JRFX是全球在線金融交易和投資的領先經紀商,提供外匯、指數、大宗商品和加密數字貨幣價值合約等交易服務。擁有極速的執行速度, 低至0點差,是投資首選。 歡迎訪問我們的官網:www.jrfx.com

unnamed

On the evening of June 27, Goldman Sachs chief commodity strategist Jeff Currie said that the recent fall in oil prices is a good buying opportunity, and the logic behind his bullishness on oil prices is that insufficient investment in the oil and gas sector will continue to drive oil prices up. “The situation across the energy sector is very optimistic right now,” Currie said. “Ultimately, the only way to solve these problems is to increase investment.”

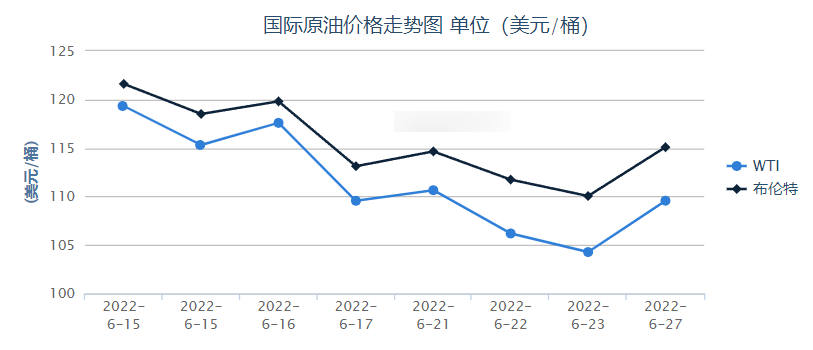

Recently, after the international oil price rose to the high pressure level during the conflict between Russia and Ukraine, it reversed in a V-shape and fell for two consecutive weeks, returning to the price level in mid-May. However, Goldman Sachs still held high the bullish banner, reiterating the view that Brent oil will soar to as high as $140 this summer.

On June 7, Goldman Sachs released a report predicting that the price of Brent crude oil will hit $140 a barrel. Damien Courvalin, head of energy research at Goldman Sachs, mentioned in a research report that the structural shortage of crude oil has not been resolved, and oil prices need to rise further to normalize inventories.

Since the start of the Russian-Ukrainian war at the beginning of this year, the global market has been hit, and the international oil price has soared by as much as 50%. However, after the Federal Reserve raised interest rates sharply by 75 basis points this month, the market has become increasingly concerned about economic recession, which has also led to a continuous decline in international oil prices recently.

Russia has cut gas flows to Germany via the Nord Stream 1 pipeline by 60 percent in recent weeks. Wood Mackenzie, an international energy consultancy, believes that if Russia completely shuts down the supply of Nord Stream 1 gas, Europe will face the risk of depleting natural gas inventories during peak winter demand.

On Monday, the European Union reached an energy storage resolution on Monday that requires domestic gas storage levels to reach 80% by the winter of 2022.

Currie believes that the recent move by Russia to cut the flow of Nord Stream 1 natural gas has exacerbated the turmoil in the European energy market. In this context, Europe will have to seek alternatives to natural gas, and oil is naturally one of the alternatives. Therefore, the upside momentum for oil and petroleum products is very high right now.

The most imminent factors affecting oil prices - the Russian-Ukrainian conflict and Western sanctions still show no signs of abating. A senior U.S. official said on June 27 that the leaders of the Group of Seven (G7) nations will commit on June 28 to take a package of new actions that would increase pressure on Russia or eventually put a cap on Russian oil prices.

Meanwhile, French President Emmanuel Macron said on Monday that the President of the United Arab Emirates had informed him that OPEC's two main oil exporters, the United Arab Emirates and Saudi Arabia, were already pumping as much oil as they could and could barely increase production.

In addition, Libya's National Oil Company (NOC) said it may suspend oil exports from the Gulf of Sirte for the next three days amid a worsening political crisis. The closure of Sirte Bay, home to many major OPEC members' ports, could also boost oil prices in the short term.

As of press time, WTI August crude oil futures closed up $1.47, or 1.34%, at $111.04 per barrel. Brent crude oil futures for August ended up $1.62, or 1.46%, at $112.06 a barrel.

JRFX reminds you: the market has risks, and investment should be cautious. This article does not constitute personal investment advice, please choose the corresponding investment products according to your own financial and risk tolerance, and do a good job of corresponding risk control.

About JRFX

12 years of financial market experience, the choice of 4 million customers, one of the most respected foreign exchange brokers in the world

· Offers 50+ trading products, including foreign exchange, gold, crude oil, stocks, cryptocurrencies, etc.

· Three trading accounts to meet the investment needs of different customers

· Zero commission, low spread, leverage up to 1 : 1000

· Minimum deposit of $100 to open an account

· 24 hours Chinese customer service

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…