馬克解讀金融科技 | MarkReadFintech https://www.instagram.com/markreadfintech/ 轉帳幫 TransferHelper - Co-founder & CEO。 用簡單的方式介紹金融科技,希望大家都能享受金融科技帶來的方便與效率。

Talking about Defi (Decentralized Finance)

Defi (decentralized finance) has been hot since last year, and it seems to have taken over the follow-up of DApps and has become the hottest topic of discussion in the blockchain today. In particular, compond (decentralized lending platform) has been introduced and promoted by more and more people in Taiwan. It seems that if you don’t understand Defi, you are a little behind. So today, let’s start with an introduction.

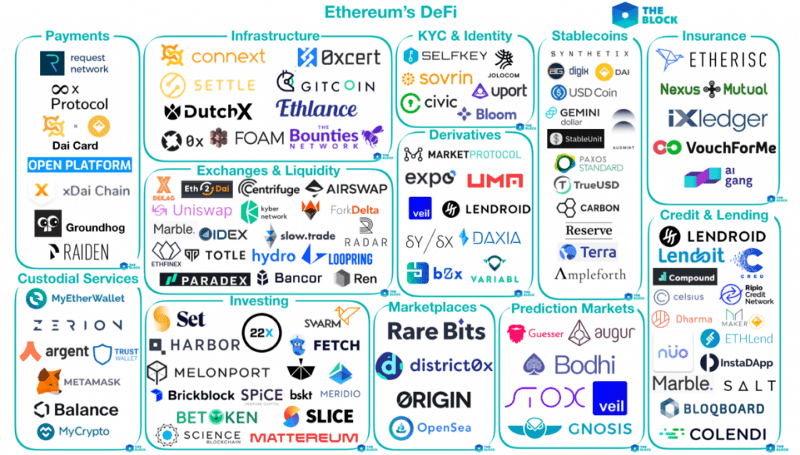

Simply put, DeFi "builds a financial ecosystem that is not controlled by authoritative institutions through an open-source and decentralized blockchain platform." To be more specific, the development of decentralized payment, trading platform, insurance, remittance, derivatives, lending, etc., is no longer centralized and guaranteed by financial institutions, but uses transparent protocols to replace unnecessary intermediaries to run , Hearing this, should financial practitioners break a cold sweat first?

Compared with traditional financial services, the use of DeFi is highly attractive to areas with high regulation or poor financial infrastructure, because DeFi can resist censorship, has low or no threshold, and is open and transparent, so it is likely to promote even Alternative to many traditional financial services.

However, the reason why Defi has not largely replaced the current financial services is because there are still several problems. The first is the problem of getting started. Users need to start from how to use blockchain wallets, buy and sell virtual currencies, how to transfer funds, and how to use different types of chains. Wait, it will take a while to understand. Compared with the financial services we are familiar with, there is indeed a high threshold.

Again, unlike traditional financial services, the credit reporting system can rely on income, bank records or other assets for evaluation. It can only use mortgage digital currency as a credit guarantee. In other words, as long as you have no digital currency , it is impossible to carry out loans or related margin operations, even if the income is high, you can't borrow a dime.

Finally, there is the issue of supervision, which is also the factor that I think is most likely to kill Defi. No KYC requirement means anonymous identity and potential crimes. From the perspective of anti-money laundering, decentralized financial ecological services provide a variety of Such money laundering methods have almost no effective supervision methods. Perhaps this will only happen when more and more Defi services become available in the future before a certain country’s regulatory agency jumps out to speak.

As a financial innovator, I like the concept of open finance like Defi very much. It is full of unlimited imagination and rich usage scenarios. Financial services are no longer determined by the type and method of services by banks, but by the public and the public. It's great to have dedicated developers to implement what's really needed, isn't it?

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…