欢迎大家关注,订阅,点赞,或者送我喝咖啡 K 说区块链专注于项目的研究,DEFI,NFT notion 文档:https://www.notion.so/9554b61a541947878530e758546bb021?v=3d170991ec5b4c35b46212f151d7f638

New DeFi Game Play | 3 Minutes to Play Fixed Income Protocol Element Testnet

Element Protocol is a DeFi primitive running on the Ethereum blockchain, the core of which is to allow tokens (ETH, BTC, USDC, etc.) to be split into two separate tokens, namely (1 ) principal token (principal token) and (2) income token. Among them, the principal tokens can be used to redeem the deposited principal, and the income tokens can be used to redeem the earnings earned during the period. This split mechanism allows users to sell their principal with a fixed-rate income position and further leverage. Or increase interest exposure without any liquidation risk.

It is reported that the agreement has also received $4.4 million in seed round financing from a16z, Placeholder and other institutions, and it has now launched the Goerli test network ( testnet.element.fi ).

The main goals of this release are:

- Allow anyone to test all features of the Element platform;

- Find vulnerabilities in UI or smart contracts;

- Get feedback from the community

Here are some details of the testbed:

1

Element Platform

In short, the platform has a total of 6 tabs that users can access on the side navigation panel, each of which has a specific purpose, summarized as follows:

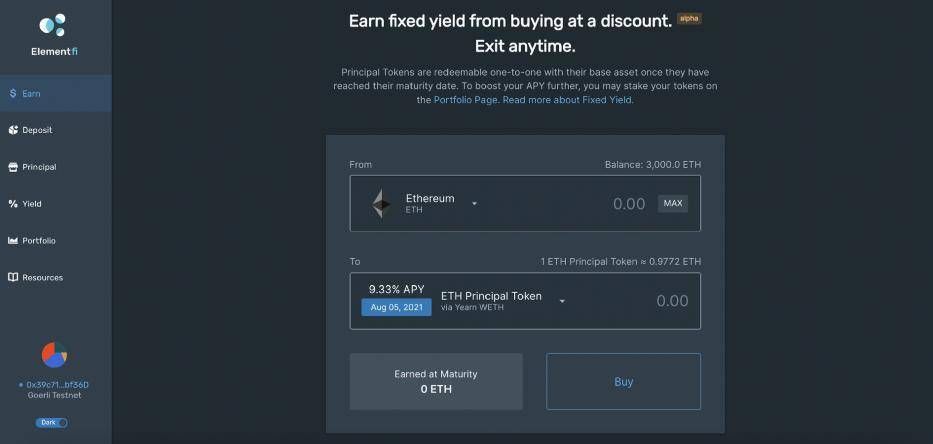

Earn

The "Earn" page allows you to earn a fixed income by purchasing an asset at a discounted price. You can withdraw at any time. Once the expiry date is reached, the Principal Token can be redeemed 1:1 for the underlying assets. In order to further increase your annualized rate of return APY, you can pledge your tokens on the portfolio page .

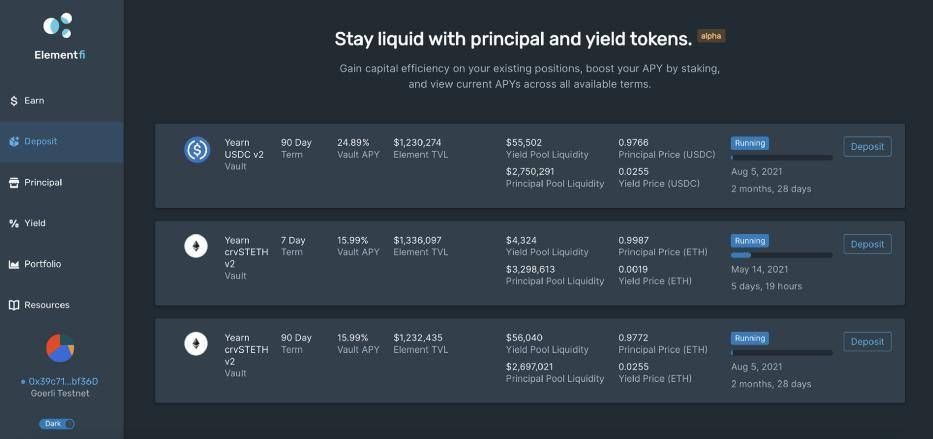

Deposit

Keep principal tokens and yield tokens liquid and increase the capital efficiency of your existing positions.

Mint principal and yield tokens, increase your APY by staking in available pools, and view current APY for all available tenors.

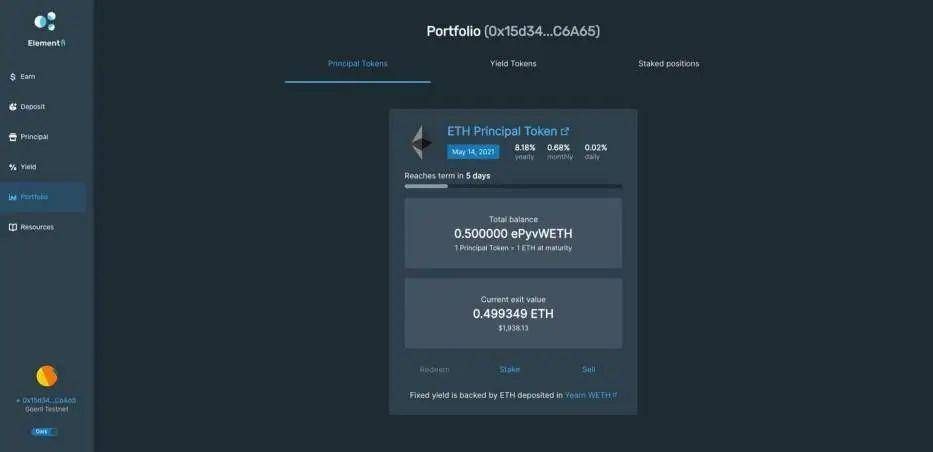

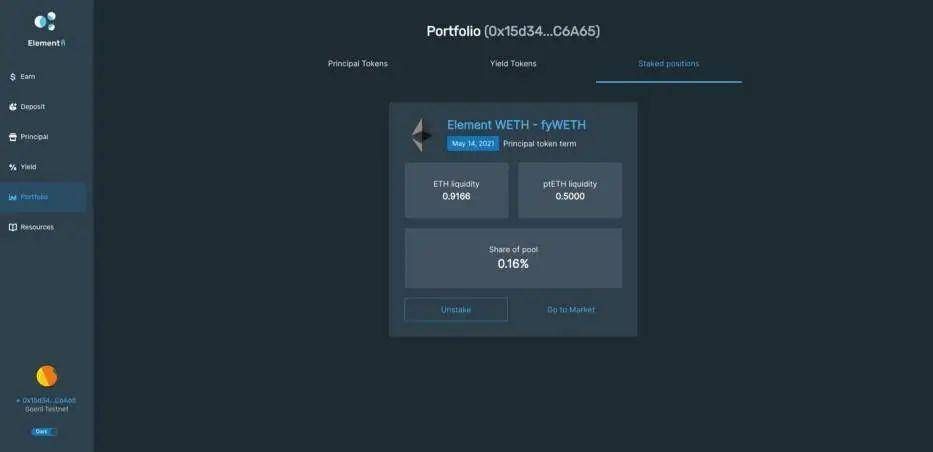

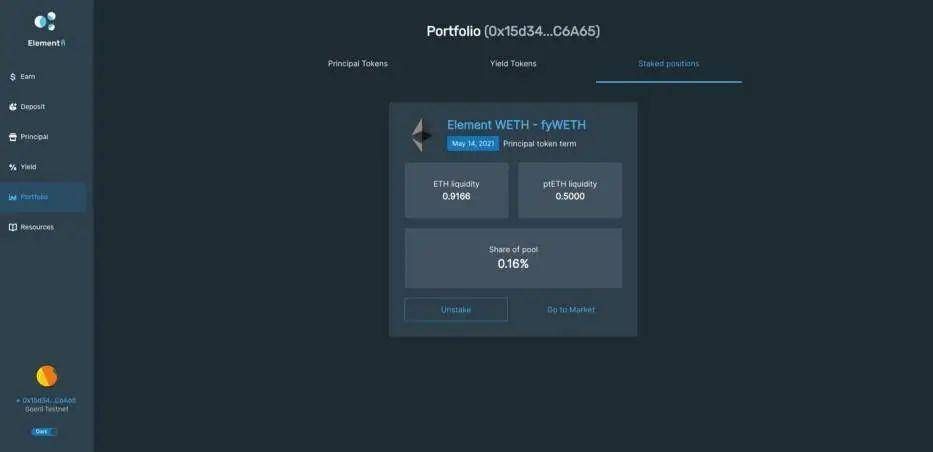

Portfolio

Track all your principal tokens, yield tokens, and staking positions.

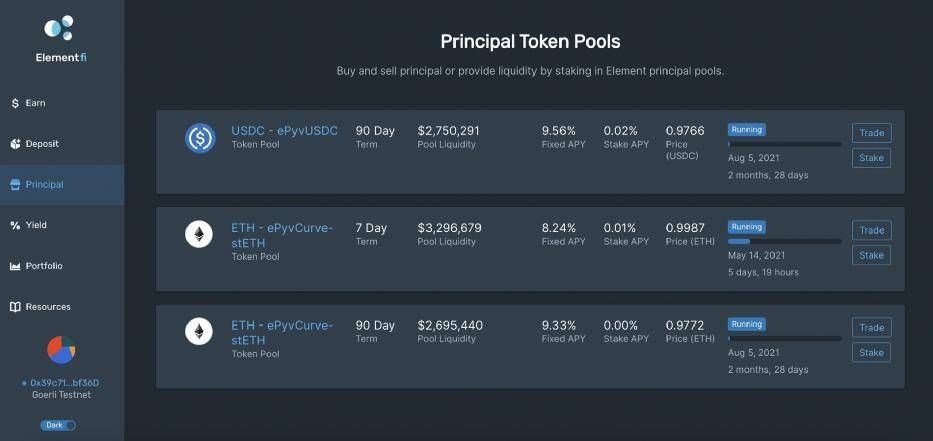

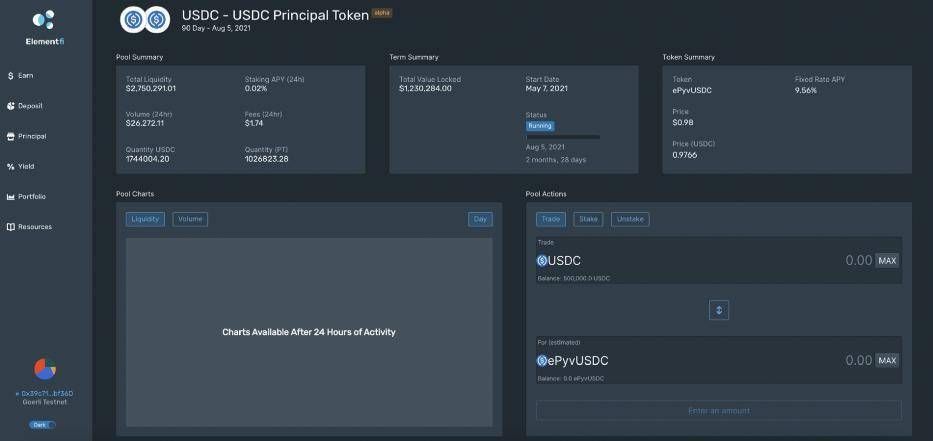

Principal Token Pool

The Principal Token Pool page allows you to buy and sell principal tokens, or provide liquidity by staking them in the Element Principal Pool. Explore all available principal trading pairs and exchange them for the underlying asset.

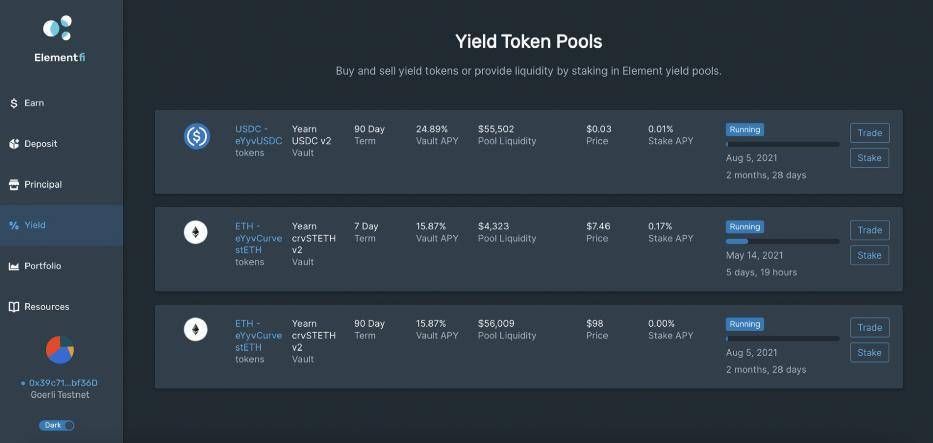

Yield Token Pool

Much like the Stake Pools page, the Yield Token Pools page allows you to buy and sell Yield Tokens, or provide liquidity by staking them in the Element Yield Pool. You can explore all available yield trading pairs and exchange them for the underlying asset.

The last tab is the resources of the Element protocol, including twitter, Discord, etc.

Protocol source code

It is reported that the code of the Element protocol has been open sourced, and the protocol includes a collection of smart contracts with the following functions.

The core codebase of the Element protocol has four main components:

- A tokenized wrapper for yield-bearing positions;

- Hierarchical contracts for the creation and redemption of fixed income tokens;

- A deployment system based on create2;

- A user agent that encapsulates a common set of user actions;

2

Goerli testnet deployment

Below is a list of classified addresses corresponding to the Element Protocol Goerli testnet deployment, each contract has been deployed and can be verified on Etherscan.

Goerli Testnet Faucet

Both ETH and USDC on the Goerli testnet can be claimed through the faucet, and then you can test the Element protocol on the testnet.

You can claim ETH from the Goerli faucet as follows: 14 ETH/day, 35 ETH/3 days, or 87.5 ETH/9 days. Claiming requirements are tied to common third-party social network accounts (anyone with a Twitter or Facebook account can claim test ETH within the limits allowed). Alternatively, you can leave your own address in the #testnet Discord channel, and the official will send some Goerli test ETH manually.

Goerli USDC (USDC): This faucet is deployed at 0x08034634bBD210485C9c8f798Afdc5432782fD18 , you can use Etherscan to get 10000 USDC, note that each wallet address can only get it once.

Goerli USDC Details:

Address: 0x78deca24cba286c0f8d56370f5406b48cfce2f86

Ticker: USDC

Length: 6

core protocol contract

WrappedPosition: A tokenized wrapper around yield-bearing positions that converts between an internal balance representation and the underlying token.

WETH: 0x9A1000D492d40bfccbc03f413A48F5B6516Ec0Fd

USDC: 0x78dEca24CBa286C0f8d56370f5406B48cFCE2f86

Tranche: Create and redeem fixed income tokens. The outstanding amount of the underlying asset can be redeemed from the Principal Token contract.

Principal Tokens:

WETH (90-day period):eP:eyWETH:06-AUG-21-GMT

0x89d66Ad25F3A723D606B78170366d8da9870A879

WETH (7-day period): eP:eyWETH:14-MAY-21-GMT

0x44eecA004b2612d131EDA7dA2b9d986E7fED562e

USDC (90-day period): fyUSDC:06-AUG-21-GMT

0x40bf8A2eCB62c6B880302b55a5552A4e315b5827

Yield Token

Element income token eyWETH: 14-MAY-21-GMT

0x91ddf92af38afac1b59f450ddb94ddab10a11490

Element income token eyWETH:06-AUG-21-GMT

0xbf4b5cb5ca49b1ef6b02615a94980723f6484899

Element Yield Token eyUSDC:06-AUG-21-GMT

0x2c637c5142ee4f31a1a78ad3df012fc242f6cae6

Custom Balancer Curve Contract

ConvergentCurvePool: An implementation of an automated market making (AMM) algorithm that allows two coins whose prices converge to make markets more efficiently than the standard choice.

WETH (7-day period): 0x9eB7F54C0eCc4d0D2dfF28a1276e36d598F2B0D1

WETH (90-day period): 0x5941DB4d6C500C4FFa57c359eE0C55c6b41D0b61

USDC (90-day period): 0x40bf8A2eCB62c6B880302b55a5552A4e315b5827

The opinions in the articles contained in this official account only represent the personal position of the original author, and do not represent the position of the way of DeFi. Investors should not regard the opinions and conclusions in the article as the only reference factors for making investment decisions, nor should they think that the opinions in the article can replace their own judgments. Before deciding to invest, if necessary, investors must consult with professionals and make decisions carefully.

Source link: https://www.chainnews.com/articles/685864533219.htm

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…