馬克解讀金融科技 | MarkReadFintech https://www.instagram.com/markreadfintech/ 轉帳幫 TransferHelper - Co-founder & CEO。 用簡單的方式介紹金融科技,希望大家都能享受金融科技帶來的方便與效率。

The Progress of Taiwan Security Token STO

Traditional Funding & ICO & STO

Before talking about STO, let's discuss the process of STO evolution. In the past, when entrepreneurs developed projects, most of them would obtain working capital through financing. However, the process of obtaining working capital is actually full of difficulties. Taking bank loans as an example, it is not only difficult to approve, but also the cost of obtaining it is not low. The time is also quite long. In order to solve this problem, the crowdfunding model is one of the ways to solve the problem.

The crowdfunding model provides entrepreneurs with a more effective financing method. Since crowdfunding faces a wider range of investors, investors can invest with a smaller amount of money, which can also help entrepreneurs to invest more. Easy to complete financing. And ICO is one of the best ways to implement such a model.

ICO (Initial Coin Offering) is an initial coin offering that allows entrepreneurs to give investors the flexibility to buy, sell and trade by issuing tradable tokens. In addition to providing equity, entrepreneurs can also provide more different ways of giving back, as well as setting up lock-in conditions for investment, etc. Therefore, ICO has become a powerful tool for new venture teams to raise funds. Many new venture teams have successfully raised funds. During the peak period (2017-2018), they raised $6.9 billion in the global market in one year.

However, the shortcomings of ICO are also exposed at this time. First of all, it is very insecure for investors. In 2017, more than 80% of ICO projects were scams, but there was no management framework or protection measures. At this time, the government has also noticed this loophole in supervision. In addition to the lack of investor protection, investor identification and anti-money laundering are also important issues.

In order to prevent the chaos of ICOs, countries have begun to formulate relevant rules for token issuance, and have begun to strictly supervise all ICOs. It is necessary to find a method that can meet the needs of fundraising at the same time and protect investors' fundraising methods at the same time. Therefore, there is a need for a Legally compliant and regulated token fundraising.

Therefore, the issuance of STO (Securitiy Token Offering) securities tokens is generated. At this time, the holders of the tokens can obtain the ownership of the assets or the relevant economic rights, and the relevant issuance and transaction records of the tokens will also be carried out under the supervision of the regulatory agency. . In conclusion, we can expect three main benefits from STOs:

- Reduce the cost of fundraising and improve efficiency

- Enable investors to participate in the market more efficiently

- Protect investors and reduce crime

The Progress of Taiwan STO Development

2019.07.03 The Financial Supervisory Commission issued an announcement to identify the concept of virtual currency in accordance with the provisions of Article 6, Paragraph 1 of the Securities and Exchange Law, “Approval of virtual currency with the nature of securities as negotiable securities under the Securities and Exchange Law”.

The term "virtual currency with the nature of securities" refers to the use of cryptography and distributed ledger technology or other similar technologies to recognize value that can be stored, exchanged or transferred in digital form, and is liquid.

Moreover, once the marketable securities judgment criteria for security tokens are identified, the money laundering risk faced by such tokens will be the highest among all types of cryptocurrencies, and the perspective of thinking will no longer be just an important aspect of innovative fundraising. , but how to comply with the strictest anti-money laundering (AML) standards.

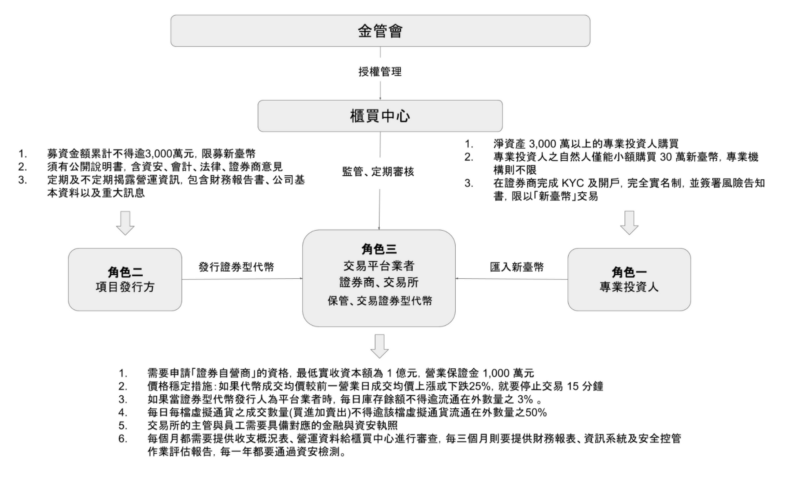

2019.09.18 Taiwan Securities OTC Center released the management plan for STO. This meeting discussed more about "the regulatory framework of security tokens". In the regulatory framework, the management system of securities tokens will be dominated by the Financial Regulatory Commission, and OTC As a regulatory agency, the center is responsible for supervising platform operators (virtual currency exchanges).

2020.01.20 The OTC Shopping Center officially promulgated the relevant general instructions, item-by-item instructions, and regulations and appendixes to the "Administrative Measures for Securities Firms Operating Their Own Trading of Virtual Currency Businesses of Securities Nature" and the on-the-job training specifications required by relevant personnel, and immediately from the announcement date Implementation, in other words, the STO-related regulations have been officially implemented since this day, and there is no longer room for ambiguity.

2020.05.01 The Stock Exchange completed the revision of the "Code of Principles for the Securities Market of the Republic of China"

1. Profit-sharing virtual currency: the first two codes are English letters ST, followed by a four-digit flow code.

2. Debt-based virtual currency: the first two codes are the English letters ST, the latter three codes are added, and the sixth code is the English letter D.

At this point, we can say that STO is ready to go on the road, just waiting for those who want to issue to make relevant applications and settings.

Characteristics of Taiwan STO Specifications

From the regulatory structure diagram, it can be found that it refers to the issuance mechanism of Taiwan securities, cooperates with the opinions of third-party experts, and strengthens the supervision of system information security with new technologies such as blockchain, plus the amount of funds raised and investors Constraints, creating a rigorous architecture. However, this structure pushes up the cost of legal compliance and investment threshold for the industry, and the excessive cost creates an invisible threshold, which makes the industry have reservations about the issuance of STO.

Here, we will not explain each detailed specification one by one, but only the key restrictive factors for investors, issuers and platform traders:

Investor: The purchase status is limited to professional investors with net assets of more than 30 million. Each professional investor's natural person (individual) can only purchase a small amount of NT$300,000, but professional investment institutions are not limited to this.

When the identity of the investor is restricted, the market circulation must be limited, and a small amount of STO can only be traded on one platform, its future trading liquidity is naturally worrying, and the probability of STO failure will also increase.

Issuer: Only open to profit-sharing and debt-based virtual currencies that do not have shareholder rights and interests, and the cumulative amount of funds raised should not exceed 30 million yuan, limited to New Taiwan dollars, and foreign investors are not open.

The lack of equity-based tokens, the potential growth and profit is not enough, and it is not easy to attract investors. It is only limited to investors in Taiwan, which greatly reduces the chances of raising funds, and makes the STO's original borderless convenience advantage unable to play. .

Platform traders: The exchange can only raise one security token case in the first year, and it can only be processed again after the transaction expires for 1 year, and the cumulative amount of funds raised by a single exchange or self-issued issuance shall not exceed 100 million Yuan.

Since the supervision can be said to be quite strict, the derived cost of entrusting experts has also risen. For the STO model, such a regulatory environment is not friendly. The market is still in the early stage, but the threshold and legal compliance costs are obviously too high. In addition, there is an upper limit on the funds raised by the platform, which also reduces the willingness of platform traders to join.

Is there still a chance for Taiwan STO to develop?

Compared with Singapore's STO securities regulation, which is just about to be combined with crowdfunding regulations, small investments can be made, and it has the freedom of ICO and combines the regulatory factors of technological innovation. Therefore, Singapore's STO regulations are relatively comprehensive and open.

An open attitude can definitely help the development of STOs. Although the current structure set by Taiwan seems to have many restrictions on STOs, at least these rules of the game allow those who want to issue STOs to have rules to follow. For the breakthrough of restrictions, we can entrust the industry to apply for entry into the financial supervision sandbox . In this way, we can break through the original structure and establish another set of new rules.

The three keys to the development of STO are supervision, technology and industry players

Therefore, there is still a long way to go, and more adjustments are needed to enable the entire STO to truly help fund raising and at the same time protect the rights of investors. Saw the first STO issued in Taiwan.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…