is suitable to continue investing, so whether it is good or not should be provided instead of simplifying all the data. If Bincentive wants to provide professional investment services, these details must be done well.

3. Reliability of expected annual rate of return information

When the investment was initially raised, the expected annual rate of return disclosed on the website was 92.5%, which translates to a three-month expected rate of return of about 22.8%, while the actual rate of return was -0.64%. This will definitely make people question how the original estimate came from, and Bincentive's statement is to estimate through the performance of the real market and the Monte Carlo backtest. These are indeed commonly used methods, but it is obvious that This assessment was not done very thoroughly.

In this investment project, 70% of the funds are implemented by the strategy provided by Lucy Lab, and the other 30% of the funds are provided by the strategy provided by Bincentive. And Lucy Lab is the main strategy this time, but in fact, the performance of these three months is not good (almost all negative performance). The explanation put forward by Bincentive is that Lucy Lab mainly uses arbitrage transactions when the volatility of the virtual currency market is converging. Problem, this point will have a very unfavorable factor for arbitrage trading products.

Different investment strategies have different characteristics and evaluation methods. In the future, Bincentive should take these into account. For example, if liquidity will affect most of the performance, it must be disclosed to investors, so that they can better understand the risks to take. What are some of them, not simply "investment has profit and loss".

4. The details of the final settlement are not transparent

After the December performance report was received, the entire project was closed, with 1/2 of the bitcoins returned directly to Bincentive's wallet, but with less details about the overall fee expenditure. It is stipulated in the project that 10% of the bitcoins invested in the project will be invested in the BCNT coins issued by Bincentive as the source of handling fees, and the BCNT coins have continued to fall (0.7195->0.3534) during the three-month process, but The loss does not appear to be reflected in performance. Exactly how much performance fees or handling fees investors paid Bincentive and Lucy Lab throughout the project was not provided.

In this regard, what is more concerned is whether Bincentive has a plan to actually implement the entire project, and if there are adjustments, whether it has communicated with investors. The beginning of an investment project is very important, and the end is even more important, and the details of all the returned funds should be clearly explained.

Investing in virtual currency commodities to hedge funds is a good idea, but in order to build trust, in addition to transparency, there should be clear norms and operating principles. What I am looking forward to is that Bincentive will improve these deficiencies and provide better services in the next investment project.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…