在股市打滾近20年深刻領悟到,一個人最大的挑戰不是市場,而是自己的偏見和心魔,其操作風格融合了武術、易經、孫子兵法等,喜歡讀書,科學、心理學、投資理財、法律、小說、佛學等各種書都有涉獵,目標是希望能練成查理.蒙格說的跨學科思維模型。

Here it is, Xiaobai!

Here it is, Xiaobai!

A friend who is worth more than ten million,

never in and out of the stock market,

But recently I saw that my friends are buying TSMC,

and made a lot of money,

So he came and asked me, can TSMC still buy it?

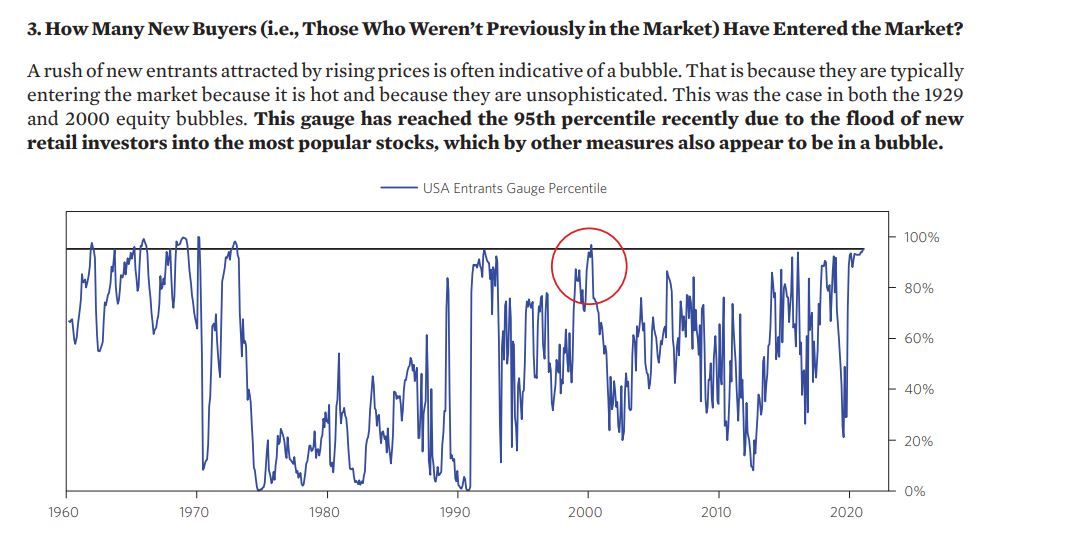

In January of this year, Ray Dalio of Bridgewater Investments released a research report,

The current level of bubbles in the stock market,

There are 6 indicators that they study the stock market bubble,

One of the indicators is the number of new entrants to the stock market,

Why study this indicator?

What does a stock market novice represent?

Ray Dalio said that the stock market novice will enter the market because the market is hot enough,

Like my friends who want to buy TSMC,

Usually indifferent to the stock market,

Suddenly one day I heard everyone talking about how to make good money in the stock market,

So I was drawn in,

Ray Dalio said that the stock market novice is unsophisticated (inexperienced, simple),

My friend used to be the head of a company,

Of course it will not be inexperienced,

But the stock market has such magic,

And the logic of the stock market is usually different from what most people think.

Take the TSMC that my friend wants to buy as an example,

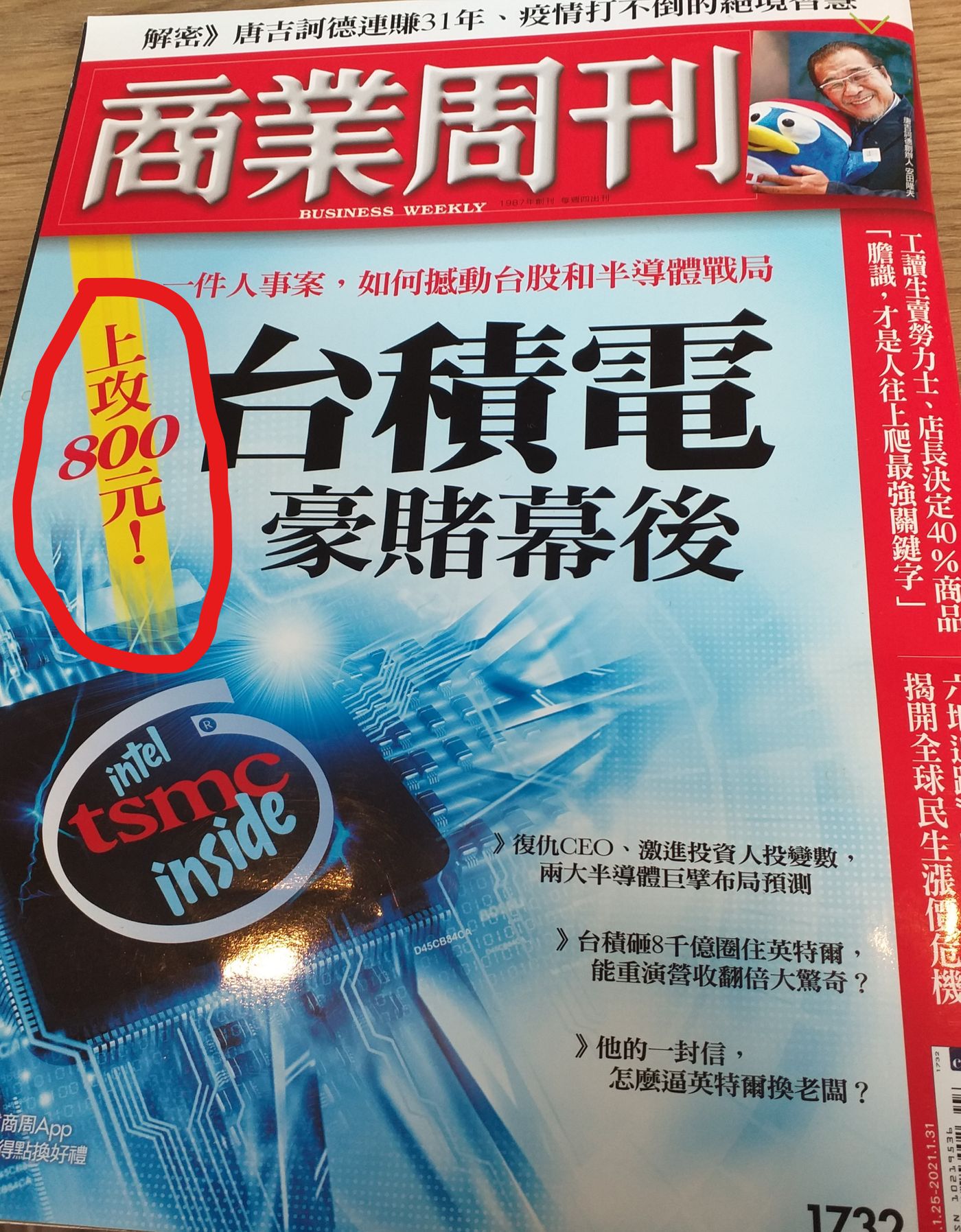

Business Week published a magazine with TSMC as the cover at the end of January,

Among them, it is mentioned that many foreign investors have called TSMC's target price to more than 800.

However, TSMC's stock price fell instead of rising during the period.

And the subsequent rebound only bounced to 668, failing to surpass the previous high of 679.

So readers, do you think TSMC will rise to 800?

I can't really blame everyone for this.

Back when I first entered the stock market,

My stock selection logic is also to find which companies have record high revenue and profit in financial newspapers,

After several experiences, I discovered that

This kind of stock selection logic is usually to buy at a relatively high point,

After a few lock-up experiences,

I just learned what it means to "buy in pessimism and sell in optimism",

Take Tesla as an example,

In early 2019, a number of foreign media have been reporting that Tesla has a bankruptcy crisis.

In the face of such rumors,

Tesla's share price also fell all the way to 35 yuan before it stopped falling.

What if you bought a Tesla at the time?

Well, you should have retired and started enjoying life!

But if you are seeing a young American engineer All in Tesla,

The result was a successful retirement,

How about buying a Tesla again...?

At present, this new stock market participant index of Bridgewater has reached 95%,

Approaching the level of the tech bubble in 2000,

So, if the stock market novices want to make money in the stock market,

Practice the basic skills first, then

Don't be used as an anti-indicator of unsophisticated!

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…