貓~偶爾懶散,偶爾機警,以不同的視角解讀這個世界。 對賺錢有濃厚興趣,尤其是加密幣,也喜歡分享自己的所思所想,希望透過網路以文會友。

Cryptocurrency Investment Monthly Report #03

The difficulty of investing is patience

Investing is the hardest and most training thing, I think it is "patient", especially in the crypto world, if you are too close to the market, you will be easily motivated to make emotional decisions.

I wanted to sell when I saw a big rise, but I didn't expect to miss the opportunity to earn several times! 😏 When I saw a big drop, I hurried to clear it, and the results were all cut at the lowest point😶

In the book " The Road to Wealth Freedom" , Chapter 35, "Don't Make a Difference - Can You Start Investing Without Money" says that investing doesn't have to wait until you have enough money to make it .

When there is no money, it is even more necessary to train the ability to choose the target, and to exercise the wisdom that can support capital in the future.

The specific method is to start practicing investing on paper , take a piece of paper, write down what you want to invest in, and record the initial price, then update the price every month, and then focus on the rate of return (that is, the relative ratio, not the absolute value). Remember, you can only update once a month!!!!

As for why it can only be updated once a month, sell it first. If you are interested, you can refer to Lecture 39 in the book.

Is it difficult to update only once a month? Seriously, it's hard~ At least I haven't gotten over it yet. It is a very bad habit to open FTX or DeFi projects every day to take a look! This is a very bad habit! Be careful!! 😌

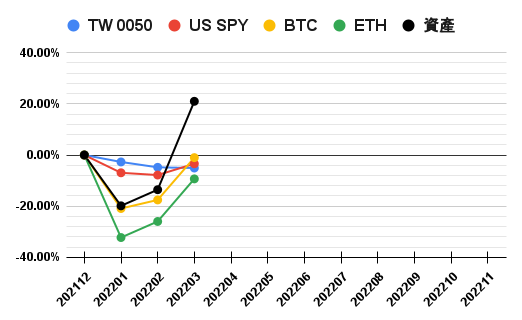

The market stabilized, assets turned positive

Back to the topic, the trend of the broader market (ETH, BTC) at the end of March was very rewarding, a big reversal. After 3/13, the daily line of ETH rose at an angle of close to 45 degrees. Judging from the record in the chart below, ETH and BTC both bottomed out at the end of January, and then turned up. On the contrary, TW0050 continued to decline.

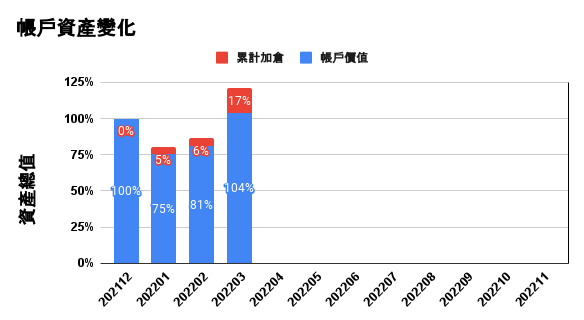

The monthly investment report compiled at the end of the month has increased by 37% compared with the beginning of the period (end of December 2021) 😮 I once mistakenly thought that my memory was wrong, so I double checked it a few times!

BTC and ETH are almost back to where they were at the beginning of the year, and have not returned to the original point. There is no reason for my assets to rise by 37%! After the recalculation and inspection, I am dazzled! 😒 Despite this, the assets have risen by 20% from negative to positive

VERY IMPRESSIVE

BUT......Yes~ There is always a BUT here!

If you look at the asset change (below), you can see that the initial account value is 100% (blue bar). When it fell later, I increased the position by 5% of the original principal in January (red bar), and increased the position to 6% in February, and so on. It has increased by 21% , but 17% of it comes from accumulative accumulation money , that is, the accumulation of continuous investment every month. Therefore, after the real decline and the rise back, my total assets began to rise, but in fact, it only increased by 4% after the blood was recovered. Not bad!

Position adjustment, continuous optimization

in the warehouse,

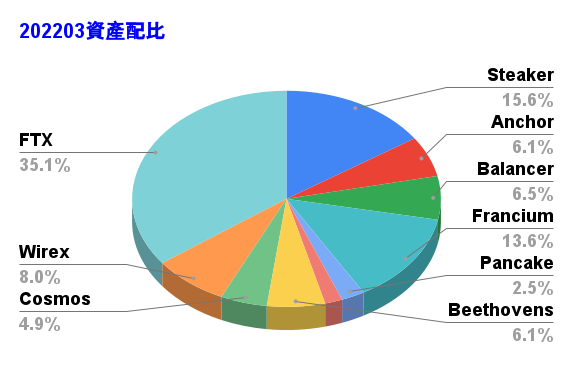

- The largest amount is FTX, which is mainly used for robot trading.

- The second largest position is Steaker, which is a fund that invests in cryptocurrencies.

- The third largest is Francium, which is a leveraged farm on the Solana chain.

- The fourth largest is the new WireX, which is the WireX credit card introduced in the Apple pencil I buy without losing money!

The part of the liquidation is mainly Orca (DeFi project on Solana) and Apollo (DeFi on Terra chain). Orca's funds moved into Francium to do leverage farms, while Apollo's moved into the Cosmos ecosystem.

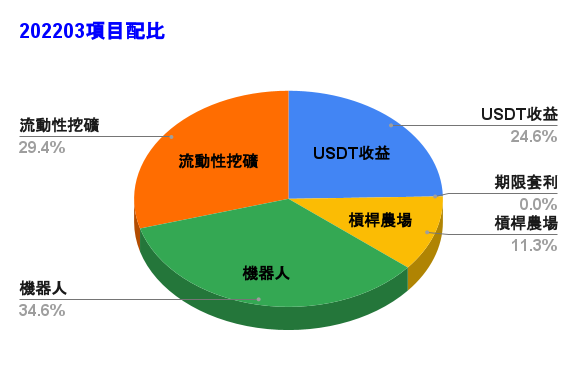

In the allocation of funds, robots are the bulk, liquidity mining is the second, and stable income is the third. Term arbitrage, because in the case of the previous decline, it was really less than a few coins, so it was turned off.

The usual greeting phrase of Spark: Live long and prospect!

The above is the monthly report for March, see you next month!

<<Remarks>>

The sharp-eyed you may feel that these charts, especially asset changes, are significantly different from the February monthly report. Mainly because I made some mistakes in my calculations in February! It may continue to change in the future. After all, I am still thinking about how to present and record the best way. (However, such a record may only be understood by me)

Like my work?

Don't forget to support or like, so I know you are with me..

雞精煉製所

***想免費加入圍爐的,請在貓眼看世界任何一篇文章中留言<我要喝雞精>**** 雞湯濃縮後成為雞精,搭建這個圍爐,用大伙圍爐的爐火,來煉製一批好的雞精,讓共襄圍爐的人可以BeingWelthy,成為富足之人。 除其朝向[手把手教學]、[雞湯文]、[加密投資]、[思考與精進]等系列,目標一周輸出一篇文章與爐友共同討論。透過圍爐吸引對我文章有興趣的人,圍成一圈可以更有互動。

Comment…